|

|

|

Noble Capital Markets Senior Research Analyst Joe Gomes sits down with FAT Brands President & CEO Andrew Wiederhorn. Research, News, and Advanced Market Data on FATView all C-Suite InterviewsThe 2022 C-Suite Interview series is now available on major podcast platforms

About FAT (Fresh. Authentic. Tasty.) Brands FAT Brands (NASDAQ: FAT) is a leading global franchising company that strategically acquires, markets, and develops fast casual, quick-service, casual dining, and polished casual dining concepts around the world. The Company currently owns 17 restaurant brands: Round Table Pizza, Fatburger, Marble Slab Creamery, Johnny Rockets, Fazoli’s, Twin Peaks, Great American Cookies, Hot Dog on a Stick, Buffalo’s Cafe & Express, Hurricane Grill & Wings, Pretzelmaker, Elevation Burger, Native Grill & Wings, Yalla Mediterranean and Ponderosa and Bonanza Steakhouses, and franchises and owns over 2,300 units worldwide. |

Month: May 2022

The Federal Reserve’s Financial Well-Being Survey Breaks Record

Image Credit: Rodnae (Pexels)

Federal Reserve Board Issues Economic Well-Being of U.S. Households Report

The Federal Reserve Board on Monday issued its Economic Well-Being of U.S. Households in 2021 report, which examines the financial lives of U.S. adults and their families. The report draws from the Board’s ninth annual Survey of Household Economics and Decisionmaking, or SHED, which was conducted in October and November of last year before the increase in COVID-19 cases from the Omicron variant and other changes to the economic landscape in recent months. The report, fact sheet, downloadable data, data visualizations, and a video summarizing the survey’s findings may be found here.

The report indicates that self-reported financial well-being reached its highest level since the SHED began in 2013. In the fourth quarter of 2021, 78 percent of adults reported either doing okay or living comfortably financially. Financial well-being also increased among all the racial and ethnic groups measured in the survey, with a particularly large increase among Hispanic adults. Parents were one group who reported large gains in financial well-being with three-fourths saying they were doing at least okay financially, up 8 percentage points from 2020.

“The SHED results provide valuable insight into Americans’ financial conditions during the late fall of 2021. This important perspective helps the Federal Reserve better understand the economic challenges that existed during that phase of the pandemic recovery,” said Federal Reserve Board Governor Michelle W. Bowman.

The share of adults who reported that they would cover a $400 emergency expense using cash or its equivalent similarly increased to the highest level since the start of the survey—68 percent—and was up from 50 percent when the survey began in 2013. Eleven percent of adults could not pay the expense by any method.

In addition, the survey presents insight into the experiences of workers through the pandemic. Fifteen percent of workers said they were in a different job than 12 months earlier. Most who changed jobs said the job change was an improvement. Remote work also continued to evolve in 2021. During the week of the survey in late 2021, 22 percent of employees worked entirely from home, down from 29 percent in late 2020, but well above the 7 percent who worked entirely from home before the pandemic. Most employees who worked from home preferred to do so, often citing work-life balance and less time commuting. Those working from home indicated that they would be about as likely to look for a new job if required to return to the office as if their employer instituted a pay freeze.

In addition, the

report explores families’ experiences related to banking and credit, income, housing, retirement, student loans, and retirement alongside several new topics, such as the use of emerging financial products including cryptocurrencies and “Buy Now, Pay Later” services.

| This press release was originally published by the U.S. Federal Reserve on May 23, 2022. Links to the survey results and release are provided below. |

Suggested Reading

Tulip Mania Compared to Cryptocurrencies and Meme Stock Investing

|

Why Good Economic Numbers Can Cause a Selloff

|

SEC Chairman Links Crypto and Other Financial Markets

|

Is the Bear Market Bull?

|

Sources

https://www.federalreserve.gov/publications/report-economic-well-being-us-households.htm

https://www.federalreserve.gov/newsevents/pressreleases/other20220523a.htm

Stay up to date. Follow us:

|

Stem Holdings, Inc. (STMH) – Reports Fiscal 2Q22 Operating Results

Monday, May 23, 2022

Stem Holdings, Inc. (STMH)

Reports Fiscal 2Q22 Operating Results

Stem is a multi-state, vertically integrated, cannabis company that, through its subsidiaries and its investments, is engaged in the cultivation, processing, packaging, distribution and branding of cannabis, hemp and their derivatives, including oils, edibles, concentrates. Additionally, the Company purchases, improves, leases, operates, and invests in properties for use in the production, distribution and sales of cannabis and cannabis-infused products licensed under the laws of the states of Oregon, Nevada, California, Massachusetts, and New York. As of December 31, 2021, Stem had ownership interests in 24 state-issued cannabis licenses including nine (9) licenses for cannabis cultivation, three (3) licenses for cannabis processing, two (2) licenses for cannabis wholesale distribution, three (3) licenses for hemp production and seven (7) cannabis dispensary licenses.

Joe Gomes, Senior Research Analyst, Noble Capital Markets, Inc.

Joshua Zoepfel, Research Associate, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

2QFY22 Results. Stem reported net revenue of $4.1 million compared to $5.5 million last year. The sales decline reflects a decrease in sales resulting from general market conditions. Stem reported a net loss of $3.5 million, or $0.02 per share, for the quarter. In the same period last year, Stem recorded a net loss of $8.6 million, or $0.06 per share. Outstanding shares increased to 223.7 million from 137.8 million. We had projected revenue of $4.2 million and a net loss of $4.0 million, or $0.02 per share.

