Image Credit: Jan-Rune Smenes Reite

Who Really Owns the Oil Industry’s Future Stranded Assets?

|

Over the past three years, the planet has experienced both an oil glut and an oil drought. Investors, including those in pension and 401K plans, have been subject to unrivaled volatility. In this article, a Professor of Economics teams up with an Earth Science Lecturer to explore what they project will unfold going forward in climate regulation, oil production, and the investors in the industry.

Paul Hoffman – Managing Editor

|

When an oil company invests in an expensive new drilling project today, it’s taking a gamble. Even if the new well is a success, future government policies designed to slow climate change could make the project unprofitable or force it to shut down years earlier than planned.

When that happens, the well and the oil become what’s known as stranded assets. That might sound like the oil company’s problem, but the company isn’t the only one taking that risk.

|

This article was republished with permission from The Conversation, a news site dedicated to sharing ideas from academic experts. It was written by and represents the research-based opinions of Gregor Semieniuk, Assistant Research Professor of Economics, UMass Amherst, and Philip Holden, Senior Lecturer in Earth System Science, The Open University

|

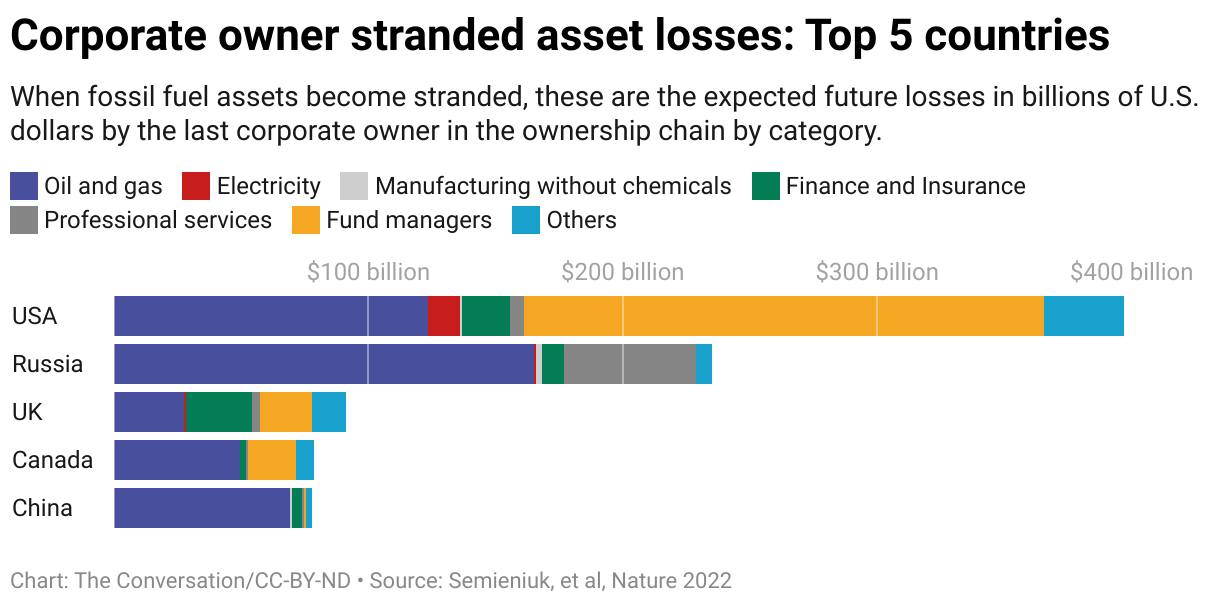

In a study published May 26, 2022, in the journal Nature Climate Change, we traced the ownership of over 43,000 oil and gas assets to reveal who ultimately loses from misguided investments that become stranded.

