Image Credit: Todd F Niemand (Flickr)

Investors and Traders that Jumped in Early to FTSE Russell Trade May Have Gotten Soaked

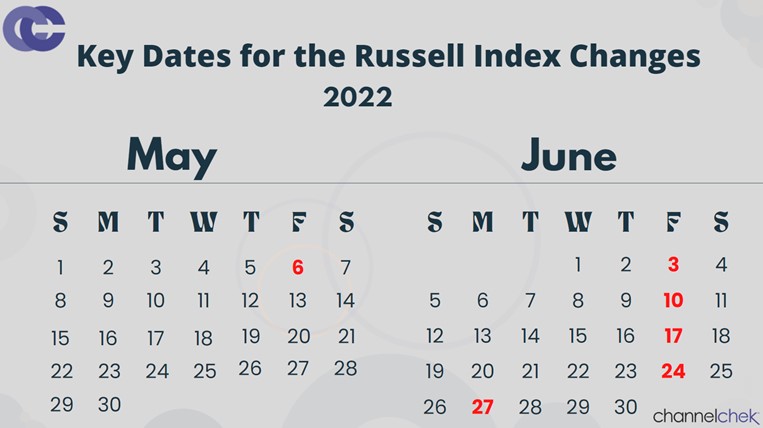

How has the stock market sell off impacted the FTSE Russell Reconstitution? A sudden rise in a stock’s price is almost always demand-related. And demand for a few hundred stocks has been expected to come a week from Monday when the market opening bell rings on June 27. The FTSE Russell 3000 will include 300 new names for the next year or more. The FTSE Russell will also be recalibrating its Microcap Index. Fund managers that manage index funds tied to these benchmarks will need to eliminate their holdings in what is exiting the index related to the fund they manage, and on a balanced weighting, take on some new names to their holdings. Hedge funds and individual investors know this and it has become popular to front-run the late June shift in demand. But an unexpected selloff might be gunking up investor strategies.

Background

Inclusion in a major market index is exciting for the management of a publicly held company, while it can cause dislocations and wild price swings that may not wind up with the stock price being higher, they can count on higher trading volume, which increases liquidity and reduces bid/ask spreads.

For investors, since the 1990s, it has signaled a period where hedge funds and individuals alike try to take advantage of the short-term dislocations and adjustments. It’s important for all involved to remember that much of the list of names included or excluded for the first time in a Russell Index may just be moving from one index classification to another. In these cases, it may be difficult to gauge whether there will be higher demand or lower. Market forces also play a large part; the market has been bearish recently, so performance is relative.