Segments. While the wholesale business saw a modest increase year-over-year, retail revenue declined to $3.2 million from $6.0 million year-over-year. We attribute the drop to a combination of a soft overall cannabis market and Stem’s ongoing restructuring of its Oregon operations.…

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Price Moves When Warren Buffett Buys and Sells (Based on May 16 SEC Filing)

The Big Price Impact on Stocks After Warren Buffett’s Most Active Buying Spree

Warren Buffett and Berkshire Hathaway (BRK.A, BRK.B) were actively spending down the company’s large pool of cash last quarter, just as they promised during their recent annual meeting. This makes sense as some stock prices are lower than they have been in years, and a few sectors are showing they could have plenty of upside potential. It makes even more sense when you consider that Berkshire Hathaway was sitting on $144 billion in cash. The inflation rate is now running above 8% and eroding the value of every unearning penny.

Jumping into the market can be costly if wrong, but investor’s ‘dry powder’ is being eroded with increased costs by the day – finding a place for money to grow by at least the inflation rate would seem prudent. The analysts at Berkshire Hathaway are certainly aware of this.

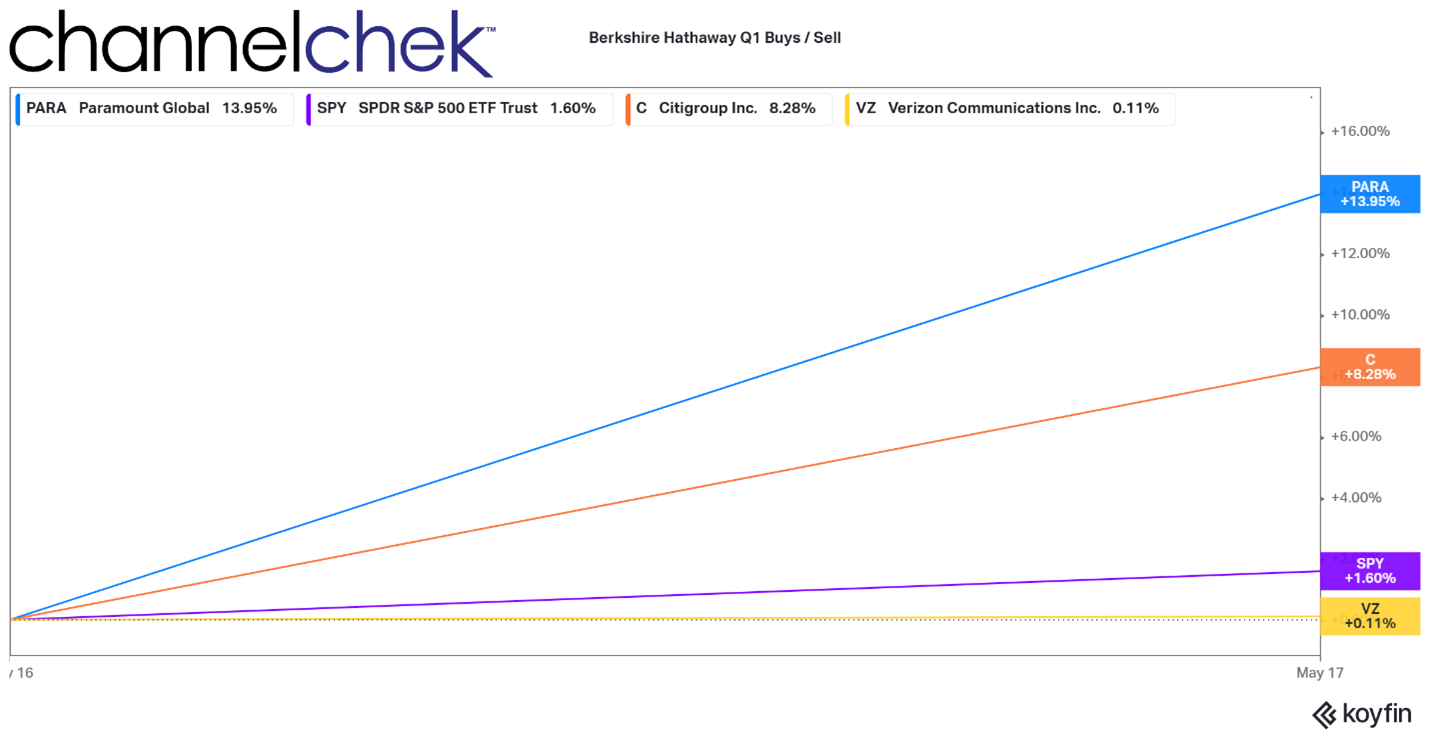

The positive impact of Berkshire showing confidence in a company is often all that is needed to exceed the near non-earnings holding a cash position. Below we look at three Berkshire Hathaway changed positions as reported on May 16, and then compare the stock’s price moves versus the overall market.

Where Did They Gain Exposure

As revealed by the companies 13F filed on May 16, as of March 31 Berkshire Hathaway added Citigroup (C), Paramount Global (PARA), and sold Verizon (VZ). There were older positions added to as well, such as Chevron (CVX), and Activision Blizzard (ATVI). But for the purpose of showing the power of Buffett’s believing a stock is attractive, or in Verizon’s case, no longer attractive, we’ll take a look at the market moves of these companies as of 1pm the day after the 13F was made public.

The above chart of Citibank, Paramount Global, and Verizon from the beginning trading on Monday compares the stocks to the S&P 500 performance during the same short period.

