Comstock Releases Shareholder Letter

Research, News, and Market Data on Comstock Mining

Company’s Cellulosic Fuels Technologies Unlock Massive New Feedstock Model for Net Zero Energy Independence

VIRGINIA CITY, NEVADA, MARCH 10, 2022 – Comstock Mining Inc. (NYSE: LODE) (“Comstock” and the “Company”) today announced that its executive chairman and chief executive officer issued the following shareholder letter.

Dear Shareholders:

On behalf of our Board of Directors, our employees, and partners, we thank each of you for participating in a pivotal year for Comstock, in which we completed a series of strategic transactions that acquired intellectual property, management, employees, and the facilities needed to transform our business and establish a platform of breakthrough renewable energy products. We have aligned on a precise goal, and we are eager to summarize our business plans and our outlook for you, here and now.

The Comstock

The Comstock Lode is one of world’s most important mineral discoveries. It has a rich history, steeped in grit and innovation. Its pioneers innovated new technologies and mined over $20 billion in gold and silver (in today’s dollars), infusing extraordinary wealth into America’s burgeoning economy at the dawn of the industrial revolution. We have been proud to inherit and contribute to that legacy throughout our own history, as we enabled an unprecedented consolidation and operation of the historic Comstock Lode mining district, including 10-square miles of land with many miles of known mineral claims and exploration targets. We mined and produced about 60,000 ounces of gold and 735,000 ounces of silver from just one of those targets between 2012 and 2016. We believe that far more remains, a bonanza with billions of dollars of gold and silver, unavailable to the century-old mining practices of our predecessors. Our strategic partners are working to unlock that value.

Accordingly, we shifted our focus during 2020 and 2021 to new investments in renewable energy, where we have differentiated technology and core competencies, while monetizing our non-strategic assets. Our objectives are to maximize the value from our mineral estate while introducing breakthrough, decarbonizing lines of business with the capacity for rapid growth.

Enabling Systemic Decarbonization – Cellulosic Fuels

Renewable fuels provide a critical pathway for decarbonization, however, most current forms of renewable fuel draw from the same pool of conventional feedstocks, including corn and various vegetable oils in the U.S., and the entire universe of those feedstocks only represents a tiny fraction of the global motor fuel burn. Further, the lifecycle carbon benefits of growing, harvesting, and using conventional feedstocks are extremely limited, even in comparison to fossil fuels. Any plan to meaningfully decarbonize using renewable fuels must involve abundant and available feedstocks that no one else is using today.

Our renewable fuels division, Comstock Fuels, acquired a portfolio of pioneering technologies that resolve conventional feedstock limitations by efficiently converting wasted, unused, widely available, and rapidly replenishable woody biomass into advanced cellulosic fuels. These technologies unlock vast quantities of historically unused and underutilized feedstocks with enough renewable carbon to permanently offset billions of tons of fossil fuel emissions.

According to the U.S. Department of Energy, America can produce upwards of one billion tons per year of biomass feedstock for renewable fuels. That’s enough to produce 1.7 billion barrels of carbon neutral fuels with our technologies, or more than a third of the U.S. transportation demand. In addition, more than 27% of American soil, or about 540 million acres, is comprised of forestland that was previously more than twice as large, before being clear cut for less productive uses. Those under-utilized resources could be restored and used to sustainably grow, harvest, and replant billions of tons of fast-growing trees and energy crops for conversion into billions of barrels of renewable fuels with our technologies. The combined output could exceed 50% of America’s current annual output of fossil crude, and it’s 100% renewable. Canada has even more. It’s the equivalent of an oil well that will never run dry, a bonanza hidden in plain sight, and our technologies are effectively the drill.

Enabling Systemic Decarbonization – Electrification Products

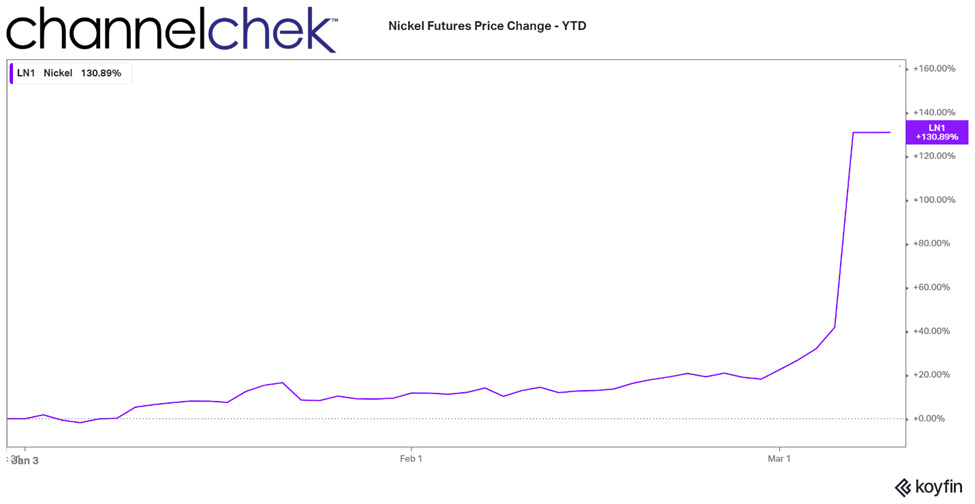

Electrification and continued advancements in energy storage are vitally necessary to reduce reliance on fossil fuels while shifting to and increasing use of renewable fuels. Our 90% owned lithium-ion battery (“LIB”) recycling business, LiNiCo Corporation (“LiNiCo”), holds the rights to a portfolio of innovative processes that efficiently crush and separate LIBs, extract lithium, nickel, cobalt, and graphite, and reuse the recovered metals to produce 99% pure cathode active precursor products. Collectively, these technologies give LiNiCo, and its existing 137,000 square foot battery metal recycling facility, differentiating competitive advantages, including the ability to process upwards of 100,000 tons of LIB and related feedstocks per year into an array of electrification products, including lithium, nickel, cobalt, graphite, and cathode materials.

According to International Energy Agency (“IEA”), there were more than 10 million electric vehicles (“EVs”) on the road in 2020, with new EV registrations increasing by 41% over 2019 and another 140% during the first quarter of 2021. Meeting the increased EV demand is estimated to require about five times more lithium carbonate equivalent (“LCE”) than the entire lithium mining industry produces today. Miners and manufacturers can scale up to meet that demand, however, according to a January 2021 USGS mineral commodity summary, there are only about 86 million tons of identified lithium reserves worldwide, and LIBs are typically landfilled after eight to ten years of use. Our technologies meet the realities of that demand by enabling profitability at the earliest stages of production, thereby positioning our LIB recycling business to contribute billions to our enterprise value from LiNiCo based on existing valuations of comparable public companies.

Our Outlook – A Net Zero Carbon World

This is our new platform for growth. We will innovate and commercialize technologies that contribute to global decarbonization and net zero circularity by efficiently converting natural resources, including wasted and unused materials, into valuable renewable energy products that shift supply chains away from and reduce reliance on fossil fuels. We will also lead and support the adoption and growth of a balanced net zero ecosystem based on the feedstocks unlocked by our technologies, with powerful embedded economic incentives for our clients, their industries, and the populations they serve to decarbonize.

We will rapidly achieve exponential growth and extraordinary financial, natural, and social gains by building, owning, and operating a fleet of advanced carbon neutral extraction and refining facilities, by selling an array of complimentary process solutions and related services, and by licensing selected technologies to qualified strategic partners. Our goal is to generate over $16 billion in revenue on an annualized basis by 2030, by producing and selling renewable energy products that enable us, our clients, and their downstream stakeholders to reduce greenhouse gas emissions by at least 100 million metric tons per year. Meeting that objective would offset more than 234 million barrels per year of fossil fuel, or about 6% of the U.S. transportation burn, and require an estimated 8% of the existing biomass residues produced annually in the U.S.

Such scales are achievable by tapping into and leveraging existing infrastructure. Our expanded team has extensive experience in the renewable fuels industry, having designed and built several dozen renewable fuel production facilities in the U.S. Notably, our team invented and commercialized pioneering processes used by more than 95% of the U.S. corn ethanol industry to produce distillers corn oil, a value-added feedstock that offsets more than 20 million barrels of fossil fuel per year and has played a disruptive role in the growth and development of the renewable fuels industry.

We have already made remarkable progress. We are currently building commercial pilot scale cellulosic fuels and LIB facilities, and we are preparing to commence operations at our full-scale LIB recycling facility later this year. We have also made significant strides in developing and establishing our new facilities and forging new revenue and licensing streams that we will soon share. We have also made meaningful progress and will complete the monetization of our non-strategic assets, as quickly as possible, while funding our new businesses and limiting our focus to the objectives outlined above.

The Comstock Lode’s history of relentless grit and innovation and pioneering and prospecting against all odds will always be part of our identity. Moving forward, we will drop the word “mining” from our name and rebrand the company as “Comstock” to reflect our new mission of enabling systemic decarbonization. Additional information in that regard will be made available in the coming weeks as we launch our new website and file our Form 10-K for our fiscal year ended December 31, 2021.

We look forward to our next communication and seeing those of you that can attend this year’s Annual General Meeting, on May 26, 2022, where we plan on showcasing our renewable energy businesses, employees, and partners, including the results of our business plans, schedules, and near-term revenues. Until then, thank you for your continued interest and support.

Kindest regards,

Corrado De Gasperis

Executive Chairman and Chief Executive Officer

Comstock Mining Inc.

About Comstock Mining Inc.

Comstock Mining Inc. (NYSE: LODE) innovates technologies that contribute to global decarbonization and circularity by shifting the consumption patterns of industries and populations. The Company’s technologies are designed to do so by efficiently converting wasted and unused natural resources into valuable renewable energy products, which the Company intends to use to achieve exponential growth and extraordinary financial, natural, and social gains by building, owning, and operating a fleet of advanced carbon neutral natural resource extraction and refining facilities, by selling an array of complementary process solutions and related services, and by licensing selected technologies to qualified strategic partners. To learn more, please visit www.comstockmining.com.

Forward-Looking Statements

This press release and any related calls or discussions may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “would,” “potential” and similar expressions identify forward-looking statements, but are not the exclusive means of doing so. Forward-looking statements include statements about matters such as: future industry market conditions; future explorations or acquisitions; future changes in our exploration activities; future changes in our research and development; future prices and sales of, and demand for, our products and services; land entitlements and uses; permits; production capacity and operations; operating and overhead costs; future capital expenditures and their impact on us; operational and management changes (including changes in the Board of Directors); changes in business strategies, planning and tactics; future employment and contributions of personnel, including consultants; future land sales; investments, acquisitions, joint ventures, strategic alliances, business combinations, operational, tax, financial and restructuring initiatives, including the nature, timing and accounting for restructuring charges, derivative assets and liabilities and the impact thereof; contingencies; litigation, administrative or arbitration proceedings; environmental compliance and changes in the regulatory environment; offerings, limitations on sales or offering of equity or debt securities, including asset sales and associated costs; and future working capital, costs, revenues, business opportunities, debt levels, cash flows, margins, taxes, earnings and growth. These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical and current trends, current conditions, possible future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties, many of which are unforeseeable and beyond our control and could cause actual results, developments and business decisions to differ materially from those contemplated by such forward-looking statements. Some of those risks and uncertainties include the risk factors set forth in reports that we file with the Securities and Exchange Commission, including Item 1A, “Risk Factors” in our most recently-filed Annual Report on Form 10-K and/or Quarterly Report on Form 10-Q, and the following: adverse effects of climate changes or natural disasters; adverse effects of global or regional pandemic disease spread or other crises; global economic and capital market uncertainties; the speculative nature of gold or mineral exploration, mercury remediation and lithium, nickel and cobalt recycling, including risks of diminishing quantities or grades of qualified resources; operational or technical difficulties in connection with exploration or mercury remediation, metal recycling, processing or mining activities; costs, hazards and uncertainties associated with precious metal based activities, including environmentally friendly and economically enhancing clean mining and processing technologies, precious metal exploration, resource development, economic feasibility assessment and cash generating mineral production; costs, hazards and uncertainties associated with mercury remediation, metal recycling, processing or mining activities; contests over our title to properties; potential dilution to our stockholders from our stock issuances, recapitalization and balance sheet restructuring activities; potential inability to comply with applicable government regulations or law; adoption of or changes in legislation or regulations adversely affecting our businesses; permitting constraints or delays; ability to achieve the benefits of business opportunities that may be presented to, or pursued by, us, including those involving battery technology, mercury remediation technology and efficacy, quantum computing and advanced materials development, and development of cellulosic technology in bio-fuels and related carbon-based material production; ability to successfully identify, finance, complete and integrate acquisitions, joint ventures, strategic alliances, business combinations, asset sales, and investments that we may be party to in the future; changes in the United States or other monetary or fiscal policies or regulations; interruptions in our production capabilities due to capital constraints; equipment failures; fluctuation of prices for gold or certain other commodities (such as silver, zinc, lithium, nickel, cobalt, cyanide, water, diesel, gasoline and alternative fuels and electricity); changes in generally accepted accounting principles; adverse effects of war, mass shooting, terrorism and geopolitical events; potential inability to implement our business strategies; potential inability to grow revenues; potential inability to attract and retain key personnel; interruptions in delivery of critical supplies, equipment and raw materials due to credit or other limitations imposed by vendors; assertion of claims, lawsuits and proceedings against us; potential inability to satisfy debt and lease obligations; potential inability to maintain an effective system of internal controls over financial reporting; potential inability or failure to timely file periodic reports with the Securities and Exchange Commission; potential inability to list our securities on any securities exchange or market or maintain the listing of our securities; and work stoppages or other labor difficulties. Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows, or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Neither this press release nor any related call or discussion constitutes an offer to sell, the solicitation of an offer to buy or a recommendation with respect to any securities of the Company, the fund or any other issuer.

Image: Dave (Flickr)

Image: Dave (Flickr)