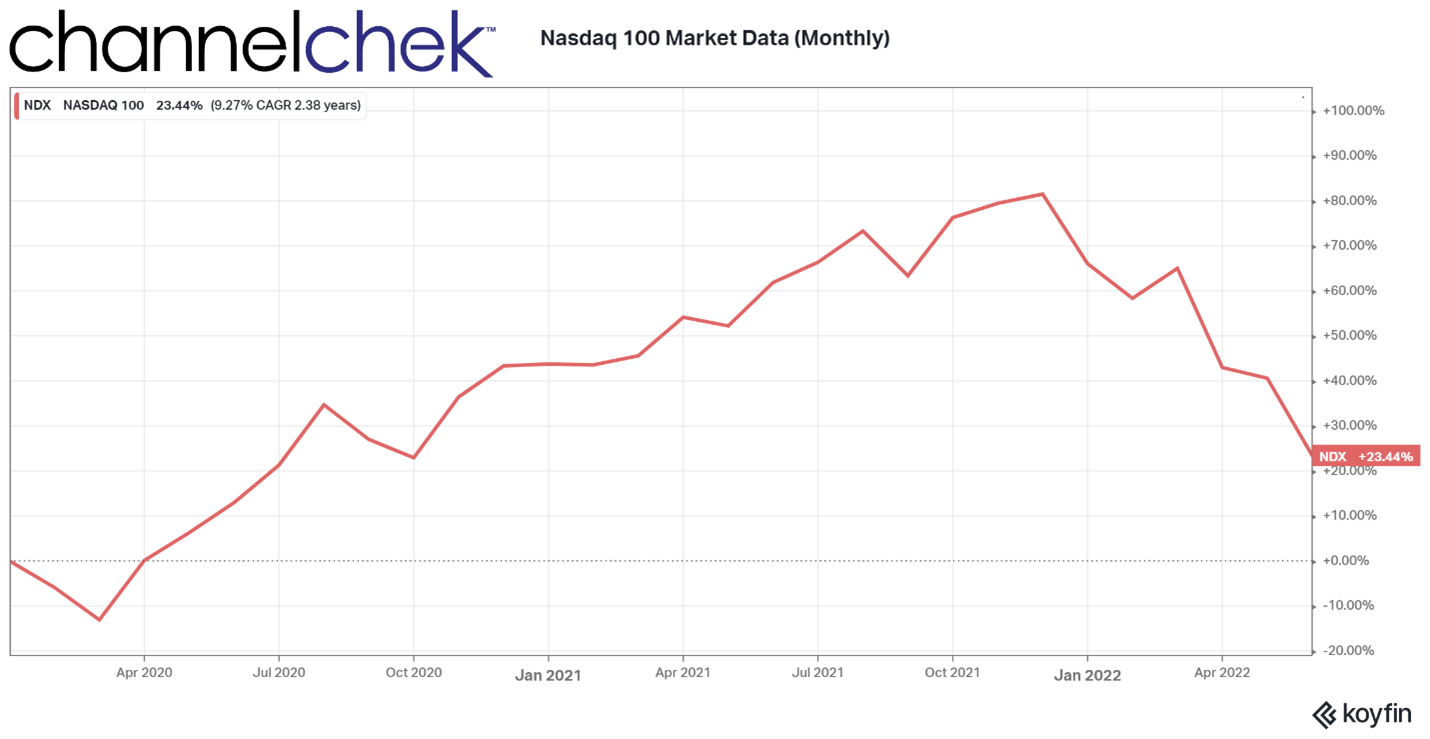

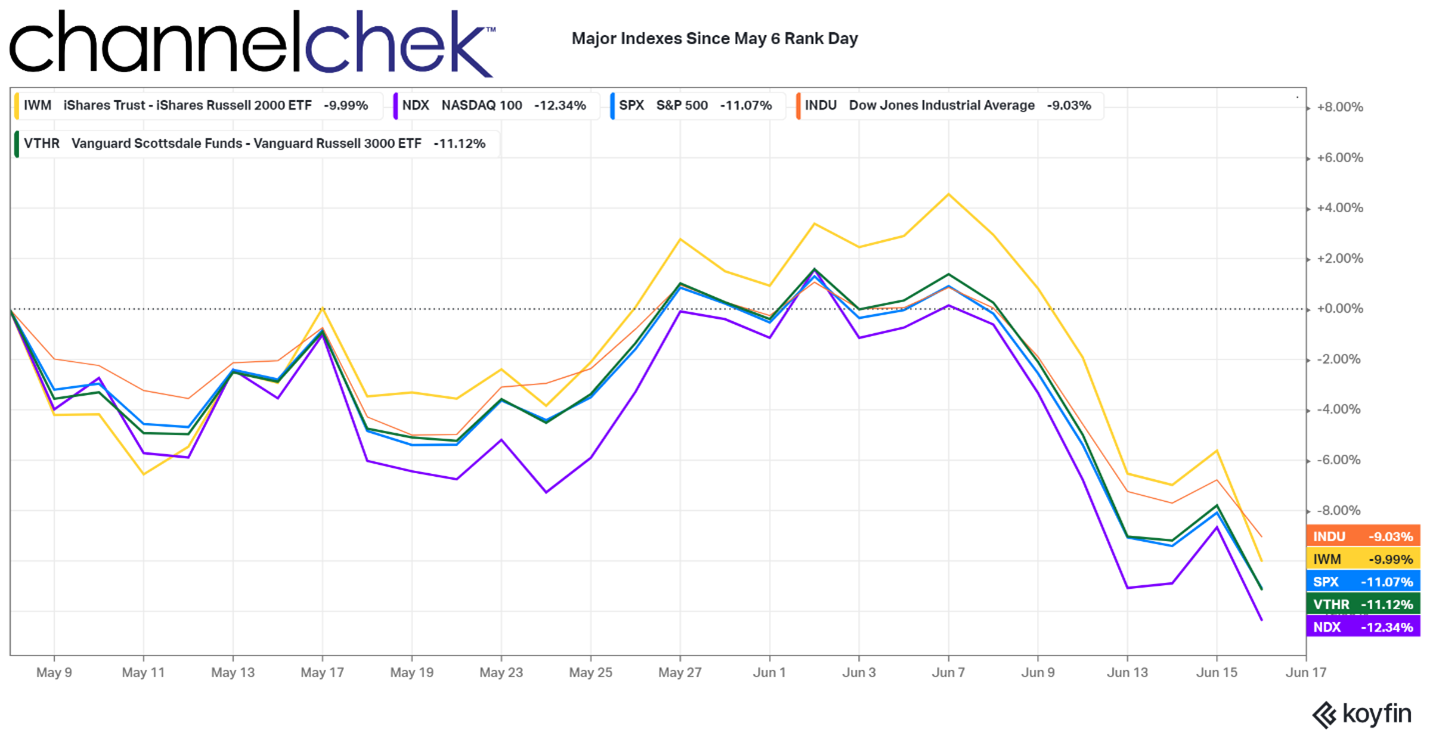

Source: Koyfin

Reconstitution June 2022

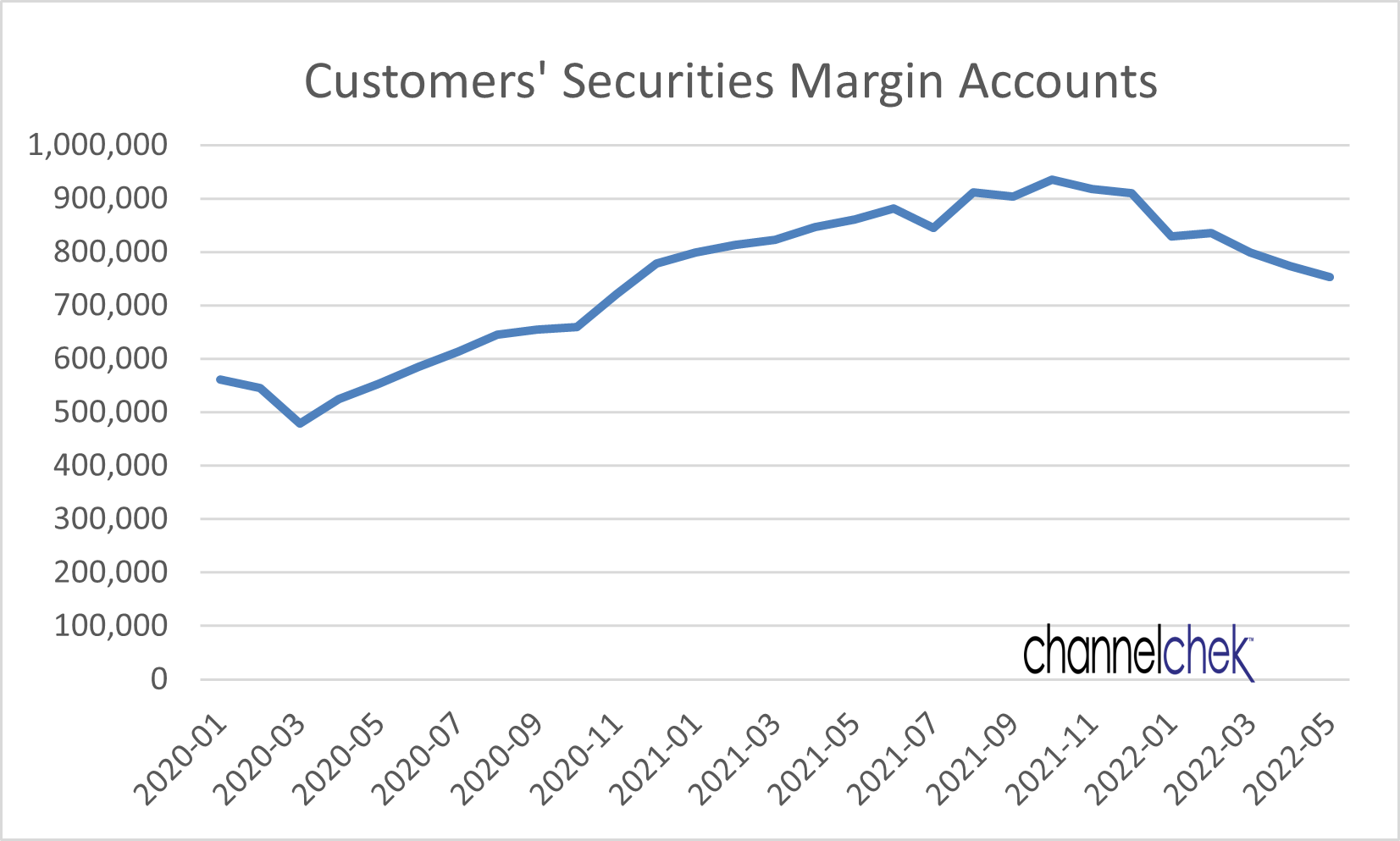

There is no indication of how monetary policy, inflation, investor appetite, and market weakness is going to affect the final days of the rebalancing. The Russell 3000 Index (shown above using VTHR) is down 11.12% since rank day. The Russell 2000 is down 9.99%. Rank day is when the FTSE Russell looks at all stock’s closing prices and determines the top 3000 stocks by market value.

For investors and traders that were looking to, and even have acted to cash in on an early entry strategy, and even portfolio managers that got an early start rebalancing, they may have been caught by all the fall off in the markets; some may have even amassed oversized losses.

Typical Pre-Rebalance Day Strategy

The basics of the strategy involves buying up shares in companies slated for inclusion in an index and selling short the companies about to be removed. Trillions of dollars in passive investment funds like Mutual funds and ETFs are designed to mimic these indexes. Knowing this, traders, hedge funds, and savvy individuals have noted the changes announced by Russell weeks in advance, purchases some of those expected to be added, and then wait until late June and early July to sell these positions. The result over the years has at times been significant, with high probability of price moves. The added stocks on average rise and the deleted stocks wane.

Not Your Typical June

This strategy has been around a while, but it has gotten crowded over the past five years. Investors and traders in 2022 may need to temper their enthusiasm with this rebalance. This year there may already be far more than average that are holding stocks in these names that will soon be lined up to unwind. This could cause weakness in the very stocks purchased to rise. Plus, investors may already be down double digits in these names.