The S&P, as reflected during the short period in this chart, beginning on the date of Berkshire’s 13F filing, shows the S&P 500 up 1.60%. This is substantial in a year when the index has mostly been delivering red to investors. Verizon was the most noteworthy sale of Buffett as they brought their position near zero. The company’s stock rose only 0.11%, well below the S&P benchmark performance.

As for the positions opened during the first quarter by Berkshire Hathaway, Citicorp shot up 8.28%. Paramount Global reacted even more strongly, rising double digits to 13.95%.

Lessons

While an SEC-registered portfolio new holdings are kept close to the vest before reported in order to avoid insider trading problems, listening to what someone like Warren Buffett is saying at annual meetings and at other times can allow you to get a sense if they have been active, and in what industries. More important, is whether they are active buying or selling. For an investor that is holding a stock which a well-followed investor has decided to sell, can cause significant underperformance for at least the near term.

Other Pertinent Info from the 13F Filing

During the first quarter of 2022, the value of Berkshire’s US stock portfolio rose by 10% to $364 billion. Buffett had indicated the firm he manages has been struggling to find bargains in recent years. He blamed this on stocks swelling to record highs, fierce competition from private equity firms, and SPACs which increased competition and costs of acquisitions. Even Berkshire’s own rising stock price made it unappealing as a company stock buy-back.

A change of appetite took place in the first quarter of 2022. Berkshire bought $51 billion worth of equities and sold less than $10 billion in stocks. Its net cash reduction of $41 billion helped slash its cash pile by 28% to $106 billion. Q1 2022 marked one of the most active buying periods in Berkshire Hathaway’s history.

Take-Away

Well known, successful investors can either make a winner out of your holding or cause it to trade at a pace below the market. While knowing and trading on information before it is made public can get you in trouble, investors like Buffett do provide guidance. These hints as to their thinking and likely direction may help investors somewhat. This is why it always makes sense to know what they’re saying – it isn’t fun holding something they just reported sold, and the tailwind they create when you’re long the same company can be profitable.

Managing Editor, Channelchek

Sources

https://www.sec.gov/Archives/edgar/data/1067983/000095012322006442/xslForm13F_X01/primary_doc.xml

https://whalewisdom.com/filer/berkshire-hathaway-inc#google_vignette

Bowlero (BOWL) – Cleans Up Capital Structure

Friday, May 20, 2022

Bowlero (BOWL)

Cleans Up Capital Structure

Bowlero Corp. is the worldwide leader in bowling entertainment, media, and events. With more than 300 bowling centers across North America, Bowlero Corp. serves more than 26 million guests each year through a family of brands that includes Bowlero, Bowlmor Lanes, and AMF. In 2019, Bowlero Corp. acquired the Professional Bowlers Association, the major league of bowling, which boasts thousands of members and millions of fans across the globe. For more information on Bowlero Corp., please visit BowleroCorp.com.

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Patrick McCann, Research Associate, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Warrants off the books. The company announced that all of its outstanding warrants have been either redeemed or exercised. As of March 31, the company had a total of roughly 14.5 million outstanding warrants, a combination of public and privately held. The company also announced the repurchase of 0.46 million shares since the last quarter-end for roughly $4.3 million.

Cashless Exercise. The company received roughly $23,000 in connection with the exercise of some of the publicly held warrants. However, the vast majority of the warrants were exercised on a cashless basis. In total, the company issued approximately 4.26 million shares for the exercise of the remaining warrants.

…

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Is Crumbling Trust in the Financial System Leading to a Flight to Real Assets?

Image Credit: Federal Reserve History

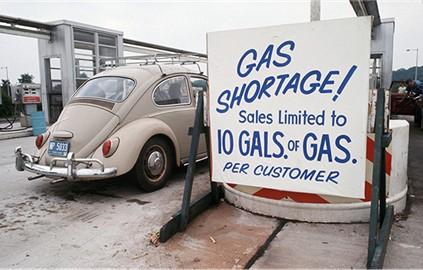

Inflation, War, and Oil: How Today’s Crises Are Rehashing the 1970s

Consumer price inflation has risen to 8.3 percent in April 2022 in the United States and 7.5 percent in the euro area. This raises the question of who is responsible. In the US, President Joe Biden has argued that 70 percent of inflation in March is attributable to Russian president Vladimir Putin. The European Central Bank has suggested that the high inflation should be seen in the context of the pandemic and the Ukraine war. ECB president Christine Lagarde sees steeply rising energy prices as unrelated to the monetary policy of the ECB. But is inflation only due to the war and the pandemic?

According to Milton Friedman, inflation is “always and everywhere a monetary phenomenon” and thereby the responsibility of central banks. Given that in all industrialized countries money supply has for a long time grown much faster than output, the resulting huge monetary overhang should be at the root of rising inflation. Whereas since the turn of the millennium stock and real estate prices have grown fast, consumer price inflation only started picking up in mid-2021, boosted by energy prices. There are five reasons why rising energy prices are linked to the global monetary overhang, which was further strongly increased during the pandemic.

|

About the Author:

Gunther Schnabl is a professor of international economics and economic policy in the department of economics at Leipzig University, Germany. |

First, because of eroding trust in the dollar and the euro, a flight to real assets has set in. Tangible assets include not only real estate and stocks, but also shares in commodity mines and raw materials, including oil and gas. Secondly, the ultraloose monetary policy of the major central banks has—together with expansionary fiscal policies—fueled aggregate demand and thus also demand for energy and raw materials. When corporations—thirdly—assume that the price increases will be permanent, they hoard raw materials, which further increases demand and prices.

