Image Credit: Marc Buehler (Flickr)

Michael Burry Tweets About the Weak Dollar While Mainstream News Discusses Dollar Strength

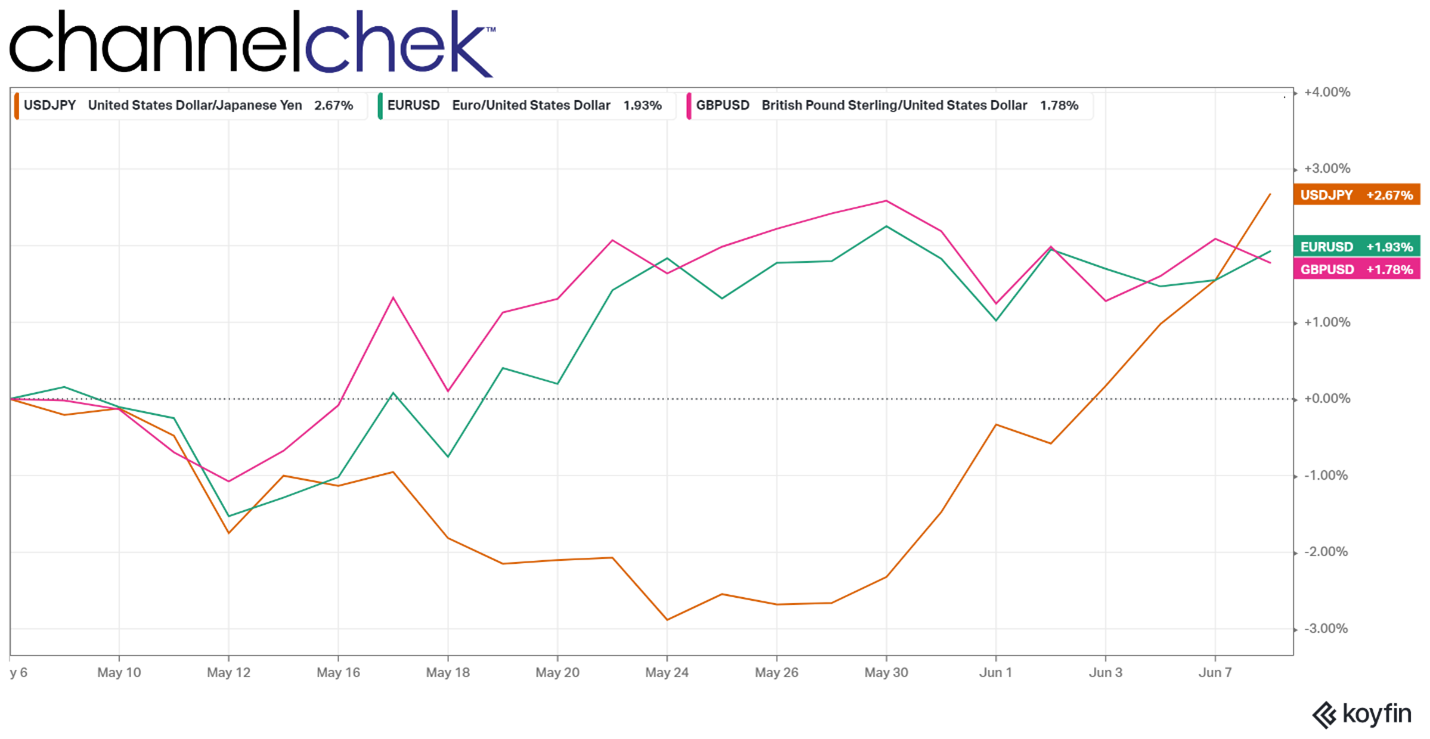

The US Dollar ($USD) has been strengthening against most major currencies of late. But, it can be argued, the currency strength directly against other currencies may not be a useful test for investors or consumers. Michael Burry, the fund manager of “The Big Short” fame, took to Twitter Tuesday to transform this talk of a stronger dollar. His tweet argues that those thinking the $USD is strong are using the wrong yardstick. US currency, he suggests, is only strong on a relative basis to other weakening currencies, and rampant inflation is actually eroding its purchasing power and its value.

Cheeseburger in Pandemonium

Burry’s words are reminiscent of The Big Mac Index. This is a measure lightheartedly created in 1986 by The Economist magazine to show currency misalignment between nations using a Macdonald’s menu item as the control. Over 36 years, it has devolved into a more simplified version called Burgernomics. Burgernomics shows the change in a currency’s direct purchasing power and, therefore, value change based on the cost of a cheeseburger.

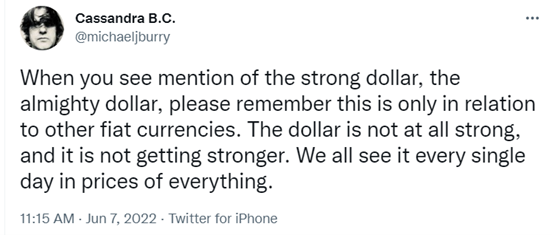

Burry tweeted on June 7th, “When you see mention of

the strong dollar, the almighty dollar, please remember this is only in

relation to other fiat currencies,” he said. “The dollar is not at all

strong, and it is not getting stronger. We all see it every single day in

prices of everything.” Burry has been very vocal since early 2020 about his concerns about the economic impact of steps taken at all levels in Washington.

Through May and continuing into June, the US dollar, measured against other currencies, hit 20-year highs. Its accelerated strength against other currencies is said to demonstrate its appeal as a haven in a volatile world. It also has gained natural strength from rising interest rates available in dollar-denominated assets.

