|

|

|

Forbes Global Media provides a preview of their upcoming presentation at NobleCon18 NobleCon18 – Noble Capital Markets 18th Annual Small and Microcap Investor Conference – April 19-21, 2022 – Hard Rock, Hollywood, FL 100+ Public Company Presentations | Scheduled Breakouts | Panel Presentations | High-Profile Keynotes | Educational Sessions | Receptions & Networking Events Free Registration Available – More InfoSPAC Report, News and Advanced Market Data on ForbesNobleCon18 Presenting Companies

About Forbes

Forbes champions success by celebrating those who have made it, and those who aspire to make it. Forbes convenes and curates the most influential leaders and entrepreneurs who are driving change, transforming business and making a significant impact on the world. The Forbes brand today reaches more than 150 million people worldwide through its trusted journalism, signature LIVE and Forbes Virtual events, custom marketing programs and 44 licensed local editions in 77 countries. Forbes Media’s brand extensions include real estate, education and financial services license agreements. |

Month: March 2022

Release – Neovasc Announces Consolidation and Extension of Convertible Debt

Neovasc Announces Consolidation and Extension of Convertible Debt

Research, News, and Market Data on Neovasc

VANCOUVER – ( NewMediaWire ) – March 24, 2022 – Neovasc Inc. (NASDAQ: NVCN) (TSX: NVCN) (“Neovasc” or the “Company”), a leader in the development of minimally invasive devices for the treatment of refractory angina, and in the development of minimally invasive transcatheter mitral valve replacement technologies, announced today that, pursuant to a Restated Securities Purchase Agreement with Strul Medical Group LLC (“SMG”), on a private placement basis (the “Private Placement”), it has issued an amended and restated convertible note (the “2022 Restated Note”).

The 2022 Restated Note was issued in an aggregate principal amount of $13,000,000 and consolidates the amount owed by the Company under certain convertible notes the Company issued to SMG in 2019 and 2020. The Company paid out in cash an additional amount of $290,961 that was owed under the 2019 and 2020 notes.

The 2022 Restated Note matures on December 31, 2025 (the “Maturity Date”) and bears interest at a rate of 9% per annum, compounded quarterly, a portion of which is payable in cash at the end of June and December annually and the rest due on the Maturity Date. The 2022 Restated Note is convertible into common shares of the Company (the “Common Shares”) at a price of $1.00 per Common Share for up to 15,674,184 Common Shares comprised of the principal amount and accrued and unpaid interest. The 2022 Restated Note is subject to a four month and one day hold period.

The transaction was conducted in accordance with Section 602.1 of the TSX Company Manual, which provides that the Toronto Stock Exchange will not apply its standards to certain transactions involving eligible interlisted issuers on a recognized exchange, such as the Nasdaq Capital Market (the “Nasdaq”).

“We are very pleased to continue with our support of Neovasc as they advance their development strategies for both Reducer and Tiara,” said Aubrey Strul, a Principal of SMG. “We continue to have confidence in Fred and the Neovasc team to achieve critical milestones during the term of the Note.”

“This is an important development for our cash requirements in the coming years. It combines and extends the terms of our current notes with the SMG beyond our targeted date for the readout of our COSIRA II clinical study and an anticipated decision from the FDA on our application for approval to commercialize the Reducer in the United States,” stated Fred Colen, President and Chief Executive Officer of Neovasc. “We have reviewed opportunities, that might generally be available to us in the debt market, and given our company status and market conditions, we came to the conclusion that this debt restructuring agreement with the SMG is the best option available to Neovasc.”

This announcement is neither an offer to sell nor a solicitation of an offer to buy any securities and shall not constitute an offer, solicitation, or sale in any jurisdiction in which such offer, solicitation, or sale is unlawful. The securities have not been and will not be registered under the Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

About Neovasc Inc.

Neovasc is a specialty medical device company that develops, manufactures, and markets products for the rapidly growing cardiovascular marketplace. Its products include Reducer, for the treatment of refractory angina, which is under clinical investigation in the United States and has been commercially available in Europe since 2015, and TiaraTMfor the transcatheter treatment of mitral valve disease, which is currently under clinical investigation in the United States, Canada, Israel and Europe. For more information, visit: www.neovasc.com .

Forward-Looking Statement Disclaimer

Certain statements in this news release contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws that may not be based on historical fact. When used herein, the words “expect”, “anticipate”, “estimate”, “may”, “will”, “should”, “intend,” “believe”, and similar expressions, are intended to identify forward-looking statements. Forward-looking statements may involve, but are not limited to SMG’s belief in the Company’s management to achieve critical milestones, the importance of the Private Placement on the Company’s cash requirements in the future, the targeted date timeline for the COSIRA-II study, the anticipated timeline of the FDA decision and the growing cardiovascular marketplace. Forward-looking statements are based on estimates and assumptions made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors that the Company believes are appropriate in the circumstances. Many factors and assumptions could cause the Company’s actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements, including, without limitation, risks around the Company’s ability to continue as a going concern; risks around the Company’s history of losses and significant accumulated deficit; risks related to the recent COVID-19 coronavirus outbreak or other health epidemics, which could significantly impact the Company’s operations, sales or ability to raise capital or enroll patients in clinical trials and complete certain Tiara development milestones on the Company’s expected schedule; risks relating to the Company’s need for significant additional future capital and the Company’s ability to raise additional funding; risks relating to the sale of a significant number of Common Shares; risks relating to the possibility that the Company’s Common Shares may be delisted from the Nasdaq or the TSX, which could affect their market price and liquidity; risks relating to the Company’s conclusion that it did have effective internal control over financial reporting as of December 31, 2021 and 2020 but not at December 31, 2019; risks relating to the Common Share price being volatile; risks relating to the Company’s significant indebtedness, and its effect on the Company’s financial condition; risks relating to the influence of significant shareholders of the Company over our business operations and share price; risks relating to lawsuits that the Company is subject to, which could divert the Company’s resources and result in the payment of significant damages and other remedies; risks relating to claims by third-parties alleging infringement of their intellectual property rights; risks relating to the Company’s ability to establish, maintain and defend intellectual property rights in the Company’s products; risks relating to results from clinical trials of the Company’s products, which may be unfavorable or perceived as unfavorable; risks associated with product liability claims, insurance and recalls; risks relating to use of the Company’s products in unapproved circumstances, which could expose the Company to liabilities; risks relating to competition in the medical device industry, including the risk that one or more competitors may develop more effective or more affordable products; risks relating to the Company’s ability to achieve or maintain expected levels of market acceptance for the Company’s products, as well as the Company’s ability to successfully build its in-house sales capabilities or secure third-party marketing or distribution partners; risks relating to the Company’s ability to convince public payors and hospitals to include the Company’s products on their approved products lists; risks relating to new legislation, new regulatory requirements and the efforts of governmental and third-party payors to contain or reduce the costs of healthcare; risks relating to increased regulation, enforcement and inspections of participants in the medical device industry, including frequent government investigations into marketing and other business practices; risks relating to the extensive regulation of the Company’s products and trials by governmental authorities, as well as the cost and time delays associated therewith; risks relating to post-market regulation of the Company’s products; risks relating to health and safety concerns associated with the Company’s products and industry; risks relating to the Company’s manufacturing operations, including the regulation of the Company’s manufacturing processes by governmental authorities and the availability of two critical components of the Reducer; risks relating to the possibility of animal disease associated with the use of the Company’s products; risks relating to the manufacturing capacity of third-party manufacturers for the Company’s products, including risks of supply interruptions impacting the Company’s ability to manufacture its own products; risks relating to the Company’s dependence on limited products for substantially all of the Company’s current revenues; risks relating to the Company’s exposure to adverse movements in foreign currency exchange rates; risks relating to the possibility that the Company could lose its foreign private issuer status under U.S. federal securities laws; risks relating to the possibility that the Company could be treated as a “passive foreign investment company”; risks relating to breaches of anti-bribery laws by the Company’s employees or agents; risks relating to future changes in financial accounting standards and new accounting pronouncements; risks relating to the Company’s dependence upon key personnel to achieve its business objectives; risks relating to the Company’s ability to maintain strong relationships with physicians; risks relating to the sufficiency of the Company’s management systems and resources in periods of significant growth; risks relating to consolidation in the health care industry, including the downward pressure on product pricing and the growing need to be selected by larger customers in order to make sales to their members or participants; risks relating to the Company’s ability to successfully identify and complete corporate transactions on favorable terms or achieve anticipated synergies relating to any acquisitions or alliances; risks relating to conflicts of interests among the Company’s officers and directors as a result of their involvement with other issuers; risks relating to future issuances of equity securities by the Company, or sales of common shares or conversions of convertible notes, and exercise of warrants, options and restricted stock units by our existing security holders, causing the price of the Company’s securities to fall; and risks relating to anti-takeover provisions in the Company’s constating documents which could discourage a third-party from making a takeover bid beneficial to the Company’s shareholders. These risk factors and others relating to the Company are discussed in greater detail in the “Risk Factors” section of the Company’s Annual Report on Form 20-F and 40-F for the years ended December 31, 2021 and 2020 (copies of which may be obtained at www.sec.gov ). The Company has no intention and undertakes no obligation to update or revise any forward-looking statements beyond required periodic filings with securities regulators (copies of which may be obtained at www.sedar.com or www.sec.gov ), whether because of new information, future events or otherwise, except as required by law.