Fourth, energy- and commodity-exporting countries hold large dollar and euro reserves, which are devalued by inflation in the US and the euro area. Since they are often oligopolists, energy- and commodity-exporting countries can hedge against this depreciation by raising prices. Recently, some Arab countries have refused to expand the production of oil and natural gas to lower world market prices. Fifth, energy and commodities are predominantly traded in dollars. If the euro depreciates due to the ECB’s ongoing loose monetary policy, prices of raw materials and energy rise in the euro area.

This leads to the question of the extent to which there are parallels with the 1970s, when high and persistent inflation was accompanied by war in the oil-rich Middle East. Global inflationary pressures emerged even before the first oil crisis in 1971, as they are today. Since the second half of the 1960s, the US had financed the Vietnam War and growing social spending partly through the printing press. Inflation was exported to the many countries whose currency was pegged to the dollar. Then as now, energy- and commodity-exporting countries had an incentive to compensate for real losses in the value of their dollar reserves through price increases. This can be seen as the origin of the cartel policy of the Organization of the Petroleum Exporting Countries and the first oil crisis in 1971.

Persistently loose monetary policies always have negative growth and distributional effects that impair political stability. In extreme cases, there are civil wars, as evidenced by the Arab Spring, or there are armed conflicts between countries. The Yom Kippur War in 1971 was—inter alia—triggered by the Egyptian president Anwar el-Sadat’s desire to distract from domestic political tensions. Since 2014, falling oil prices have been depressing growth in Russia. It cannot be ruled out that one of Putin’s major motivations to go to war was securing his power in Russia. Finally, as in the 1970s, the growing international political instability has further increased global inflationary pressure via rising oil and commodity prices.

In the 1970s, inflation only came to an end when, starting in 1979, the new US Federal Reserve chairman Paul Volcker rigorously raised interest rates to 20 percent (Volcker shock). As a result, oil prices started to fall. Both the Fed and the ECB are still far from taking similar steps. The Fed has decisively announced interest rate hikes, but a rise in interest rates above the inflation rate is still a long way off. In the euro area, President Lagarde has kept all options open despite high inflation.

A decisive defense of price stability looks different. This implies that inflationary pressure will persist for longer, particularly in the euro area, as the high level of government debt can be melted down by inflation, helping to financially stabilize the heavily indebted euro area countries. As this process is likely to come along with persistent economic instability, however, the Ukraine crisis may not be the last political crisis in Europe.

Suggested Reading

The Basket of Goods Will Become Financially Heavier

|

Since 2008, Monetary Policy Has Cost American Savers about $4 Trillion

|

Money Supply Drives Stock Market Performance

|

Avoiding the Noise and Focusing on Managing Your Investments

|

Stay up to date. Follow us:

|

Is the Move Toward ESG Funds and Sustainability Fading?

Image Credit: Wallumrod (Pexels)

Sustainability and ESG Investing May Not be a Top Priority for those Hiring Portfolio Managers

A few of the winning categories in the stock market over the past two years have fallen from grace. The slide suggests that they had either been overbought or the demand changed for their products; it’s also possible they are now oversold. For example, high tech and disruptive tech were high flyers; they now are underperforming and seem to be “out of the rotation” of where investor money is flowing. Another category that saw money piling into it was ESG (Environmental, Social, Governance). This is a relatively new category that was so much in demand that many new funds were created to capitalize on the flow of cash. Many publicly traded companies even altered their business and their branding to capitalize on the expanded demand for stocks in these funds.

With the overall market declining and investors challenged to find companies on an upswing, are ESG labeled investments still getting attention?

ESG Scores

ESG scores are based on environmental, social, and governance factors that take into account corporate energy use, land use, emissions, employee satisfaction, business practices, and executive compensation. The popularity of funds that invest in ESG ranked companies had escalated as the new administration entered the White House in 2021. This is in part because there were big plans to recover from the pandemic-related slowdown with financial support for green or sustainable projects. ESG funds then experienced large and growing inflows of assets. With the increase in assets and a limited field of stocks to choose from, the category outperformed. As the above-average performance was recognized and reported on, it attracted more assets.

This caused companies that didn’t fit into the category to make changes that would provide them a decent ESG score. The list of acceptable companies from which fund managers can choose is still growing. This creates a situation where there is an increasing number of names, while the amount going into these funds has slowed.

The ESG ratings themselves are provided by private companies that have earned a reputation in the business. They wield a lot of power as they dictate who can be included in a fund and who cannot. The better-known firms are MSCI (MSCI), the largest ESG rating company, Standard & Poor’s (SPGI) and Sustainalytics, owned by Morningstar (MORN). Investors, including fund managers, use these as a guide to screen stocks for inclusion in ESG and sustainable portfolios.

