Image Credit: NobleCon (4/20/2022)

Panelists Pulled No Punches at NobleCon18 Discussing ESG, Politics, Inflation, and War

Is the world going through a financial, political, and logistical phase that will forever change investment markets? This was not the name given to the panel discussion that closed the first day of presentations at NobleCon18. The actual title was more directly, The World Is HOT Right

Now! The room full of investors was treated to insights by panelists from the world of energy, banking, retail, and the U.S. military. Mike Gallagher, the host of the Mike Gallagher radio show, made sure the panelists didn’t pull any punches as they agreed and disagreed on subjects as hot as political unrest, supply chain constraints, the ESG movement, inflation, and War.

The Line-up

Radio Personality, Host of the Mike Gallagher Show (Moderator)

Brigadier General Blaine Holt, Deputy US Military Representative to NATO (Panelist)

Rani Selwanes, Noble’s Head of Investment Banking (Panelist)

Chuck Rubin, former Chairman & CEO, Michaels (Panelist)

Mark Chalmers, CEO, Energy Fuels (Panelist)

ESG Movement

Mike Gallagher began the discussion with the day’s big news story that Disney (DIS) could lose its special district privileges in Florida. This would cost the public company dearly. He dovetailed this into the discussion of companies taking a strong stance on subjects that come under the mantle of ESG.

None of the panelists shied from discussing their take on the topic as the former CEO of Michael’s pointed out that management’s job is to make money, and that they should do this in a way that has a good impact. He relayed a story where the craft giant he ran, that sold items that averaged between $7-$8, saved on costs, and helped the environment by using less packaging. The overall message was to serve your customers in a way that benefits society. Don’t cater to the PR benefit, instead, do what makes sense.

The investment banker on the panel discussed the movement from an investor’s standpoint. He discussed many examples where issuers, particularly in the fixed income market are being required by investors and asset managers for their ESG policies.

Geopolitical Events and War

The Brigadier General was brought into the conversation as Mike Gallagher pointed out that this is the first time since the 1980’s that the words “World War III” and possible “nuclear war” is being used. The General made sure the investor crowd was aware that President Putin had sold all of Russia’s holding of U.S. Treasuries in 2018. He told the listeners that they should teach military officers more about economics because Russia then proceeded to increase its gold position to $140 billion worth. The point was that this aggression has been going on for the past eight years, and only recently has it reached a point where it’s being recognized.

The concern raised by a few panelists is that Ukraine and Russia provide 30% of the world’s wheat. Conditions could reach a point where there is famine, and in the past, those conditions lead to war.

The CEO of an energy company explained to the attendees that we have become addicted to “cheap.” By this, he explained we are always shopping for the lowest price, and not building at home. With this, a country allows its capacity to wain and leaves them relying on others, potentially future enemies. One notable example given was that we no longer enrich uranium anyplace in the United States. We rely on unfriendly nations for enriching nuclear fuel and even weapons-grade material. The expression used by the CEO was, “digging a hole that you don’t have a ladder to climb back out of.”

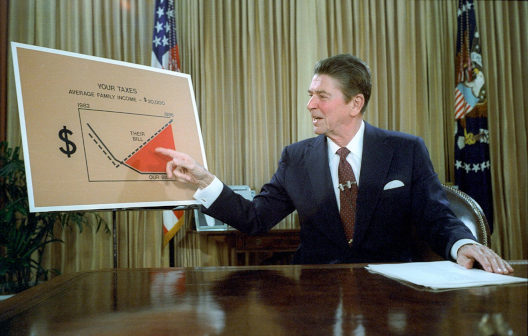

Inflation

Rising prices is more than just supply chain issues. We have been creating money which has been our answer to every problem. Instead, we need to build our way out of challenges. From the military point of view, it was explained that the higher inflation goes, the more national security is threatened.

The conversation moved to why people aren’t going back to work. While there was no definitive explanation, it was clear the panelists are perplexed that it is not likely to lead to a soft landing of the economy. The basic cost of living is rising, workers at the lowest levels are able to command much higher wages, and it is very difficult to attract employees which is inflationary.

Take Away

While this discussion hit on many difficult realities, and the panelists, to their credit took them head-on, the silver lining was pointed out to the investors at the end.

The Head of Investment Banking at Noble Capital Markets called upon his international knowledge and experience to remind the audience of something important. He told investors that during periods of turmoil capital experiences a “flight to quality.” That quality has historically been to the U.S., the largest receiver of capital when the world senses enhanced risk. He reminded everyone, including many of the C-level audience members, that there is plenty of capital looking for opportunity in the U.S., they just don’t know where to find you. His advice was to find an advisor (i.e. investment bank) that can help you find this capital.

Managing Editor, Channelchek

Suggested Reading

What Media Experts Expect from the Metaverse

|

EV Inflation Outpacing Traditional Cars

|

Stay up to date. Follow us:

|