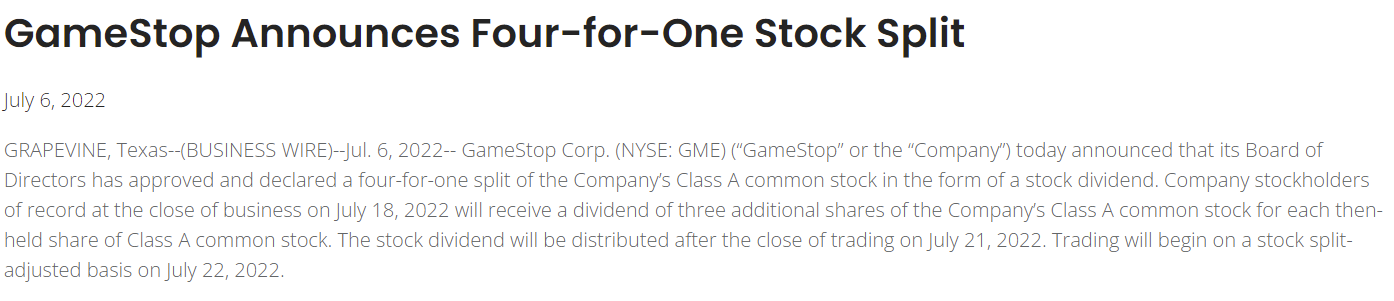

Voyager Digital Commences Financial Restructuring Process to Maximize Value for All Stakeholders

Research, News, and Market Data on Voyager Digital

Files Voluntary Petitions for Chapter 11

Protection to Implement Restructuring; Proposed Plan of Reorganization Creates

Efficient Path to Resume Account Access and Return Value to Customers

Voyager Has Approximately $1.3 Billion of

Crypto Assets on the Platform, More Than $350 Million of Cash Held in

the FBO Account for Customers at Metropolitan Commercial Bank, and Claims

Against Three Arrows Capital of More Than $650 Million1

NEW YORK, July 5, 2022 /PRNewswire/ – Voyager Digital Ltd. (“Voyager” or the “Company”) (TSX: VOYG) (OTCQX: VYGVF) (FRA: UCD2), today announced that it has commenced a voluntary Chapter 11 process to maximize value for all stakeholders. As part of this process, the Company and its main operating subsidiaries filed voluntary petitions for reorganization under Chapter 11 in the U.S. Bankruptcy Court of the Southern District of New York (the “Court”). The Company intends to seek recognition of the Chapter 11 case of Voyager in the Ontario Superior Court of Justice (Commercial List) pursuant to the Companies’ Creditors Arrangement Act.

“This comprehensive reorganization is the best way to protect assets on the platform and maximize value for all stakeholders, including customers,” said Stephen Ehrlich, Chief Executive Officer of Voyager. “Voyager’s platform was built to empower investors by providing access to crypto asset trading with simplicity, speed, liquidity, and transparency. While I strongly believe in this future, the prolonged volatility and contagion in the crypto markets over the past few months, and the default of Three Arrows Capital (“3AC”) on a loan from the Company’s subsidiary, Voyager Digital, LLC, require us to take deliberate and decisive action now. The chapter 11 process provides an efficient and equitable mechanism to maximize recovery.”

The proposed Plan of Reorganization (“Plan”) would, upon implementation, resume account access and return value to customers. Under this Plan, which is subject to change given ongoing discussions with other parties, and requires Court approval, customers with crypto in their account(s) will receive in exchange a combination of the crypto in their account(s), proceeds from the 3AC recovery, common shares in the newly reorganized Company, and Voyager tokens. The plan contemplates an opportunity for customers to elect the proportion of common equity and crypto they will receive, subject to certain maximum thresholds.

Customers with USD deposits in their account(s) will receive access to those funds after a reconciliation and fraud prevention process is completed with Metropolitan Commercial Bank.

The Company continues to evaluate all strategic alternatives to maximize value for stakeholders.

The Company has over $110 million of cash and owned crypto assets on hand, which will provide liquidity to support day-to-day operations during the Chapter 11 process, in addition to more than $350 million of cash held in the For Benefit of Customers (FBO) account at Metropolitan Commercial Bank. Voyager also has approximately $1.3 billion of crypto assets on its platform, plus claims against Three Arrows Capital (“3AC”) of more than $650 million.

Voyager previously announced that its subsidiary, Voyager Digital LLC, issued a notice of default to 3AC for failure to make the required payments on its previously disclosed loan of 15,250 BTC and $350 million USDC. Voyager is actively pursuing all available remedies for recovery from 3AC, including through the court-supervised processes in the British Virgin Islands and New York.

The Company also announced the appointment of a four new independent directors: Matthew Ray at Voyager Digital Ltd.; Scott Vogel at Voyager Digital Holdings, Inc.; and Jill Frizzley and Timothy Pohl at Voyager Digital LLC. Information regarding their backgrounds and relevant experience is included at the end of this release.

As part of the reorganization process, the Company will file customary “First Day” motions to allow it to maintain operations in the ordinary course. Voyager intends to pay its employees in the usual manner and continue their primary benefits and certain customer programs without disruption. The Company expects to receive court approval for all these routine requests. Trading, deposits, withdrawals and loyalty rewards on the Voyager platform remain temporarily suspended.

Parties with questions about the chapter 11 process may contact the Company’s Claims Agent, Stretto, at +1 (855) 473-8665 (toll-free in the U.S.) or +1 (949) 271-6507 (for parties outside the U.S.). They have also set up a website at

http://cases.stretto.com/Voyager, which includes court documents and other information.

To effectuate the restructuring process, the Company has engaged Moelis & Company and The Consello Group as financial advisors, Kirkland & Ellis LLP as legal advisors, and Berkeley Research Group, LLC, as restructuring advisor.

New Independent Directors

to Provide Additional Leadership and Expertise

Matthew Ray joins as an independent director of Voyager Digital Ltd. Mr. Ray is the Founder and Managing Partner of Portage Point Partners where he has served as Chief Restructuring Officer (CRO), Chief Executive Officer (CEO), Chairman, Lead Independent Director, Special Restructuring Committee Chairperson and Strategic Advisor leading wide-ranging transformations and restructurings for both private and public companies.

Scott Vogel joins as an independent director of Voyager Digital Holdings, Inc. Mr. Vogel has broad experience sitting on numerous boards of directors for financially distressed companies in a diverse set of industries. Mr. Vogel carefully and skillfully manages complex situations, develops restructuring plans and post-restructuring organizational priorities, builds consensus amongst and between stakeholders and management, executes complex capital market and corporate transactions, facilitates clear lines of communication, and aligns management incentives to ensure accountability.

Jill Frizzley joins as an independent director of Voyager Digital LLC. Ms. Frizzley is a corporate governance expert with significant experience serving on boards of directors and advising on corporate governance, restructuring, bankruptcies, and mergers and acquisitions. Leveraging over two decades of legal practice in financial restructuring and insolvency, Ms. Frizzley has a deep wealth of knowledge encompassing corporate, financial, and governance matters across a wide range of industries.

Timothy Pohl joins as an independent director of Voyager Digital LLC. Mr. Pohl has extensive experience and expertise in all aspects of corporate restructurings and financing, mergers and acquisitions, valuation, liquidity and balance sheet assessment and analysis, capital markets, corporate law, restructuring law, and litigation. Mr. Pohl currently serves as a Senior Advisor in a number of situations, as well as an Independent Director for a number of corporations. Mr. Pohl has also advised across a wide range of industries and has provided expert testimony on valuation and corporate and restructuring matters.

About Voyager Digital

Ltd.

Voyager Digital Ltd.’s (TSX: VOYG) (OTCQX: VYGVF) (FRA: UCD2) US subsidiary, Voyager Digital, LLC, is a cryptocurrency platform in the United States founded in 2018 to bring choice, transparency, and cost-efficiency to the marketplace. Voyager offers a secure way to trade over 100 different crypto assets using its easy-to-use mobile application. Through its subsidiary Coinify ApS, Voyager provides crypto payment solutions for both consumers and merchants around the globe. To learn more about the company, please visit https://www.investvoyager.com.