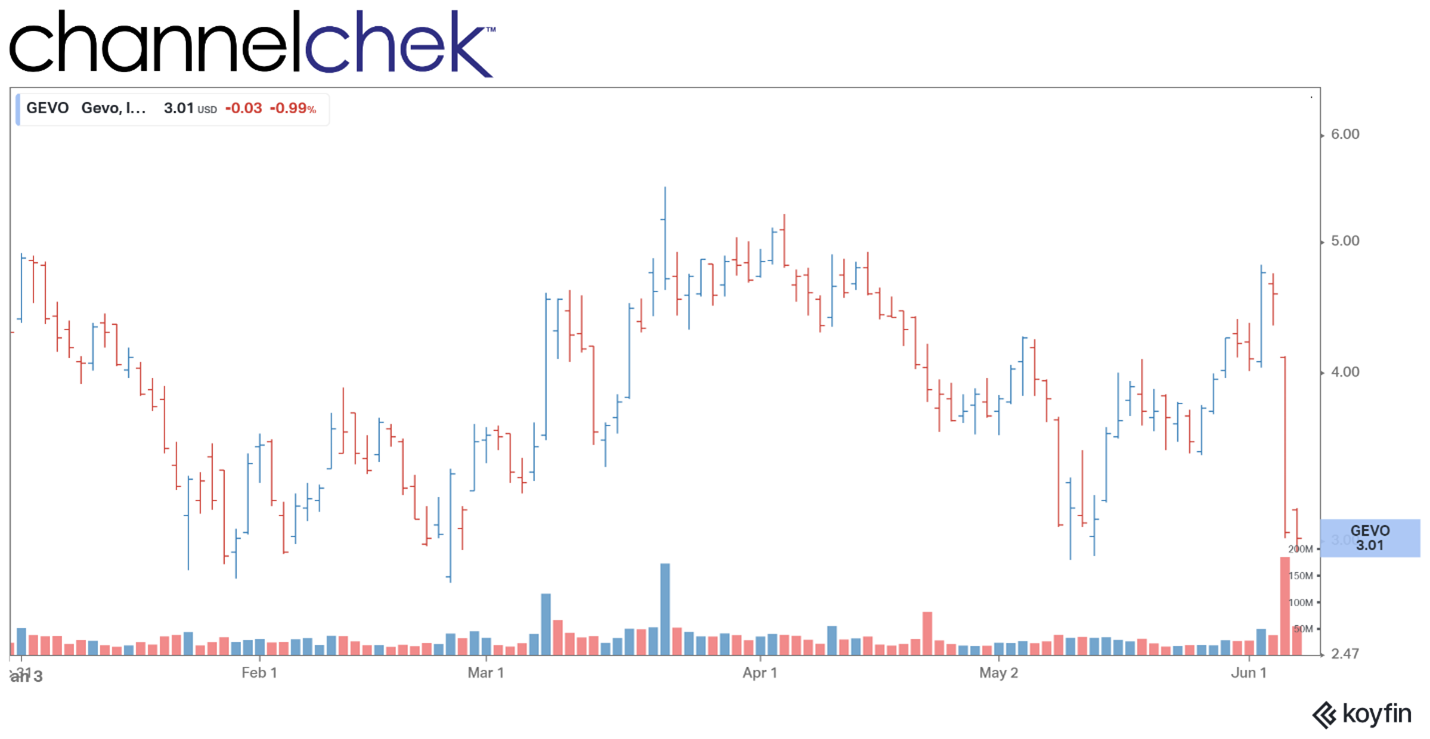

Source: Koyfin

Burry’s point is that a dollar may be worth more in euros or yen than before, but it buys far less due to the soaring prices of food, gas, housing, and many other goods and services. The expression “picking the cleanest dirty shirt” was used by many economists after 2008 to explain why foreign assets were invested in the US despite US troubles. The expression doesn’t suggest the US economy was at all good, it instead emphasizes that it was just best.

Source: Twitter

This thinking is not out of line with another widely followed investor, Warren Buffett. At the Berkshire Hathaway annual meeting, the Oracle of Omaha was quoted as saying. “Inflation swindles the bond investor … it swindles the person who keeps their cash under their mattress, it swindles almost everybody.”

Further Warnings from Burry

Burry, who is known to go on a tweeting frenzy only to delete them by day’s end, has left the above tweet available on his account. He recently highlighted that Americans are saving less, borrowing more, and could virtually exhaust their savings before the end of this year. He explained, that trend threatens to slash consumer spending and pile more pressure on corporate earnings.

Take Away

The well-followed hedge fund manager and founder of Scion Asset Management, LLC took to Twitter to give a different view than most often shown in financial news. Burry had frequently called out the economic cheerleaders and irrational speculation in the markets during the pandemic. He once discussed at length with Bloomberg how the reaction to coronavirus would eventually be worse

than the disease. He has compared

index funds to the real estate crisis. And he also bemoaned the “greatest speculative bubble of all time in all things” last summer, and warned owners of meme stocks and cryptocurrencies that they were headed towards the “mother of all crashes.”

He is never on CNBC or FOX Business News, but his thoughts and tweets are worth paying attention to. Channelchek will selectively highlight those thoughts when they seem relevant to our subscribers.

Managing Editor, Channelchek

Suggested Content

Michael Burry’s Stock Market Holdings (Filed May 16, 2022)

|

Michael Burry vs Cathie Wood is Not an Even Competition

|

Is the Index Bubble Michael Burry Warned About Still Looming?

|

SEC Pokes Fun at Investors, Draws Controversy

|

Sources

https://www.economist.com/big-mac-index

Stay up to date. Follow us:

|