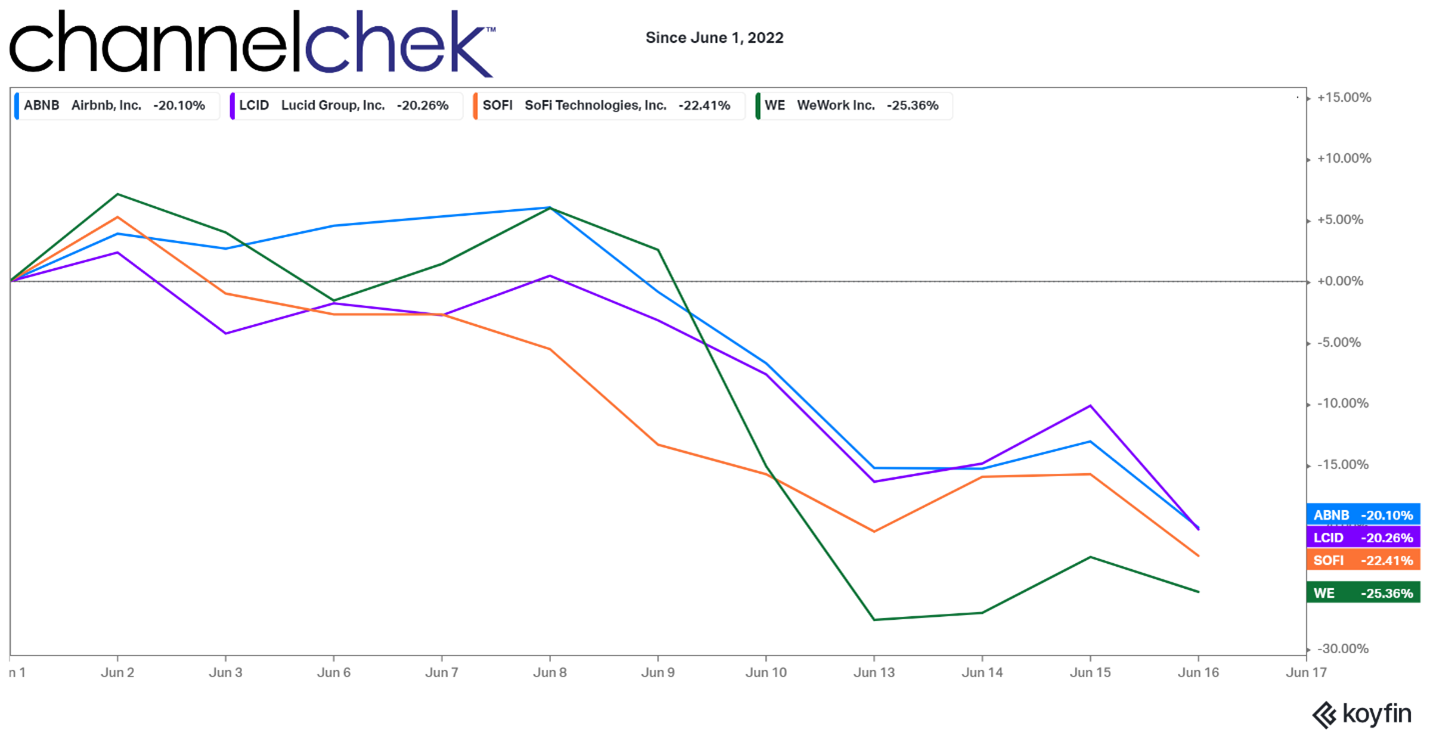

Source: Koyfin

The nearly 300 stocks scheduled to join the index on June 27 include Airbnb (ABNB), Lucid Motors (LCID), SoFi Technologies (SOFI) , WeWork (WE), and many others that have gone off a cliff this month. The S&P 500 and Russell 3000 are each down 9%.

It’s not the first time the index-rebalance trade has soaked participants. In 2020, specialists in the strategy started off in disarray as fallout from COVID-19 late Spring altered many of the rebalance participants that hedge funds had presupposed. What was strong became weak and what was weak became strong just before the rank date.

Take Away

There are investors that look to determine which companies may be added to an index and which may be removed. Although being right doesn’t always mean huge gains, the rewards, on average, make this a legitimate approach for stock picking. This year the Russell 3000 index may have undermined strategies to get in early unless those that got in early shorted stocks being removed.

The sell off prior to the June 27 reopening could leave many who looked at their Russell Index play as a short term holding taking a huge loss, or keeping the money tied up while hoping for a 30% rally. Tax considerations aside, if any holding becomes dead money for any length of time, while there are better opportunities, taking a loss should be considered.

Be careful out there.

Managing Editor, Channelchek

Suggested Content

Russell Reconstitution 2022, What Investors Should Know

|

Investors Keeping Their Eye on Fridays in June

|

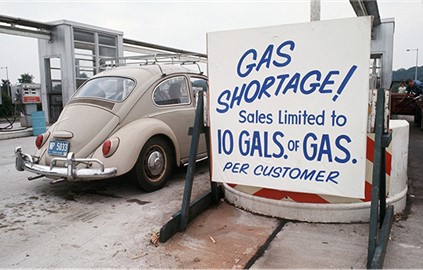

Has Summer Driving Season Been Cancelled by High Gas Prices?

|

Is Crumbling Trust in the Financial System Leading to a Flight to Real Assets?

|

Sources

https://www.ftserussell.com/press

https://www.sec.gov/fast-answers/answersindiceshtm.html

Sources

https://twitter.com/elonmusk/status/1501449525831081987

https://www.cnbc.com/2022/06/14/bitcoin-plunge-spells-trouble-for-michael-saylors-microstrategy.html

Stay up to date. Follow us:

|