New Gene Therapies May Soon Treat Dozens of Rare Diseases, but Million-Dollar Price Tags Will Put them out of Reach for Many

Zolgensma – which treats spinal muscular atrophy, a rare genetic disease that damages nerve cells, leading to muscle decay – is currently the most expensive drug in the world. A one-time treatment of the life-saving drug for a young child costs US$2.1 million.

While Zolgensma’s exorbitant price is an outlier today, by the end of the decade there’ll be dozens of cell and gene therapies, costing hundreds of thousands to millions of dollars for a single dose. The Food and Drug Administration predicts that by 2025 it will be approving 10 to 20 cell and gene therapies every year.

| This article was republished with permission from The Conversation, a news site dedicated to sharing ideas from academic experts. It represents the research-based findings and thoughts of Kevin Doxzen, Hoffmann Postdoctoral Fellow, |

I’m a biotechnology and policy expert focused on improving access to cell and gene therapies. While these forthcoming treatments have the potential to save many lives and ease much suffering, health care systems around the world aren’t equipped to handle them. Creative new payment systems will be necessary to ensure everyone has equal access to these therapies.

The Rise of Gene Therapies

Currently, only 5% of the roughly 7,000 rare diseases have an FDA-approved drug, leaving thousands of conditions without a cure.

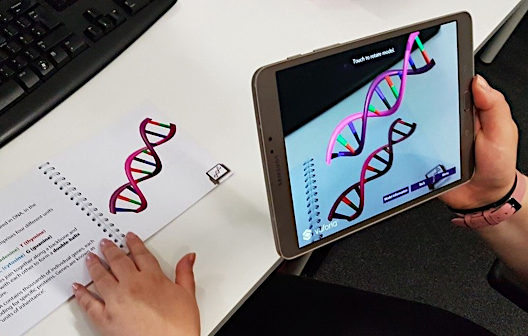

But over the past few years, genetic engineering technology has made impressive strides toward the ultimate goal of curing disease by changing a cell’s genetic instructions. The resulting gene therapies will be able to treat many diseases at the DNA level in a single dose.

Thousands of diseases are the result of DNA errors, which prevent cells from functioning normally. By directly correcting disease-causing mutations or altering a cell’s DNA to give the cell new tools to fight disease, gene therapy offers a powerful new approach to medicine.

There are 1,745 gene therapies in development around the world. A large fraction of this research focuses on rare genetic diseases, which affect 400 million people worldwide.

We may soon see cures for rare diseases like sickle cell disease, muscular dystrophy and progeria, a rare and progressive genetic disorder that causes children to age rapidly.

Further into the future, gene therapies may help treat more common conditions, like heart disease and chronic pain.

Sky-High Price Tags

The problem is these therapies will carry enormous price tags.

Gene therapies are the result of years of research and development totaling hundreds of millions to billions of dollars. Sophisticated manufacturing facilities, highly trained personnel and complex biological materials set gene therapies apart from other drugs.

Pharmaceutical companies say recouping costs, especially for drugs with small numbers of potential patients, means higher prices. The toll of high prices on health care systems will not be trivial. Consider a gene therapy cure for sickle cell disease, which is expected to be available in the next few years. The estimated price of this treatment is $1.85 million per patient. As a result, economists predict that it could cost a single state Medicare program almost $30 million per year, even assuming only 7% of the eligible population received the treatment.

And that’s just one drug. Introducing dozens of similar therapies into the market would strain health care systems and create difficult financial decisions for private insurers.

Lowering Costs, Finding New Ways to Pay

One solution for improving patient access to gene therapies would be to simply demand drugmakers charge less money, a tactic recently taken in Germany. But this comes with a lot of challenges and may mean that companies simply refuse to offer the treatment in certain places.

I think a more balanced and sustainable approach is two-fold. In the short term, it’ll be important to develop new payment methods that entice insurance companies to cover high-cost therapies and distribute risks across patients, insurance companies and drugmakers. In the long run, improved gene therapy technology will inevitably help lower costs.

For innovative payment models, one tested approach is tying coverage to patient health outcomes. Since these therapies are still experimental and relatively new, there isn’t much data to help insurers make the risky decision of whether to cover them. If an insurance company is paying $1 million for a therapy, it had better work.

In outcomes-based models, insurers will either pay for some of the therapy upfront and the rest only if the patient improves, or cover the entire cost upfront and receive a reimbursement if the patient doesn’t get better. These models help insurers share financial risk with the drug developers.

Another model is known as the “Netflix model” and would act as a subscription-based service. Under this model, a state Medicaid program would pay a pharmaceutical company a flat fee for access to unlimited treatments. This would allow a state to provide the treatment to residents who qualify, helping governments balance their budget books while giving drugmakers money upfront.

This model has worked well for improving access to hepatitis C drugs in Louisiana.

On the cost front, the key to improving access will be investing in new technologies that simplify medical procedures. For example, the costly sickle cell gene therapies currently in clinical trials require a series of expensive steps, including a stem cell transplant.

The Bill & Melinda Gates Foundation, the National Institute of Health and Novartis are partnering to develop an alternative approach that would involve a simple injection of gene therapy molecules. The goal of their collaboration is to help bring an affordable sickle cell treatment to patients in Africa and other low-resource settings.

Improving access to gene therapies requires collaboration and compromise across governments, nonprofits, pharmaceutical companies, and insurers. Taking proactive steps now to develop innovative payment models and invest in new technologies will help ensure that health care systems are ready to deliver on the promise of gene therapies.

Suggested Reading:

Genetics Now Touch All Areas of Life Sciences

|

Small Caps in the Covid 19 Treatment Space

|

Are Biotech Scientists on the Road to a Cure for Type One Diabetes?

|

Stem Cells Role in the Anti-Aging Process

|

Stay up to date. Follow us:

|