Forward

Looking Statements

Certain information in this press release, including, but not limited to, statements regarding the restructuring process, the restructuring Plan, available remedies for recovery from 3AC, intended filings as part of the restructuring process, resumption of account access, return of value to customers, the ability of Voyager to continue as a going concern, exploration of strategic alternatives, discussions with third parties in respect of strategic alternatives and the results of those discussions, the temporary nature of the suspension of the platform, future growth and performance of the business, the exploration of strategic alternatives, future adoption of digital assets, anticipated trends and challenges in our business and industry, the regulation of digital assets offerings, the impact of the 3AC default on the Company, the Company’s liquidity and ability to satisfy customer orders and withdrawals and the Company’s anticipated results may constitute forward looking information (collectively, forward-looking statements), which can be identified by the use of terms such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” (or the negatives) or other similar variations. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Voyager’s actual results, performance or achievements to be materially different from any of its future results, performance or achievements expressed or implied by forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this press release may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. It is uncertain as to the timing or results of the restructuring process or the terms of the final restructuring plan, when account access will resume, the value to be returned to customers, what amount Voyager will be able to recover from 3AC for non-payment or the legal remedies available to Voyager in connection with such non-payment or the impact on the future business, cash flows, liquidity and prospects of Voyager as a result of 3AC’s non-payment. Forward looking statements are subject to the risk that the global economy, industry, or the Company’s businesses and investments do not perform as anticipated, that revenue or expenses estimates may not be met or may be materially less or more than those anticipated, that parties to whom the Company lends assets are able to repay such loans in full and in a timely manner, that trading momentum does not continue or the demand for trading solutions declines, customer acquisition does not increase as planned, product and international expansion do not occur as planned, risks of compliance with laws and regulations that currently apply or become applicable to the business and those other risks contained in the Company’s public filings, including in its Management Discussion and Analysis and its Annual Information Form (AIF). Factors that could cause actual results of the Company and its businesses to differ materially from those described in such forward-looking statements include, but are not limited to, the results of the restructuring process and the terms of the restructuring plan, if such a plan is ultimately agreed to, the results from the exploration of strategic alternatives, the inability to resume trading, deposits, withdrawals and rewards on the platform in a timely manner, an inability to drawdown under the credit facility or access other sources of financing, an increase in customer demands for withdrawals from the platform, any insolvency or similar proceedings with respect to 3AC, our ability to find a strategic alternative, a decline in the digital asset market or general economic conditions; changes in laws or approaches to regulation, the failure or delay in the adoption of digital assets and the blockchain ecosystem by institutions; changes in the volatility of crypto currency, changes in demand for Bitcoin and Ethereum, changes in the status or classification of cryptocurrency assets, cybersecurity breaches, a delay or failure in developing infrastructure for the trading businesses or achieving mandates and gaining traction; failure to grow assets under management, an adverse development with respect to an issuer or party to the transaction or failure to obtain a required regulatory approval. Readers are cautioned that Assets on Platform and trading volumes fluctuate and may increase and decrease from time to time and that such fluctuations are beyond the Company’s control. Forward-looking statements, past and present performance and trends are not guarantees of future performance, accordingly, you should not put undue reliance on forward-looking statements, current or past performance, or current or past trends. Information identifying assumptions, risks, and uncertainties relating to the Company are contained in its filings with the Canadian securities regulators available at www.sedar.com. The forward-looking statements in this press release are applicable only as of the date of this release or as of the date specified in the relevant forward-looking statement and the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events, except as required by law. The Company assumes no obligation to provide operational updates, except as required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements, unless required by law. Readers are cautioned that past performance is not indicative of future performance. There is no assurance that the funds available under the loan agreement will be available or, even if available will, together with any other assets of Voyager be sufficient to safeguard assets.

The TSX

has not approved or disapproved of the information contained herein.

|

__________________

|

|

1 The amounts are as of June 30, 2022, and are preliminary, non-reviewed and unaudited, and subject to final adjustments following completion of quarterly and year-end close procedures.

|

SOURCE Voyager Digital Ltd.