Performance

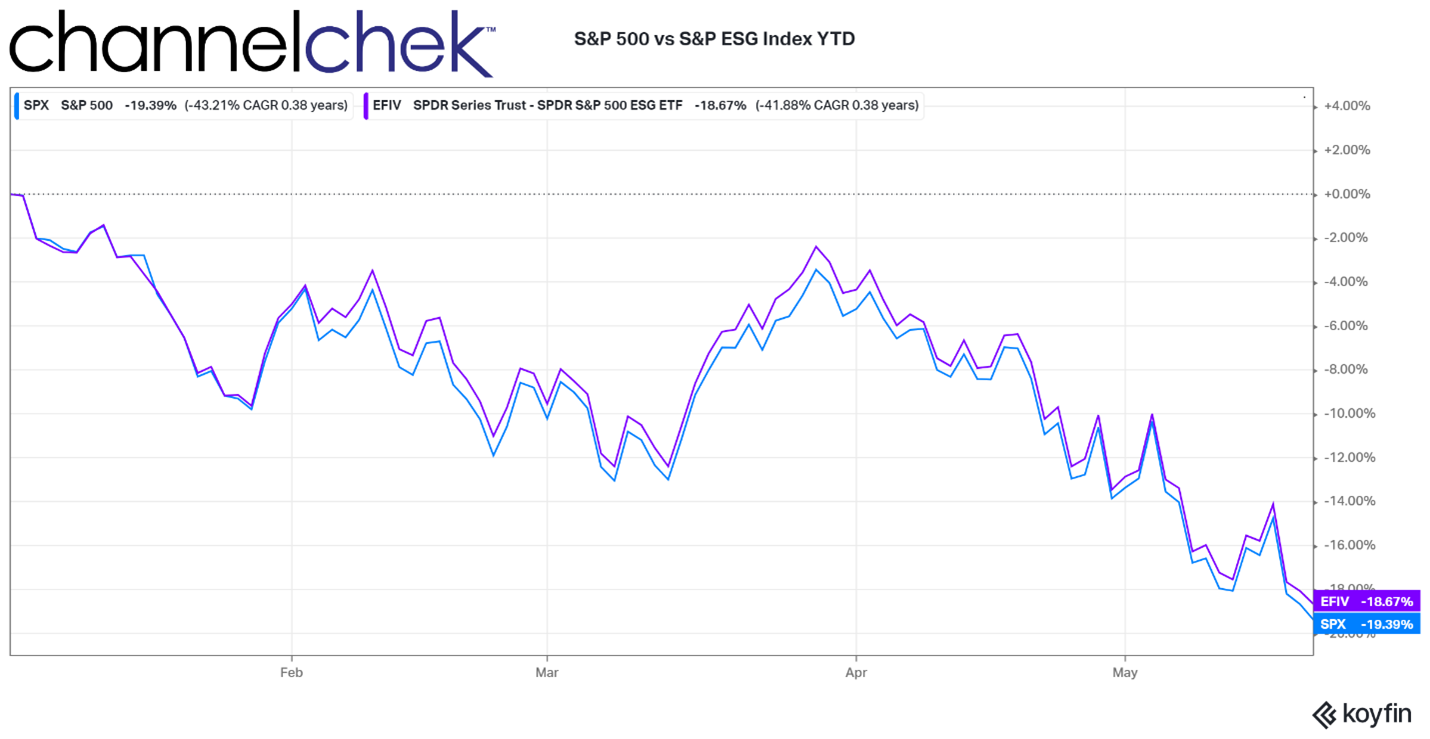

The year-to-date (YTD) S&P ESG Index (308 stocks) and the S&P 500 performance have tracked pretty close since the beginning of the year. There has only been a slight benefit to those earning the ESG index which is down 18.7% vs. 19.4% for the S&P 500.

Source: Koyfin

The YTD performance difference of just over 1% represents a narrowing of the performance spread for the two indexes. As the graph below indicates since August 1, 2021, (one year after launch of the index) there is more than a 5% difference in return, favoring the ESG fund.

Source: Koyfin

Mood Change?

ESG funds and ratings have been under fire in 2022. This is in part related to the attention the Russian invasion of Ukraine brought to the category. Some critics question why ESG-labeled funds own companies such as Russia’s state-backed energy company Gazprom.

In a recent study by Seeward & Kissel they surveyed funds-of-funds, family offices, endowments, seeders, and other investors, the law firm discovered ESG considerations rank low as a priority when hiring managers. The Seeward & Kissel’s 2022 Alternative Investment

Allocator Survey indicated, that overwhelmingly the main criteria used are investment strategies and a track record of performance.

According to the survey over 40% said ESG and investment team diversity were the least important issues when sourcing portfolio managers. A full 90% answered that investment strategy was the most important factor and track record also ranked high on the list.

Daniel Bresler, a partner at Seeward & Kissel said, “We don’t think ESG is going away anytime soon, but it has been placed on the backburner because of concerns with Ukraine and markets going crazy.” Bresler also indicated he was surprised by the results showing how low the ESG category ranked in importance.

This week’s announcement that Tesla (TSLA) was ineligible and therefore cut from the S&P DJI ESG, has also caused confusion among onlookers who viewed the electric car company as the ESG “poster child.” At the same time, the strong position of Exxon Mobil (XOM) which moved up within the same S&P index has raised questions about methodology.

Take-Away

ESG is maturing and will have its place. The attention it received as the Biden Administration was laying plans for greener projects while helping rebuild infrastructure provided a high level of enthusiasm for the category. The overall market has turned somewhat sour and returns are now a stronger driver than an often misunderstood ESG and sustainability category. Along with the market weakness, the nature of rewarding some companies with a high ESG score and other seemingly less destructive companies with a lower score has reduced enthusiasm.

These perceived problems are likely just part of the growing pains of a category that will likely ebb and flow as the other investment categories, sectors, and companies do.

Managing Editor, Channelchek

Suggested Content

Avoiding the Noise and Focusing on Managing Your Investments

|

What Would Failure Look Like to Elon Musk if He Buys Twitter?

|

Can Mining be Green and Sustainable?

|

The World is Hot Right Now! NobleCon18 Panel Presentation

|

Sources

https://www.investmentnews.com/major-outflows-hit-most-asset-classes-as-recession-woes-mount-221753

https://etfdb.com/esg-channel/how-long-will-esg-funds-rake-in-capital/

Stay up to date. Follow us:

|

Release – InPlay Oil Corp. Announces Annual Meeting Voting Results for Election of Directors

InPlay Oil Corp. Announces Annual Meeting Voting Results for Election of Directors

News and Market Data on InPlay Oil Corp

CALGARY, Alberta, May 19, 2022 (GLOBE NEWSWIRE) — InPlay Oil Corp. (TSX: IPO) (OTCQX: IPOOF) (“InPlay” or the “Company”) announced today the voting results for the election of directors at its annual meeting of shareholders held on May 19, 2022 (the “Meeting”). The following five nominees were elected as directors of InPlay to serve until the next annual meeting of shareholders or until their successors are elected or appointed, with common shares represented at the Meeting voting in favour of individual nominees as follows:

|

Director |

|

Percentage Approval |

|

Percentage Withheld |

|

|

|

Douglas J. Bartole |

|

99.8 |

% |

|

0.2 |

% |

|

Joan E. Dunne |

|

99.6 |

% |

|

0.4 |

% |

|

Craig Golinowski |

|

99.5 |

% |

|

0.5 |

% |

|

Stephen C. Nikiforuk |

|

99.7 |

% |

|

0.3 |

% |

|

Dale O. Shwed |

|

99.4 |

% |

|

0.6 |

% |

|

|

|

|

|

|

|

|

For complete voting results, please see our Report of Voting Results which is available through SEDAR at www.sedar.com.

InPlay is based in Calgary, Alberta and the common shares of InPlay are traded on The Toronto Stock Exchange under the trading symbol “IPO”. For further information about the Corporation, please visit our website at www.inplayoil.com.

For further information please contact:

|

Doug Bartole |

|

Darren Dittmer |

Release – BOWLERO CORP. COMPLETES REDEMPTION OF ALL OUTSTANDING WARRANTS AND PROVIDES AN UPDATE ON ITS SHARE REPURCHASE PROGRAM

BOWLERO CORP. COMPLETES REDEMPTION OF ALL OUTSTANDING WARRANTS AND PROVIDES AN UPDATE ON ITS SHARE REPURCHASE PROGRAM

Research, News, and Market Data on Bowlero

05/19/2022

- As of 5:00 PM

New York City time on May 18, 2022, all outstanding publicly and privately

held warrants have been exercised or redeemed. - 2,040 warrants

were exercised for cash and 14,524,679 warrants were exercised on a

cashless basis. - 4,264,399 Class

A Shares were issued for the cashless exercise; however, on a fully

diluted basis, at a share price of $20, the share count would now be lower

by approximately 2 million shares. - Following the

end of Q3 FY ’22 and through May 11, 2022, the company repurchased 465,667

shares of Class A common stock for $4,305,750.

RICHMOND, Va., May 19, 2022 (GLOBE NEWSWIRE) — Bowlero Corp. (NYSE:BOWL), (“Bowlero” or the “Company”) today announced the completion of its redemption of all publicly traded warrants (the “Public Warrants”) and privately held warrants (the “Private Warrants”, together with the Public Warrants, the “Warrants”) to purchase shares of the Bowlero’s Class A common stock, par value $0.0001 per share (the “Common Stock”), that were issued under the Warrant Agreement (the “Warrant Agreement”), dated March 2, 2021, by and between the Company and Continental Stock Transfer & Trust Company (“CST”), as warrant agent (“the Warrant Agent”), that remained outstanding at 5:00 p.m. New York City time on May 16, 2022 (the “Redemption Date”), for a redemption price of $0.10 per Warrant.

“By retiring all of the Warrants and continuing our share purchases, we were able to return capital to shareholders, reduce the prospects of future dilution and simplify our capital structure. This was all done in a very cash efficient manner, and is in line with our plans to opportunistically allocate capital to maximize returns for shareholders,” said Brett Parker, President and CFO of Bowlero Corp.

On April 14, 2022, the Company issued a press release stating that, pursuant to the terms of the Warrant Agreement, on the Redemption Date it would redeem all of the outstanding Warrants at a redemption price of $0.10 per Warrant.

Of the 9,137,592 Public Warrants that were outstanding as of the quarter ended on March 27, 2022, 2,040 Public Warrants were exercised for cash at an exercise price of $11.50 per share of Common Stock and 9,126,851 Public Warrants were exercised on a cashless basis in exchange for an aggregate of 2,679,597 shares of Common Stock, in each case in accordance with the terms of the Warrant Agreement, representing approximately 99.9% of the outstanding Public Warrants.

In addition, all 5,397,828 Private Warrants that were outstanding as of the closing of the Business Combination were exercised on a cashless basis in exchange for an aggregate of 1,584,802 shares of Common Stock in accordance with the terms of the Warrant Agreement. Total cash proceeds to the Company generated from exercises of the Public Warrants for cash were approximately $23,000. 8,701 Public Warrants were redeemed by the Company for the redemption price of $0.10 per warrant, for a total of $870.10. Following the Redemption Date, the Company had no Public Warrants or Private Warrants outstanding.

In total, as a result of the completion of the redemption of the Public and Private Warrants, the Company issued 4,264,399 shares of Common Stock for exercise on a cashless basis, in which the exercising holders received 0.2936 shares of Common Stock per warrant exercised. If the Company were to have conducted such redemption when the price of its Common Stock were equal to $20 per share, the Company estimates that it would have had to issue approximately 2 million additional shares of Common Stock for exercise on a cashless basis, assuming that all holders chose to exercise their Warrants on a cashless basis.

