Chakana Intersects 10m with 15.48 g/t Gold, 1.27% Copper and 82.4 g/t Silver (18.50 G/t Au-eq or 12.09% Cu-eq) within 237m of 1.74 g/t Gold, 0.59% Copper and 25.2 g/t Silver in Breccia Pipe 5 from Surface at Soledad, Peru

Soledad

Project Highlights Include:

- Reporting 12 remaining resource definition

holes totalling 2,541m at Breccia Pipe 5 (Bx 5), all with significant intercepts.

- Additional resource definition drill

results pending for Huancarama.

- Off-set IP surveys continue over all high

priority targets defined to date.

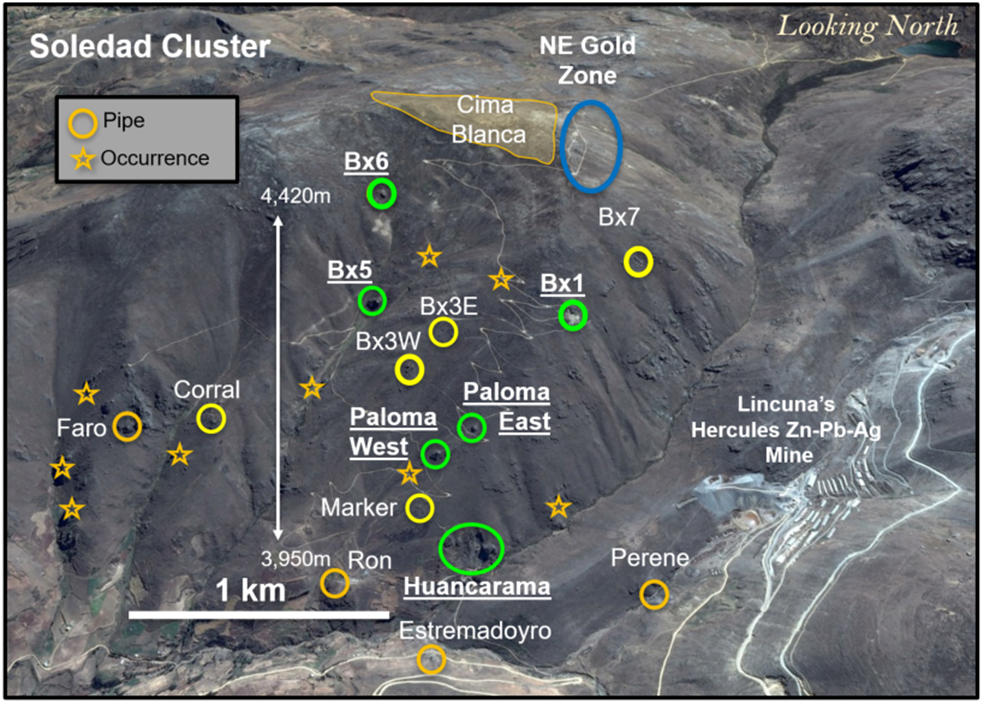

Vancouver, B.C., November 18, 2021 – Chakana Copper Corp. (TSX-V: PERU;

OTCQB: CHKKF; FRA: 1ZX) (the “Company” or

“Chakana”), is pleased to provide results from the remaining twelve resource definition holes drilled in Bx 5 totaling 2,541m at the Soledad project, Ancash, Peru (see table below). This resource drilling is part of the fully funded 26,000m exploration and resource drilling program planned for 2021 (Fig. 1). These results will further increase confidence in the initial resource estimate, anticipated to be completed by the end of 2021.

“The

final resource definition drill results released today for Bx 5 are an

outstanding culmination of the drilling on this breccia pipe. In addition to

the very strong mineralization that starts at surface, we now have

mineralization confirmed to a depth of 485m at Bx 5 where the breccia pipe and

mineralization are open at depth. Bx 5 is known to have very consistent and

continuous mineralization with zones of very high grades surrounded by long

runs of strong copper, gold, and silver grades. The breccia pipe plunges

slightly to the east from surface to 200m depth, then plunges gently north in

the direction of Bx 6. The area between Bx 5 and Bx 6 is highly prospective for

the discovery of additional breccia-hosted mineralization. With this release,

all resource definition drill results for Bx 5 have been published. We have

pending resource definition drill results for Huancarama to publish leading up

to the first ever National Instrument 43-101 compliant resource estimate for

the Soledad project,” stated President and CEO David Kelley.

Drill Results

Bx 5 (Resource Definition)

DDH #

|

From – To (m)

|

Core Length (m)

|

Au

g/t

|

Ag

g/t

|

Cu

%

|

Cu-eq

%*

|

Au-eq g/t*

|

|

SDH21-244

|

0.00

|

155.00

|

155.00

|

1.41

|

26.2

|

0.30

|

1.45

|

2.21

|

|

SDH21-252

|

0.00

|

97.00

|

97.00

|

0.77

|

24.9

|

0.18

|

0.90

|

1.37

|

|

SDH21-253

|

0.00

|

106.00

|

106.00

|

1.24

|

31.5

|

0.32

|

1.40

|

2.14

|

|

SDH21-255

|

0.00

|

123.00

|

123.00

|

1.23

|

29.3

|

0.36

|

1.41

|

2.16

|

|

and

|

132.00

|

141.00

|

9.00

|

1.28

|

24.6

|

0.36

|

1.41

|

2.15

|

|

and

|

158.00

|

194.00

|

36.00

|

0.63

|

14.6

|

0.56

|

1.10

|

1.68

|

|

SDH21-256

|

0.00

|

237.00

|

237.00#

|

1.74

|

25.2

|

0.59

|

1.94

|

2.97

|

|

including

|

0.00

|

105.00

|

105.00

|

1.15

|

26.0

|

0.27

|

1.24

|

1.90

|

|

including

|

105.00

|

115.00

|

10.00

|

15.48

|

82.4

|

1.27

|

12.09

|

18.50

|

|

including

|

115.00

|

237.00

|

122.00

|

1.12

|

19.8

|

0.81

|

1.71

|

2.62

|

|

SDH21-258

|

0.00

|

92.00

|

92.00

|

1.32

|

40.0

|

0.37

|

1.57

|

2.41

|

|

SDH21-260

|

0.00

|

147.00

|

147.00

|

1.36

|

24.8

|

0.30

|

1.40

|

2.14

|

|

SDH21-261

|

0.00

|

92.00

|

92.00

|

1.42

|

43.1

|

0.34

|

1.64

|

2.50

|

|

SDH21-262

|

0.00

|

160.00

|

160.00

|

1.80

|

24.5

|

0.32

|

1.71

|

2.61

|

|

SDH21-264

|

0.00

|

121.80

|

121.80

|

1.34

|

33.3

|

0.30

|

1.46

|

2.23

|

|

SDH21-270

|

339.80

|

343.00

|

3.20

|

7.82

|

60.2

|

0.97

|

6.60

|

10.09

|

|

and

|

390.20

|

414.00

|

23.80

|

0.16

|

6.3

|

0.71

|

0.87

|

1.33

|

|

SDH21-272

|

313.00

|

417.00

|

104.00

|

0.48

|

10.1

|

1.38

|

1.78

|

2.72

|

|

and

|

432.00

|

438.00

|

6.00

|

0.21

|

2.2

|

1.06

|

1.22

|

1.86

|

|

and

|

447.00

|

485.65

|

38.65

|

0.26

|

8.1

|

1.12

|

1.36

|

2.08

|

* Cu_eq and Au_eq values were calculated using copper, gold, and silver. Metal prices utilized for the calculations are Cu – US$2.90/lb, Au – US$1,300/oz, and Ag – US$17/oz. No adjustments were made for recovery as the project is an early-stage exploration project and metallurgical data to allow for estimation of recoveries are not yet available. The formulas utilized to calculate equivalent values are Cu-eq (%) = Cu% + (Au g/t * 0.6556) + (Ag g/t * 0.00857) and Au-eq (g/t) = Au g/t + (Cu% * 1.5296) + (Ag g/t * 0.01307). # SDH21-256 is mineralized from surface to 237m; for greater clarity the analytical results are also reported in three separate intervals so as to identify a high-grade interval from 105 to 115m.

Bx 5

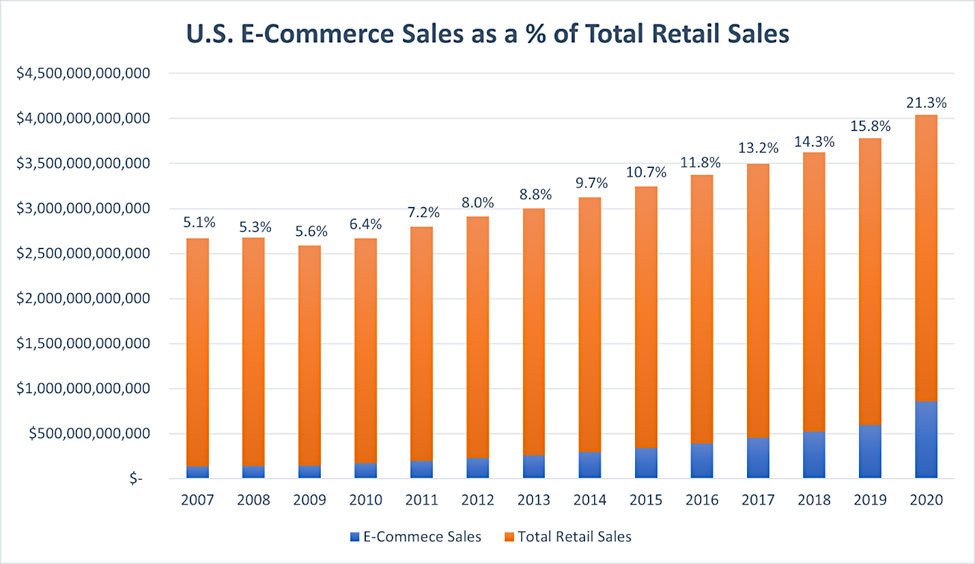

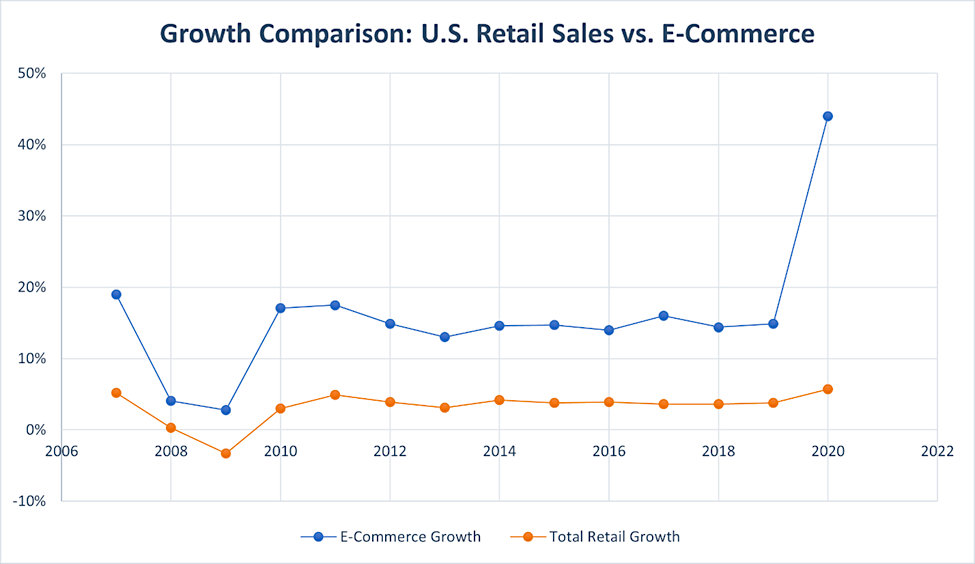

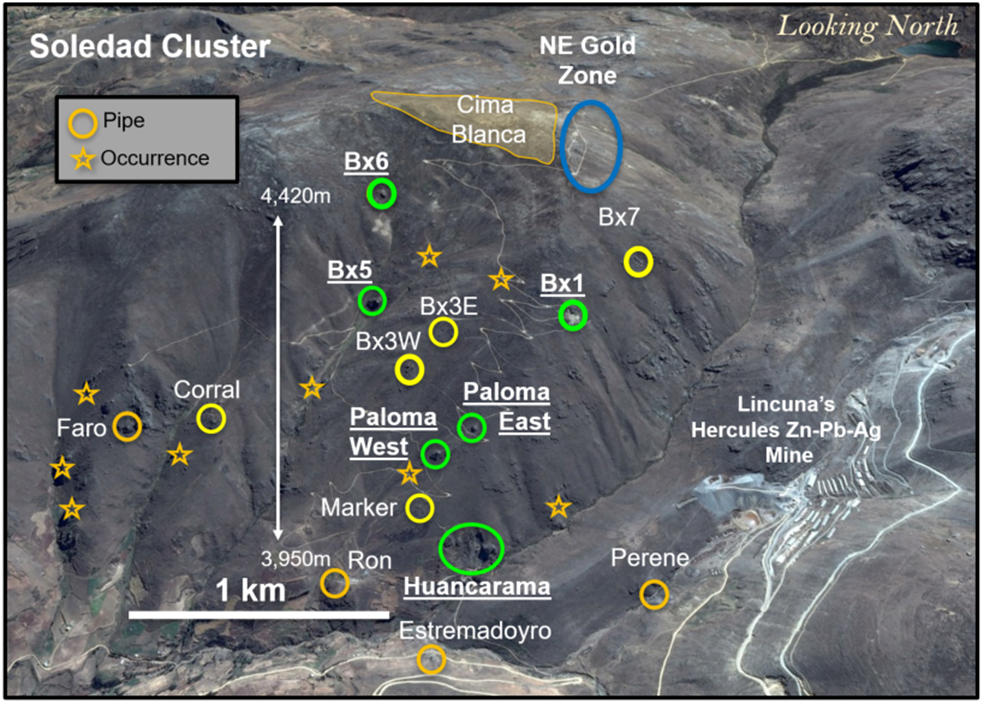

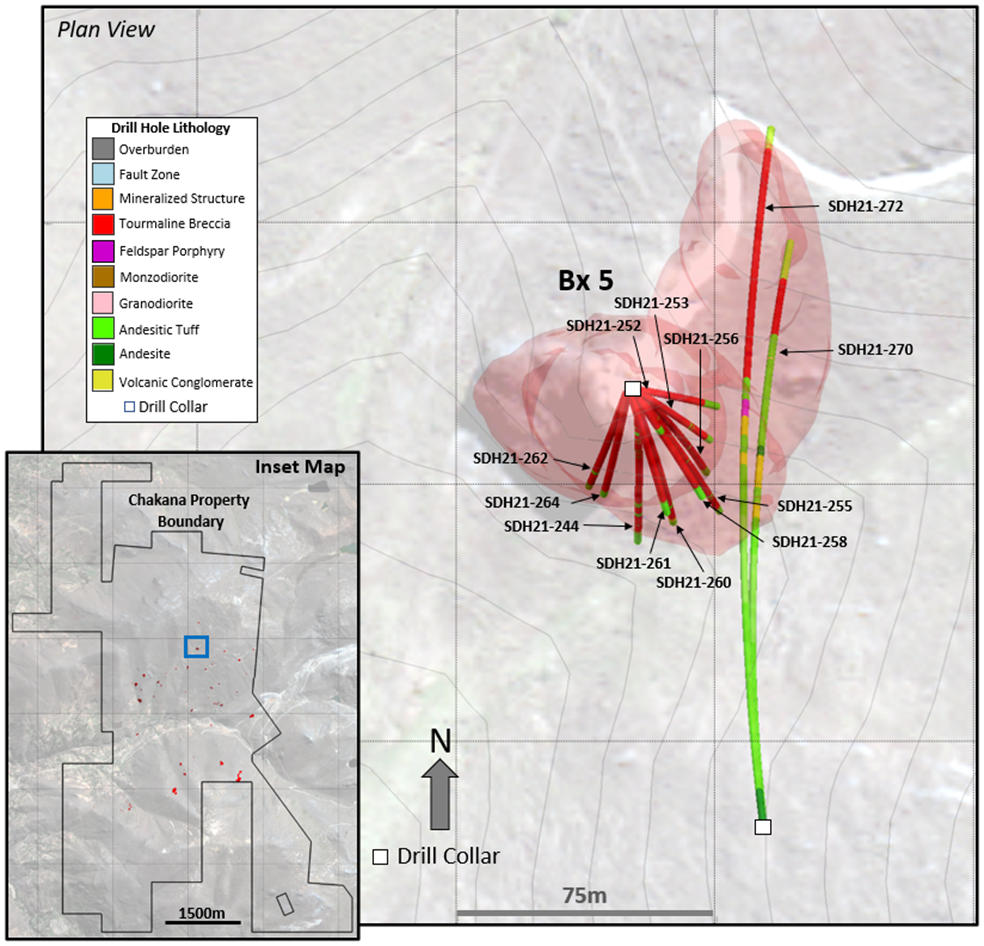

The Bx 5 breccia pipe is in the north-central part of the project and is one of six breccia pipes that will be included in our initial resource estimate (Fig. 1). The breccia pipe forms a prominent monument outcrop and extends to depths greater than 485m where mineralization remains open. Drill holes described in this release were designed to confirm shallow mineralization in the top southeastern quadrant of the breccia pipe, as well as deeper extents of mineralization probed by two holes drilled to the north from a platform located 100m south of the breccia pipe (Figs. 2 and 3). All holes intersected significant mineralization (see Figure 4 for select core photos of the mineralization).

2021 Resource and

Exploration Drill Program

A total of 23,947m of drilling has been completed in 2021. The objectives of this drill program are to complete resource definition drilling on six initial breccia pipes to an approximate depth of 300m and test several new exploration targets. Breccia pipes that will be included in the initial resource estimate are: Bx1, Bx 5, Bx6, Paloma East, Paloma West, and Huancarama (Fig. 1). Additional resource definition drill results for Huancarama are pending. During 2021 our drilling was focused on the north half of the project where drill permits are in place. Permitting for the south half of the project is well advanced. The southern half of the property hosts several outcropping mineralized tourmaline breccia pipes and has been recently covered by the Company’s ongoing geophysical program. Numerous targets exist, none of which have been drilled previously.

Geophysical Surveys

Gradient-array induced-polarization (IP) surveys have been completed over the entire 12km2 footprint of the Soledad mineral system. Off-set IP surveys are now in-progress covering high priority target areas. This work complements the extensive exploration database that supports our current inventory of 110 exploration targets. This new information identifies both new targets and prioritizes existing targets that will be tested when the exploration drilling programs resume.

About Chakana Copper

Chakana Copper Corp is a Canadian-based minerals exploration company that is currently advancing the Soledad Project located in the Ancash region of Peru, a highly favorable mining jurisdiction with supportive communities. The Soledad Project is notable for the high-grade copper-gold-silver mineralization that is hosted in tourmaline breccia pipes. A total of 60,854 metres in 261 diamond core holes for exploration and resource definition drilling have been completed since 2017, testing 16 of 110 total exploration targets, confirming that Soledad is a large, well-endowed mineral system with strong exploration upside. Chakana’s investors are uniquely positioned as the Soledad Project provides exposure to base and precious metals. For more information on the Soledad project, please visit the website at www.chakanacopper.com.

Sampling and Analytical Procedures

Chakana follows rigorous sampling and analytical protocols that meet or exceed industry standards. Core samples are stored in a secured area until transport in batches to the ALS facility in Callao, Lima, Peru. Sample batches include certified reference materials, blank, and duplicate samples that are then processed under the control of ALS. All samples are analyzed using the ME-MS41 (ICP technique that provides a comprehensive multi-element overview of the rock geochemistry), while gold is analyzed by AA24 and GRA22 when values exceed 10 g/t by AA24. Over limit silver, copper, lead and zinc are analyzed using the OG-46 procedure. Soil samples are analyzed by 4-acid (ME-MS61) and for gold by Fire Assay on a 30g sample (Au-ICP21).

Results of previous drilling and additional information concerning the Project, including a technical report prepared in accordance with National Instrument 43-101, are made available on Chakana’s SEDAR profile at www.sedar.com.

Qualified

Person

David Kelley, an officer and a director of Chakana, and a Qualified Person as defined by NI 43-101, reviewed and approved the technical information in this news release.

ON BEHALF OF THE BOARD

(signed) “David Kelley”

David Kelley

President and CEO

For further information contact:

Joanne Jobin, Investor Relations Officer

Phone: 647 964 0292

Email: jjobin@chakanacopper.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as

that term is defined in the policies of the Exchange) accepts responsibility

for the adequacy or accuracy of this release.

Forward-looking Statement Advisory: This release may contain forward-looking

statements. Forward-looking statements involve known and unknown risks,

uncertainties, and other factors which may cause the actual results,

performance, or achievements of Chakana to be materially different from any

future results, performance, or achievements expressed or implied by the

forward-looking statements. Forward looking statements or information relates

to, among other things, the interpretation of the nature of the mineralization

at the Soledad copper-gold-silver project

(the “Project”), the potential to expand the mineralization, and

to develop and grow a resource within the Project, the

planning for further exploration work, the ability to de-risk the potential

exploration targets, and our belief in the potential

for mineralization within unexplored parts of the Project. These

forward-looking statements are based on management’s current expectations and

beliefs but given the uncertainties, assumptions and risks, readers are

cautioned not to place undue reliance on such forward- looking statements or

information. The Company disclaims any obligation to update, or to publicly

announce, any such statements, events or developments except as required by

law.

Figure 1 – View looking north showing outcropping breccia pipes and occurrences within the northern Soledad cluster. Pipes that will be included in the initial resource are shown in green (Bx 1, Bx 5, Bx 6, Paloma East, Paloma West, and Huancarama). Breccia pipes shown in yellow have had exploration drilling completed. Other pipes/occurrences and targets defined by other exploration data remain to be tested by drilling. Additional breccia pipes occur on the south half of the property and are not shown here.

Figure 2 – Map showing drill holes reported in this release and modeled breccia pipe (light red shape) based on all drill holes. Light gray contours are at 10m intervals. Blue rectangle in the inset map shows the area of Figure 2 within the overall Chakana property.

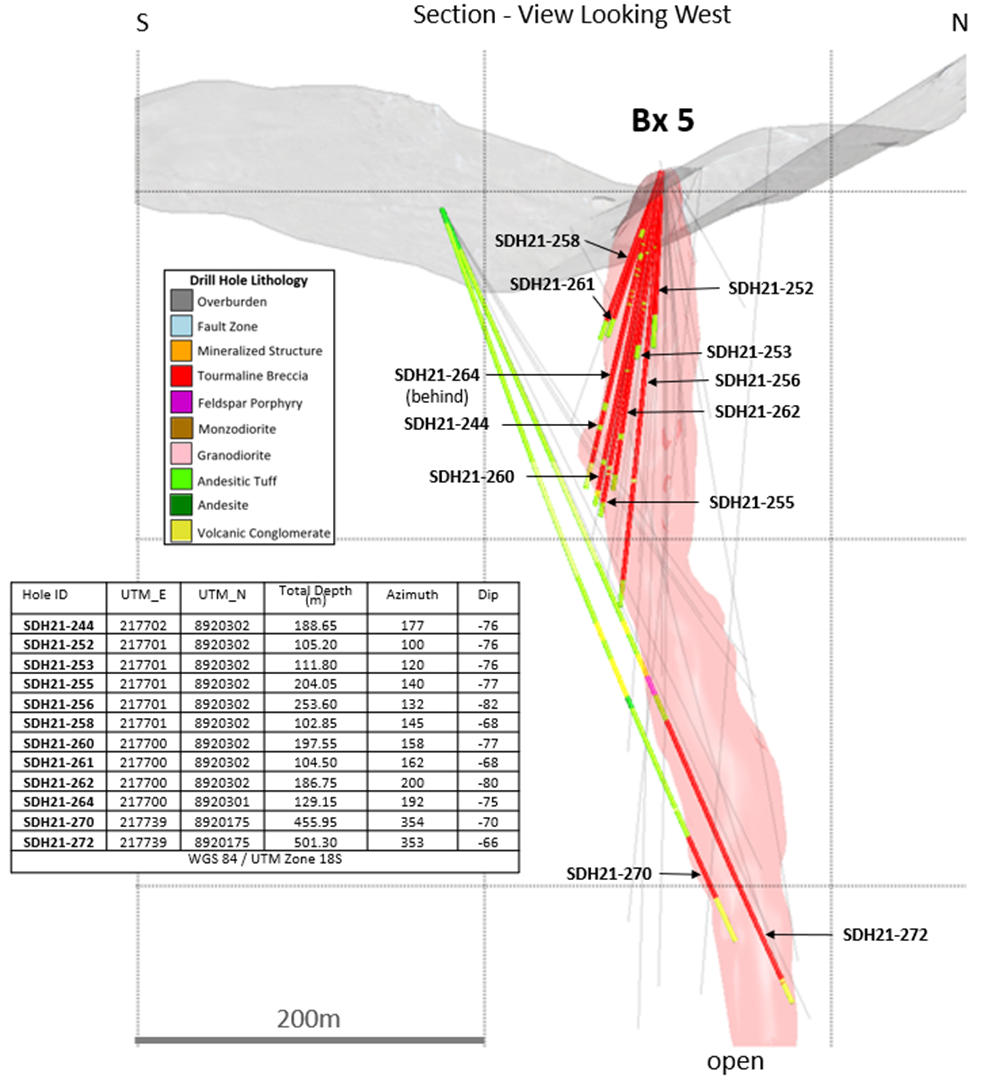

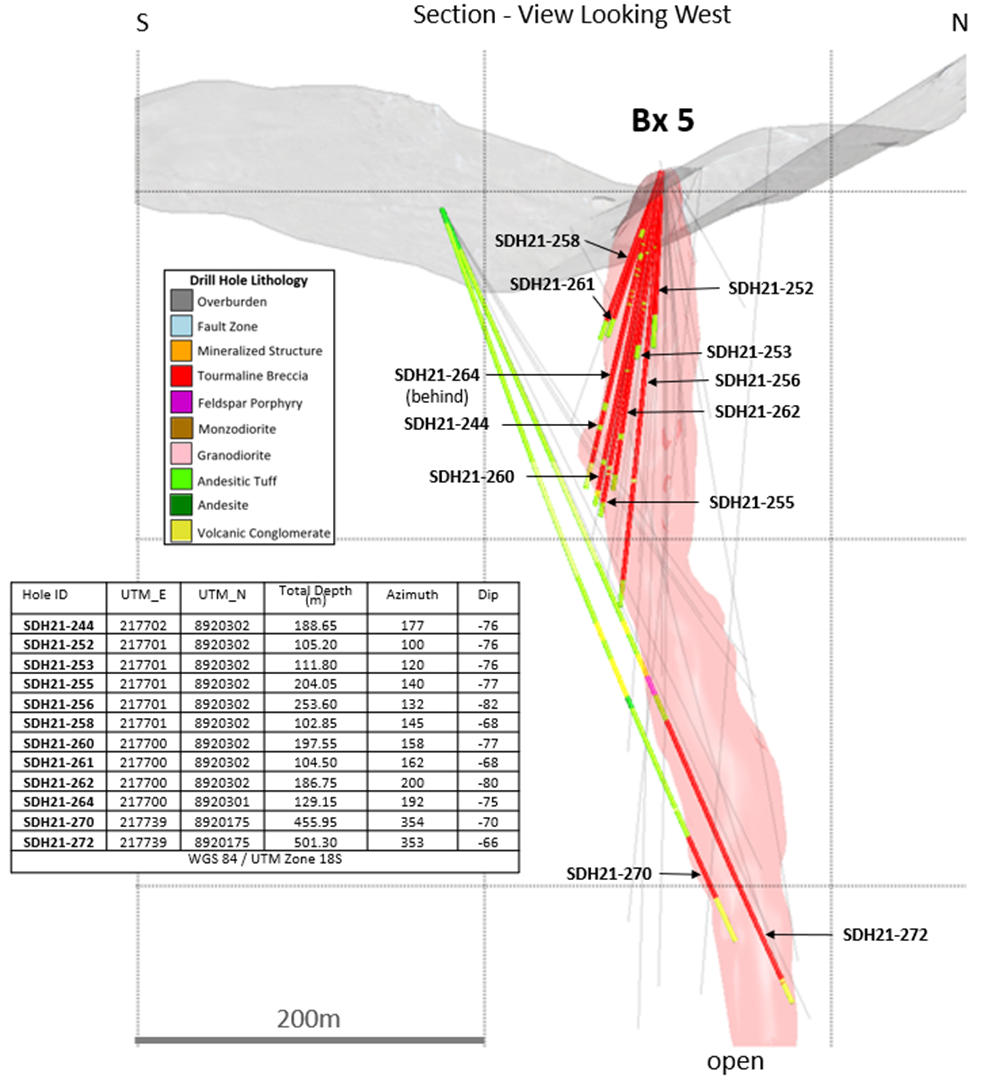

Figure 3 – 3D sectional view of Bx 5 looking west. Light red 3D shape shows breccia pipe geometry based on all drill holes. Previous holes drilled shown in grey traces.

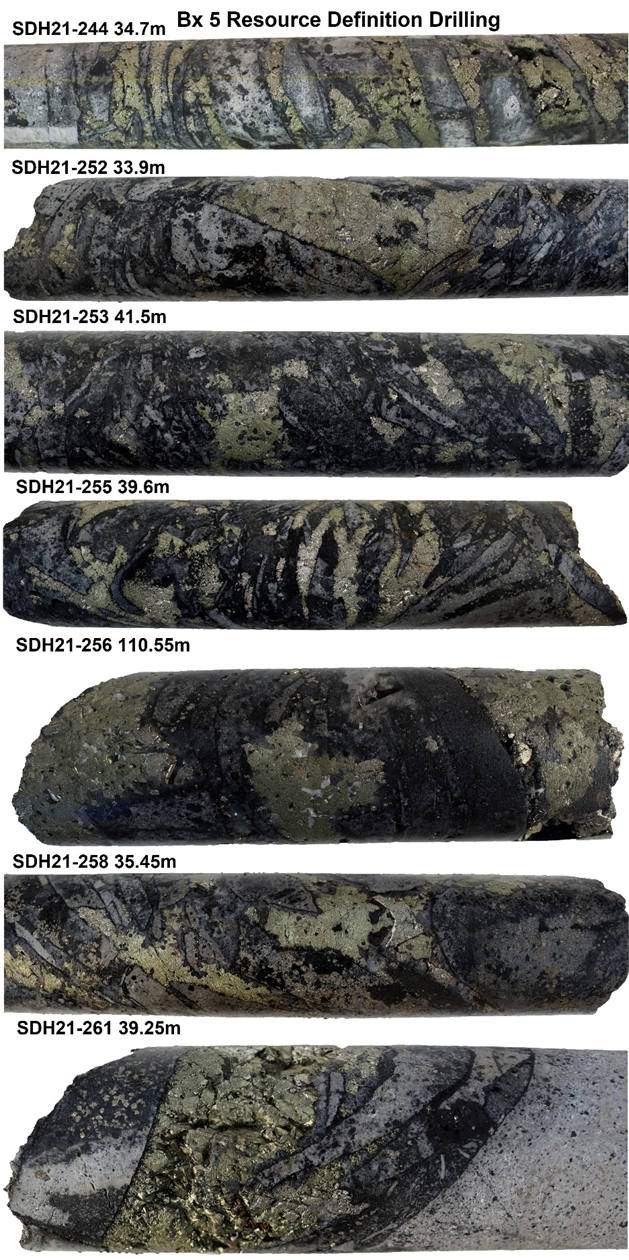

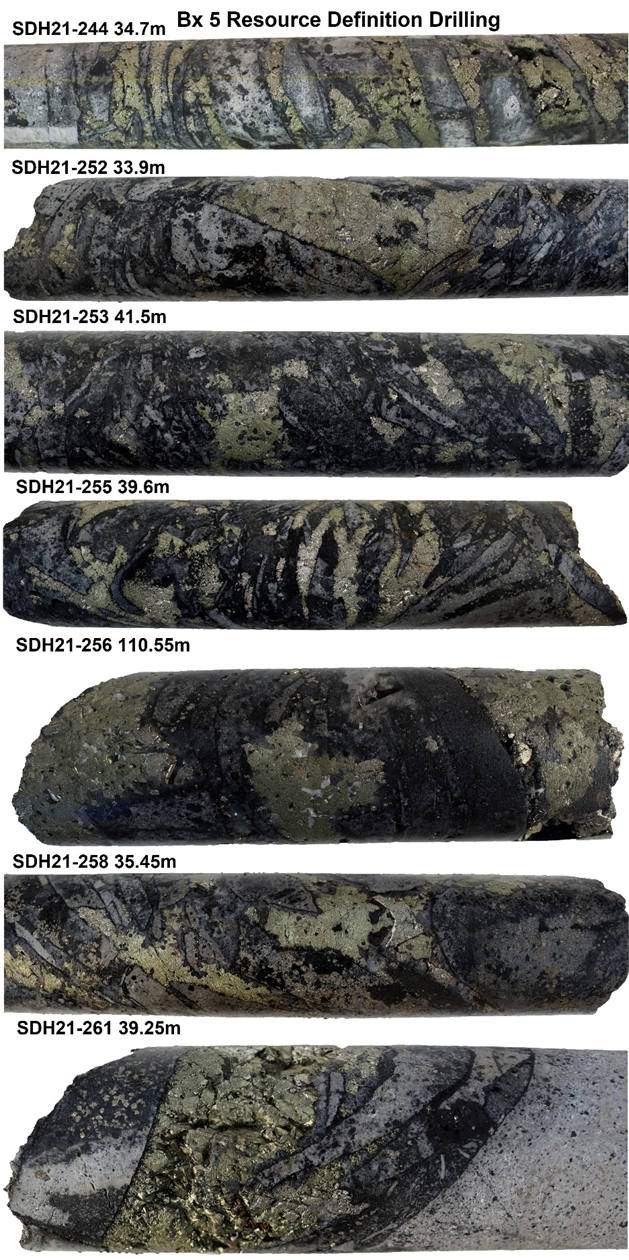

Figure 4 – Select core photos from Bx 5 reported in this release: SDH21-244 (34.7m) shingle breccia cemented with chalcopyrite-pyrite; SDH21-252 (33.9m) chaotic shingle breccia with chalcopyrite-pyrite in matrix; SDH21-253 (41.5m) chaotic shingle breccia with chalcopyrite-pyrite in matrix; SDH21-255 (39.6m) shingle breccia cemented with chalcopyrite-pyrite; SDH21-256 (110.55m) chaotic shingle breccia with semi-massive chalcopyrite-pyrite; SDH21-258 (35.45m) shingle breccia cemented with chalcopyrite-pyrite; SDH21-261 (39.25m) chaotic shingle breccia with semi-massive chalcopyrite-pyrite. Core diameter is 6.35cm (HQ) in all instances.

Chart:

Chart: Chart:

Chart: