Image Credit: Stuart Rankin (Via USAF – Flickr)

Afghanistan’s Mineral Resources are Estimated to be Worth $1 Trillion to $3 Trillion

Besides leaving the Taliban billions of dollars of military equipment, including aircraft, grenades, firearms, and helicopters, the United States is exiting a country with a rich mineral endowment in terms of metals, minerals, and gemstones and providing an opening for other countries such as China and Russia to extend their influence in the region.

According to an article published by The Hill, the United States provided Afghan forces with 7,035 machine guns, 4,702 Humvees, 20,040 hand grenades, 2,520 bombs, and 1,394 grenade launchers from 2017 to 2019 based on a report from the Special Inspector General for Afghanistan Reconstruction (SIGAR). The Taliban has taken possession of U.S. military equipment following the recent fall of the Afghan government.

Afghanistan is Rich in Natural Resources

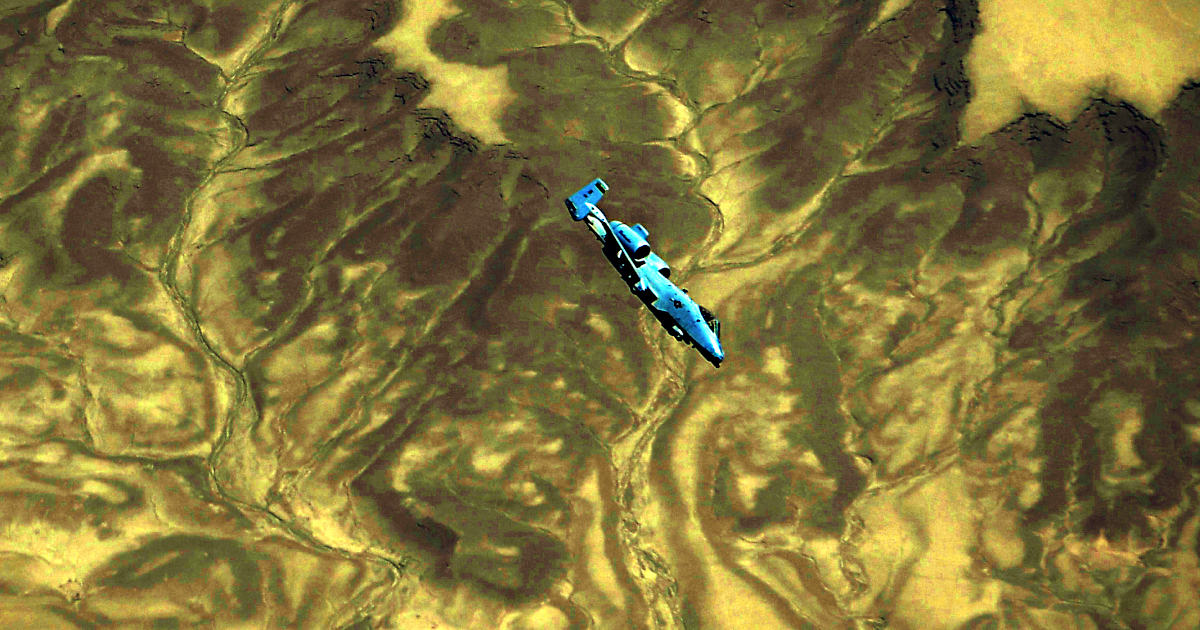

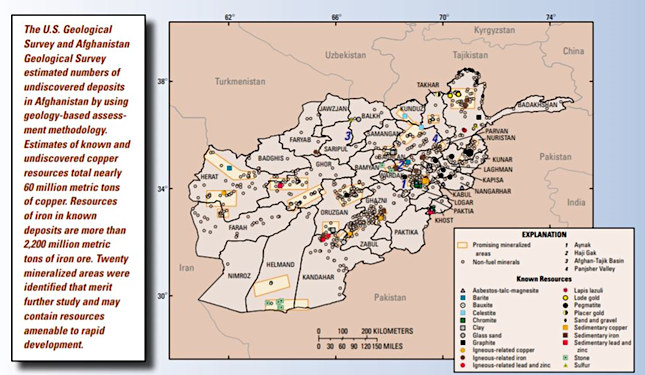

Like many countries in the world with long histories of political instability and corruption, Afghanistan has significant natural resources, including gold, silver, platinum, copper, iron, chromite, lithium, uranium, and rare earths. Additionally, the country is a rich source of gemstones, including, emeralds, lapis lazuli, rubies, sapphires, and turquoise. According to a 2007 preliminary assessment of non-fuel mineral resources by the United States Geological Survey (USGS) in cooperation with the Afghanistan Geological Survey, Afghanistan may hold 60 million metric tons of copper, 2.2 billion metric tons of iron ore, and 1.4 million metric tons of rare earth elements (REE). Based on the study, Afghanistan’s mineral deposits were estimated to be worth nearly $1 trillion. Some now believe the value could be upwards of $3 trillion.

