Waterbury South Uranium Targets Extended in Latest Winter Drill Program

Research, News, and Market Data on CanAlaska Uranium

Strong Clay and Sulfide Alteration Halo Associated With Previously Discovered Polymetallic Uranium Mineralization Extended

Structurally-Complex Area Identified in Sandstone and Deep Into Basement

Update on Corporate Activities in the Athabasca Basin and Thompson Nickel Belt

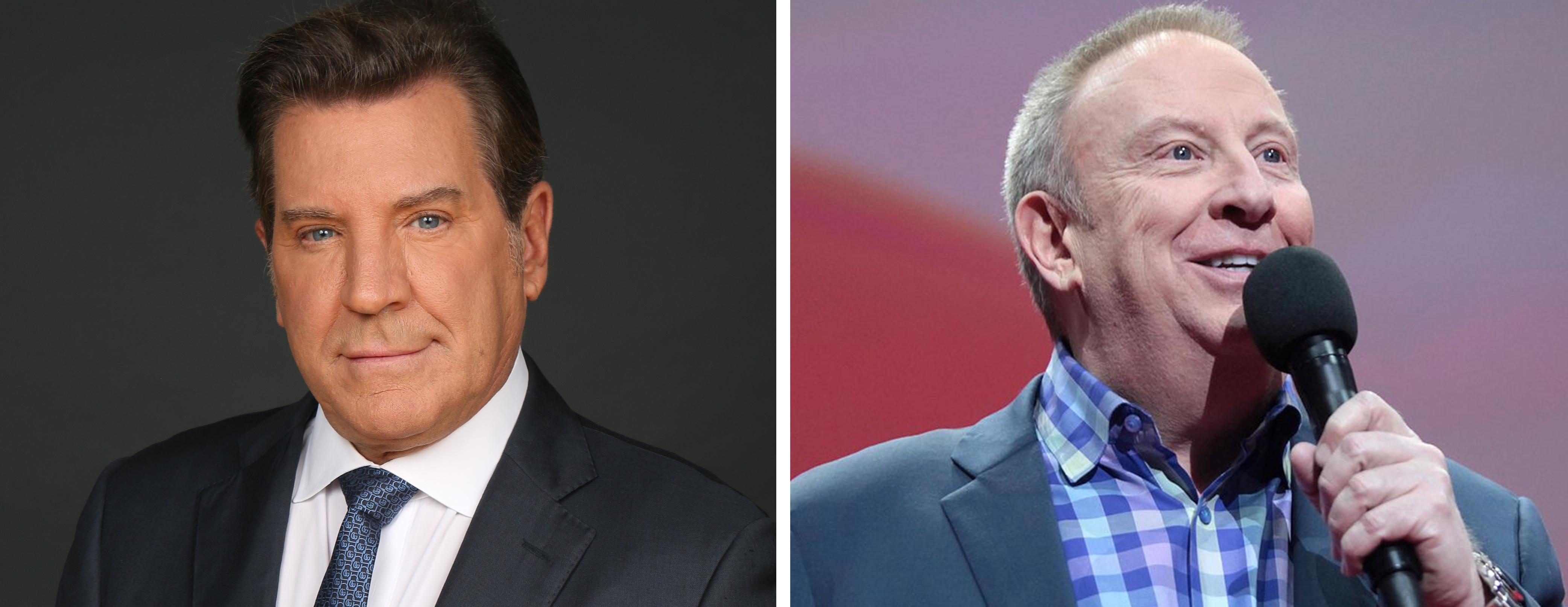

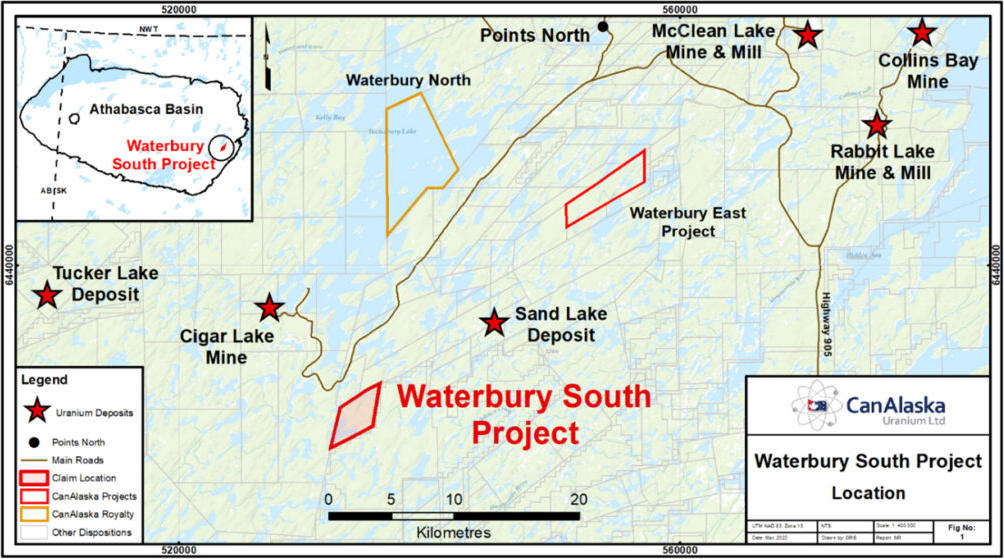

Vancouver, Canada, March 31, 2022 – CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) (“CanAlaska” or the “Company”) is pleased to announce the successful completion of the 2022 drilling program at its 100%-owned Waterbury South uranium project. The project is located approximately 10 km southeast of the producing Cigar Lake uranium mine in the Eastern Athabasca Basin (Figure 1).

Figure 1 – Property location map for the Waterbury South project.

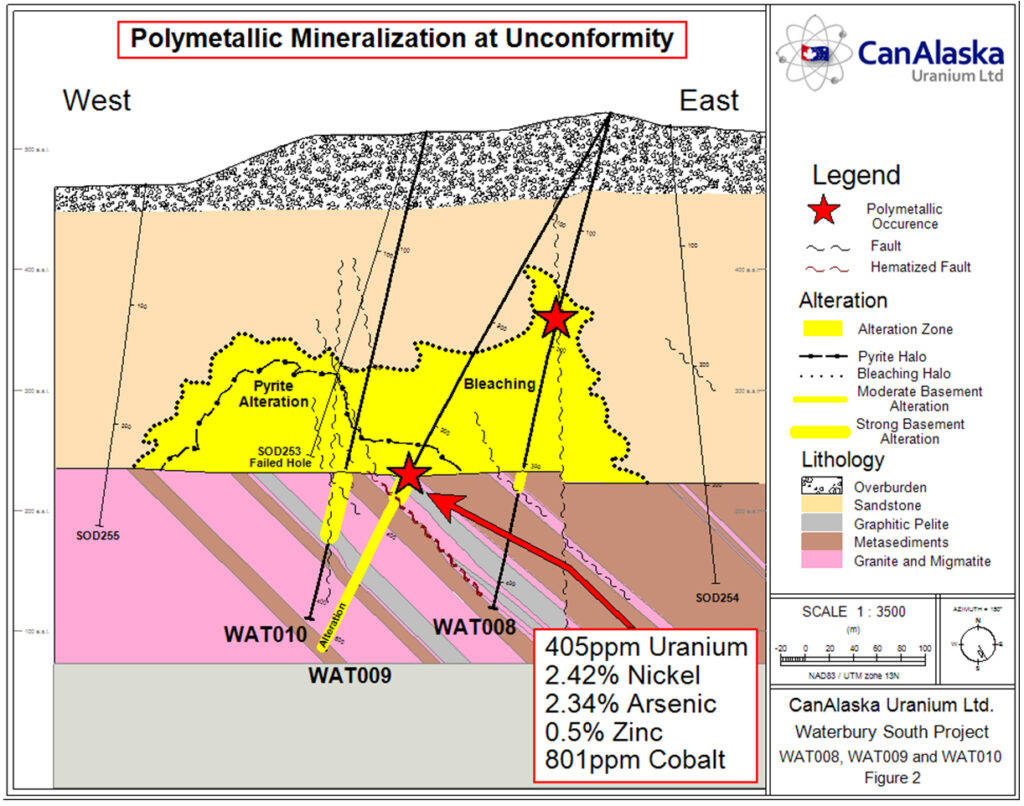

The drill program was focused on extending and understanding the geological controls of the polymetallic unconformity uranium mineralization associated with nickel, arsenic, cobalt, and zinc, intersected during the previous 2021 winter drill program (see News Release dated June 17, 2021). Program objectives were successfully met with the completion of six drill holes totalling 2,787 metres (m). Results indicate a structurally-complex fault system that extends the footprint of previously intersected strong sandstone and deep basement alteration.

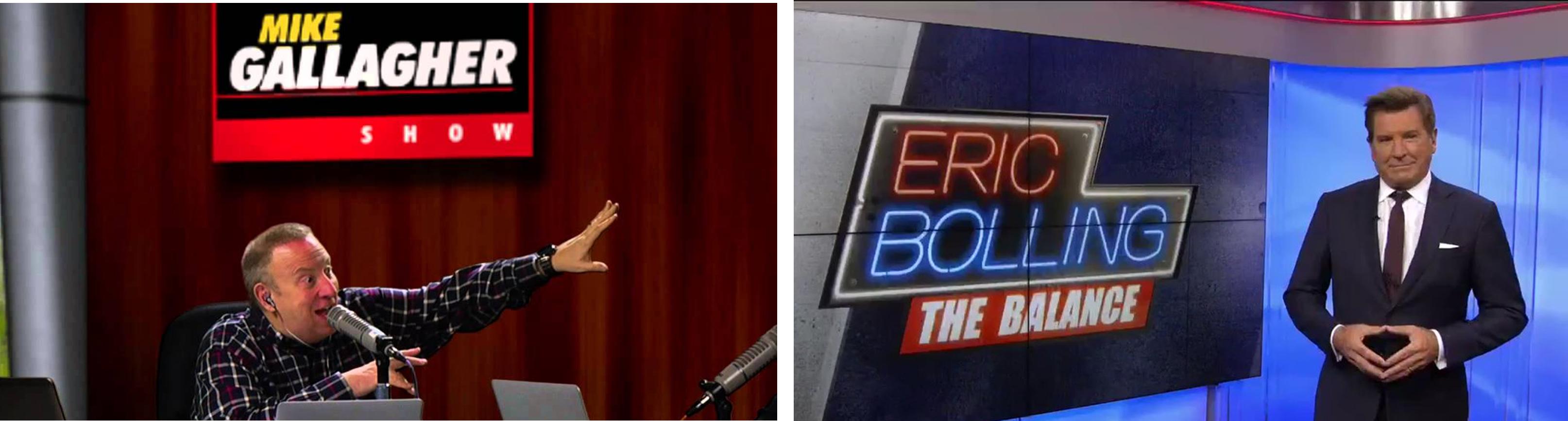

Figure 2 – Drillhole section along WAT009 and WAT010 showing the distribution of the strong alteration

and structure in the lower sandstone and basement along the fence.

Drillhole WAT010, drilled along the same fence as WAT009, targeted the unconformity projection of strong faulting intersected in the basement of WAT009. WAT010 intersected the unconformity target approximately 52 m north of WAT009 on section. The drillhole intersected a strongly altered and structured lower sandstone column with strong bleaching, pyrite, clay alteration, secondary hematite, desilicification, and clay-replaced sandstone (Figure 2). Strong bleaching and chlorite alteration extends over 60 m into the basement on WAT 010 and is associated with quartz-carbonate healed breccias that contain brittle reactivation . Based on the intensity of structure and alteration in the sandstone column, WAT010 is interpreted to have overshot the ideal target at the unconformity. The results on this fence from both 2021 and 2022 drilling indicate that strong hydrothermal alteration and fault structures are present above the unconformity and extend deep into the basement indicating the possible presence of a large mineralizing event nearby.

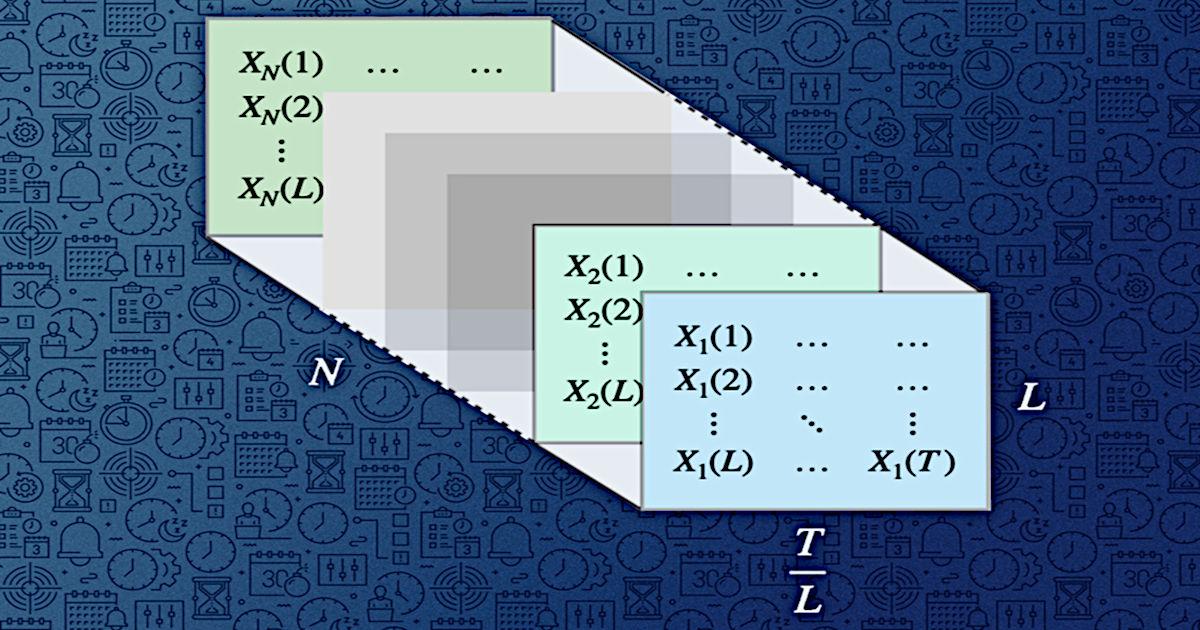

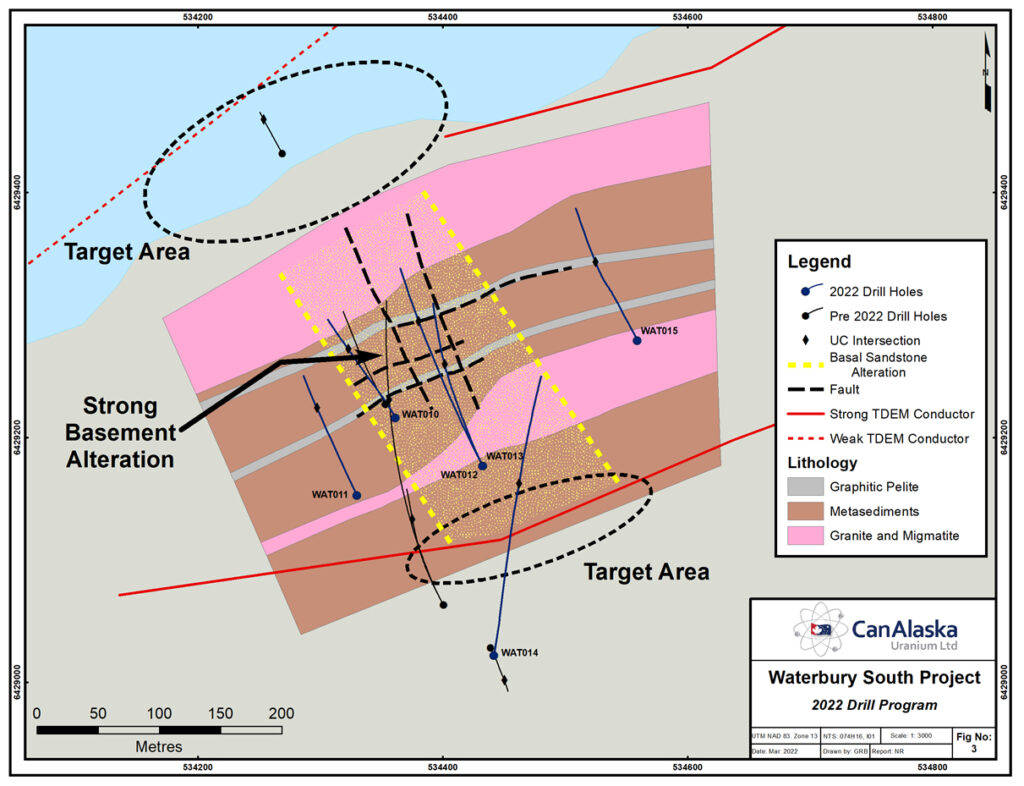

Drillhole WAT012 to the east of WAT010 confirmed the strike extension of strong alteration within WAT009 and WAT010. WAT012 intersected the unconformity approximately 55 m east of WAT009 (Figure 3). The lower sandstone column contains a five metre wide zone of strong hydrothermal alteration including bleaching, patches of strong black sulfide alteration, clay and chlorite, similar to WAT009 and WAT010. The strong bleaching and clay alteration extends into the upper four metres of the basement. Nearly 70 m below the unconformity, a series of 1 to 4 m wide strongly graphitic and re-activated fault zones characterized by broken core and quartz-carbonate healed breccias were intersected indicating further evidence of a major graphitic fault system in the basement. WAT012 is interpreted to have undershot the ideal target at the unconformity. WAT 014 was drilled to test the structural complexity in the area; it intersected bedding-controlled sulfide alteration throughout the lower sandstone column.

Figure 3 – Map of the Waterbury South project shows the complex structural relationship between

the drillholes completed to date and the currently defined sandstone alteration.

The drillholes completed during the program show evidence for multiple orientations of re-activated fault structures. These fault structures are parallel and cross-cutting to the basement stratigraphy in the area. In other uranium deposits such as Eagle Point, cross-cutting and splay faults play a very important role in controlling and localizing fluid movement along the main graphitic strucures. In the case of Eagle Point, these cross-cutting and splay structures can be strongly altered and mineralized for several hundred metres away from the mine area. The sandstone and deep basement faults with strong alteration are indicative of the presence of hydrothermal processes generally associated with a uranium mineralizing event. Given the structural complexity encountered in the 2022 program, the Company is investigating use of high resolution geophysical surveys to plan the next phase of drilling.

Geochemical assay results for the 2022 drilling program are pending.

CanAlaska VP Exploration, Nathan Bridge, comments, “The CanAlaska team set out to understand the controls on the previously discovered polymetallic unconformity uranium mineralization in WAT009. The strong alteration system in WAT009, that is host to high-grade nickel-sulfides and associated uranium mineralization, was extended to the east and remains open in several directions. The Waterbury South area is structurally-complex, with multiple fault orientations and deep basement alteration that suggests multiple periods of reactivation and hydrothermal fluid-movement, key to uranium deposit formation in the Athabasca Basin. The results obtained during this drill season are promising and several kilometers of strike length remain open along this structural corridor.”

CanAlaska CEO, Cory Belyk, comments, “The 2022 program significantly increased our knowledge of the polymetallic uranium mineralization drilled in 2021. Continuation of strong sandstone and deep basement alteration along major structures is very encouraging and is an important aspect in nearly all uranium deposits in the Basin, specifically basement-hosted uranium deposits such as Eagle Point, where altered and mineralized cross-structures extend for several hundred metres away from the main deposit. The team did a great job of working out the geology and results from this program have generated nearby targets for the next round of drilling.”

Corporate Update

West McArthur Drill Preparation:

The Company has nearly completed its detailed Stepwise Moving Loop Time Domain Electromagnetic Survey (TDEM) on its West McArthur Joint Venture project. The geophysical survey is part of the approved $5 million 2022 exploration program. Preliminary survey results show multiple strong conductive responses along the Grid 5 trend that appear to be associated with newly interpreted potential folds and fault structures. The Company anticipates the program will be complete in early April and targets from the survey will be ready for drill testing during the upcoming summer exploration program.

Key Extension Ground Gravity Survey:

A ground gravity survey at the Company’s new Key Extension project is over 50% complete. Preliminary processing of the data has identified a series of gravity low features that are associated with conductors on the property. These initial results are encouraging as this association is common in many basement-hosted uranium deposits. The Company plans to release the results of the survey once the full data set has been received and final processing has been completed in preparation for the inaugural drilling program later in the year.

Manibridge Drill Program

Drilling at the Company’s Manibridge project is ongoing. The drilling program is being fully funded by Metal Energy Corp. as part of a staged earn-in option agreement. Metal Energy have earned a 49% interest in the property and have elected to proceed with the 70% earn-in option. CanAlaska is the current operator on the project and drilling is ongoing.

Hunter Geophysics

In the Thompson Nickel Belt, the Company is preparing for an airborne VTEM survey on it’s 100%-owned Hunter nickel project.

About CanAlaska Uranium

CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) holds interests in approximately 300,000 hectares (750,000 acres), in Canada’s Athabasca Basin – the “Saudi Arabia of Uranium.” CanAlaska’s strategic holdings have attracted major international mining companies. CanAlaska is currently working with Cameco and Denison at two of the Company’s properties in the Eastern Athabasca Basin. CanAlaska is a project generator positioned for discovery success in the world’s richest uranium district. The Company also holds properties prospective for nickel, copper, gold and diamonds.

The qualified technical person for this news release is Nathan Bridge, MSc., P.Geo., CanAlaska’s Vice President, Exploration.

For further information visit www.canalaska.com.

On behalf of the Board of Directors

“Peter Dasler”

Peter Dasler, M.Sc., P.Geo.

President

CanAlaska Uranium Ltd.

Contacts:

Peter Dasler, President

Tel: +1.604.688.3211 x 138

Email: info@canalaska.com

Cory Belyk, CEO and Executive Vice President

Tel: +1.604.688.3211 x 138

Email: cbelyk@canalaska.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve numerous assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. In addition, these statements involve substantial known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will prove inaccurate, certain of which are beyond the Company’s control. Readers should not place undue reliance on forward-looking statements. Except as required by law, the Company does not intend to revise or update these forward-looking statements after the date hereof or revise them to reflect the occurrence of future unanticipated events.