Investors:

Mike Cavanaugh

ICR Westwicke

Phone: +1.617.877.9641

Email: Mike.Cavanaugh@westwicke.com

Media:

Sean Leous

ICR Westwicke

Phone: +1.646.866.4012

Email: Sean.Leous@westwicke.com

Enough US Produced Lithium to Exceed Today’s Demand

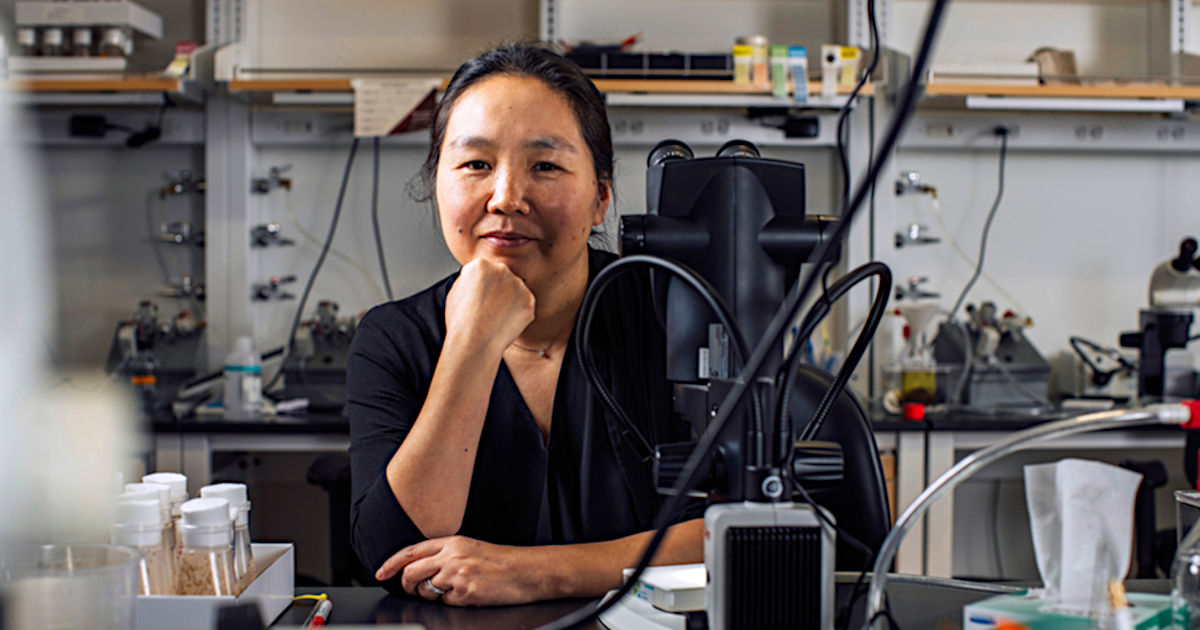

Image Credit: Michael McKibben

How a Few Geothermal Plants Could Solve America’s Lithium Supply Crunch and Boost the EV Battery Industry

Geothermal energy has long been the forgotten member of the clean energy family, overshadowed by relatively cheap solar and wind power, despite its proven potential. But that may soon change – for an unexpected reason.

Geothermal technologies are on the verge of unlocking vast quantities of lithium from naturally occurring hot brines beneath places like California’s Salton Sea, a two-hour drive from San Diego (image shown above).

Lithium is essential for lithium-ion batteries, which power electric vehicles and energy storage. Demand for these batteries is quickly rising, but the U.S. is currently heavily reliant on lithium imports from other countries – most of the nation’s lithium supply comes from Argentina, Chile, Russia, and China. The ability to recover critical minerals from geothermal brines in the U.S. could have important implications for energy and mineral security, as well as global supply chains, workforce transitions and geopolitics.

|

This article was republished with permission from The Conversation, a news site dedicated to sharing ideas from academic experts. It represents the research-based findings and thoughts of Bryant Jones Ph.D. Candidate of Energy Policy, Boise State University and Michael McKibben Research Professor of Geology, University of California, Riverside. |

As a geologist who works with geothermal brines and an energy policy scholar, we believe this technology can bolster the nation’s critical minerals supply chain at a time when concerns about the supply chain’s security are rising.

The Elmore geothermal plant, one of ten operated by Berkshire Hathaway Energy

Geothermal power plants use heat from the Earth to generate a constant supply of steam to run turbines that produce electricity. The plants operate by bringing up a complex saline solution located far underground, where it absorbs heat and is enriched with minerals such as lithium, manganese, zinc, potassium, and boron.

Geothermal brines are the concentrated liquid left over after heat and steam are extracted at a geothermal plant. In the Salton Sea plants, these brines contain high concentrations – about 30% – of dissolved solids.

Three geothermal operators at the Salton Sea geothermal field are in various stages of designing, constructing and testing pilot plants for direct lithium extraction from the hot brines.

At full production capacity, the 11 existing power plants near the Salton Sea, which currently generate about 432 megawatts of electricity, could also produce about 20,000 metric tons of lithium metal per year. The annual market value of this metal would be over $5 billion at current prices.

Geopolitical Risks in the Lithium Supply Chain

Existing lithium supply chains are rife with uncertainties that put mineral security in question for the United States.

Russia’s war in Ukraine and competition with China, as well as close ties between Russia and China, underscore the geopolitical implications of the mineral-intensive clean energy transformation.

China is currently the leader in lithium processing and actively procures lithium reserves from other major producers. Chinese state mining operators often own mines in other countries, which produce other vital clean energy minerals like cobalt and nickel.

There is currently one lithium production facility in the U.S. That facility, in Nevada, extracts saline liquid and concentrates the lithium by allowing the water to evaporate in large, shallow ponds. In contrast, the process for extracting lithium while producing geothermal energy returns the water and brines to the earth. Adding another domestic source of lithium could improve energy and mineral security for the United States and its allies.

A Lack of Policy Support

Geothermal power today represents less than 0.5% of the utility-scale electricity generation in the U.S.

One reason it remains a stagnant energy technology in the U.S. is the lack of strong policy support. Preliminary findings from a research study being conducted by one of us indicate that part of the problem is rooted in disagreements among older and newer geothermal companies themselves, including how they talk about geothermal energy’s benefits with policymakers, investors, the media and the public.

Geothermal power has the ability to complement solar and wind energy as a baseload power source – it is constant, unlike sunshine and wind – and to provide energy and mineral security. It could also offer a professional bridge for oil, gas and coal employees to transition into the clean energy economy.

The industry could benefit from policies like risk mitigation funds to lessen drilling exploration costs, grant programs to demonstrate innovations, long-term power contracts or tax incentives.

Adding the production of critical metals like lithium, manganese and zinc from geothermal brines could provide geothermal electrical power operators a new competitive advantage and help get geothermal onto the policy agenda.

Geothermal Energy Gets a Boost in California

Trends might be moving in the right direction for geothermal energy producers.

In February, the California Public Utilities Commission adopted a new Preferred System Plan that encourages the state to develop 1,160 megawatts of new geothermal electricity. That’s on top of a 2021 decision to procure 1,000 megawatts from zero emissions, renewable, firm generating resources with an 80% capacity factor – which can only be met by geothermal technologies.

Suggested Reading

Li-Ion Batteries Promising New Process

|

Lithium Prices Continue Their Ascent

|

EV Inflation Outpacing Traditional Cars

|

Is the SEC conducting Unfounded Investigations of Elon Musk?

|

Stay up to date. Follow us:

|

Release – Comstock Announces 2022 Annual Meeting

Comstock Announces 2022 Annual Meeting

Research, News, and Market Data on Comstock Mining

VIRGINIA CITY, Nev., March 24, 2022 (GLOBE NEWSWIRE) — Comstock Mining Inc. (NYSE: LODE) (“Comstock” and the “Company”) today announced that its 2022 Annual Meeting of Shareholders has been scheduled for Thursday, May 26, 2022, starting at 9:00 a.m. Pacific Daylight Time in Reno, Nevada, at the Atlantis Hotel. The meeting will feature Comstock’s renewable fuels and electrification businesses, and highlight the Company’s expanded senior management team and recently expanded portfolio of decarbonizing technologies.

The 2022 Annual Meeting schedule for May 26, 2022, is as follows:

| 8:00 am to 9:00 am PDT | Continental Breakfast |

| 9:00 am to 11:30 am PDT | 2022 Annual Shareholders Meeting, Company Presentations, Q & A |

| 12:00 pm to 2:00 pm PDT | Lunch and Conversations with Company Management and Directors |

The record date for the Annual Meeting is March 31, 2022. Only shareholders of record at the close of business on March 31, 2022, may vote at the meeting. The Company’s proxy statement will be sent to shareholders of record and will describe all matters to be voted on, including the Company’s name change to Comstock Inc. Shareholders are invited to register for the 2022 Annual Meeting at Comstock’s newly released website at www.comstock.inc.

About Comstock Mining Inc.

Comstock Mining Inc. (NYSE: LODE) innovates technologies that contribute to global decarbonization and circularity by efficiently converting massive supplies of under-utilized natural resources into renewable fuels and electrification products that contribute to balancing global uses and emissions of carbon. The Company intends to achieve exponential growth and extraordinary financial, natural, and social gains by building, owning, and operating a fleet of advanced carbon neutral extraction and refining facilities, by selling an array of complimentary process solutions and related services, and by licensing selected technologies to qualified strategic partners. To learn more, please visit www.comstock.inc.

Forward-Looking Statements

This press release and any related calls or discussions may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “would,” “potential” and similar expressions identify forward-looking statements, but are not the exclusive means of doing so. Forward-looking statements include statements about matters such as: future industry market conditions; future explorations or acquisitions; future changes in our exploration activities; future changes in our research and development; future prices and sales of, and demand for, our products and services; land entitlements and uses; permits; production capacity and operations; operating and overhead costs; future capital expenditures and their impact on us; operational and management changes (including changes in the Board of Directors); changes in business strategies, planning and tactics; future employment and contributions of personnel, including consultants; future land sales; investments, acquisitions, joint ventures, strategic alliances, business combinations, operational, tax, financial and restructuring initiatives, including the nature, timing and accounting for restructuring charges, derivative assets and liabilities and the impact thereof; contingencies; litigation, administrative or arbitration proceedings; environmental compliance and changes in the regulatory environment; offerings, limitations on sales or offering of equity or debt securities, including asset sales and associated costs; and future working capital, costs, revenues, business opportunities, debt levels, cash flows, margins, taxes, earnings and growth. These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical and current trends, current conditions, possible future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties, many of which are unforeseeable and beyond our control and could cause actual results, developments and business decisions to differ materially from those contemplated by such forward-looking statements. Some of those risks and uncertainties include the risk factors set forth in reports that we file with the Securities and Exchange Commission, including Item 1A, “Risk Factors” in our most recently-filed Annual Report on Form 10-K and/or Quarterly Report on Form 10-Q, and the following: adverse effects of climate changes or natural disasters; adverse effects of global or regional pandemic disease spread or other crises; global economic and capital market uncertainties; the speculative nature of gold or mineral exploration, mercury remediation and lithium, nickel and cobalt recycling, including risks of diminishing quantities or grades of qualified resources; operational or technical difficulties in connection with exploration or mercury remediation, metal recycling, processing or mining activities; costs, hazards and uncertainties associated with precious metal based activities, including environmentally friendly and economically enhancing clean mining and processing technologies, precious metal exploration, resource development, economic feasibility assessment and cash generating mineral production; costs, hazards and uncertainties associated with mercury remediation, metal recycling, processing or mining activities; contests over our title to properties; potential dilution to our stockholders from our stock issuances, recapitalization and balance sheet restructuring activities; potential inability to comply with applicable government regulations or law; adoption of or changes in legislation or regulations adversely affecting our businesses; permitting constraints or delays; ability to achieve the benefits of business opportunities that may be presented to, or pursued by, us, including those involving battery technology, mercury remediation technology and efficacy, quantum computing and advanced materials development, and development of cellulosic technology in bio-fuels and related carbon-based material production; ability to successfully identify, finance, complete and integrate acquisitions, joint ventures, strategic alliances, business combinations, asset sales, and investments that we may be party to in the future; changes in the United States or other monetary or fiscal policies or regulations; interruptions in our production capabilities due to capital constraints; equipment failures; fluctuation of prices for gold or certain other commodities (such as silver, zinc, lithium, nickel, cobalt, cyanide, water, diesel, gasoline and alternative fuels and electricity); changes in generally accepted accounting principles; adverse effects of war, mass shooting, terrorism and geopolitical events; potential inability to implement our business strategies; potential inability to grow revenues; potential inability to attract and retain key personnel; interruptions in delivery of critical supplies, equipment and raw materials due to credit or other limitations imposed by vendors; assertion of claims, lawsuits and proceedings against us; potential inability to satisfy debt and lease obligations; potential inability to maintain an effective system of internal controls over financial reporting; potential inability or failure to timely file periodic reports with the Securities and Exchange Commission; potential inability to list our securities on any securities exchange or market or maintain the listing of our securities; and work stoppages or other labor difficulties. Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows, or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Neither this press release nor any related call or discussion constitutes an offer to sell, the solicitation of an offer to buy or a recommendation with respect to any securities of the Company, the fund or any other issuer.

| Contact information: |

||

| Comstock Mining Inc. P.O. Box 1118 Virginia City, NV 89440 ComstockMining.com |

Corrado De Gasperis Executive Chairman & CEO Tel (775) 847-4755 degasperis@comstockmining.com |

Zach Spencer Director of External Relations Tel (775) 847-5272 Ext.151 questions@comstockmining.com |

Release – ProMIS Neurosciences to Present at the 10th Annual Neurodegenerative Drug Development Summit

ProMIS Neurosciences to Present at the 10th Annual Neurodegenerative Drug Development Summit

News and Market Data on ProMIS Neurosciences

TORONTO, Ontario and CAMBRIDGE, MA , March 24, 2022 (GLOBE NEWSWIRE) — ProMIS Neurosciences, Inc. (TSX: PMN) (OTCQB: ARFXF), a biotechnology company focused on the discovery and development of therapeutics targeting misfolded proteins such as toxic oligomers implicated in the development of neurodegenerative diseases, announced today that it will be presenting at the upcoming 10th Annual Neurodegenerative Drug Development Summit, to be held in Boston, MA, March 28-30, 2022.

