|

|

|

enCore Energy Executive Chairman William Sheriff & CEO Paul Goranson deliver a formal corporate overview, followed by a Q & A session moderated by Noble Capital Markets Senior Energy Analyst Michael Heim. Return to the Investor Forum Event Page

enCore Energy Corp. is a U.S. domestic uranium developer focused on becoming a leading in-situ recovery (ISR) uranium producer. The Company is led by a team of industry experts with extensive knowledge and experience in the development and operations of in situ recovery uranium operations. enCore Energy’s opportunities are created from the Company’s transformational acquisition of its two South Texas production facilities, the changing global uranium supply/demand outlook and opportunities for industry consolidation. These short-term opportunities are augmented by our strong long term commitment to working with local indigenous communities in New Mexico where the company holds significant uranium resources. |

Month: August 2021

Peninsula Energy (PENMF)(PEN.AX) – Noble Capital Markets Uranium Power Players Investor Forum

|

|

|

Peninsula Energy Managing Director & CEO Wayne Heili delivers a formal corporate overview, followed by a Q & A session moderated by Noble Capital Markets Senior Energy Analyst Michael Heim. Return to the Investor Forum Event Page

Peninsula Energy Limited is an ASX listed company that owns the Lance Uranium Projects in Wyoming, USA which are in transition from an alkaline to a low pH in-situ recovery operation, with the aim of achieving the operating performance and cost profile of the industry leading uranium projects. |

CanAlaska Uranium (CVVUF)(CVV:CA) – Noble Capital Markets Uranium Power Players Investor Forum

|

|

|

CanAlaska Uranium CEO & EVP Cory Belyk delivers a formal corporate overview, followed by a Q & A session moderated by Noble Capital Markets Senior Energy Analyst Michael Heim. Return to the Investor Forum Event Page

CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) holds interests in approximately 214,000 hectares (530,000 acres), in Canada’s Athabasca Basin – the “Saudi Arabia of Uranium.” CanAlaska’s strategic holdings have attracted major international mining companies. CanAlaska is currently working with Cameco and Denison at two of the Company’s properties in the Eastern Athabasca Basin. CanAlaska is a project generator positioned for discovery success in the world’s richest uranium district. The Company also holds properties prospective for nickel, copper, gold and diamonds. |

Standard Uranium (STTDF)(STND:CA) – Noble Capital Markets Uranium Power Players Investor Forum

|

|

|

Standard Uranium President & CEO Jon Bey and VP, Exploration Sean Hillacre deliver a formal corporate overview, followed by a Q & A session moderated by Noble Capital Markets Senior Energy Analyst Michael Heim. Return to the Investor Forum Event Page

Standard Uranium is a mineral resource exploration company based in Vancouver, British Columbia. Since its establishment, Standard Uranium has focused on the identification and development of prospective exploration stage uranium projects in the Athabasca Basin in Saskatchewan, Canada. Standard Uranium’s Davidson River Project, in the southwest part of the Athabasca Basin, Saskatchewan, is comprised of 21 mineral claims over 25,886 hectares. The Davidson River Project is highly prospective for basement hosted uranium deposits yet remains relatively untested by drilling despite its location along trend from recent high-grade uranium discoveries. A copy of the 43-101 Technical Report that summarizes the exploration on the Project is available for review under Standard Uranium’s SEDAR profile (www.sedar.com). |

GoviEx Uranium (GVXXF)(GXU:CA) – Noble Capital Markets Uranium Power Players Investor Forum

|

|

|

GoviEx Uranium CEO Daniel Major delivers a formal corporate overview, followed by a Q & A session moderated by Noble Capital Markets Senior Energy Analyst Michael Heim. Return to the Investor Forum Event Page

GoviEx is a mineral resource company focused on the exploration and development of uranium properties in Africa. The company has a sizable resource inventory with over 143M lbs U3O8 in measured and indicated categories, and 86.9M lbs U3O8 in the inferred category. GoviEx’s principal objective is to become a significant uranium producer through the continued exploration and development of its flagship mine-permitted Madaouela Project in Niger, its mine-permitted Mutanga Project in Zambia, and its multi-element Falea Project in Mali. |

Release – Voyager Digital Completes Historic Token Merger

Voyager Digital Completes Historic Token Merger

More than $900 million of VGX and LGO tokens swapped for VGX 2.0, a new utility token

NEW YORK, Aug. 31, 2021 /PRNewswire/ – Voyager Digital Ltd. (CSE: VYGR) (OTCQX: VYGVF) (FRA: UCD2), the fastest-growing, publicly traded cryptocurrency platform in the United States, completed one of the largest token swaps and mergers in the history of cryptocurrencies. The swap and merger combine the original Voyager token, VGX, with the LGO token that originated from the European digital asset exchange, LGO, SAS acquired by Voyager in December 2020. To complete the token swap, the VGX and LGO tokens were converted to a single, new token under the ticker VGX. At the time of the official swap, the new VGX had a total market capitalization of over $900 million.

