Image Credit: It’s Our City (Flickr)

Monitoring the Gusher of Cross Currents in the Energy Industry

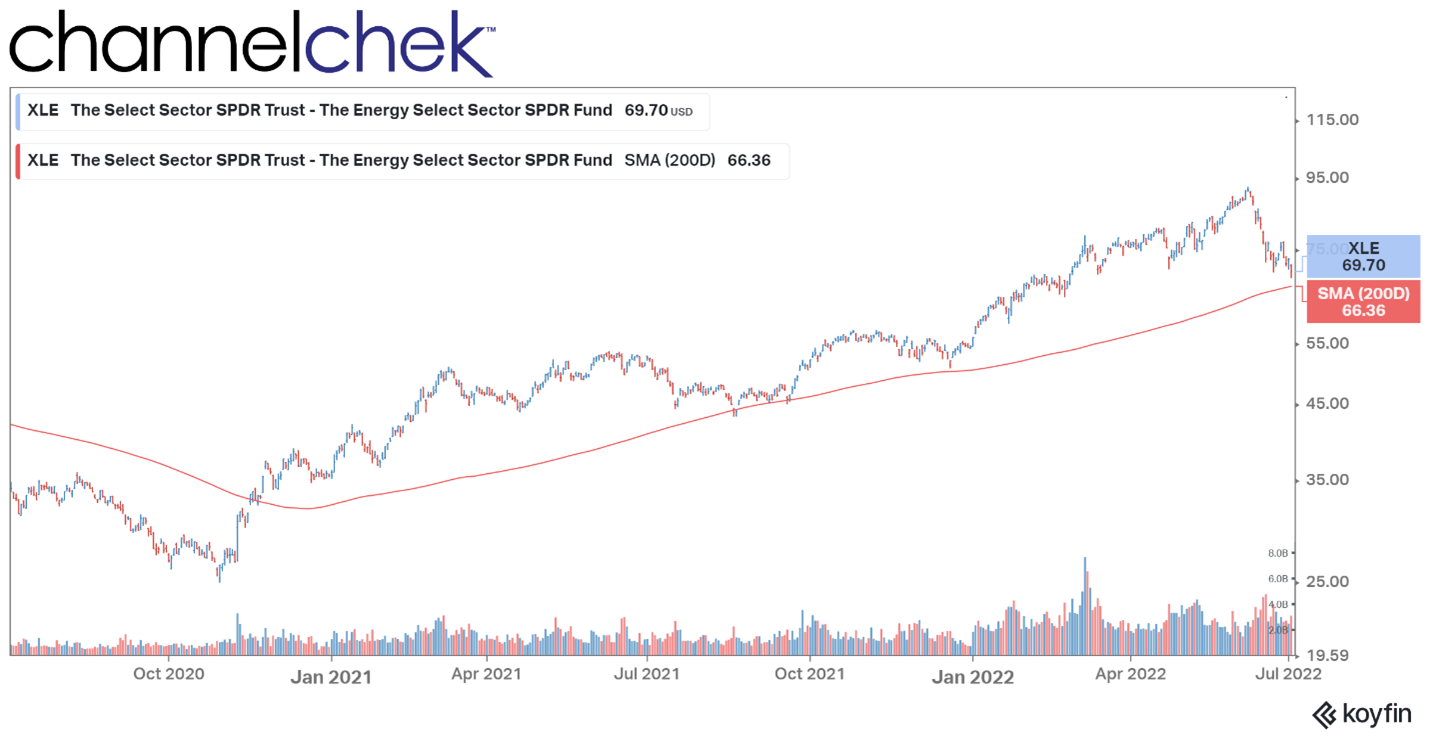

A plan from the White House to allow drilling in the Gulf of Mexico. Calls for a crude export ban. A Biden tweet asks companies running gas stations to drop prices. A proposed price cap on Russian oil. And OPEC-plus output is expected to remain steady. These are just some of the events impacting energy company stocks. Meanwhile, travel in the U.S. skyrocketed to levels not seen in years to kick off the summer vacation season. For their part, oil industry stocks, as measured by the XLE, are down 25% from their high a month ago (June 8), and are approaching their 200-day moving average. Is the cooling off in oil company stocks temporary? Could the recent sell-off attract dip buyers, and what is the overall health of the industry beyond the outside noise?

Source: Koyfin

Selling Gulf Drilling Leases

On July 1, in a disappointment to some environmental groups, the Biden administration made two moves to open public lands to fossil fuel extraction. The administration held its first onshore lease sales, and it released a proposal for offshore drilling that could open parts of the Gulf of Mexico and Alaska’s Cook Inlet to leasing through 2028.

Oil industry officials said the action would do little to help counter high energy prices. This is important to the President as gasoline prices have been a daily reminder for voters of how life has changed since the President has taken office. Biden’s taking action against higher fuel prices could be seen as a political move aimed at helping the mid-term elections come out in favor of the President’s party. The oil industry officials throw cold water on any thinking that it would change prices, they say there will be a months-long gap before a new plan can be put in place. The oil industry spokespersons say the delay could cause problems in planning new drilling and potentially lead to decreased oil production. Overall, oil companies are hesitant to go all out and bid for leases and commit extraordinary resources to projects when the administration’s commitment is uncertain.

The administration had already suspended lease sales earlier in 2022, citing climate concerns. As a result of a court order by a U.S. district judge in Louisiana, the company involved was cleared to resume.

There is a long start-up time between the bidding process and the developing drilling operations. In the meantime, there is no sign for the oil companies to feel comfortable committing to long-range projects because the administration has not shown unwavering commitment. Resources allocated to what the administration says it is committed to, that is a move away from fossil fuels, would seem more appropriate in the long run for energy companies.

Export Ban Feasibility

The Biden administration wants to potentially place an outright ban on U.S. exports of oil and refined products. Speaking to reporters during a tour of the Strategic Petroleum Reserve in Louisiana, Energy Secretary Jennifer Granholm said that the administration was “not taking any tools off the table” in its effort to reduce prices at the pump, including reimposing the 1970s ban on oil exports that was lifted in 2015. This is confusing to consumers and oil companies alike as it was just last December that Granholm said an export ban was not under consideration. Secretary Granholm’s comments seem to mark a significant shift in energy policy for the administration.

A ban would have to take into account the complex global oil market. Each country does not produce the quality of crude oil or refined petroleum products used in its country. For many, imports from the U.S. have no substitutes. This would force them to find other providers, or do without. The highly advanced U.S. refining capabilities allow it to take low-cost heavy oil from Central America and Canada and turn it into high-grade gasoline. This ability to input low-cost crude and export high-value refined products is a net positive for the U.S. when measuring trade surplus’/deficits.

While an export ban may score points politically, it may not accomplish a useful goal. In January, the Dallas Federal Reserve released a study on the potential impacts of a crude oil export ban. It measures possible consequences on worldwide energy prices and their impact on Americans. The study concluded that a halt of U.S. exports “would lower the supply of oil in global markets and raise its price” and “one would expect global fuel prices, if anything, to increase as a result.”

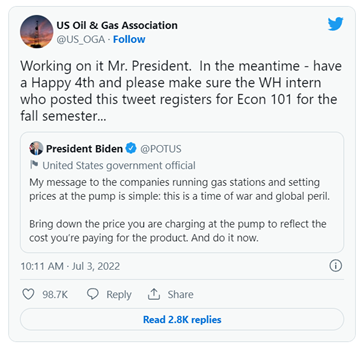

Image: A tweet from @POTUS draws a snarky reply from the domestic oil and gas advocate USOGA.

OPEC-Plus Output Decision

OPEC+ is the name given to the combined oil-producing countries that include the 13 members of OPEC, and 10 other oil-producing countries including Russia. On Thursday (June 30) OPEC+ confirmed it would not increase output for the month of August any more than previously announced. The group had concerns about oversupplying in the face of mounting factors that could lead to a recession. Ironically, one of those factors is the tight global supply of oil.

Previously, OPEC+ decided to increase output each month by 648,000 barrels per day (BPD) in July and August. The OPEC+ group of producers ended the meeting by agreeing to stick to its output strategy. The producers did not discuss policy for September or beyond.

Analysts Report

“Energy industry fundamentals remain strong.” Wrote Noble Capital Markets, Senior Energy Analyst Michael

Heim, in his quarterly

report on the industry released this week. Heim went on to write that cash flow levels are envious in the industry, and debt levels are being pared down. He maintains his positive bias toward the sector and favors small-caps within the sector “with the ability to expand operations.”

Take Away

Energy companies’ performance, particularly those involved in oil or natural gas, have had excellent performance over the past two years – they have been the top-performing sector so far this year. However there has been a bit of a dip, and there are many crosscurrents that could make a continued rise a bit choppier than it had been.

The outlook on the industry is positive as the companies are faced with an enviable number of options and opportunities to rework their finances and perhaps move into new projects, both traditional and future-looking.

They, however, need to pin down the administration on whether it is committed to their products long term. This nod to the future could open the door to more investment in production. Alternatively, if they are caught in political positioning that may not carry any weight six months down the road, wrong decisions now could be expensive.

Read Michael Heim’s Energy Industry Report – The Outlook for Energy Stocks Remains Favorable

here.

Managing Editor, Channelchek

Suggested Content

A 132-Year-Old Infrastructure Company Uniquely Positioned to Build the Future

|

C-Suite Interview with Alvopetro Energy (Video)

|

The Outlook for Energy Stocks Remains Favorable (Energy Industry Report)

|

Metals & Mining Second Quarter 2022 Review and Outlook

|

Sources

https://insideclimatenews.org/news/01072022/public-lands-fossil-fuel-drilling-leases-biden/

Stay up to date. Follow us:

|