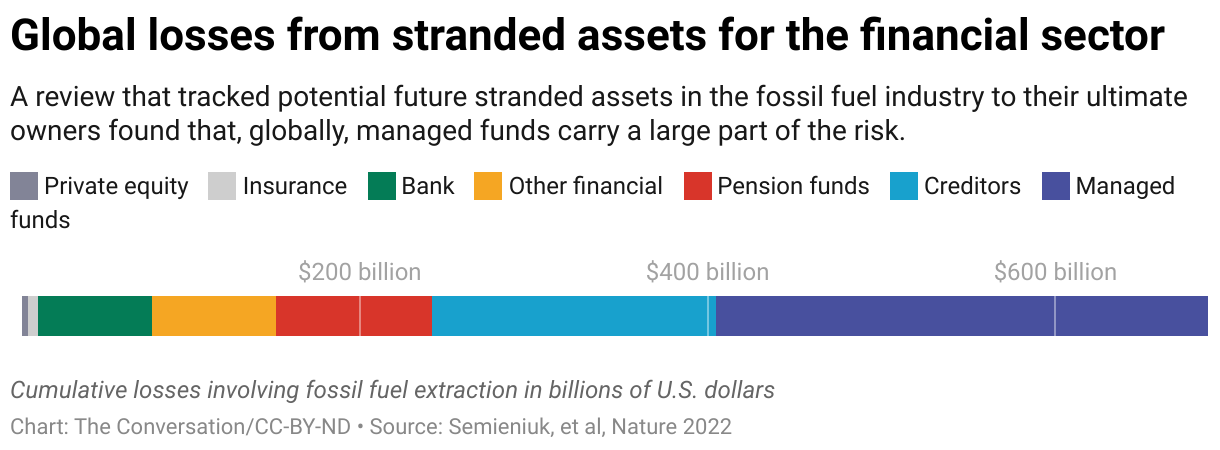

It turns out, private individuals own over half the assets at risk, and ordinary people with pensions and savings that are invested in managed funds shoulder a surprisingly large part, which could exceed a quarter of all losses.

More Climate Regulations are Coming

In 2015, almost every country worldwide signed the Paris climate agreement, committing to try to hold global warming to well under 2 degrees Celsius (3.6 F) compared to pre-industrial averages. Rising global temperatures were already contributing to deadly heat waves and worsening wildfires. Studies showed the hazards would increase as greenhouse gas emissions, primarily from fossil fuel use, continue to rise.

It’s clear that meeting the Paris goals will require a global energy transition away from fossil fuels. And many countries are developing climate policies designed to encourage that shift to cleaner energy.

But the oil industry is still launching new fossil fuel projects, which suggests that it doesn’t think it will be on the hook for future stranded assets. U.N. Secretary-General António Guterres called a recent wave of new oil and gas projects “moral and economic madness.”

How Risk Flows from Oil Field to Small Investor

When an asset becomes stranded, the owner’s anticipated payoff won’t materialize.

For example, say an oil company buys drilling rights, does the exploration work and builds an offshore oil platform. Then it discovers that demand for its product has declined so much because of climate change policies that it would cost more to extract the oil than the oil could be sold for.

The oil company is owned by shareholders. Some of those shareholders are individuals. Others are companies that are in turn owned by their own shareholders. The lost profits are ultimately felt by those remote owners.

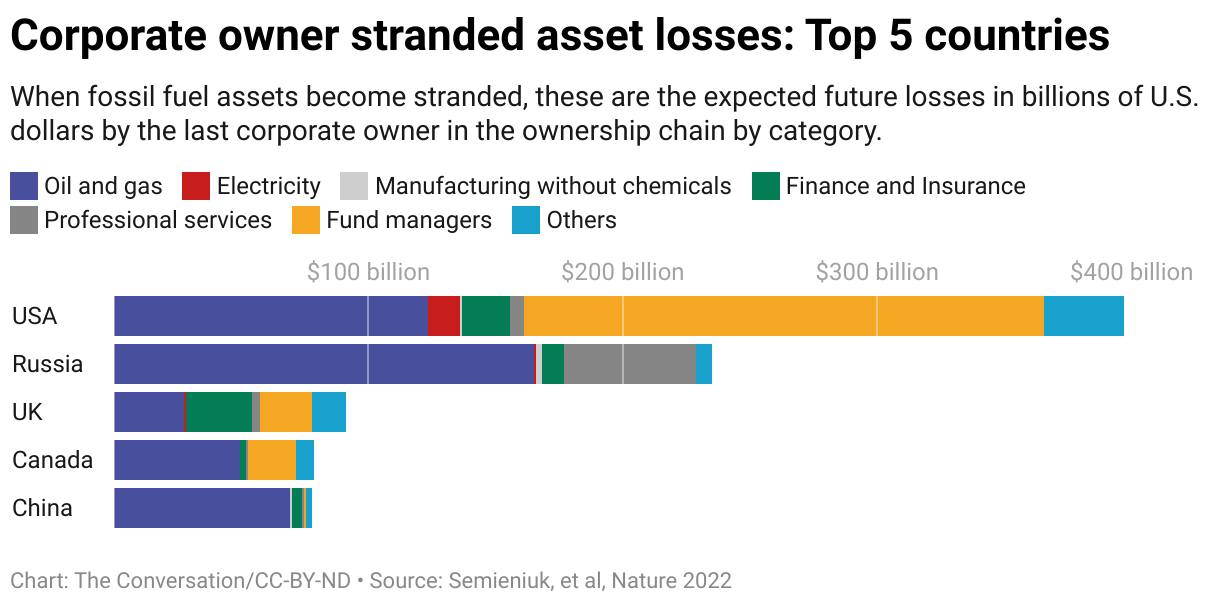

In the study, we modeled how demand for fossil fuels could decline if governments make good on their recent emissions reduction pledges and what that would mean for stranded assets. We found that $1.4 trillion in oil and gas assets globally would be at risk of becoming stranded.

Stranded assets mean a wealth loss for the owners of the assets. We traced the losses from the oil and gas fields, through the extraction companies, on to those companies’ immediate shareholders and fundholders, and again their shareholders and fundholders if the immediate shareholders are companies, and all the way to people and governments that own stock in the companies in this chain of ownership.