ProMIS Chief Scientific Officer, Dr. Neil Cashman, will deliver an oral presentation entitled: “Abeta oligomers in Alzheimer Disease: Target Engagement and Target Distraction”, on Tuesday, March 29, 2022, at 3 PM local time at the Boston Park Plaza Hotel.

Much scientific data has implicated misfolded oligomers as the toxic molecular species of amyloid beta (Abeta) relevant to Alzheimer’s disease. However, using conventional methods, it has proven difficult to selectively target oligomers while sparing other species – including monomers and fibrils – which “distract” a therapeutic antibody from its primary target. Immune recognition of Abeta fibrils can also lead to dose-limiting adverse effects. In his presentation, Dr. Cashman will discuss the use of Collective CoordinatesTM, a proprietary computational algorithm, to design conformational epitopes that specifically target oligomers, while sparing monomers and fibrils from immune recognition.

Dr. Cashman’s presentation will be available on the ProMIS website (www.promisneurosciences.com) at the conclusion of the meeting. For more information about the meeting please consult the organizer’s website here.

About ProMIS Neurosciences

ProMIS Neurosciences, Inc. is a development stage biotechnology company focused on discovering and developing therapeutics selectively targeting toxic misfolded oligomers implicated in the development and progression of neurodegenerative diseases, in particular Alzheimer’s disease (AD), amyotrophic lateral sclerosis (ALS) and Parkinson’s disease (PD). The Company’s proprietary target discovery engine is based on the use of two complementary computational modeling techniques. The Company applies its molecular dynamics, computational discovery platform -ProMIS™ and Collective Coordinates – to predict novel targets known as Disease Specific Epitopes on the molecular surface of misfolded proteins. ProMIS is headquartered in Toronto, Ontario, with offices in Cambridge, Massachusetts. ProMIS is listed on the Toronto Stock Exchange under the symbol PMN, and on the OTCQB Venture Market under the symbol ARFXF

To learn more, visit us at www.promisneurosciences.com, follow us on Twitter and LinkedIn

For Investor Relations please contact:

Alpine Equity Advisors

Nicholas Rigopulos, President

nick@alpineequityadv.com

Tel. 617 901-0785

The TSX has not reviewed and does not accept responsibility for the adequacy or accuracy of this release. This information release contains certain forward-looking information. Such information involves known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by statements herein, and therefore these statements should not be read as guarantees of future performance or results. All forward-looking statements are based on the Company’s current beliefs as well as assumptions made by and information currently available to it as well as other factors. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Due to risks and uncertainties, including the risks and uncertainties identified by the Company in its public securities filings, actual events may differ materially from current expectations. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Source: ProMIS Neurosciences Inc.

Neovasc Announces Consolidation and Extension of Convertible Debt

Neovasc Announces Consolidation and Extension of Convertible Debt

Research, News, and Market Data on Neovasc

VANCOUVER – ( NewMediaWire ) – March 24, 2022 – Neovasc Inc. (NASDAQ: NVCN) (TSX: NVCN) (“Neovasc” or the “Company”), a leader in the development of minimally invasive devices for the treatment of refractory angina, and in the development of minimally invasive transcatheter mitral valve replacement technologies, announced today that, pursuant to a Restated Securities Purchase Agreement with Strul Medical Group LLC (“SMG”), on a private placement basis (the “Private Placement”), it has issued an amended and restated convertible note (the “2022 Restated Note”).

The 2022 Restated Note was issued in an aggregate principal amount of $13,000,000 and consolidates the amount owed by the Company under certain convertible notes the Company issued to SMG in 2019 and 2020. The Company paid out in cash an additional amount of $290,961 that was owed under the 2019 and 2020 notes.

The 2022 Restated Note matures on December 31, 2025 (the “Maturity Date”) and bears interest at a rate of 9% per annum, compounded quarterly, a portion of which is payable in cash at the end of June and December annually and the rest due on the Maturity Date. The 2022 Restated Note is convertible into common shares of the Company (the “Common Shares”) at a price of $1.00 per Common Share for up to 15,674,184 Common Shares comprised of the principal amount and accrued and unpaid interest. The 2022 Restated Note is subject to a four month and one day hold period.

The transaction was conducted in accordance with Section 602.1 of the TSX Company Manual, which provides that the Toronto Stock Exchange will not apply its standards to certain transactions involving eligible interlisted issuers on a recognized exchange, such as the Nasdaq Capital Market (the “Nasdaq”).

“We are very pleased to continue with our support of Neovasc as they advance their development strategies for both Reducer and Tiara,” said Aubrey Strul, a Principal of SMG. “We continue to have confidence in Fred and the Neovasc team to achieve critical milestones during the term of the Note.”

“This is an important development for our cash requirements in the coming years. It combines and extends the terms of our current notes with the SMG beyond our targeted date for the readout of our COSIRA II clinical study and an anticipated decision from the FDA on our application for approval to commercialize the Reducer in the United States,” stated Fred Colen, President and Chief Executive Officer of Neovasc. “We have reviewed opportunities, that might generally be available to us in the debt market, and given our company status and market conditions, we came to the conclusion that this debt restructuring agreement with the SMG is the best option available to Neovasc.”

This announcement is neither an offer to sell nor a solicitation of an offer to buy any securities and shall not constitute an offer, solicitation, or sale in any jurisdiction in which such offer, solicitation, or sale is unlawful. The securities have not been and will not be registered under the Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

About Neovasc Inc.

Neovasc is a specialty medical device company that develops, manufactures, and markets products for the rapidly growing cardiovascular marketplace. Its products include Reducer, for the treatment of refractory angina, which is under clinical investigation in the United States and has been commercially available in Europe since 2015, and TiaraTMfor the transcatheter treatment of mitral valve disease, which is currently under clinical investigation in the United States, Canada, Israel and Europe. For more information, visit: www.neovasc.com .

Forward-Looking Statement Disclaimer

Certain statements in this news release contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws that may not be based on historical fact. When used herein, the words “expect”, “anticipate”, “estimate”, “may”, “will”, “should”, “intend,” “believe”, and similar expressions, are intended to identify forward-looking statements. Forward-looking statements may involve, but are not limited to SMG’s belief in the Company’s management to achieve critical milestones, the importance of the Private Placement on the Company’s cash requirements in the future, the targeted date timeline for the COSIRA-II study, the anticipated timeline of the FDA decision and the growing cardiovascular marketplace. Forward-looking statements are based on estimates and assumptions made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors that the Company believes are appropriate in the circumstances. Many factors and assumptions could cause the Company’s actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements, including, without limitation, risks around the Company’s ability to continue as a going concern; risks around the Company’s history of losses and significant accumulated deficit; risks related to the recent COVID-19 coronavirus outbreak or other health epidemics, which could significantly impact the Company’s operations, sales or ability to raise capital or enroll patients in clinical trials and complete certain Tiara development milestones on the Company’s expected schedule; risks relating to the Company’s need for significant additional future capital and the Company’s ability to raise additional funding; risks relating to the sale of a significant number of Common Shares; risks relating to the possibility that the Company’s Common Shares may be delisted from the Nasdaq or the TSX, which could affect their market price and liquidity; risks relating to the Company’s conclusion that it did have effective internal control over financial reporting as of December 31, 2021 and 2020 but not at December 31, 2019; risks relating to the Common Share price being volatile; risks relating to the Company’s significant indebtedness, and its effect on the Company’s financial condition; risks relating to the influence of significant shareholders of the Company over our business operations and share price; risks relating to lawsuits that the Company is subject to, which could divert the Company’s resources and result in the payment of significant damages and other remedies; risks relating to claims by third-parties alleging infringement of their intellectual property rights; risks relating to the Company’s ability to establish, maintain and defend intellectual property rights in the Company’s products; risks relating to results from clinical trials of the Company’s products, which may be unfavorable or perceived as unfavorable; risks associated with product liability claims, insurance and recalls; risks relating to use of the Company’s products in unapproved circumstances, which could expose the Company to liabilities; risks relating to competition in the medical device industry, including the risk that one or more competitors may develop more effective or more affordable products; risks relating to the Company’s ability to achieve or maintain expected levels of market acceptance for the Company’s products, as well as the Company’s ability to successfully build its in-house sales capabilities or secure third-party marketing or distribution partners; risks relating to the Company’s ability to convince public payors and hospitals to include the Company’s products on their approved products lists; risks relating to new legislation, new regulatory requirements and the efforts of governmental and third-party payors to contain or reduce the costs of healthcare; risks relating to increased regulation, enforcement and inspections of participants in the medical device industry, including frequent government investigations into marketing and other business practices; risks relating to the extensive regulation of the Company’s products and trials by governmental authorities, as well as the cost and time delays associated therewith; risks relating to post-market regulation of the Company’s products; risks relating to health and safety concerns associated with the Company’s products and industry; risks relating to the Company’s manufacturing operations, including the regulation of the Company’s manufacturing processes by governmental authorities and the availability of two critical components of the Reducer; risks relating to the possibility of animal disease associated with the use of the Company’s products; risks relating to the manufacturing capacity of third-party manufacturers for the Company’s products, including risks of supply interruptions impacting the Company’s ability to manufacture its own products; risks relating to the Company’s dependence on limited products for substantially all of the Company’s current revenues; risks relating to the Company’s exposure to adverse movements in foreign currency exchange rates; risks relating to the possibility that the Company could lose its foreign private issuer status under U.S. federal securities laws; risks relating to the possibility that the Company could be treated as a “passive foreign investment company”; risks relating to breaches of anti-bribery laws by the Company’s employees or agents; risks relating to future changes in financial accounting standards and new accounting pronouncements; risks relating to the Company’s dependence upon key personnel to achieve its business objectives; risks relating to the Company’s ability to maintain strong relationships with physicians; risks relating to the sufficiency of the Company’s management systems and resources in periods of significant growth; risks relating to consolidation in the health care industry, including the downward pressure on product pricing and the growing need to be selected by larger customers in order to make sales to their members or participants; risks relating to the Company’s ability to successfully identify and complete corporate transactions on favorable terms or achieve anticipated synergies relating to any acquisitions or alliances; risks relating to conflicts of interests among the Company’s officers and directors as a result of their involvement with other issuers; risks relating to future issuances of equity securities by the Company, or sales of common shares or conversions of convertible notes, and exercise of warrants, options and restricted stock units by our existing security holders, causing the price of the Company’s securities to fall; and risks relating to anti-takeover provisions in the Company’s constating documents which could discourage a third-party from making a takeover bid beneficial to the Company’s shareholders. These risk factors and others relating to the Company are discussed in greater detail in the “Risk Factors” section of the Company’s Annual Report on Form 20-F and 40-F for the years ended December 31, 2021 and 2020 (copies of which may be obtained at www.sec.gov ). The Company has no intention and undertakes no obligation to update or revise any forward-looking statements beyond required periodic filings with securities regulators (copies of which may be obtained at www.sedar.com or www.sec.gov ), whether because of new information, future events or otherwise, except as required by law.

Investors:

Mike Cavanaugh

ICR Westwicke

Phone: +1.617.877.9641

Email: Mike.Cavanaugh@westwicke.com

Media:

Sean Leous

ICR Westwicke

Phone: +1.646.866.4012

Email: Sean.Leous@westwicke.com

Comstock Announces 2022 Annual Meeting

Comstock Announces 2022 Annual Meeting

Research, News, and Market Data on Comstock Mining

VIRGINIA CITY, Nev., March 24, 2022 (GLOBE NEWSWIRE) — Comstock Mining Inc. (NYSE: LODE) (“Comstock” and the “Company”) today announced that its 2022 Annual Meeting of Shareholders has been scheduled for Thursday, May 26, 2022, starting at 9:00 a.m. Pacific Daylight Time in Reno, Nevada, at the Atlantis Hotel. The meeting will feature Comstock’s renewable fuels and electrification businesses, and highlight the Company’s expanded senior management team and recently expanded portfolio of decarbonizing technologies.

The 2022 Annual Meeting schedule for May 26, 2022, is as follows:

| 8:00 am to 9:00 am PDT | Continental Breakfast |

| 9:00 am to 11:30 am PDT | 2022 Annual Shareholders Meeting, Company Presentations, Q & A |

| 12:00 pm to 2:00 pm PDT | Lunch and Conversations with Company Management and Directors |

The record date for the Annual Meeting is March 31, 2022. Only shareholders of record at the close of business on March 31, 2022, may vote at the meeting. The Company’s proxy statement will be sent to shareholders of record and will describe all matters to be voted on, including the Company’s name change to Comstock Inc. Shareholders are invited to register for the 2022 Annual Meeting at Comstock’s newly released website at www.comstock.inc.

About Comstock Mining Inc.

Comstock Mining Inc. (NYSE: LODE) innovates technologies that contribute to global decarbonization and circularity by efficiently converting massive supplies of under-utilized natural resources into renewable fuels and electrification products that contribute to balancing global uses and emissions of carbon. The Company intends to achieve exponential growth and extraordinary financial, natural, and social gains by building, owning, and operating a fleet of advanced carbon neutral extraction and refining facilities, by selling an array of complimentary process solutions and related services, and by licensing selected technologies to qualified strategic partners. To learn more, please visit www.comstock.inc.

Forward-Looking Statements

This press release and any related calls or discussions may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “would,” “potential” and similar expressions identify forward-looking statements, but are not the exclusive means of doing so. Forward-looking statements include statements about matters such as: future industry market conditions; future explorations or acquisitions; future changes in our exploration activities; future changes in our research and development; future prices and sales of, and demand for, our products and services; land entitlements and uses; permits; production capacity and operations; operating and overhead costs; future capital expenditures and their impact on us; operational and management changes (including changes in the Board of Directors); changes in business strategies, planning and tactics; future employment and contributions of personnel, including consultants; future land sales; investments, acquisitions, joint ventures, strategic alliances, business combinations, operational, tax, financial and restructuring initiatives, including the nature, timing and accounting for restructuring charges, derivative assets and liabilities and the impact thereof; contingencies; litigation, administrative or arbitration proceedings; environmental compliance and changes in the regulatory environment; offerings, limitations on sales or offering of equity or debt securities, including asset sales and associated costs; and future working capital, costs, revenues, business opportunities, debt levels, cash flows, margins, taxes, earnings and growth. These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical and current trends, current conditions, possible future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties, many of which are unforeseeable and beyond our control and could cause actual results, developments and business decisions to differ materially from those contemplated by such forward-looking statements. Some of those risks and uncertainties include the risk factors set forth in reports that we file with the Securities and Exchange Commission, including Item 1A, “Risk Factors” in our most recently-filed Annual Report on Form 10-K and/or Quarterly Report on Form 10-Q, and the following: adverse effects of climate changes or natural disasters; adverse effects of global or regional pandemic disease spread or other crises; global economic and capital market uncertainties; the speculative nature of gold or mineral exploration, mercury remediation and lithium, nickel and cobalt recycling, including risks of diminishing quantities or grades of qualified resources; operational or technical difficulties in connection with exploration or mercury remediation, metal recycling, processing or mining activities; costs, hazards and uncertainties associated with precious metal based activities, including environmentally friendly and economically enhancing clean mining and processing technologies, precious metal exploration, resource development, economic feasibility assessment and cash generating mineral production; costs, hazards and uncertainties associated with mercury remediation, metal recycling, processing or mining activities; contests over our title to properties; potential dilution to our stockholders from our stock issuances, recapitalization and balance sheet restructuring activities; potential inability to comply with applicable government regulations or law; adoption of or changes in legislation or regulations adversely affecting our businesses; permitting constraints or delays; ability to achieve the benefits of business opportunities that may be presented to, or pursued by, us, including those involving battery technology, mercury remediation technology and efficacy, quantum computing and advanced materials development, and development of cellulosic technology in bio-fuels and related carbon-based material production; ability to successfully identify, finance, complete and integrate acquisitions, joint ventures, strategic alliances, business combinations, asset sales, and investments that we may be party to in the future; changes in the United States or other monetary or fiscal policies or regulations; interruptions in our production capabilities due to capital constraints; equipment failures; fluctuation of prices for gold or certain other commodities (such as silver, zinc, lithium, nickel, cobalt, cyanide, water, diesel, gasoline and alternative fuels and electricity); changes in generally accepted accounting principles; adverse effects of war, mass shooting, terrorism and geopolitical events; potential inability to implement our business strategies; potential inability to grow revenues; potential inability to attract and retain key personnel; interruptions in delivery of critical supplies, equipment and raw materials due to credit or other limitations imposed by vendors; assertion of claims, lawsuits and proceedings against us; potential inability to satisfy debt and lease obligations; potential inability to maintain an effective system of internal controls over financial reporting; potential inability or failure to timely file periodic reports with the Securities and Exchange Commission; potential inability to list our securities on any securities exchange or market or maintain the listing of our securities; and work stoppages or other labor difficulties. Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows, or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Neither this press release nor any related call or discussion constitutes an offer to sell, the solicitation of an offer to buy or a recommendation with respect to any securities of the Company, the fund or any other issuer.

| Contact information: |

||

| Comstock Mining Inc. P.O. Box 1118 Virginia City, NV 89440 ComstockMining.com |

Corrado De Gasperis Executive Chairman & CEO Tel (775) 847-4755 degasperis@comstockmining.com |

Zach Spencer Director of External Relations Tel (775) 847-5272 Ext.151 questions@comstockmining.com |

Avivagen Inc. (VIVXF)(VIV:CA) – A Debt for a Debt

Thursday, March 24, 2022

Avivagen Inc. (VIVXF)(VIV:CA)

A Debt for a Debt

Avivagen Inc is a Canadian based company operating in the healthcare sector. It develops science-based, natural health products for animals. It develops and commercializes products for livestock feeds to replace antibiotics for growth promotion and to help prevent disease by supporting the animal’s own health defenses. Its product range includes OxC-beta, Vivamune health chews, Oximunol chewable tablets, and Carotenoid Oxidation products.

Joe Gomes, Senior Research Analyst, Noble Capital Markets, Inc.

Joshua Zoepfel, Research Associate, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

The New Offering. Avivagen’s management announced yesterday the intention to complete a private placement financing of secured debentures. The gross proceeds of this financing will total up to CAD$6.5 million and will close on March 28, 2022. Bloom Burton Securities is acting as the agent in the offering.

Details on the Offering. The debentures will have an annual interest rate of 9%, payable semi annually, and the purchasers will be paid a maintenance fee of 3%. Purchasers of the debentures will also receive common shares equal to 20% of the principal amount of the debentures divided by the market price of the shares on the TSX Venture Exchange on the last trading day prior to closing. These are …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Unraveling Stem Cells Secrets

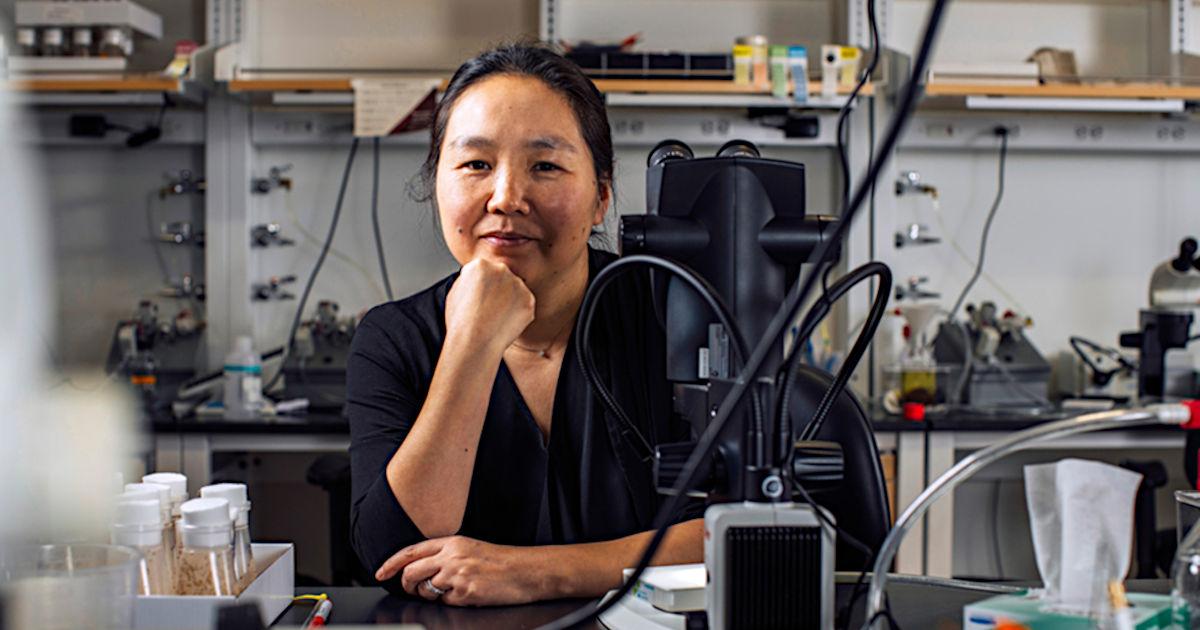

Image of Yukiko Yamashita, courtesy of MIT

Research has Shed Light on the Immortality of Germline Cells and the Function of “Junk DNA”

Anne Trafton | MIT News

Office

When cells divide, they usually generate two identical daughter cells. However, there are some important exceptions to this rule: When stem cells divide, they often produce one differentiated cell along with another stem cell, to maintain the pool of stem cells.

Yukiko Yamashita has spent much of her career exploring how these “asymmetrical” cell divisions occur. These processes are critically important not only for cells to develop into different types of tissue, but also for germline cells such as eggs and sperm to maintain their viability from generation to generation.

“We came from our parents’ germ cells, who used to be also single cells who came from the germ cells of their parents, who used to be single cells that came from their parents, and so on. That means our existence can be tracked through the history of multicellular life,” Yamashita says. “How germ cells manage to not go extinct, while our somatic cells cannot last that long, is a fascinating question.”

Yamashita, who began her faculty career at the University of Michigan, joined MIT and the Whitehead Institute in 2020, as the inaugural holder of the Susan Lindquist Chair for Women in Science and a professor in the Department of Biology. She was drawn to MIT, she says, by the eagerness to explore new ideas that she found among other scientists.

“When I visited MIT, I really enjoyed talking to people here,” she says. “They are very curious, and they are very open to unconventional ideas. I realized I would have a lot of fun if I came here.”

Exploring Paradoxes

Before she even knew what a scientist was, Yamashita knew that she wanted to be one.

“My father was an admirer of Albert Einstein, so because of that, I grew up thinking that the pursuit of the truth is the best thing you could do with your life,” she recalls. “At the age of 2 or 3, I didn’t know there was such a thing as a professor, or such a thing as a scientist, but I thought doing science was probably the coolest thing I could do.”

Yamashita majored in biology at Kyoto University and then stayed to pursue her PhD, studying how cells make exact copies of themselves when they divide. As a postdoc at Stanford University, she became interested in the exceptions to that carefully orchestrated process, and began to study how cells undergo divisions that produce daughter cells that are not identical. This kind of asymmetric division is critical for multicellular organisms, which begin life as a single cell that eventually differentiates into many types of tissue.

Those studies led to a discovery that helped to overturn previous theories about the role of so-called junk DNA. These sequences, which make up most of the genome, were thought to be essentially useless because they don’t code for any proteins. To Yamashita, it seemed paradoxical that cells would carry so much DNA that wasn’t serving any purpose.

“I couldn’t really believe that huge amount of our DNA is junk, because every time a cell divides, it still has the burden of replicating that junk,” she says. “So, my lab started studying the function of that junk, and then we realized it is a really important part of the chromosome.”

In human cells, the genome is stored on 23 pairs of chromosomes. Keeping all of those chromosomes together is critical to cells’ ability to copy genes when they are needed. Over several years, Yamashita and her colleagues at the University of Michigan, and then at MIT, discovered that stretches of junk DNA act like bar codes, labeling each chromosome and helping them bind to proteins that bundle chromosomes together within the cell nucleus.

Without those barcodes, chromosomes scatter and start to leak out of the cell’s nucleus. Another intriguing observation regarding these stretches of junk DNA was that they have much greater variability between different species than protein-coding regions of DNA. By crossing two different species of fruit flies, Yamashita showed that in cells of the hybrid offspring flies, chromosomes leak out just as they would if they lost their barcodes, suggesting that the codes are specific to each species.

“We think that might be one of the big reasons why different species become incompatible, because they don’t have the right information to bundle all of their chromosomes together into one place,” Yamashita says.

Stem Cell Longevity

Yamashita’s interest in stem cells also led her to study how germline cells (the cells that give rise to eggs and sperm cells) maintain their viability so much longer than regular body cells across generations. In typical animal cells, one factor that contributes to age-related decline is loss of genetic sequences that encode genes that cells use continuously, such as genes for ribosomal RNAs.

A typical human cell may have hundreds of copies of these critical genes, but as cells age, they lose some of them. For germline cells, this can be detrimental because if the numbers get too low, the cells can no longer form viable daughter cells.

Yamashita and her colleagues found that germline cells overcome this by tearing sections of DNA out of one daughter cell during cell division and transferring them to the other daughter cell. That way, one daughter cell has the full complement of those genes restored, while the other cell is sacrificed.

That wasteful strategy would likely be too extravagant to work for all cells in the body, but for the small population of germline cells, the tradeoff is worthwhile, Yamashita says.

“If skin cells did that kind of thing, where every time you make one cell, you are essentially trashing the other one, you couldn’t afford it. You would be wasting too many resources,” she says. “Germ cells are not critical for viability of an organism. You have the luxury to put many resources into them but then let only half of the cells recover.”

Suggested Content

What Cells Can be Made from Stem Cells?

|

Scientists Now Better Understand Viral Mutations

|

Stem Cells Role in the Anti-Aging Business

|

Ultra-Rapid DNA Sequencing Identifies Rare Diseases in Hours

|

Stay up to date. Follow us:

|

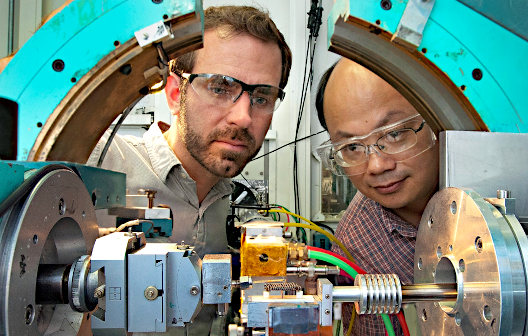

What is the Yield Curve?

Why Investors Monitor the Yield Curve and Yield Curve Changes

The difference between interest rates being paid for all available maturities of the same credit quality bonds and notes forms the yield curve. When these points are plotted on a line graph, the shape of the line is the “curve.” The US Treasury Yield curve is by far the most discussed. However, there are yield curves for corporate bonds, mortgage securities, municipal bonds, and other interest rate products. But these are often quoted as an interest rate spread to the US Treasury yield curve.

Data: US

Department of Treasury

The shape of a yield curve—where the Y-axis is interest rates, and the X-axis shows increasing time to maturity— can take on different shapes. The most common are upward sloping or “normal yield curve,”

downward sloping, or “inverted yield curve,” and flat.

The significance of these shapes has historically been used by

stock

market investors as a gauge of future expectations of economic activity and inflation. A normal yield curve indicates expectations of a growing economy, and the risk of rates being pushed up over time. A downward-sloping yield curve indicates expectations of a contracting economy or one where interest rates may need to be lowered in the future. A flat yield curve typically indicates expectations of a stagnant economy. This is also viewed as negative for stocks because equity investors like to see economic growth.

Shifts in Curve

Changes in rates from one period to the next will cause changes in the shape or steepness of the curve. The graph above shows the shift in yields from March 1, 2022 to March 23, 2022 – the Fed

tightened overnight rates by 25 bp on March 16, then on March 21, indicated a need to further increase rates. This caused a steepening.

Shifts in the curve indicate whether bond investor sentiment for higher rates is increasing or decreasing. Historically this has been based on an accelerating or decelerating economy and a changed inflation forecast. Bond market investors want to be compensated for inflation. In recent years the US Federal Reserve has taken steps that include buying bonds to adjust longer rates or add liquidity to the market. This impacts the usefulness of the curve, so investors ought to take these actions into account. There is now increased importance of Fed

announcements surrounding these purchase activities (sometimes referred to as yield-curve-control, quantitative easing, or QE). A reduction in Fed purchases (

tapering) will tend to push longer-term rates up as the Fed has been a significant buyer of the maturity range they targeted with QE.

You May Also Be Interested In:

What is Fed Tightening

|

Merger of a SPAC

|

Stay up to date. Follow us:

|

ProMIS Neurosciences to Present at the 10th Annual Neurodegenerative Drug Development Summit

ProMIS Neurosciences to Present at the 10th Annual Neurodegenerative Drug Development Summit

News and Market Data on ProMIS Neurosciences

TORONTO, Ontario and CAMBRIDGE, MA , March 24, 2022 (GLOBE NEWSWIRE) — ProMIS Neurosciences, Inc. (TSX: PMN) (OTCQB: ARFXF), a biotechnology company focused on the discovery and development of therapeutics targeting misfolded proteins such as toxic oligomers implicated in the development of neurodegenerative diseases, announced today that it will be presenting at the upcoming 10th Annual Neurodegenerative Drug Development Summit, to be held in Boston, MA, March 28-30, 2022.

ProMIS Chief Scientific Officer, Dr. Neil Cashman, will deliver an oral presentation entitled: “Abeta oligomers in Alzheimer Disease: Target Engagement and Target Distraction”, on Tuesday, March 29, 2022, at 3 PM local time at the Boston Park Plaza Hotel.

Much scientific data has implicated misfolded oligomers as the toxic molecular species of amyloid beta (Abeta) relevant to Alzheimer’s disease. However, using conventional methods, it has proven difficult to selectively target oligomers while sparing other species – including monomers and fibrils – which “distract” a therapeutic antibody from its primary target. Immune recognition of Abeta fibrils can also lead to dose-limiting adverse effects. In his presentation, Dr. Cashman will discuss the use of Collective CoordinatesTM, a proprietary computational algorithm, to design conformational epitopes that specifically target oligomers, while sparing monomers and fibrils from immune recognition.

Dr. Cashman’s presentation will be available on the ProMIS website (www.promisneurosciences.com) at the conclusion of the meeting. For more information about the meeting please consult the organizer’s website here.

About ProMIS Neurosciences

ProMIS Neurosciences, Inc. is a development stage biotechnology company focused on discovering and developing therapeutics selectively targeting toxic misfolded oligomers implicated in the development and progression of neurodegenerative diseases, in particular Alzheimer’s disease (AD), amyotrophic lateral sclerosis (ALS) and Parkinson’s disease (PD). The Company’s proprietary target discovery engine is based on the use of two complementary computational modeling techniques. The Company applies its molecular dynamics, computational discovery platform -ProMIS™ and Collective Coordinates – to predict novel targets known as Disease Specific Epitopes on the molecular surface of misfolded proteins. ProMIS is headquartered in Toronto, Ontario, with offices in Cambridge, Massachusetts. ProMIS is listed on the Toronto Stock Exchange under the symbol PMN, and on the OTCQB Venture Market under the symbol ARFXF

To learn more, visit us at www.promisneurosciences.com, follow us on Twitter and LinkedIn

For Investor Relations please contact:

Alpine Equity Advisors

Nicholas Rigopulos, President

nick@alpineequityadv.com

Tel. 617 901-0785

The TSX has not reviewed and does not accept responsibility for the adequacy or accuracy of this release. This information release contains certain forward-looking information. Such information involves known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by statements herein, and therefore these statements should not be read as guarantees of future performance or results. All forward-looking statements are based on the Company’s current beliefs as well as assumptions made by and information currently available to it as well as other factors. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Due to risks and uncertainties, including the risks and uncertainties identified by the Company in its public securities filings, actual events may differ materially from current expectations. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Source: ProMIS Neurosciences Inc.

Unraveling Stem Cell’s Secrets

Image of Yukiko Yamashita, courtesy of MIT

Research has Shed Light on the Immortality of Germline Cells and the Function of “Junk DNA”

Anne Trafton | MIT News

Office

When cells divide, they usually generate two identical daughter cells. However, there are some important exceptions to this rule: When stem cells divide, they often produce one differentiated cell along with another stem cell, to maintain the pool of stem cells.

Yukiko Yamashita has spent much of her career exploring how these “asymmetrical” cell divisions occur. These processes are critically important not only for cells to develop into different types of tissue, but also for germline cells such as eggs and sperm to maintain their viability from generation to generation.

“We came from our parents’ germ cells, who used to be also single cells who came from the germ cells of their parents, who used to be single cells that came from their parents, and so on. That means our existence can be tracked through the history of multicellular life,” Yamashita says. “How germ cells manage to not go extinct, while our somatic cells cannot last that long, is a fascinating question.”

Yamashita, who began her faculty career at the University of Michigan, joined MIT and the Whitehead Institute in 2020, as the inaugural holder of the Susan Lindquist Chair for Women in Science and a professor in the Department of Biology. She was drawn to MIT, she says, by the eagerness to explore new ideas that she found among other scientists.

“When I visited MIT, I really enjoyed talking to people here,” she says. “They are very curious, and they are very open to unconventional ideas. I realized I would have a lot of fun if I came here.”

Exploring Paradoxes

Before she even knew what a scientist was, Yamashita knew that she wanted to be one.

“My father was an admirer of Albert Einstein, so because of that, I grew up thinking that the pursuit of the truth is the best thing you could do with your life,” she recalls. “At the age of 2 or 3, I didn’t know there was such a thing as a professor, or such a thing as a scientist, but I thought doing science was probably the coolest thing I could do.”

Yamashita majored in biology at Kyoto University and then stayed to pursue her PhD, studying how cells make exact copies of themselves when they divide. As a postdoc at Stanford University, she became interested in the exceptions to that carefully orchestrated process, and began to study how cells undergo divisions that produce daughter cells that are not identical. This kind of asymmetric division is critical for multicellular organisms, which begin life as a single cell that eventually differentiates into many types of tissue.

Those studies led to a discovery that helped to overturn previous theories about the role of so-called junk DNA. These sequences, which make up most of the genome, were thought to be essentially useless because they don’t code for any proteins. To Yamashita, it seemed paradoxical that cells would carry so much DNA that wasn’t serving any purpose.

“I couldn’t really believe that huge amount of our DNA is junk, because every time a cell divides, it still has the burden of replicating that junk,” she says. “So, my lab started studying the function of that junk, and then we realized it is a really important part of the chromosome.”

In human cells, the genome is stored on 23 pairs of chromosomes. Keeping all of those chromosomes together is critical to cells’ ability to copy genes when they are needed. Over several years, Yamashita and her colleagues at the University of Michigan, and then at MIT, discovered that stretches of junk DNA act like bar codes, labeling each chromosome and helping them bind to proteins that bundle chromosomes together within the cell nucleus.

Without those barcodes, chromosomes scatter and start to leak out of the cell’s nucleus. Another intriguing observation regarding these stretches of junk DNA was that they have much greater variability between different species than protein-coding regions of DNA. By crossing two different species of fruit flies, Yamashita showed that in cells of the hybrid offspring flies, chromosomes leak out just as they would if they lost their barcodes, suggesting that the codes are specific to each species.

“We think that might be one of the big reasons why different species become incompatible, because they don’t have the right information to bundle all of their chromosomes together into one place,” Yamashita says.

Stem Cell Longevity

Yamashita’s interest in stem cells also led her to study how germline cells (the cells that give rise to eggs and sperm cells) maintain their viability so much longer than regular body cells across generations. In typical animal cells, one factor that contributes to age-related decline is loss of genetic sequences that encode genes that cells use continuously, such as genes for ribosomal RNAs.

A typical human cell may have hundreds of copies of these critical genes, but as cells age, they lose some of them. For germline cells, this can be detrimental because if the numbers get too low, the cells can no longer form viable daughter cells.

Yamashita and her colleagues found that germline cells overcome this by tearing sections of DNA out of one daughter cell during cell division and transferring them to the other daughter cell. That way, one daughter cell has the full complement of those genes restored, while the other cell is sacrificed.

That wasteful strategy would likely be too extravagant to work for all cells in the body, but for the small population of germline cells, the tradeoff is worthwhile, Yamashita says.

“If skin cells did that kind of thing, where every time you make one cell, you are essentially trashing the other one, you couldn’t afford it. You would be wasting too many resources,” she says. “Germ cells are not critical for viability of an organism. You have the luxury to put many resources into them but then let only half of the cells recover.”

Suggested Content

What Cells Can be Made from Stem Cells?

|

Scientists Now Better Understand Viral Mutations

|

Stem Cells Role in the Anti-Aging Business

|

Ultra-Rapid DNA Sequencing Identifies Rare Diseases in Hours

|

Stay up to date. Follow us:

|

Gevo (GEVO) – Two SAF Commitments of 105 MGPY From Two Airlines

Wednesday, March 23, 2022

Gevo (GEVO)

Two SAF Commitments of 105 MGPY From Two Airlines

Gevo Inc is a renewable chemicals and biofuels company engaged in the development and commercialization of alternatives to petroleum-based products based on isobutanol produced from renewable feedstocks. Its operating segments are the Gevo segment and the Gevo Development/Agri-Energy segment. By its segments, it is involved in research and development activities related to the future production of isobutanol, including the development of its biocatalysts, the production and sale of biojet fuel, its Retrofit process and the next generation of chemicals and biofuels that will be based on its isobutanol technology. Gevo Development/Agri-Energy is the key revenue generating segment which involves the operation of the Luverne Facility and production of ethanol, isobutanol and related products.

Poe Fratt, Senior Research Analyst, Logistics, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Delta Air Lines (DAL) upsizes SAF commitment and another airline commits. DAL increased the sustainable aviation fuel (SAF) commitment to 75 MGPY from 10 MGPY, or an extra 65 MGPY, under a seven year agreement that represents potential revenue of $2.8 billion, including green and other credits. Also, a member of the oneworld Alliance has committed to buy 30 MGPY, which represents potential revenue of $800 million.

Contracted FSA portfolio remains high and added contracts likely later this year. While the two commitments move the contracted FSA portfolio to 194 MGPY from 99 MGPY, or potential revenue of ~$8.0 billion, other potential large commitments from CVX (up to 150 MGPY) and others remains on the horizon. The development pipeline remains very high at more than 1,500 MGPY, or revenue potential in excess …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.