CanAlaska Deals Further Three Uranium Projects for AUD$15M

Research, News, and Market Data on CanAlaska Uranium

Basin Energy has Staged Option to Earn up to 80% Interest in Two Properties and Additional Option to Earn up to 100% in One Property

Focus on High-Grade Eastern Athabasca Basement and Unconformity Uranium Targets

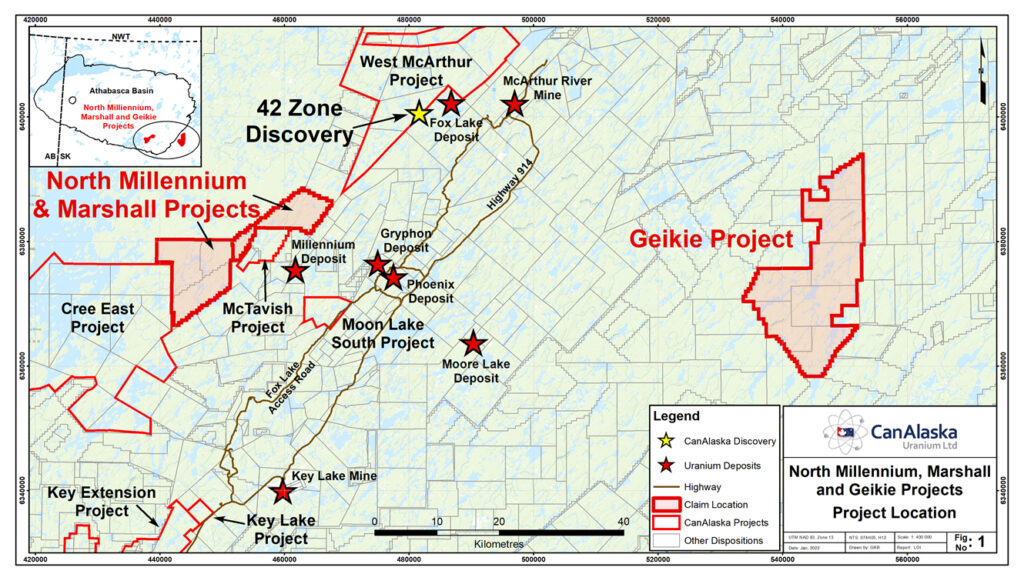

Vancouver, Canada, January 26, 2022 – CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) (“CanAlaska” or the “Company”) is pleased to announce it has entered into a Letter of Intent (“LOI”) with Basin Energy Limited (“Basin Energy”), an Australian unlisted public company, to allow Basin Energy to earn up to an 80% interest in CanAlaska’s 100%-owned North Millennium and Geikie projects, and a 100% interest in CanAlaska’s 100%-owned Marshall project. These projects total 50,994.56 hectares in the Eastern Athabasca Basin in Saskatchewan, Canada (the “Projects”) (Figure 1).

North Millennium and Geikie Projects

Basin Energy may earn up to an 80% interest in each of the North Millennium and Geikie projects by undertaking work and milestone payments in three defined earn-in stages on each project.

- Basin Energy may earn an initial 40% interest (“40% Option”) in each of the projects by paying the Company AUD$41,666.66 cash per project and issuing 6.66% worth of ordinary shares in Basin Energy’s capital structure as at listing on the Australian Securities Exchange (“ASX”) per project within 180 days following execution of a definitive Property Option Agreement (“POA”). Basin Energy will have the right to extend the 40% Option on a month-by-month basis for up to three (3) consecutive months upon payment of an option extension fee of AUD$8,333 per month per project.

- Basin Energy may earn an additional 20% interest (“60% Option”) in each of the projects by incurring AUD$2,500,000 in exploration expenditures per project within 24 months of the ASX listing date.

- Basin Energy may earn an additional 20% interest (“80% Option”) in each of the projects by issuing a further 2,250,000 ordinary shares in Basin Energy per project and incurring an additional AUD$5,000,000 (total: AUD$7,500,000) in exploration expenditures per project within 48 months of the ASX listing date and granting the Company a 2.75% net smelter returns (“NSR”) royalty on all products derived from the claims with a repurchase right of 0.50% NSR for AUD$500,000 at any time commencing from the grant of the 2.75% NSR per project.

- CanAlaska will be operator of the projects through the 60% Option threshold and charge an operator fee.

- Basin Energy will be obligated to keep and maintain the North Millennium and Geikie claims in good standing for a minimum period of one year at all times during the term of the POA.

- A Joint Technical Operating Committee (“JTOC”) will be established. Basin Energy will have the deciding vote on all expenditures to be incurred on the claims during the term of the POA.

After successful completion of either of the 40% Option or 60% Option stages of the agreement, and if Basin Energy elects to not enter the final stage, a joint venture will be formed and the parties will co-contribute on a simple pro-rata basis or dilute on a pre-defined straight-line dilution formula. If either party dilutes to a 10% interest, the diluting party will automatically forfeit its interest in the respective project and in lieu thereof will be granted a 2.75% net smelter returns (NSR) royalty on the respective property on all products derived from the claims with a repurchase right of 0.50% NSR for AUD$500,000 at any time commencing from the grant of the 2.75% NSR, except that, this provision will not apply to CanAlaska if CanAlaska has already been granted the 2.75% NSR prior to diluting to a 10% interest.

An area of mutual interest will be established that extends two kilometres from the boundary of the claims.

Marshall Project

Basin Energy may acquire a 100% interest in the Marshall project by:

- Paying the Company AUD$41,666.66 cash and issuing 6.66% worth of ordinary shares in Basin Energy’s capital structure as at listing on the ASX within 180 days following execution of a definitive POA. Basin Energy will have the right to extend the payment period on a month-by-month basis for up to three (3) consecutive months upon payment of an option extension fee of AUD$8,333 per month.

- Granting to the Company a 2.75% net smelter returns (“NSR”) royalty on all products derived from the claims with a repurchase right of 0.50% NSR for AUD$500,000 at any time commencing from the grant of the 2.75% NSR.

- CanAlaska and Basin Energy will enter into an agreement, on terms acceptable to both parties, pursuant to which Basin Energy will engage the Company to be the operator of the initial AUD$1,500,000 work program on the property after closing of the transaction. CanAlaska will be entitled to charge Basin Energy an operator fee.

About Basin Energy Limited

Basin Energy Limited (ACN 655 515 110) is an Australian unlisted uranium exploration and development company incorporated for the purpose of pursuing highly prospective uranium opportunities globally. It is a condition of completion of this transaction that Basin Energy be listed on the ASX.

CanAlaska CEO, Cory Belyk, comments, “CanAlaska is very pleased to work with Basin Energy, another pending Australian-listed player in the Athabasca Basin, to help fund the next stages of exploration on these new and highly prospective Eastern Athabasca uranium projects we staked in 2021. This very significant investment by Basin Energy is another example of CanAlaska’s project generator model at work that will allow for discovery opportunities for our shareholders without dilution in our core Eastern Athabasca projects.”

Other News

The Company is currently drilling on its Waterbury South project near the Cigar Lake mine.

About CanAlaska Uranium

CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) holds interests in approximately 300,000 hectares (750,000 acres), in Canada’s Athabasca Basin – the “Saudi Arabia of Uranium.” CanAlaska’s strategic holdings have attracted major international mining companies. CanAlaska is currently working with Cameco and Denison at two of the Company’s properties in the Eastern Athabasca Basin. CanAlaska is a project generator positioned for discovery success in the world’s richest uranium district. The Company also holds properties prospective for nickel, copper, gold and diamonds.

For further information visit www.canalaska.com.

On behalf of the Board of Directors

“Peter Dasler”

Peter Dasler, M.Sc., P.Geo.

President

CanAlaska Uranium Ltd.

Contacts:

Peter Dasler, President

Tel: +1.604.688.3211 x 138

Email: info@canalaska.com

Cory Belyk, CEO and Executive Vice President

Tel: +1.604.688.3211 x 138

Email: cbelyk@canalaska.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve numerous assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. In addition, these statements involve substantial known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will prove inaccurate, certain of which are beyond the Company’s control. Readers should not place undue reliance on forward-looking statements. Except as required by law, the Company does not intend to revise or update these forward-looking statements after the date hereof or revise them to reflect the occurrence of future unanticipated events.