Aurania Intersects Silver-Zinc Mineralization in Hole 3 at Tiria-Shimpia

Toronto, Ontario, September 27, 2021 – Aurania Resources Ltd. (TSXV: ARU) (OTCQB: AUIAF) (Frankfurt: 20Q) (“Aurania” or the “Company”) reports that the third hole drilled on the 22 kilometre-long Tiria-Shimpia silver-zinc target, intersected the extension of the mineralized layer that was seen at surface. Hole SH-003 intersected 5 metres (“m”) at a grade of 10.5 grams per tonne (“g/t”) silver and 2.5% zinc within a 31.5m thick halo of mineralization in layered sedimentary rock in the central part of the Company’s Lost Cities – Cutucu Project area (“Project”) in southeastern Ecuador.

Aurania’s Chairman & CEO, Dr. Keith Barron commented, “We’ve finally hit significant mineralization in drill hole 3 at our Tiria-Shimpia target in the Lost Cities Project. We have intersected the extension of mineralization exposed at surface as planned, and now we need to home in on the higher-grade parts of the system within the 22km long trend defined by metal enrichment in soil.”

Details of the Mineralization Intersected in Hole SH-003

Drill hole 3 at Tiria-Shimpia was planned to intersect a layer of fracture-controlled mineralization that geological mapping at surface showed to be 20m wide and over 800m long – layer “P” in the Press Release dated April 12, 2021. The top of the targeted layer of crackle-brecciated limestone was intersected at a depth of 35m down-hole, and mineralization occurs over 29m at a grade of 3.5g/t silver and 0.6% zinc, that contains the higher-grade interval of 5m at 10.5g/t silver and 2.5% zinc.

The crackle-brecciated limestone is sandwiched between layers of sandstone. Pathfinder elements such as naturally-occurring arsenic, cadmium, mercury and strontium are closely related with the silver-zinc. The whole limestone-sandstone sequence in which the mineralization occurs, shows illite clay alteration.

The sandstone is likely to have provided the permeable layers along which the mineralizing fluids flowed – providing the access required for the fluids to react with the limestone and deposit the metals. The presence of the alteration mineral illite, indicates that the mineral-bearing fluids had a temperature of 200° to 300°C.

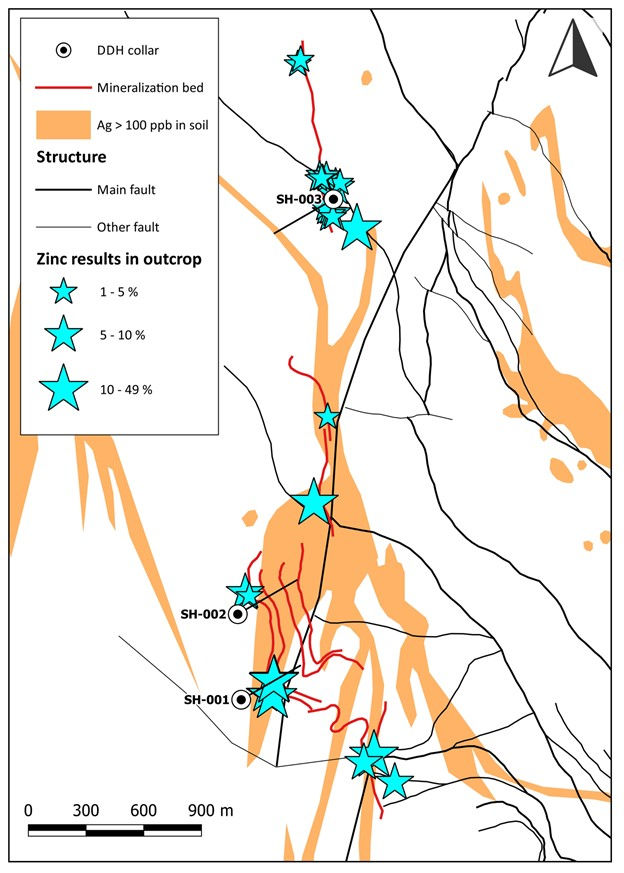

Hole 3 was drilled approximately 2km to the north of where holes SH-001 and SH-002 were drilled (Figure 1). A total of 1,018 metres has been drilled in the three holes completed at Tiria-Shimpia.

The field team undertaking the silver-zinc exploration is comparing geological information observed in the drill core with their mapping at surface to determine the geometry of the system. Soil geochemistry and MobileMT data are being incorporated into this focus on refining the target for higher-grade mineralization. Additional drill sites will be selected from this on-going work.

Update on Scout Drilling at Tsenken N1

Drilling at hole 7 (TSN1-007) at the Company’s Tsenken N1 sediment-hosted copper-silver target has been completed and results are awaited. Drilling at hole 8 has been started.

Figure 1. Map of the north-central part of Tiria-Shimpia showing zinc grades in outcrop relative to silver in soil, and the positions of drill holes SH-001 to SH-003.

Sample Analysis & Quality Assurance / Quality Control (“QAQC”)

Laboratories: The samples were prepared for analysis at MS Analytical (“MSA”) in Cuenca, Ecuador, and the analyses were done in Vancouver, Canada.

Sample preparation: The rock samples were jaw-crushed to 10 mesh (crushed material passes through a mesh with apertures of 2 millimetres (“mm”)), from which a one-kilogram sub-sample was taken. The sub-sample was crushed to a grain size of 0.075mm and a 200 gram (“g”) split was set aside for analysis.

Analytical procedure: Approximately 0.25g of rock pulp underwent four-acid digestion and analysis for 48 elements by ICP-MS. For the over-limit samples, those that had a grade of greater than 1% copper, zinc and lead, and 100g/t silver, 0.4 grams of pulp underwent digestion in four acids and the resulting liquid was diluted and analyzed by ICP-MS.

QAQC: Aurania personnel inserted a certified standard pulp sample, alternating with a field blank, at approximate 20 sample intervals in all sample batches. Aurania’s analysis of results from its independent QAQC samples showed the batches reported on above, lie within acceptable limits. In addition, the labs reported that the analyses had passed their internal QAQC tests.

Qualified Person

The geological information contained in this news release has been verified and approved by Jean-Paul Pallier, MSc. Mr. Pallier is a designated EurGeol by the European Federation of Geologists and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

About Aurania

Aurania is a mineral exploration company engaged in the identification, evaluation, acquisition and exploration of mineral property interests, with a focus on precious metals and copper in South America. Its flagship asset, The Lost Cities – Cutucu Project, is located in the Jurassic Metallogenic Belt in the eastern foothills of the Andes mountain range of southeastern Ecuador.

Information on Aurania and technical reports are available at www.aurania.com and www.sedar.com, as well as on Facebook at https://www.facebook.com/auranialtd/, Twitter at https://twitter.com/auranialtd, and LinkedIn at https://www.linkedin.com/company/aurania-resources-ltd-.

For further information, please contact:

| Carolyn Muir

VP Investor Relations Aurania Resources Ltd. (416) 367-3200 |

Dr. Richard Spencer

President Aurania Resources Ltd. (416) 367-3200 |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain forward-looking information that involves substantial known and unknown risks and uncertainties, most of which are beyond the control of Aurania. Forward-looking statements include estimates and statements that describe Aurania’s future plans, objectives or goals, including words to the effect that Aurania or its management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to Aurania, Aurania provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to Aurania’s objectives, goals or future plans, statements, exploration results, potential mineralization, the corporation’s portfolio, treasury, management team and enhanced capital markets profile, the estimation of mineral resources, exploration, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, regulatory, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, the effects of COVID-19 on the business of the Company including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restrictions on labour and international travel and supply chains, and those risks set out in Aurania’s public documents filed on SEDAR. Although Aurania believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Aurania disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.