The token swap required a series of new smart contracts on the Ethereum blockchain, and the development of new features such as on-chain staking rewards and more. The new token smart contracts and swap portal were built by Republic Crypto, a crypto advisory group based in New York City. The new VGX token has more utility features than the predecessor tokens, and when held on the Voyager app, can earn 7 percent annual rewards. The token will also power the upcoming Voyager Loyalty Program.

“This historic token swap brings together two loyal token communities, VGX and LGO, from around the globe,” said Stephen Ehrlich, Voyager’s CEO and Co-founder. “Holders of the new VGX token will benefit from Voyager’s Loyalty Program, which will include staking rewards, increased referral bonuses, cash back on trades, and more features as we continue to expand our product offering on the Voyager app.”

“As the blockchain industry matures, we’ll continue to see more crypto company acquisitions and token mergers, and now we have a successful framework for token mergers of this scale,” said Andrew Durgee, Head of Crypto and Tokenization at Republic. According to Durgee, “the VGX/LGO token swap was not the first of its kind, but the largest in volume and most complicated yet.”

When the token swap portal was first released on August 1st, approximately 100 million VGX and LGO tokens were swapped in under 48 hours. On the Voyager app, the official token swap began for VGX token holders on August 16th and completed on August 20th. International token holders will be able to swap until September 20th, and continue to stake via the web portal on an ongoing basis.

About Voyager

Voyager Digital Ltd. is the fast-growing, publicly traded cryptocurrency platform founded in 2018 to bring choice, transparency, and cost efficiency to the marketplace. Voyager offers a secure way to invest and trade in over 60 different crypto assets, with zero commissions, using its easy-to-use mobile application, and earn rewards up to 12 percent APY on more than 30 cryptocurrencies. Through its subsidiary Coinify ApS, Voyager provides crypto payment solutions for both consumers and merchants around the globe. To learn more about the company, please visit https://www.investvoyager.com.

Neither the TSX, the CSE nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release. No securities regulatory authority has either approved or disapproved of the contents of this press release.

About Republic

Republic is a leading alternative investment platform open to all investors. Republic has deployed over $500 million in investments in 500+ companies across one million users in 100 countries. Republic is backed by both strategic capital partners and traditional venture capital firms including Galaxy Digital, Binance and Passport Capital. Founded in 2016, Republic is based in New York City and has 150+ employees. Republic has its own profit-sharing token, the Republic Note. For additional information, visit republic.co, @joinrepublic, and facebook.com/joinrepublic.

Forward Looking Statements

This news release contains “forward-looking statements” that are based on expectations, estimates, projections and interpretations as at the date of this news release. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “seek”, “intend”, “believe”, “anticipate”, “estimate”, “suggest”, “indicate” and other similar words or statements that certain events or conditions “may” or “will” occur. Such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors may include, but are not limited to, those risk factors outlined in the Company’s Management Discussion and Analysis as filed on SEDAR. The Company does not undertake to update any forward-looking information except in accordance with applicable securities laws.

Press Contacts

Voyager Digital, Ltd.

Michael Legg

Chief Communications Officer

(212) 547-8807

mlegg@investvoyager.com

Public Relations Team

pr@investvoyager.com

Republic Crypto, LLC

Kinsa Durst

Marketing Director at Republic Crypto Advisory

kinsa@republicadvisory.io

(510) 703-9898

SOURCE Voyager Digital (Canada) Ltd.

Release – Item 9 Labs Corp. Secures $19 Million Construction-Financing Loan with Pelorus Equity Group

Item 9 Labs Corp. Secures $19 Million Construction-Financing Loan with Pelorus Equity Group for Expansion of Cultivation & Lab Sites in Arizona & Nevada

Financing to Fund Master Site Expansion in Arizona, including Acquisition of the 45 acres of Adjacent Land Next to the Company’s Existing 19,200 sq. ft. Facility Capacity of Arizona Operations to be Enhanced by 33x

Item 9 Labs Corp. Secures $19 Million Construction-Financing Loan with Pelorus Equity Group for Expansion of Cultivation & Lab Sites in Arizona & Nevada

Item 9 Labs Corp. Secures $19 Million Construction-Financing Loan with Pelorus Equity Group for Expansion of Cultivation & Lab Sites in Arizona & Nevada

Financing to Fund Master Site Expansion in Arizona, including Acquisition of the 45 acres of Adjacent Land Next to the Company’s Existing 19,200 sq. ft. Facility Capacity of Arizona Operations to be Enhanced by 33x

ESPN Seeks $3 Billion to License Its Name to Sports Betting Operator

Will Disney Owned ESPN Fetch $3 Billion From Sports Betting?