It’s a complex network.

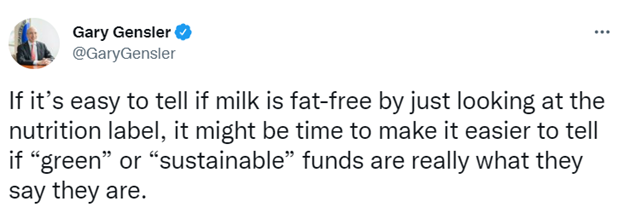

On their way to ultimate owners, much of the loss passes through financial firms, including pension funds. Globally, pension funds that invest their members’ savings directly into other companies own a sizable amount of those future stranded assets. In addition, many defined contribution pensions have investments through fund managers, such as BlackRock or Vanguard, that invest on their behalf.

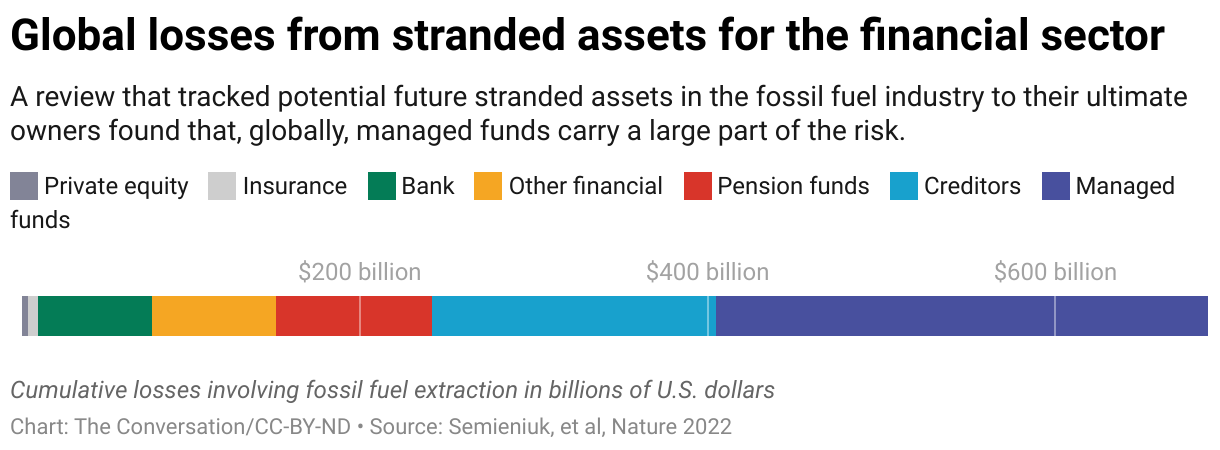

We estimate that total global losses hitting the financial sector – including through cross-ownership of one financial firm by another – from stranded assets in oil and gas production could be as high as $681 billion. Of this, about $371 billion would be held by fund managers, $146 billion by other financial firms and $164 billion could even affect bondholders, often pension funds, whose collateral would be diminished.

U.S. owners have by far the largest exposure. Ultimately, we found that losses of up to $362 billion could be distributed through the financial system to U.S. investors.

Some of the assets and companies in an ownership chain are also overseas, which can make the exposure to risk for a fund owner even more difficult to track.

Someone Will Get Stuck with those Assets

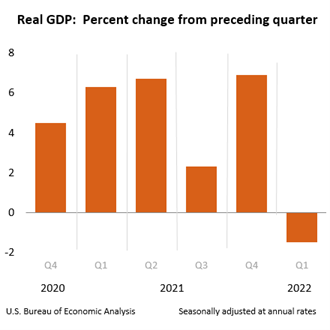

Our estimates are based on a snapshot of recent global share ownership. At the moment, with oil and gas prices near record highs due to supply chain problems and the Russian war in Ukraine, oil and gas companies are paying splendid dividends. And in principle, every shareholder could sell off their holdings in the near future.

But that does not mean the risk disappears: Someone else buys that stock.

Ultimately, it’s like a game of

musical chairs. When the music stops, someone will be left with the stranded asset.

And since the most affluent investors have sophisticated investment teams, they

may be best placed to get out in time, leaving less sophisticated investors and

defined contribution pension plans to join the oil and gas field workers as

losers, while the managers of the oil companies unfold their golden parachutes.

Alternatively, powerful investors could successfully lobby for compensation, as has happened repeatedly in the U.S. and Germany. One argument would be that they couldn’t have anticipated the stricter climate laws when they invested or they could point to governments asking companies to produce more in the short-term, as happened recently in the U.S. to substitute for Russian supplies.

However, divesting right away or hoping for compensation aren’t the only options. Investors – the owners of the company – can also pressure companies to shift from fossil fuels to renewable energy generation or another choice with growth potential for the future.

Investors not only may have the financial risk, but also the related financial responsibility, and ethical choices may help preserve both the value of their investments and the climate.

Suggested Reading

Stay up to date. Follow us: