Promising New Opregen® Clinical Data Featured At 54th Annual Retina Society Meeting In Podium Presentation By Christopher D. Riemann, M.D.

Statistically Significant Evidence of a Treatment Effect with OpRegen Observed in Cohort 4 Patients

CARLSBAD, Calif.–(BUSINESS WIRE)–Sep. 30, 2021–

Lineage Cell Therapeutics, Inc.

(NYSE American and TASE: LCTX), a clinical-stage biotechnology company developing allogeneic cell therapies for unmet medical needs, reported today that updated interim results from a Phase 1/2a clinical study of its lead product candidate, OpRegen®, an investigational retinal pigment epithelium cell transplant therapy currently in development for the treatment of dry age-related macular degeneration (AMD), were featured in a podium presentation at the 54th Annual Scientific Meeting of the Retina Society. The presentation, “Phase 1/2a Clinical Trial of Transplanted Allogeneic Retinal Pigmented Epithelium (RPE, OpRegen) Cells in Advanced Dry Age-Related Macular Degeneration (AMD): Interim Results,” was presented by

Christopher D. Riemann

, M.D., Vitreoretinal Surgeon and Fellowship Director,

Cincinnati Eye Institute

(CEI) and

University of Cincinnati School of Medicine.

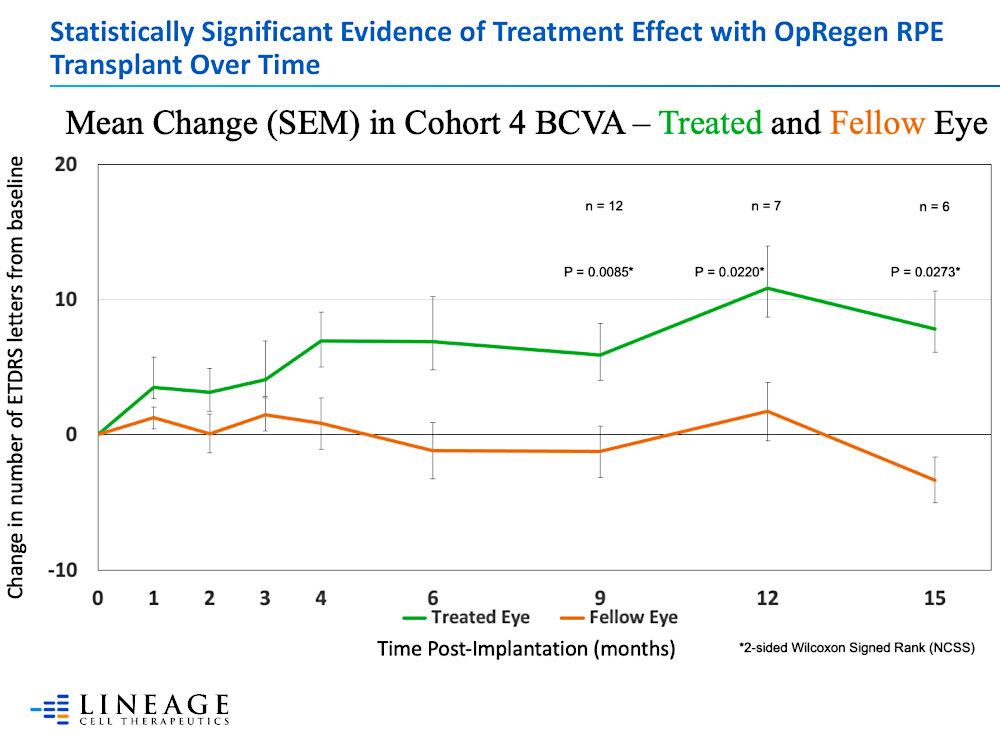

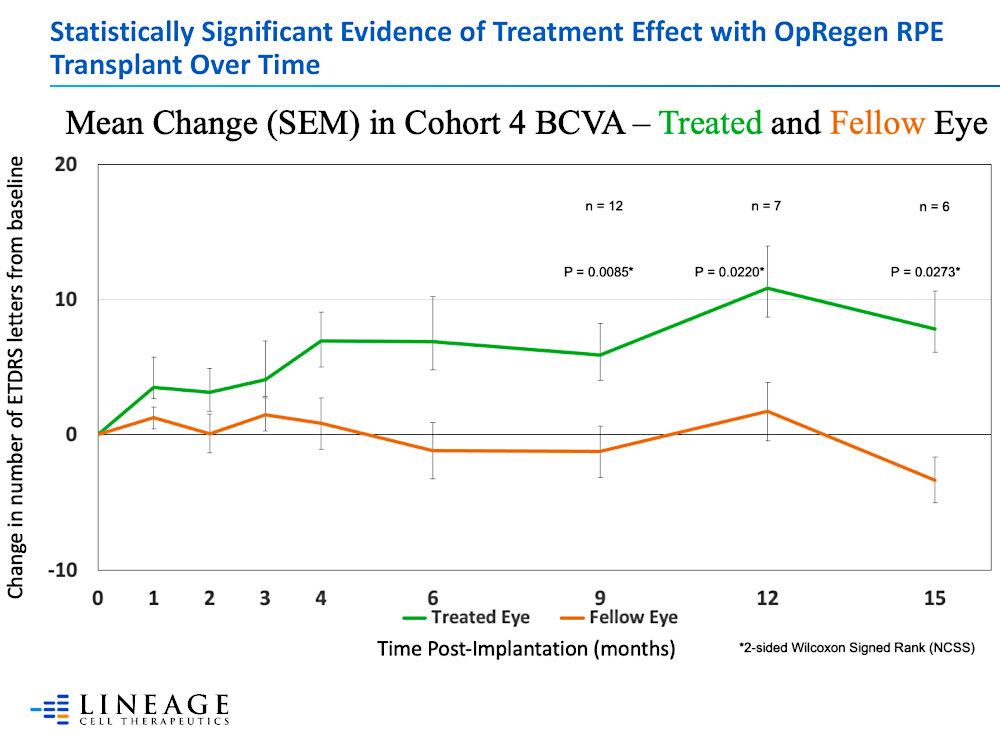

Patients enrolled into the clinical study all had bilateral, advanced, atrophic AMD. OpRegen was transplanted into the subretinal space, near or across the area of geographic atrophy (GA) of their worse seeing eyes, and the patients were routinely followed as scheduled per protocol. Data presented today showed that as patients continued to progress into post-operative follow-up, eyes receiving OpRegen trended toward improvement in visual acuity, a secondary objective under the study, while their untreated eyes typically lost visual acuity, as expected with this progressive disease. As additional patients have reached longer periods post-treatment, differences in visual acuity between treated and untreated eyes across Cohort 4 patients became statistically significant beginning at month 9 (P = 0.0085), as well as months 12 (P = 0.0220) and 15 (P = 0.0273) as determined via 2-sided Wilcoxon Signed Rank (using

NCSS, LLC statistical software). These results, when combined with the previously reported data from detailed analyses of multimodal imaging, including optical coherence tomography (OCT), which showed evidence of retinal restoration in areas previously considered to be atrophic, suggest that both a structural and functional benefit is possible with OpRegen therapy. Additionally, OpRegen continues to be well tolerated and there have been no new, unexpected ocular or systemic adverse events or serious adverse events.

“This is an exciting time for the OpRegen program, the participating investigative sites, and for patients suffering from dry AMD. The efficacy findings presented today are both statistically significant as well as clinically important,” stated

Christopher D. Riemann, M.D. “Prior clinical data readouts were mostly descriptive and lacked enough patients and post-treatment follow-up to allow for detailed statistical analyses. A significant number of better vision Cohort 4 patients are now 9, 12, and even 15 months post-treatment with OpRegen. As a result, we were able to analyze the available results to ascertain if a detectable efficacy signal could be observed in a relatively small number of patients. Though this early phase trial is open label, non-randomized and not placebo controlled, the significant differences in visual acuity of patients’ OpRegen treated eyes compared to their fellow, untreated eyes over time is very important. Though larger, controlled studies are needed, OpRegen is a potentially transformational therapy for these patients without any approved treatment options. These results strongly support further late-stage development, and we are eager to begin those studies.”

“As more patients in the OpRegen trial reach clinically relevant observation periods, our data set grows larger and permits us to conduct additional analyses like the one reported today. These new data support our view that our cell transplant approach can deliver not only anatomical changes detectable by imaging studies, but also durable functional benefits to visual acuity,” stated

Brian M. Culley, Lineage CEO. “OpRegen already is well-positioned among product candidates in development for dry AMD as the only one that has demonstrated an ability to halt or reverse the expansion of geographic atrophy and we are additionally reporting statistically significant differences in visual acuity over time between treated and untreated eyes in our intended patient population. We are excited to continue developing OpRegen as a potential treatment for dry AMD with GA.”

Dr. Riemann’s presentation will be available on the Events and Presentations section of Lineage’s website.

The

Retina Society was founded in 1968 exclusively for educational and scientific purposes concerning the diagnosis, care and treatment of diseases and injuries to the retina. For more information on the

Retina Society or its annual scientific meeting, please visit https://www.retinasociety.org/ or follow the association on Twitter @RetinaSociety.

About OpRegen

OpRegen is currently being evaluated in a Phase 1/2a open-label, dose escalation safety and efficacy study of a single injection of human retinal pigment epithelium cells derived from an established pluripotent cell line and transplanted subretinally in patients with advanced dry AMD with GA. The study enrolled 24 patients into 4 cohorts. The first 3 cohorts enrolled only legally blind patients with BCVA of 20/200 or worse. The fourth cohort enrolled 12 better vision patients (BCVA from 20/65 to 20/250 with smaller mean areas of GA). Cohort 4 also included patients treated with a new “thaw-and-inject” formulation of OpRegen, which can be shipped directly to sites and used immediately upon thawing, removing the complications and logistics of having to use a dose preparation facility. The primary objective of the study is to evaluate the safety and tolerability of OpRegen as assessed by the incidence and frequency of treatment emergent adverse events. Secondary objectives are to evaluate the preliminary efficacy of OpRegen treatment by assessing the changes in ophthalmological parameters measured by various methods of primary clinical relevance. OpRegen has been well tolerated to date and there have been no new, unexpected ocular or systemic adverse events or serious adverse events that have not been previously reported. OpRegen is a registered trademark of

Cell Cure Neurosciences Ltd., a majority-owned subsidiary of

Lineage Cell Therapeutics, Inc.

About Age-Related Macular Degeneration

Age-related macular degeneration (AMD) is an eye disease that can blur the sharp, central vision in patients and is the leading cause of vision loss in people over the age of 60. There are two forms of AMD: dry (atrophic) AMD and wet (neovascular) AMD. Dry (atrophic) AMD is the more common of the two forms, accounting for approximately 85-90% of all cases. In atrophic AMD, parts of the macula get thinner with age and accumulations of extracellular material between Bruch’s membrane and the RPE, known as drusen, increase in number and volume, leading to a progressive loss of central vision, typically in both eyes. Global sales of the two leading wet AMD therapies were in excess of

$10 billion in 2019. Nearly all cases of wet AMD eventually will develop the underlying atrophic AMD if the newly formed blood vessels are treated correctly. There are currently no

U.S. Food and Drug Administration (FDA), or

European Medicines Agency, approved treatment options available for patients with atrophic AMD.

About Lineage Cell Therapeutics, Inc.

Lineage Cell Therapeutics is a clinical-stage biotechnology company developing novel cell therapies for unmet medical needs. Lineage’s programs are based on its robust proprietary cell-based therapy platform and associated in-house development and manufacturing capabilities. With this platform Lineage develops and manufactures specialized, terminally differentiated human cells from its pluripotent and progenitor cell starting materials. These differentiated cells are developed to either replace or support cells that are dysfunctional or absent due to degenerative disease or traumatic injury or administered as a means of helping the body mount an effective immune response to cancer. Lineage’s clinical programs are in markets with billion dollar opportunities and include three allogeneic (“off-the-shelf”) product candidates: (i) OpRegen®, a retinal pigment epithelium transplant therapy in Phase 1/2a development for the treatment of dry age-related macular degeneration, a leading cause of blindness in the developed world; (ii) OPC1, an oligodendrocyte progenitor cell therapy in Phase 1/2a development for the treatment of acute spinal cord injuries; and (iii) VAC2, an allogeneic dendritic cell therapy produced from Lineage’s VAC technology platform for immuno-oncology and infectious disease, currently in Phase 1 clinical development for the treatment of non-small cell lung cancer. For more information, please visit www.lineagecell.com or follow the Company on Twitter @LineageCell.

Forward-Looking Statements

Lineage cautions you that all statements, other than statements of historical facts, contained in this press release, are forward-looking statements. Forward-looking statements, in some cases, can be identified by terms such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “expect,” “could,” “can,” “plan,” “potential,” “predict,” “seek,” “should,” “would,” “contemplate,” “project,” “target,” “tend to,” or the negative version of these words and similar expressions. Such statements include, but are not limited to, statements relating to the potential benefits of treatment with OpRegen in dry AMD patients with GA, the significance of clinical data reported to date from the ongoing Phase 1/2a study of OpRegen, including the findings of retinal tissue restoration, Lineage’s plans to meet with the FDA to discuss OpRegen’s clinical development, the potential utilization of OCT imaging to measure efficacy in a pivotal clinical trial of OpRegen for the treatment of dry AMD with GA, and the potential for Lineage’s investigational allogeneic cell therapies to provide safe and effective treatment for multiple, diverse serious or life threatening conditions. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Lineage’s actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by the forward-looking statements in this press release, including risks and uncertainties inherent in Lineage’s business and other risks in Lineage’s filings with the

Securities and Exchange Commission (SEC). Lineage’s forward-looking statements are based upon its current expectations and involve assumptions that may never materialize or may prove to be incorrect. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. Further information regarding these and other risks is included under the heading “Risk Factors” in Lineage’s periodic reports with the

SEC, including Lineage’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the

SEC and its other reports, which are available from the SEC’s website. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were made. Lineage undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

Lineage Cell Therapeutics, Inc. IR

Ioana C. Hone

(ir@lineagecell.com)

(442) 287-8963

Solebury Trout IR

Mike Biega

(Mbiega@soleburytrout.com)

(617) 221-9660

Russo Partners – Media Relations

Nic Johnson or

David Schull

Nic.johnson@russopartnersllc.com

David.schull@russopartnersllc.com

(212) 845-4242

Source:

Lineage Cell Therapeutics, Inc.