Sierra Metals Announces Changes to Its Organizational Structure, Following Strategic Review

Research, News, and Market Data on Sierra Metals

TORONTO–(BUSINESS WIRE)– Sierra Metals Inc. (TSX: SMT) (NYSE American: SMTS) (BVL: SMT) (“Sierra Metals” or the “Company”) is pleased to announce the completion of an internal organizational review, following the strategic review announced in late 2021.

Sierra Metals is strengthening its current operating portfolio through various value-enhancing opportunities. These include:

– Increased focus on the production of copper and steel-making products such as zinc and iron-ore;

– Advancement of the Company’s mine expansion plans, with the aim of increasing the return at both the Yauricocha and Bolivar Mines;

– Re-activation of brownfield and greenfield exploration activities, throughout Sierra’s extensive resource base;

– Heightened focus on ESG, Human Capital and Permitting

In order to align the organization to effectively achieve these goals, as well as to overcome current operational issues, the following appointments have been made:

James León – Vice President, Operations

Effective February 1st, following his previous appointment as Country Manager Perú, Mr. León will now manage both Yauricocha and Bolivar operations. Mr. León will be based in Mexico. He will oversee the delivery of increasingly improved operational results and efficiencies, following the difficult challenges Bolivar and Yauricocha have faced over the past two years.

Mr. León is a Peruvian Mining Engineer with over 25 years of experience and has been with Sierra Metals since August of 2017 in various roles including Operations Manager in Mexico until 2019, and then Country Manager in Peru.

Alonso Lujan – Vice President, Exploration

Effective February 1st, as Vice President, Exploration, Mr. Lujan will focus on the extensive resource growth and business opportunities, in both brownfield and greenfield exploration, at our properties in Perú and México. Both Yauricocha and Bolivar are in underexplored, highly prospective geological regions, with another 80,000 Hectares of greenfield properties owned by Sierra Metals. His role is fully aligned with the strategic objective of unlocking the significant potential value at these properties.

Mr. Lujan is a Mexican Geological and Mining Engineer with over 30 years international experience in mineral exploration with a positive track record for increasing companies’ resources, output and company value.

Alberto Calle – Vice President, Human Resources

Effective November 1, 2021, Mr. Calle is taking the role of VP Human Resources, in charge of the HR function at Sierra Metals. Provided the changing environment and ongoing challenges on this area, this role is key to assist with strengthening our teams, and maintaining a healthy and motivated work environment, in both Peru and Mexico.

Mr. Calle has spent 20 years of his professional experience in Human Capital with 13 years dedicated to the large-scale mining industry. He previously held positions at MMG – Las Bambas as Human Resource Manager, and Regional Manager of Human Resources for Newmont

Juan Jose Mostajo – Vice President, Legal Affairs

Effective December 1, 2021, Mr. Mostajo joins our legal team and will assist in legal matters related to both Peru and Mexico. His role is key for managing the ongoing legal and permitting issues at both of our operations and supporting the strategy of the Company moving forward.

He has over 23 years of experience in the mining sector and has been legal advisor to various mining companies, both Peruvian and foreign. His previous positions include a role as part of the legal management team at Anglo American in Peru as well as Vice President of Legal Affairs of Minera Chinalco, Peru.

About Sierra Metals

Sierra Metals Inc. is a diversified Canadian mining company with Green Metal exposure including increasing copper production and base metal production with precious metals byproduct credits, focused on the production and development of its Yauricocha Mine in Peru, and Bolivar and Cusi Mines in Mexico. The Company is focused on increasing production volume and growing mineral resources. Sierra Metals has recently had several new key discoveries and still has many more exciting brownfield exploration opportunities at all three Mines in Peru and Mexico that are within close proximity to the existing mines. Additionally, the Company also has large land packages at all three mines with several prospective regional targets providing longer-term exploration upside and mineral resource growth potential.

The Company’s Common Shares trade on the Bolsa de Valores de Lima and on the Toronto Stock Exchange under the symbol “SMT” and on the NYSE American Exchange under the symbol “SMTS”.

For further information regarding Sierra Metals, please visit www.sierrametals.com.

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com | Twitter:sierrametals | Facebook:SierraMetalsInc | LinkedIn:Sierra Metals Inc

Forward-Looking Statements

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of Canadian and U.S. securities laws (collectively, “forward-looking information“). Forward-looking information includes, but is not limited to, statements with respect to the date of the 2020 Shareholders’ Meeting and the anticipated filing of the Compensation Disclosure. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential” or variations thereof, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking information.

Forward-looking information is subject to a variety of risks and uncertainties, which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the risks described under the heading “Risk Factors” in the Company’s annual information form dated March 18, 2020 for its fiscal year ended December 31, 2020 and other risks identified in the Company’s filings with Canadian securities regulators and the United States Securities and Exchange Commission, which filings are available at www.sedar.com and www.sec.gov, respectively.

The risk factors referred to above are not an exhaustive list of the factors that may affect any of the Company’s forward-looking information. Forward-looking information includes statements about the future and is inherently uncertain, and the Company’s actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking information due to a variety of risks, uncertainties and other factors. The Company’s statements containing forward-looking information are based on the beliefs, expectations and opinions of management on the date the statements are made, and the Company does not assume any obligation to update such forward-looking information if circumstances or management’s beliefs, expectations or opinions should change, other than as required by applicable law. For the reasons set forth above, one should not place undue reliance on forward-looking information.

Investor relations

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Email: info@sierrametals.com

Luis Marchese

CEO

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Source: Sierra Metals Inc.

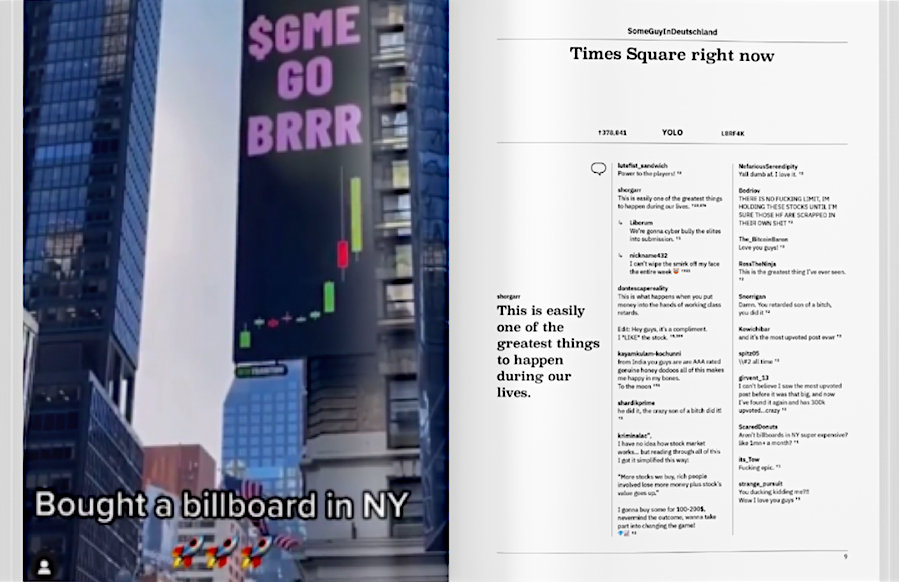

WallStreetBets users calling themselves “Diamond Hands History” have launched a Kickstarter fund to publish an archive of the fun memes from the era of self-deprecation and intentional misspelling STONKS (stocks), and HODL (hold).

WallStreetBets users calling themselves “Diamond Hands History” have launched a Kickstarter fund to publish an archive of the fun memes from the era of self-deprecation and intentional misspelling STONKS (stocks), and HODL (hold).