The Company also announced that, as of May 11, 2022 it has repurchased 465,667 shares of Common Stock for an average cost of $9.25 or $4,305,750 since the end of its third fiscal quarter ended March 27, 2022 under its previously authorized program for the repurchase of up to an aggregate amount of $200 million of its shares of Common Stock and Warrants, which was announced on February 7, 2022. After the cumulative share and Warrant repurchases, the Company has approximately $189 million remaining under the program.

The Company will continue to review the authorized share repurchase program and may repurchase additional shares of Common Stock depending upon market conditions, corporate liquidity requirements and priorities, debt agreement limitations and other factors in its sole discretion. The share repurchase program does not obligate the Company to repurchase any particular amount of Common Stock and may be suspended or discontinued at any time without notice.

In connection with the redemption, the Warrants ceased trading on the New York Stock Exchange and were delisted, with the trading halt announced after close of market on May 16, 2022. The Common Stock continues to trade on the New York Stock Exchange under the symbol “BOWL.”

Forward Looking Statements

Some of the statements contained in this press release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are generally identified by the use of words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and, in each case, their negative or other various or comparable terminology. These forward-looking statements reflect our views with respect to future events as of the date of this release and are based on our management’s current expectations, estimates, forecasts, projections, assumptions, beliefs and information. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. All such forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, and could cause future events or results to be materially different from those stated or implied in this document. It is not possible to predict or identify all such risks. These risks include, but are not limited to: the impact of COVID-19 or other adverse public health developments on our business; our ability to grow and manage growth profitably, maintain relationships with customers, compete within our industry and retain our key employees; changes in consumer preferences and buying patterns; the possibility that we may be adversely affected by other economic, business, and/or competitive factors; the risk that the market for our entertainment offerings may not develop on the timeframe or in the manner that we currently anticipate; general economic conditions and uncertainties affecting markets in which we operate and economic volatility that could adversely impact our business, including the COVID-19 pandemic and other factors described under the section titled “Risk Factors” in the registration statement on Form S-1 filed with the U.S. Securities and Exchange Commission (the “SEC”) by the Company, as well as other filings that the Company will make, or has made, with the SEC, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this press release and in other filings. We expressly disclaim any obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

No Offer or Solicitation

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any Bowlero securities, and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Bowlero

Bowlero Corp. is the worldwide leader in bowling entertainment, media, and events. With more than 300 bowling centers across North America, Bowlero Corp. serves more than 26 million guests each year through a family of brands that includes Bowlero, Bowlmor Lanes, and AMF. In 2019, Bowlero Corp. acquired the Professional Bowlers Association, the major league of bowling, which boasts thousands of members and millions of fans across the globe. For more information on Bowlero Corp., please visit BowleroCorp.com.

Contacts:

For Media:

ICR, Inc.

Maple Gold Mines (MGMLF) – Stepping Out and Drilling Deep

Friday, May 20, 2022

Maple Gold Mines (MGMLF)

Stepping Out and Drilling Deep

Mark Reichman, Senior Research Analyst, Natural Resources, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Exploration to include deep drilling programs. The joint venture between Maple Gold and Agnico Eagle Mines Limited will increase its 2022 exploration budget by C$4.8 million to support a deep drilling program at the Douay and Joutel Gold projects in Quebec. Goals for the more aggressive step-out and deep drilling program include defining a larger gold system at Douay and extending higher-grade mineralization along the entire past-producing Eagle-Telbel mine trend at Joutel. The deep drilling program is expected to include four to six drill holes and/or drill hole extensions totaling roughly 10,000 meters across Douay and Joutel.

Updating estimates. The C$4.8 million supplemental exploration budget provides additional funding beyond Agnico’s second year JV spending commitment of C$4 million. Therefore, the partners will each contribute C$2.4 million on a pro-rata basis. While our per share estimates are unchanged, we have increased our 2022 and 2023 exploration expenditure estimates to C$10.4 million and C$10.65 million, respectively, from C$8.0 million and C$8.25 million….

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Cypress Development (CYDVF) – Recent Share Price Weakness Offers Investors an Attractive Entry Point

Friday, May 20, 2022

Cypress Development (CYDVF)

Recent Share Price Weakness Offers Investors an Attractive Entry Point

Mark Reichman, Senior Research Analyst, Natural Resources, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Well positioned to meet growing demand for lithium. Cypress Development is advancing its 100%-owned Clayton Valley Lithium Project near Silver Peak, Nevada. Cypress intends to mine Nevada claystone, produce a high-grade lithium concentrate solution and apply a licensed lithium extraction process based on ion-exchange to produce lithium carbonate or hydroxide. Clayton Valley could go into production as early as 2025, following the completion of a feasibility study by year-end 2022, a two-year permitting period which could begin mid-year 2022, and one-year construction period. We have assumed commercial production commences in 2026.