Major sports-betting companies have been offered the opportunity by ESPN to license its brand. The large sports media network is a division of Walt Disney and has recently held talks with players that own major sportsbooks. On that list are DraftKings and casino operator Caesars Entertainment.

Cost

The price tag is massive. According to the Wall Street Journal and other sources, they seek to license the ESPN brand, over several years, for $3 billion. The idea is that Disney could profit from the licensing arrangement while the gaming companies could gain wider recognition with larger audiences as a result of ESPN’s footprint.

Is the $3 billion price tag too steep for any company that would be interested in immediately gaining this level of brand strength, marketing, and media coverage? That remains to be seen. Eilers & Krejcik serves as a research firm focused on the gaming equipment, sports, and interactive gaming sectors of the industry; according to their data, sports betting is on track to generate revenue of about $4 billion in the U.S. in 2021.

Brand Considerations

There is no guarantee Disney’s ESPN will find a suitor to accept its terms. Gaming companies that are large enough to consider the offer have already built respectable brand names of their own – perhaps brand recognition that better resonates with their audiences.

The ESPN brand has already incorporated gambling and betting lines into some of its studio programming and even offered betting-themed shows. But it has not launched its own sportsbook, which would mean handling payouts to winners and collecting money. They currently even have marketing partnerships with both Caesers and DraftKings; however, any deal now would come with an exclusive marketing commitment that would require the sports-betting firm to spend a specified amount of money advertising on the ESPN platform.

Take-Away

Not many years back, gambling was rarely mentioned on sports media outlets. During football games, if an announcer mentioned a point spread at all, it was not taken far enough for the untrained ear to tie it to gambling. It would be mentioned more in a way that suggested the outcome of the game may have been misjudged. There is now new thinking at the media outlets. TV broadcasts of some sports today play ads from leading U.S. sportsbooks such as DraftKings (DKNG), or FanDuel. In many instances, odds for games are shown on television.

As mentioned, there are also sports betting TV shows. ESPN has been involved here with a show dedicated to sports gambling called the “Daily Wager.” Viacom has a gambling show called “SportsLine Edge.” This change in acceptance of what are still considered “vices” is allowing a lot of money to change hands. As with other vices, once they’re mainstreamed, they often prove to be relatively stable businesses as people turn to their products in good economic times as well as bad.

Suggested Content:

Esports Investors Now Better Able To Evaluate Industry

|

How to Invest in Esports

|

C-Suite Interview With Esports Entertainment, GMBL (YouTube)

|

Industry Report – Are Media Investors Too Pessimistic?

|

Sources:

https://www.wsj.com/articles/espn-explores-sports-betting-deal-worth-at-least-3-billion-11630089962

Stay up to date. Follow us:

|

Noble Capital Markets Uranium Power Players Investor Forum

Noble Capital Markets Uranium Power Players Investor Forum

Event Main Page

Use the links below to watch all the replays from the Investor Form. Power Players Investor Forum video content is available to registered Channelchek users. Click below to register for Channelchek – at no cost (please note the separate registration link for mobile users).

Register for Channechek to gain access to the Investor Forum

On Mobile? Register for Channelchek here!

View the Official Investor Forum Book Here

Watch the Replay (GVXXF) |

Watch the Replay (BKUCF) |

Watch the Replay (CVVUF) |

Watch the Replay (STTDF) |

Watch the Replay (PENMF) |

Watch the Replay (UUUU) |

Watch the Replay (ENCUF) |

Will Free Trades Disappear?

Could $Hood Survive if PFOF Goes POOF?

Payment for order flow (PFOF) for stock transactions is again coming under fire. This time by the SEC Chairman. PFOF is the act of a broker taking orders from a customer and directing them to a specific market maker in the security. After the order is filled, the market maker returns a “tip,” usually fractions of a penny per share, as compensation for giving them an opportunity to fill the trade.

In an article yesterday (Aug 31), SEC Chairman Gary Gensler was interviewed by Barron’s. In response to questions, he discussed thoughts on PFOF and said that a full ban of payment for order flow is “on the table.” Part of his reasoning is, in Gensler’s words, the practice has “an inherent conflict of interest.” Market makers make a small spread on each trade, but that’s not all they get. “They get the data, they get the first look, they get to match off buyers and sellers out of that order flow,” according to Gensler. “That may not be the most efficient markets for the 2020s.”