A map of Afghanistan’s mineral wealth, sourced from the U.S. Geological Survey report is illustrated below.

Map of Mineralized Areas in Afghanistan

Source: Preliminary Assessment of Non-Fuel Mineral Resources of Afghanistan, 2007, U.S. Department of the Interior, U.S. Geological Survey, October 2007.

Responsible Mining May Hold the Key to Afghanistan’s Future

Many believe that if Afghanistan’s mineral resources were developed and extracted effectively, the country could improve its economic fortunes while lowering its dependence on foreign aid. Illegal mining, most often done irresponsibly, is common throughout Afghanistan to raise money for terrorists, armed militias, and insurgency groups. A stable government with sound policies could promote economic growth by fostering a healthy mining industry. However, with an undeveloped mining industry or infrastructure in place, it could take many years for Afghanistan to fully exploit its mineral wealth.

Who Will Partner with Afghanistan?

In late July, Chinese Foreign Minister Wang Yi met with a delegation led by Taliban leader Mullah Abdul Ghani Baradar in Tianjin, China. Shortly following the Taliban’s take-over of Afghanistan, China’s foreign ministry signaled that it was ready for friendly cooperation with Afghanistan. China dominates the rare earths market globally. Russia has been engaging with the Taliban for years and is expected to seek opportunities to extend its influence.

Take-Away

Many of the world’s richest mineral resources are found in countries characterized by widespread poverty, extreme wealth inequality, unstable political regimes, and corruption. It should not be surprising that for those that hold democratic elections, populist or left-leaning candidates promising greater wealth equality and social programs are gaining more traction in countries like Mexico and Peru. This may provide an opening for countries like China that have instituted global development programs, such as the Belt and Road initiative, that provide financing and aid in exchange for greater influence. The lesson in Afghanistan may be that economic and intellectual resources aimed at economic development may have a more durable impact than seeking purely military solutions. In the case of Afghanistan, it may be too late.

Suggested Reading:

Sources:

Billions

in US Weaponry Seized by Taliban, The Hill, Rebecca Kheel, August 19, 2021.

Planes, Guns, Night-Vision Goggles: The Taliban’s New U.S.-Made War Chest, Reuters, Idrees Ali and Patricia Zengerle, Jonathan Landay, August 19, 2021.

Factbox: What are Afghanistan’s Untapped Minerals and Resources?, Reuters, Ahmad Masood, August 19, 2021.

The

Taliban Are Sitting on $1 Trillion Worth of Minerals the World Desperately Needs, CNN, Julia Horowitz, August 19, 2021.

Preliminary Assessment of Non-Fuel Mineral Resources of Afghanistan, 2007, U.S. Department of the Interior, U.S. Geological Survey, October 2007.

Russia

Was Ready for Taliban’s Win Due to Longtime Contacts, Associated Press, Vladimir Isachenkov, August 19,2021.

Russia

Has Been Engaging with the Taliban for Years. The U.S. Withdrawal Might Give It an Opportunity to Expand its Role, CBS News, Mary Ilyushina, August 21, 2021.

Afghanistan:

Taliban to Reap $1 Trillion Mineral Wealth, DW Akademie, Nik Martin, August 18, 2021.

China May Align Itself with Taliban and Try to Exploit Afghanistan’s Rare Earth

Metals, Analyst Warns, CNBC, World Markets, Weizen Tan, August 17, 2021.

U.S. Identifies Vast Mineral Riches in Afghanistan, The New York Times, James Risen, June 13, 2010.

Afghanistan’s Mineral Resources Are a Lost Opportunity and a Threat, The Diplomat, Ahmad Shah Katawazai, February 1, 2020.

As U.S. Retreats, China Looks to Back Taliban with Afghan Mining Investments, Forbes, Ariel Cohen, August 17, 2021.

Image

Stay up to date. Follow us: