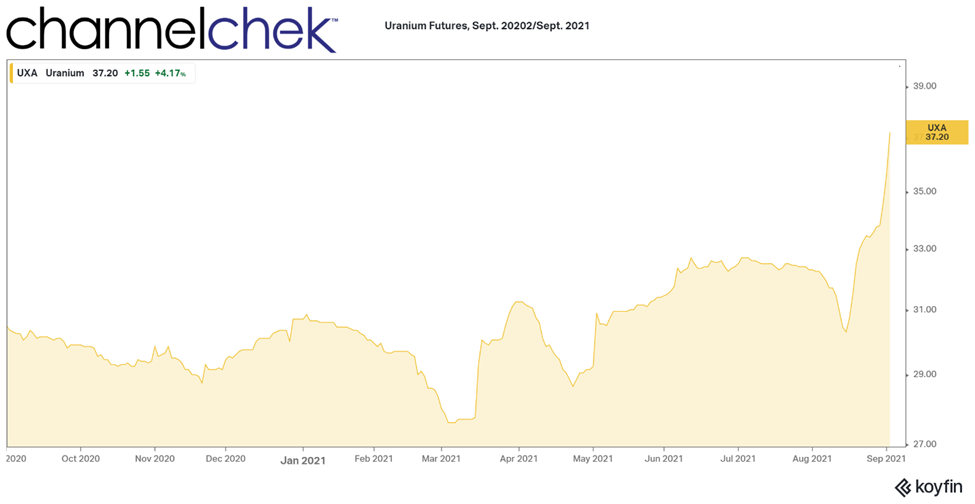

enCore Energy and Azarga Uranium To Combine To Create Leading American Uranium ISR Company

CORPUS CHRISTI, Texas, Sept. 7, 2021 /CNW/ – enCore Energy Corp. (“enCore“) (TSXV: EU) (OTCQB: ENCUF) and Azarga Uranium Corp. (“Azarga“) (TSX: AZZ) (OTCQB: AZZUF) (FRA: P8AA) are pleased to announce that they have entered into a definitive arrangement agreement (the “Agreement“) whereby enCore will acquire all of the issued and outstanding common shares of Azarga pursuant to a court-approved plan of arrangement (the “Transaction“). The Transaction consolidates an industry leading pipeline of exploration and development staged in-situ recovery (“ISR“) focused uranium projects located in the United States, including the licensed Rosita & Kingsville Dome past producing uranium production facilities in South Texas, the advanced stage Dewey Burdock development project in South Dakota, which has been issued its key federal permits, the PEA-staged Gas Hills Project located in Wyoming, and a portfolio of resource staged projects throughout the United States. The combined company will possess a uranium resource base of 90.0 million pounds in the measured & indicated category, 9.9 million pounds in the inferred category, as well as 68.4 million pounds in the historic category*.

Under the terms of the Agreement, Azarga shareholders will receive 0.375 common shares of enCore for each Azarga common share held (the “Exchange Ratio“). The Exchange Ratio implies consideration of $0.71 per Azarga common share based on the closing price of the enCore common shares on the TSX Venture Exchange on September 3rd, 2021.

Additionally, the Exchange Ratio will be subject to an adjustment mechanism at the closing of the Transaction (the “Closing Exchange Ratio“). The Closing Exchange Ratio shall be equal to the greater of: (i) the Exchange Ratio; or (ii) an exchange ratio calculated as $0.54 divided by enCore’s 15-day volume-weighted average price prior to the closing of the Transaction, subject to a maximum Closing Exchange Ratio of 0.49 common shares of enCore for each share of Azarga outstanding.

Transaction Highlights

- Creation of a top-tier American uranium ISR mining company with multiple assets at various stages of development;

- Two licensed ISR production facilities and multiple potential satellite exploration and development projects in South Texas;

- Advanced stage Dewey Burdock development project in South Dakota with key federal permits issued;

- Recently published preliminary economic assessment for the Gas Hills project in Wyoming;

- Large uranium resource endowment in New Mexico including the Marquez-Juan Tafoya project, for which a recent preliminary economic assessment was published and the Crownpoint and Hosta Butte project;

- Well positioned to benefit from America’s nuclear renaissance, which boasts bi-partisan political support; and

- Management team and board with unrivaled experience in the permitting, development, and mining of ISR uranium deposits in the USA.

Paul Goranson, CEO of enCore, commented: “enCore is delighted to combine our assets with those of Azarga. Dewey Burdock is an excellent ISR uranium project and we look forward to building upon Azarga’s successes to create additional value through development progress and eventually production. In addition to the execution of plans for near term production in Texas and a dominant mineral position in New Mexico, this combination will see enCore take another leap forward towards realizing the goal of becoming a larger and more diversified uranium development company during a time of positive sentiment for nuclear energy.”

Blake Steele, President & CEO of Azarga, further added: “We are pleased to partner with enCore as a result of this transaction, while realizing a material premium for shareholders in the process. Scale is important in the natural resource sector and this transaction will position the new company among the top uranium miners based in the USA. enCore possesses a great depth of uranium development and mining experience within its management team and board of directors. As such, we are confident that the combined portfolio will be in good hands for the benefit of both sets of shareholders.”

William Sheriff, Executive Chairman of enCore, stated: “This strategic acquisition fills the gap in enCore’s pipeline of projects with key intermediate development opportunities in Wyoming and South Dakota, in between initial production in Texas and longer-term opportunities in New Mexico. This second major acquisition for enCore within the last 12 months is in keeping with our announced aggressive M&A strategy which was successfully employed at Energy Metals Corp, which was sold for $1.6 billion during the last cycle. Consolidation in conjunction with an elite operational team are the keys to success in building a leading US ISR company.”

Transaction Details

Pursuant to the terms of the Agreement, all of the issued and outstanding common shares of Azarga will be exchanged for common shares of enCore at the Closing Exchange Ratio. Outstanding and unexercised warrants and stock options to purchase common shares of Azarga will be adjusted in accordance with their terms based on the Closing Exchange Ratio.

The Agreement includes standard deal protection provisions, including non-solicitation, right-to-match, and fiduciary out provisions, as well as certain representations, covenants and conditions that are customary for a transaction of this nature, along with a termination fee of $4 million payable to enCore in certain circumstances.

The proposed Transaction will be effected by way of a plan of arrangement completed under the Business Corporations Act (British Columbia). The Transaction will require approval by at least 66 2/3% of the votes cast by Azarga shareholders and, if required by Multilateral Instrument 61-101, a simple majority of the votes cast by Azarga shareholders excluding certain interested or related parties, in each case by shareholders present in person or represented by proxy at a special meeting of the shareholders of Azarga to be called in connection with the Transaction (the “Azarga Special Meeting“).

The Azarga Special Meeting is expected to be held in October or November 2021. An information circular detailing the terms and conditions of the Transaction will be mailed to the shareholders of Azarga in connection with the Azarga Special Meeting. All shareholders are urged to read the information circular once available, as it will contain important additional information concerning the Transaction.

Closing of the Transaction is subject to the receipt of applicable regulatory approvals and the satisfaction of certain other closing conditions customary in transactions of this nature, including, without limitation, court and stock exchange approval. Closing of the Transaction is anticipated to occur in November 2021.

None of the securities to be issued pursuant to the Transaction have been or will be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act“), or any state securities laws, and any securities issuable in the Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Management and Board of Directors

The combined company will be managed by the current enCore executive team, led by Paul Goranson as CEO & Director, William Sheriff as Executive Chairman, Carrie Mierkey as Chief Financial Officer, and Dennis Stover, as Chief Technical Officer. Blake Steele, current President & CEO of Azarga, will continue as a Strategic Advisor to the combined company and John Mays, current COO of Azarga, will continue as Chief Operating Officer of the Azarga subsidiary, with a core focus to manage the continued advancement of the Dewey Burdock and Gas Hills projects.

Upon closing of the Transaction, Sandra MacKay, a current director of Azarga, will be appointed to the board of enCore.

In connection with the closing of the Transaction, enCore intends to seek the listing of its shares on the NYSE-AMEX or NASDAQ exchange which may include a share consolidation in order to meet initial listing requirements.

Board Recommendations and Voting Support

The Agreement has been unanimously approved by the boards of directors of both enCore and Azarga, and Azarga’s board unanimously recommends that its shareholders vote in favour of the Transaction.

Officers and Directors of Azarga holding approximately 7% of the outstanding shares of Azarga have entered into customary voting support agreements pursuant to which they have agreed, among other things, to vote their Azarga common shares in favour of the Transaction.

Clarus Securities Inc. has provided a fairness opinion to the Board of Directors of enCore, to the effect that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications set out in such opinion, the consideration to be paid by enCore pursuant to the Transaction is fair, from a financial point of view, to enCore.

Each of Haywood Securities Inc. and Evans & Evans, Inc. have provided fairness opinions to the Board of Directors of Azarga, to the effect that, as of the date of such opinion, and based upon and subject to the respective assumptions, limitations and qualifications set out in such opinion, the consideration to be received by Azarga shareholders pursuant to the Transaction is fair, from a financial point of view, to Azarga shareholders.

Advisors and Counsel

PowerOne Capital Markets Ltd. is acting as financial advisor to enCore. Morton Law LLP is acting as legal counsel to enCore.

Haywood Securities Inc. is acting as financial advisor to Azarga. Blake, Cassels & Graydon LLP is acting as legal counsel to Azarga.

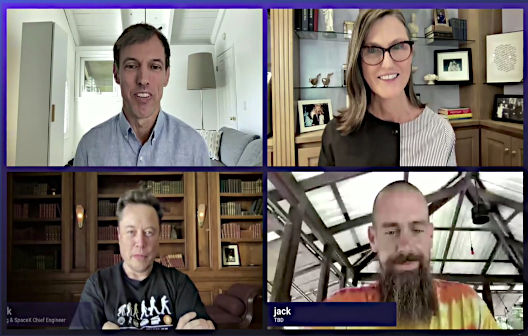

Conference Call & Webcast

enCore and Azarga will be hosting a joint online investor webinar on Thursday, September 9, 2021 at 10:00 AM EDT / 7:00 AM PDT to discuss the Transaction.

To register and attend the webinar please visit: https://attendee.gotowebinar.com/register/1027177374309475597

Additionally, Mr. Goranson and Mr. Sheriff will join Smith Weekly Research in discussing the Transaction that will be available at this link:

Smith Weekly Research – enCore Energy & Azarga Uranium Business Combination

enCore Resource Summary

|

Project

|

Million Tons

|

Grade eU3O8%

|

U3O8 (M lbs.)

|

|

Crownpoint and Hosta Butte(1)

|

|

|

|

|

Indicated

|

12.68

|

0.105%

|

26.6

|

|

Inferred

|

2.76

|

0.110%

|

6.1

|

|

Marquez-Juan Tafoya(2)

|

|

|

|

|

Indicated

|

7.1

|

0.127%

|

18.1

|

|

Historic Mineral Resources*

|

|

|

|

|

Marquez-Juan Tafoya: Sunshine(3)

|

1.1

|

0.11%

|

2.48

|

|

Nose Rock(4)(5)

|

11.8

|

0.148%

|

35.0

|

|

West Largo(6)(7)

|

2.9

|

0.300%

|

17.2

|

|

Ambrosia Lake(8)(9)

|

2.0

|

0.176%

|

7.1

|

|

Moonshine Springs(9)

|

1.4

|

0.165%

|

4.7

|

|

Butler Ranch(10)

|

0.4

|

0.15%

|

1.3

|

|

Rosita(11)

|

0.4

|

0.082%

|

0.6

|

|

Total Historic Resources*

|

|

|

68.4

|

|

1.

|

NI 43-101, Technical Report, Crownpoint & Hosta Butte , McKinley County, New Mexico, prepared by BRS Engineering, dated May 14, 2012. Crownpoint & Hosta Butte hosts Indicated resource of 12.7 Mt of 0.105% eU3O8 totaling 26.6 M lbs, Inferred resource of 2.8 Mt of 0.110% eU3O8 totaling 6.1 M lbs.

|

|

2.

|

Beahm, Douglas L., P.E., P.G., BRS Inc., Terence P. McNulty, P.E., PHD, McNulty and Associates, “NI 43-101 Technical Report, Preliminary Economic Assessment, Marquez-Juan Tafoya Uranium Project”, prepared by BRS Engineering, dated June 9. 2021. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

|

|

3.

|

Carter, Geoffrey S., P.Eng., 2014, “NI 43-101 Technical Report on Mineral Resources: Juan Tafoya Uranium Project, Cibola, McKinley, and Sandoval Counties, New Mexico, USA”, reported and effective May 15, 2014, prepared for Uranium Resources Inc. by Broad Oak Associates. Carter reports the non-contiguous Southeast Deposit located about 1 mile southeast of the Marquez-Juan Tafoya Deposit has an historic estimated Inferred Resource of 1,125,900 tons containing 2.481 million pounds U3O8 at an average grade of 0.110 %, with a cutoff grade of 0.05% U3O8.

|

|

4.

|

M. Hassan Alief, Technical Report on Section 1, T18N, R12W, Nose Rock Uranium Property, McKinley County, New Mexico, reported an effective February 9, 2009 for Strathmore Minerals Corp.

|

|

5.

|

Behre Dolbear & Company (USA) Inc., 2011, Technical Report on the Nose Rock Project of Uranium Resources Inc., prepared by Robert D. Maxwell, CPG.

|

|

6.

|

Behre Dolbear & Company (USA) Inc., 2011, Technical Report on the West Largo Project of Uranium Resources Inc., prepared by Robert D. Maxwell, CPG.

|

|

7.

|

Conoco Inc., Internal Memorandum, Treeline Uranium Property, McKinley County, New Mexico, 1978.

|

|

8.

|

Behre Dolbear & Company (USA) Inc., 2010, Technical Report on the Ambrosia Lake Project of Uranium Resources Inc., prepared by Robert D. Maxwell, CPG and Bernard J. Guarnera, RPG, CPG. The report references Historic Mineral Resources with sources including:

|

|

1.

|

Sec 27-14N-10W estimated by Capitan, Melvin, Feb 25, 2008, Uranium Resources Inc., “Ore Reserve Calculation Sheet 3, T14N R10W Section 27”, in Maxwell, Robert, CPG and Bernard Guarnera, March 1, 2010, Technical Report on Ambrosia Lake Project, Section 27, et al., Behre Dolbear Report 07-019

|

|

9.

|

Wilton, Dean T., CPG, PG, MAIG, Chief Geologist Westwater Resources, 2018, Technical Report on the Ambrosia Lake Uranium Project, McKinley County, USA. This report outlines several Historic Mineral Resources including:

|

|

1.

|

Sec 25-14N-10W estimated by Yancy & Associates, May 1997, Mine Plan – Sections 23 and 25 Ambrosia Lake, New Mexico, for Rio Algom Mining Corporation, Quivira Mining Company

|

|

2.

|

Sec 7-14N-10W estimated by Pathfinder Mines, 1980, Mine PlanExxon Minerals Company, Moonshine Springs, Mohave County, Arizona, 1982.

|

|

3.

|

Sec 17-13N-9W estimated by Nelson, Jon, Uranium Resources Inc., January 18, 2008.

|

|

4.

|

Sec 13-13N-9W estimated by Nelson, Jon, Uranium Resources Inc., June 29, 2007.

|

|

10.

|

Uranium Resources, Inc., News Release dated July 7, 2015

|

|

11.

|

Uranium Resources Inc., Form 10K, US Security and Exchange Commission, March 27, 2014.

|

*A Qualified Person (as defined in NI43-101) has not done sufficient work to classify the historical estimates as current mineral resources. Additional work will be required to verify and update historical estimates, including a review of assumptions, parameters, methods and testing. Historical estimates do not use the current mineral resource categories prescribed under NI43-101. enCore is not treating the historical estimates as current mineral resources and they should not be relied upon.

Azarga Resource Summary

|

Project

|

Million Tons

|

Grade U3O8%

|

U3O8 (M lbs.)

|

|

Dewey Burdock(1)

|

|

|

|

|

Measured & Indicated (ISR)

|

7.39

|

0.116%

|

17.12

|

|

Inferred (ISR)

|

0.65

|

0.055%

|

0.71

|

|

Centennial(2)

|

|

|

|

|

Measured & Indicated (ISR)

|

6.87

|

0.09%

|

10.37

|

|

Inferred (ISR)

|

1.36

|

0.09%

|

2.33

|

|

Aladdin(3)

|

|

|

|

|

Measured & Indicated

|

0.47

|

0.111%

|

1.04

|

|

Inferred

|

0.04

|

0.119%

|

0.10

|

|

Gas Hills(4)

|

|

|

|

|

Measured & Indicated (ISR)

|

3.83

|

0.101%

|

7.71

|

|

Measured & Indicated (non-ISR)

|

3.20

|

0.048%

|

3.06

|

|

Inferred (ISR)

|

0.41

|

0.052%

|

0.43

|

|

Inferred (non-ISR)

|

0.11

|

0.030%

|

0.06

|

|

Juniper Ridge(5)

|

|

|

|

|

Measured & Indicated (non-ISR)

|

5.14

|

0.058%

|

6.01

|

|

Inferred (non-ISR)

|

0.11

|

0.085%

|

0.18

|

|

1.

|

NI 43-101 Technical Report, Preliminary Economic Assessment, Dewey-Burdock Uranium ISR Project, South Dakota, USA, completed by Woodard & Curran and Rough Stock Mining Services (effective 3 December 2019).

|

|

2.

|

NI 43-101 Preliminary Assessment, Powertech Uranium Corp., Centennial Uranium Project, Weld County, Colorado, completed by SRK Consulting (effective 2 June 2010).

|

|

3.

|

Technical Report on the Aladdin Uranium Project, Crook County, Wyoming, completed by Jerry D. Bush, certified Professional Geologist (effective 21 June 2012).

|

|

4.

|

NI 43-101 Technical Report, Preliminary Economic Assessment, Gas Hills Uranium Project, Fremont and Natrona Counties, Wyoming, USA, completed by WWC Engineering and Rough Stock Mining Services (effective 28 June 2021).

|

|

5.

|

Juniper Ridge Uranium Project, Carbon County, Wyoming, USA, Amended and Restated NI 43-101 Mineral Resource and Preliminary Economic Assessment, completed by Douglas L. Beahm, P.E., P.G., Principal Engineer, BRS Inc. and Terrence P. (Terry) McNulty, P.E., D.Sc., T.P McNulty and Associates (effective 9 June 2017).

|

|

|

Mineral Resources that are not mineral reserves do not have demonstrated economic viability

|

Qualified Persons

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in NI 43-101 and reviewed and approved on behalf of enCore by Douglas H. Underhill, PhD, CPG, and on behalf of Azarga by John Mays, P.E. and Chief Operating Officer of Azarga, each of whom are a “Qualified Person” as defined by NI 43-101.

About enCore

enCore Energy Corp. is a U.S. domestic uranium developer focused on becoming a leading in-situ recovery (ISR) uranium producer. The company is led by a team of industry experts with extensive knowledge and experience in the development and operations of in situ recovery uranium operations. enCore Energy’s opportunities are created from the company’s transformational acquisition of its two South Texas production facilities, the changing global uranium supply/demand outlook and opportunities for industry consolidation. These short-term opportunities are augmented by our strong long term commitment to working with local indigenous communities in New Mexico where the company holds significant uranium resources.

About Azarga

Azarga Uranium is an integrated uranium exploration and development company that controls ten uranium projects and prospects in the United States of America (“USA”) (South Dakota, Wyoming, Utah and Colorado), with a primary focus of developing in-situ recovery uranium projects. The Dewey Burdock in-situ recovery uranium project in South Dakota, USA (the “Dewey Burdock Project”), which is the company’s initial development priority, has received its Nuclear Regulatory Commission License and Class III and Class V Underground Injection Control permits from the Environmental Protection Agency and the company is in the process of completing other major regulatory permit approvals necessary for the construction of the Dewey Burdock Project.

Cautionary Statements

Certain information contained herein constitutes forward-looking information or statements under applicable securities legislation and rules. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements are frequently identified by such words as “may”, “will”, “plan”, “expect”, “anticipate”, “estimate”, “intend”, “indicate”, “scheduled”, “target”, “goal”, “potential”, “subject”, “efforts”, “option” and similar words, or the negative connotations thereof, referring to future events and results. Forward-looking statements in this press release include, but are not limited to, statements related to the anticipated completion of the Transaction, the terms of the Transaction, the benefits of the Transaction, the combined company, the directors and officers of the combined company, the merits of the properties of enCore and Azarga, the potential share consolidation and listing of the shares of the combined company on a U.S. stock exchange and all statements related to the business plans, expectations and objectives of enCore and Azarga.

Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of enCore and/or Azarga to be materially different from those expressed or implied by such forward-looking statements, including, but not limited to: any inability of the parties to satisfy the conditions to the completion of the Transaction on acceptable terms or at all; receipt of necessary stock exchange, court and shareholder approvals; the ability of enCore and Azarga to achieve their stated goals and objectives; the costs associated with the companies’ objectives; risks and uncertainties related to the COVID-19 pandemic and measures taken to attempt to reduce the spread of COVID-19; and the risks and uncertainties identified in enCore’s Management’s Discussion and Analysis for the six months ended June 30, 2021 and Azarga’s Annual Information Form for the year ended December 31, 2020, each filed on SEDAR at www.sedar.com. Although management of each of enCore and Azarga has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate. Accordingly, readers should not place undue reliance on forward-looking statements. Neither party will update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. The parties caution readers not to place undue reliance on these forward-looking statements and it does not undertake any obligation to revise and disseminate forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non-occurrence of any events.

This press release is not and is not to be construed in any way as, an offer to buy or sell securities in the United States. The distribution of the enCore common shares in connection with the transactions described herein will not be registered under the United States Securities Act of 1933 (the “U.S. Securities Act”) and the enCore common shares may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy the enCore common shares, nor shall there be any offer or sale of the enCore common shares in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Neither the TSX, the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX and TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE enCore Energy Corp.

For further information: enCore Energy Corp., William M. Sheriff, Executive Chairman, 972-333-2214, info@encoreenergycorp.com, www.encoreenergycorp.com; Azarga Uranium Corp., Blake Steele, President & CEO, 605-662-8308, info@azargauranium.com, www.azargauranium.com