Enertopia acquisition closed. Cypress Development recently completed its acquisition of Enertopia’s lithium claystone project adjacent and at the northwest end of its own Clayton Valley lithium project. The acquisition adds seventeen unpatented mining claims totaling 160 contiguous acres and will be rolled into Cypress’ own resource model and feasibility study which is expected by year-end 2022. The acquired property could extend the pit outline to the northeast and provide material that could enhance the production schedule in the early years. …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Energy Fuels (UUUU) – UUUU locks up Rare Earth Element Supplies

Friday, May 20, 2022

Energy Fuels (UUUU)

UUUU locks up Rare Earth Element Supplies

Energy Fuels is a leading U.S.-based uranium mining company, supplying U3O8 to major nuclear utilities. Energy Fuels also produces vanadium from certain of its projects, as market conditions warrant, and is ramping up commercial-scale production of REE carbonate. Its corporate offices are in Lakewood, Colorado, near Denver, and all its assets and employees are in the United States. Energy Fuels holds three of America’s key uranium production centers: the White Mesa Mill in Utah, the Nichols Ranch in-situ recovery (“ISR”) Project in Wyoming, and the Alta Mesa ISR Project in Texas. The White Mesa Mill is the only conventional uranium mill operating in the U.S. today, has a licensed capacity of over 8 million pounds of U3O8 per year, has the ability to produce vanadium when market conditions warrant, as well as REE carbonate from various uranium-bearing ores. The Nichols Ranch ISR Project is on standby and has a licensed capacity of 2 million pounds of U3O8 per year. The Alta Mesa ISR Project is also on standby and has a licensed capacity of 1.5 million pounds of U3O8 per year. In addition to the above production facilities, Energy Fuels also has one of the largest NI 43-101 compliant uranium resource portfolios in the U.S. and several uranium and uranium/vanadium mining projects on standby and in various stages of permitting and development. The primary trading market for Energy Fuels’ common shares is the NYSE American under the trading symbol “UUUU,” and the Company’s common shares are also listed on the Toronto Stock Exchange under the trading symbol “EFR.” Energy Fuels’ website is www.energyfuels.com.

Michael Heim, CFA, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Energy Fuels signed purchase agreements to acquire mineral concessions in Bahia, Brazil believed to include monazite sand, which contains both rare earth elements (REE) and uranium. The project has yet to be mined, but over 3,300 holes have been drilled indicating the presence of monazite. The monazite is close to the surface and should be a low-cost source of supply. The monazite will be shipped to UUUU’s milling operations in the United States where it is developing and expanding REE extraction and separation operations. Management indicated that building a Brazil milling plant is possible, although we do not view that as a near-term project. Energy Fuels will pay $27.5 million for the concessions, an amount easily funded with its $106 million of cash and marketable securities.

Management believes the project could supply 3,000-10,000 per year of monazite containing 1,500-5,000 of total rare earth oxides (TREO). The company had previously stated a goal of eventually producing 10,000 tons of REE annually, implying processing 20,000-25,000 tons of monazite. To date, production ramp up has been hampered by an inability to secure sufficient monazite sand. If management is correct about the potential of the Brazil project, it could represent 25-50% of supply at full production (which we model to be in 2026). As such, the agreement represents a significant step in locking up supply. We expect the company to continue to look to sign additional supply agreements….

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

SEC Chairman Links Crypto and Other Financial Markets

Image Credit: Third Way Think Tank (Flickr)

Has the Crypto Crunch Accelerated SEC Plans to Regulate the Market?

The Securities and Exchange Commission (SEC) Chairman Gary Gensler says he’s concerned and expects other crypto tokens will fail, and it could undermine overall faith in financial markets. The comments came after May’s implosion of TerraUSD, which was the third-largest stablecoin by total value. The SEC chairman was speaking before the House Appropriations Committee on May 18.

“I think a lot of these tokens will fail,” Gensler told reporters after the Committee panel hearing. “I fear that in crypto…there’s going to be a lot of people hurt, and that will undermine some of the confidence in markets and trust in markets writ large.”

Assets in the cryptocurrency markets have shrunk by more than $1 trillion in value since December as signs that the Federal Reserve would unwind its accommodative policies became accepted. Around the same time, regulators began placing crypto under a spotlight with the intent to protect speculators by providing rules and constraints. The use of crypto by Russia cast the tokens under an even darker light for much of the world. The accelerated crypto selloff came after the U.S. central bank raised interest rates. TerraUSD, a token whose price was supposed to remain 1:1 with the $US, suddenly crashed. It’s sister coin, Terra Luna, that was meant to back it, also fell apart.

The token price action has caused concern about the possibility of other asset classes getting spooked. Chairman Gensler said that exposure to crypto by SEC-registered asset managers isn’t significant but that the agency has less knowledge of family offices and other private funds. Back in January, the SEC proposed a rule that would increase the speed and quantity of confidential information that private-equity and hedge funds provide the Commission through Form PF filings.

SEC Standing

The SEC

announced in early May that it plans to add 20 investigators and litigators to its unit dedicated to cryptocurrency and cybersecurity enforcement, nearly doubling the unit’s size. During the House meeting, which concerned budget items, Gensler said he wished he had more to work with for oversight. “We’re really outpersonned,” he said.

Most cryptocurrencies likely meet the legal definition

of a security that should be registered with the SEC, both Mr. Gensler and his predecessor, Jay Clayton, have said. No major cryptocurrency issuer or trading platform has proactively opted into the commission’s oversight. If there is going to be more oversight, it will be forced.

Gensler’s is a former MIT professor that taught blockchain and cryptocurrencies. As the top SEC cop, he has been working on persuading trading platforms such as Coinbase to be regulated as exchanges, saying many of the assets they provide trading in are securities. The platforms take a different stance. From a legal point of view, it isn’t clear how an SEC-registered exchange could allow trading in securities that have not been registered with the commission.

Managing Editor, Channelchek

Suggested Content

Will the Current Stablecoin Situation Hasten Regulation and Oversight?

|

Global Regulators Release Principles for Financial Market Infrastructures to Stablecoin

|

The SEC Wants to Extend Investor Protections to Crypto Platforms

|

SEC Climate Change Disclosure Rules and Challenges

|

Sources

https://www.sec.gov/news/press-release/2022-78

Stay up to date. Follow us:

|