Endeavour Silver to Acquire the Pitarrilla Project, One of the World’s Largest Undeveloped Silver Projects¹, Leveraging Regional Platform and Operating Expertise in Mexico

Research, News, and Market Data on Endeavour Silver

VANCOUVER, British Columbia, Jan. 13, 2022 (GLOBE NEWSWIRE) — Endeavour Silver Corp. (“Endeavour” or the “Company”) (TSX: EDR, NYSE: EXK) has entered into a definitive agreement to purchase the Pitarrilla project (“ Pitarrilla ”) in Durango State, Mexico by acquiring all of the issued and outstanding shares of SSR Durango, S.A. de C.V. (the “ Transaction ”) from SSR Mining Inc. (NASDAQ/TSX: SSRM; ASX: SSR) (” SSR Mining “) for total consideration of $70 million and a 1.25% net smelter returns royalty (“ NSR Royalty ”). All references to dollars ($) in this news release are to United States dollars (US$).

Pitarrilla is a large undeveloped silver, lead, and zinc project located 160 kilometres north of Durango City, in northern Mexico. The Pitarrilla property consists of 4,950 hectares across five concessions and has significant infrastructure in place with direct access to utilities. SSR Mining filed a technical report prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) titled “NI 43-101 Technical Report on the Pitarrilla Project” dated December 14, 2012 (the “ 2012 Technical Report ”). The 2012 Technical Report provided a feasibility study outlining a large, mainly open-pit operation and a mineral resource estimate, which has since been updated by SSR Mining for its Annual Information Form for the financial year ended December 31, 2020 (the “ SSR Mining 2020 AIF ”) (together, the “Historical Estimate” ) 2 .

“The acquisition of Pitarrilla, one of the world’s largest undeveloped silver projects 1 , accelerates our vision to become a premier senior silver producer,” said Dan Dickson, Endeavour’s Chief Executive Officer. “We now have a tremendous growth pipeline, which in addition to Pitarrilla includes the Terronera and Parral projects, in a country where we have extensive experience and expertise. While Terronera is the next project to be developed, we anticipate that Pitarrilla will be a significant asset in our portfolio and may take priority over the advancement of Parral. We will be in a position to make such a decision once we complete further drilling and analyze the economics of various scales and options for production.”

Total Consideration

Total consideration payable on closing of the Transaction is $70 million, consisting of $35 million in Endeavour shares and a further $35 million in cash or in Endeavour shares at the election of SSR Mining and agreed to by Endeavour. The number of Endeavour shares to be issued will be based on a deemed price of $4.0805 per share, being the volume weighted average price of Endeavour’s common shares on the New York Stock Exchange (“ NYSE ”) for the 10 business days immediately preceding the date of signing the definitive agreement. The shares will be subject to a hold period of four months and one day following the date of closing.

SSR Mining will retain a 1.25% NSR Royalty on Pitarrilla. Endeavour will have matching rights to purchase the NSR Royalty in the event SSR Mining proposes to sell it.

Any cash component will be satisfied with cash on hand. As at September 30, 2021, Endeavour had $101 million in cash and cash equivalents and $129 million in working capital.

Strategic Rationale for Acquisition

- Acquiring One of the World’s Largest Undeveloped Silver Projects

- As outlined in the 2012 Technical Report and updated in the SSR Mining 2020 AIF, Pitarrilla has the following mineral resource estimate which Endeavour is treating as a Historical Estimate 3 :

- a measured & indicated mineral resource (open-pit and underground) of 525.27 million ounces (oz) silver (Ag) in 164.79 million tonnes grading 99.1 grams per tonne (gpt) Ag.

- an open-pit inferred mineral resource of 21.21 million oz Ag in 8.52 million tonnes at an average grade of 77.4 gpt and underground inferred mineral resource of 5.46 million oz Ag in 1.23 million tonnes at a grade of 138.1 gpt.

- By way of comparison, Endeavour Silver has the following mineral reserve and resource estimates 4 as outlined in its Annual Information Form for the year ended December 31, 2020:

- a proven and probable mineral reserve of 86.3 million oz silver equivalent (AgEq) from 6.99 million tonnes at 380 gpt AgEq.

- a measured & indicated mineral resource of 43.7 million oz AgEq in 4.40 million tonnes at an average grade of 309 gpt AgEq.

- an inferred mineral resource of 87.13 million oz AgEq in 8.04 million tonnes at an average grade of 337 gpt AgEq.

- Pitarrilla Leverages Endeavour’s Platform and Experience in Mining-Friendly Mexico

- Acquisition is an excellent fit for Endeavour’s experienced regional team, which has a successful development, exploration and underground mining track record.

- Accretive Acquisition at an Attractive Valuation

- Once a current resource is defined, Pitarrilla is expected to be substantially accretive on a silver equivalent resource per share metric — anticipate announcing a current resource in 2022.

- Endeavour expects to maintain significant silver exposure, silver beta and trading multiples.

- Pitarrilla provides additional optionality in a rising silver price environment.

- Enhances Endeavour’s Attractive Growth Pipeline

- Pitarrilla, together with Endeavour’s Terronera and Parral projects, form the key cornerstones of Endeavour’s mid to long-term growth profile.

- Over the next several years, analyze the economics of various scales of production, including underground option, and then advance towards potential development and production to strengthen Endeavour’s long-term production and free cash flow profile.

- Currently categorized as a development asset, Pitarrilla has been de-risked by SSR Mining as follows:

- several key exploration and mining permits have been obtained; and

- collaboration agreements are in place with the local community.

- Potential Exploration Upside as Land Package Remains Largely Underexplored

- Deposit remains open with minimal drilling completed to explore the deposit at depth.

- Significant underexplored land package with an opportunity to make new discoveries.

- The geology at Pitarrilla and at Endeavour’s underground mines – Guanacevi and Bolanitos – is broadly similar.

- Upside potential from upper oxide resource as well as open-pit and underground optionality.

Approvals and Timing

The Transaction has been approved by the board of directors of Endeavour.

Closing of the Transaction remains subject to TSX and NYSE regulatory approvals and receipt of Mexican Federal Economic Competition Commission approval, as well as customary closing conditions for a transaction of this kind, which is expected to occur in the first half of 2022.

On closing, Endeavour plans to prepare a current mineral resource estimate for Pitarrilla, develop exploration targets and analyze the economics of various scales of production.

Advisors and Counsel

PI Financial acted as Endeavour’s financial advisor. Koffman Kalef LLP acted as the Company’s legal counsel.

Conference Call and Webcast

Management will host a live conference call and audio webcast later today to discuss the highlights of the Transaction as follows:

| Date & Time: |

Thursday, January 13, 2022 at 1:00 p.m. PT / 4:00 p.m. ET |

| |

|

| Telephone: |

Toll-free in Canada and the US +1-800-319-4610 |

| |

Local or International +1-604-638-5340 |

| |

Please allow 10 minutes to be connected to the conference call. |

| |

|

| Webcast: |

Pitarrilla Acquisition Webcast |

| |

|

| Replay: |

A replay of the conference call will be available by dialing +1-800-319-6413 in Canada and the US (toll-free) or +1-604-638-9010 outside of Canada and the US. The required passcode is 8339#. The replay will also be available on the Company’s website at www.edrsilver.com . |

| |

|

| Note: |

A slide presentation will be available for download at www.edrsilver.com in advance of the call. |

Endeavour Qualified Person and QA/QC

The scientific and technical data contained in this news release relating to the Pitarrilla project has been reviewed and approved by Dale Mah, P.Geo., a qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Mah is Vice President Corporate Development of Endeavour.

About Endeavour Silver

Endeavour Silver is a mid-tier precious metals mining company that operates two high-grade, underground silver-gold mines in Mexico. Endeavour is currently advancing the Terronera mine project towards a development decision, pending financing and final permits and exploring its portfolio of exploration and development projects in Mexico, Chile and the United States to facilitate its goal to become a premier senior silver producer. The Company’s philosophy of corporate social integrity creates value for all stakeholders.

SOURCE Endeavour Silver Corp.

Contact Information

Trish Moran

Interim Head of Investor Relations

Tel: (416) 564-4290

Email: pmoran@edrsilver.com

Website: www.edrsilver.com

Follow Endeavour Silver on Facebook , Twitter , Instagram and LinkedIn

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the United States private securities litigation reform act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Such forward-looking statements and information herein include but are not limited to statements regarding the timing and completion of the Transaction, estimates of mineral resources including the Historical Estimate, future plans and objectives of the Company, proposed operations of the Company at Pitarrilla including mine development and future events and conditions that are not historical facts. The Company does not intend to and does not assume any obligation to update such forward-looking statements or information, other than as required by applicable law.

Forward-looking statements are based on assumptions management believes to be reasonable including, but not limited to, the ability to obtain regulatory approvals required for completion of the Transaction, the reliability of mineral resource estimate, the continuation of exploration and mining operations, no material adverse change in the market price of commodities, mining operations and production will be completed in accordance with management’s expectations and achieve their stated production outcomes, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or information, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended. There can be no assurance that any forward-looking statements or information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

Forward-looking statements or information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements to be materially different from those expressed or implied by such statements. Such factors include but are not limited to the inability or failure of the Company or SSR Mining to satisfy the conditions for closing the Transaction including regulatory approvals; the availability of funds; the financial position of the Company, timing and content of work programs; results of exploration activities and development of mineral properties; the calculation of mineral resources including the Historical Estimate; the receipt and security of mineral property titles; project cost overruns or unanticipated costs and expenses; currency fluctuations; the ultimate impact of the COVID 19 pandemic on operations and results; national and local governments’ legislation, taxation, controls, regulations and political or economic developments in Canada and Mexico; financial risks due to precious metals prices; operating or technical difficulties in mineral exploration, development and mining activities; risks and hazards of mineral exploration, development and mining; the speculative nature of mineral exploration and development and risks in obtaining necessary licenses and permits.

Although the forward-looking statements contained herein reflect management’s current beliefs and reasonable assumptions based upon information available to management as of the date hereof, Endeavour cannot be certain that actual results will be consistent with such forward-looking information. As a result, the Company cannot guarantee that the Transaction will be completed on the terms and within the time disclosed herein or at all.

_______________________________________________

1 One of the world’s largest undeveloped silver deposits is based on publicly filed data available on SNL Metals and Mining and company disclosure as at December 31, 2021 and includes the following projects: Navidad project (Argentina), Cordero (Mexico) and Escobal (Guatemala). Other companies may calculate their respective resource base differently.

2 For more information on the Historical Estimate and related notes, please refer to the 2012 Technical Report and the SSR Mining 2020 AIF, which are available at www.ssrmining.com and on SEDAR at www.sedar.com. The economic analysis presented in the 2012 Technical Report is not considered current, is not being relied upon by Endeavour and should not be considered as representing the expected economic outcome under Endeavour’s ownership. A qualified person has not done sufficient work to classify the Historical Estimate as current mineral resources or mineral reserves. The Company is not treating this information as current mineral resources or reserves, has not verified this information and is not relying on it. Following closing of the Transaction, Endeavour plans to prepare a current mineral resource estimate for Pitarrilla, develop exploration targets and analyze the economics of various scales of production.

3 For more information on the Historical Estimate and related notes, please refer to the 2012 Technical Report and SSR Mining’s 2020 AIF, which are available at www.ssrmining.com and on SEDAR at www.sedar.com. The economic analysis presented in the 2012 Technical Report is not considered current and is not being relied upon by Endeavour and should not be considered as representing the expected economic outcome under Endeavour’s ownership. A qualified person has not done sufficient work to classify the Historical Estimate as current mineral resources or mineral reserves. The Company is not treating this information as current mineral resources or reserves, has not verified this information and is not relying on it. Following closing of the Transaction, Endeavour plans to prepare a current mineral resource estimate for Pitarrilla, develop exploration targets and analyze the economics of various scales of production.

4 For more information regarding Endeavour’s mineral reserve and mineral resource estimates and related notes, please refer to the Company’s annual information form for the year ended December 31, 2020 dated February 25, 2021 available on the Company’s website at www.edrsilver.com and SEDAR at www.sedar.com.

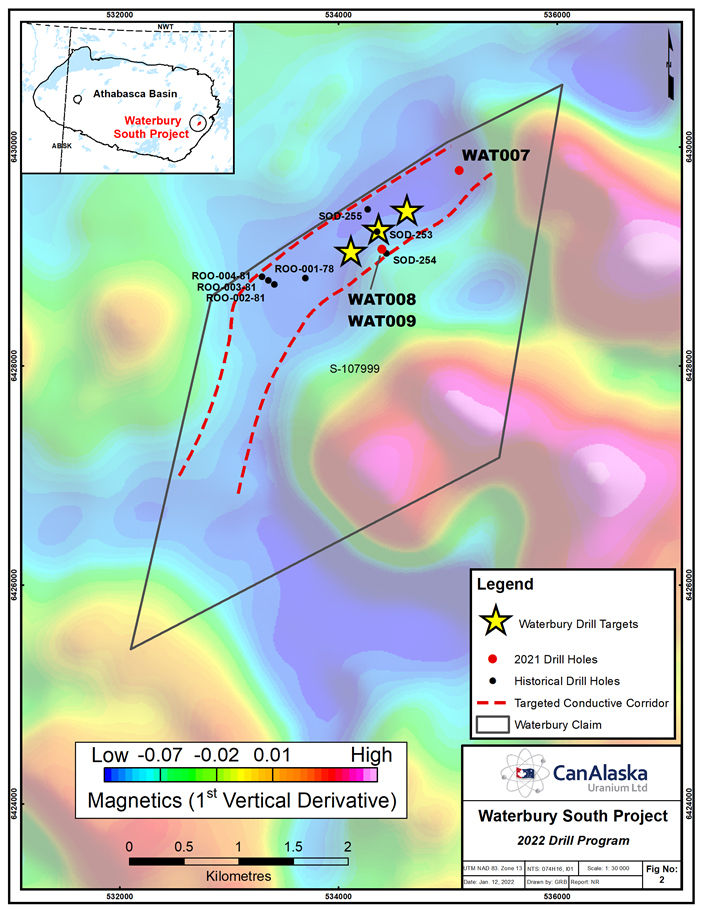

WAT-008 intersected a pyrite-rich zone associated with a fault in the mid-sandstone column well above the unconformity, followed by a thick graphitic unit in the basement which was the target for WAT-009.

WAT-008 intersected a pyrite-rich zone associated with a fault in the mid-sandstone column well above the unconformity, followed by a thick graphitic unit in the basement which was the target for WAT-009.