The SEC Chief didn’t say whether the agency has found instances where the practice resulted in harm to investors. It was made known, however, that the Securities and Exchange Commission is reviewing PFOF and could come out with a proposal in the coming months.

| Gensler has mentioned several times that the U.K., Australia, and Canada forbid payment for order flow. Asked if he raises those examples because a ban could also happen in the U.S., he replied: “I’m raising this because it’s on the table. This is very clear.” – Barron’s, August 30, 2021 |

What Could This Mean for

Commission Free Trades?

The average online broker earns a low percentage of their revenue from PFOF, often as low as 10%. For Robinhood Markets, and a few other trading apps, these payments could add upwards of 80% to revenue.

The SEC says all the fractions of a penny add up to a lot of money at the expense of customers. Last year the Commission and Robinhood settled a dispute over how the company negotiated order flow and customer disclosures. The SEC alleged that Robinhood made deals during the period 2015 to 2018 with market makers that gave the company a much higher percentage of the spread – traditional brokers tend to share a higher percentage with customers. This would make each share on average a bit higher in cost than if the client had transacted with a traditional discount broker. Robinhood agreed to pay $65 million but neither admitted nor denied the allegations. The company has also said it has changed its payment for order flow practices.

Proponents of payment for order flow take a different view. Robinhood’s CFO holds the position that PFOF is a way for brokers to make money that doesn’t really hurt consumers and allows apps to charge zero commissions. He says it is a major reason that more people than ever have started investing.

PFOF can constitute up to 80% of the revenue Robinhood makes per transaction per relationship. With this math, the stock trading business model could very well be in jeopardy.

In defense of the practice, Warnick has noted that other brokers had historically accepted payment for order flow on top of commissions, Robinhood has never charged commissions for equities.

Alternatives

There has been a boom in retail trading in the past two years, with millions of new investors introduced to brokerage apps to invest in stocks, options, and cryptocurrencies for the first time. The popularity has been driven in part by a change in the way that brokers make money. Would a change in PFOF rules for stockbrokers cause this to fall apart?

If Robinhood or other high transaction brokers cannot accept PFOF from those that it “outsources” to, then it can do much of the trade matching in-house. Using its own balance sheet and systems it can execute trades at presumably better prices than available where another party is involved and achieve “best execution” while retaining the full bid/ask spread.

What Else?

On July 21 Robinhood reported their earnings for the first time as a public company. Although Robinhood is best known as a retail stock brokerage app, regulated by the SEC, among others, about 41% of their earnings came from payment for order flow from cryptocurrency transactions. At this point in time, the SEC has little say in that market.

Take-Away

The head of the SEC said yesterday that the practice of payment for order flow is on the table as something they may not allow in the near future. The adoption of commission-free trades by most brokers relies on some revenue to come from PFOF; they also benefit from unused account balances, and in some cases selling customer data.

This could cut into profits and challenge the larger, high-volume brokers initially. The smaller start-up brokers will have to continue to work with third-party “wholesalers” and earn reduced revenue from that source. Brokers that are still engaged in the practice of reducing the cost of a transaction for customers using the PFOF, may now have to pass along the full cost to their account holders.

Suggested Reading:

Are there Enough ESG Stocks to Go Around?

|

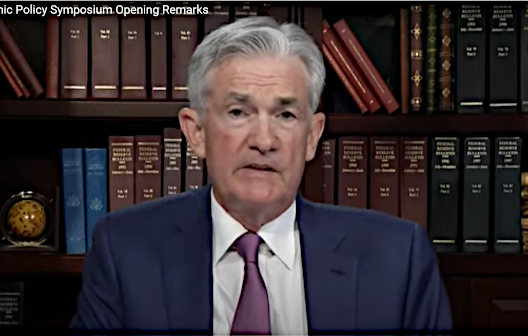

High Points of the Jackson Hole Presentation

|

Your Data is Used to Generate Big Returns

|

Seeking Alpha Paywall Causes Frustration

|

Sources:

https://www.investopedia.com/terms/p/paymentoforderflow.asp

https://www.barrons.com/articles/payment-for-order-flow-robinhood-51623412441?mod=article_inline

Stay up to date. Follow us:

|

Blue Sky Uranium (BKUCF)(BSK:CA) – Noble Capital Markets Uranium Power Players Investor Forum

|

|

|

Blue Sky Uranium President and CEO Niko Cacos & VP, Exploration & Development Guillermo Pensado deliver a formal corporate overview, followed by a Q & A session moderated by Noble Capital Markets Senior Energy Analyst Michael Heim. Return to the Investor Forum Event Page

Blue Sky Uranium Corp. (TSX.V: BSK; FSE: MAL2.F; OTC: BKUCF) is one of Argentina’s best-positioned uranium & vanadium exploration companies with more than 4,000 km2 (400,000 ha) of prospective tenements. The Company’s mission is to deliver exceptional returns to shareholders by acquiring, exploring and advancing towards production a portfolio of uranium-vanadium projects, with an emphasis on near-surface deposits with the potential for near-term low-cost production. The Company follows international best practices in exploration, with a focus on respect for the environment, the communities, and the cultures in all the areas in which we work. Argentina is the largest generator of electricity from nuclear energy in South America. The country is working to further expand their nuclear energy sector with additional power plants, but currently lacks domestic uranium production. Argentina’s desire for security of supply could provide a “guaranteed” first customer for a new domestic supplier. Large scale production could make Argentina a strategic exporter of uranium to the international nuclear energy sector. Blue Sky’s exploration work between 2007 and 2012 led to the discovery of a new uranium district in Rio Negro Province. The Company’s Amarillo Grande Project covers the district with three major properties, including the Ivana near-surface uranium deposit which hosts the largest NI 43-101 uranium resource in the country; Ivana also has potentially significant vanadium credits. Other exploration targets for blind uranium and vanadium mineralization are also present within the project area. The close proximity of the properties & targets provides the potential for an integrated, low-cost uranium-vanadium producing operation, making Amarillo Grande an excellent candidate to be the first near-term uranium producer in Argentina. The Company is a member of the Grosso Group, a resource-focused management group that pioneered the mineral exploration industry in Argentina and has operated there since 1993. The group is credited with four exceptional mineral deposit discoveries, and has a highly-regarded track-record for fostering strong relationships with the communities and governments where it works. The Grosso Group leverages its vast network of local, regional and international industry contacts to support the exploration team as they search for quality resource opportunities. |

Voyager Digital Completes Historic Token Merger

Voyager Digital Completes Historic Token Merger

More than $900 million of VGX and LGO tokens swapped for VGX 2.0, a new utility token

NEW YORK, Aug. 31, 2021 /PRNewswire/ – Voyager Digital Ltd. (CSE: VYGR) (OTCQX: VYGVF) (FRA: UCD2), the fastest-growing, publicly traded cryptocurrency platform in the United States, completed one of the largest token swaps and mergers in the history of cryptocurrencies. The swap and merger combine the original Voyager token, VGX, with the LGO token that originated from the European digital asset exchange, LGO, SAS acquired by Voyager in December 2020. To complete the token swap, the VGX and LGO tokens were converted to a single, new token under the ticker VGX. At the time of the official swap, the new VGX had a total market capitalization of over $900 million.

The token swap required a series of new smart contracts on the Ethereum blockchain, and the development of new features such as on-chain staking rewards and more. The new token smart contracts and swap portal were built by Republic Crypto, a crypto advisory group based in New York City. The new VGX token has more utility features than the predecessor tokens, and when held on the Voyager app, can earn 7 percent annual rewards. The token will also power the upcoming Voyager Loyalty Program.

“This historic token swap brings together two loyal token communities, VGX and LGO, from around the globe,” said Stephen Ehrlich, Voyager’s CEO and Co-founder. “Holders of the new VGX token will benefit from Voyager’s Loyalty Program, which will include staking rewards, increased referral bonuses, cash back on trades, and more features as we continue to expand our product offering on the Voyager app.”

“As the blockchain industry matures, we’ll continue to see more crypto company acquisitions and token mergers, and now we have a successful framework for token mergers of this scale,” said Andrew Durgee, Head of Crypto and Tokenization at Republic. According to Durgee, “the VGX/LGO token swap was not the first of its kind, but the largest in volume and most complicated yet.”

When the token swap portal was first released on August 1st, approximately 100 million VGX and LGO tokens were swapped in under 48 hours. On the Voyager app, the official token swap began for VGX token holders on August 16th and completed on August 20th. International token holders will be able to swap until September 20th, and continue to stake via the web portal on an ongoing basis.

About Voyager

Voyager Digital Ltd. is the fast-growing, publicly traded cryptocurrency platform founded in 2018 to bring choice, transparency, and cost efficiency to the marketplace. Voyager offers a secure way to invest and trade in over 60 different crypto assets, with zero commissions, using its easy-to-use mobile application, and earn rewards up to 12 percent APY on more than 30 cryptocurrencies. Through its subsidiary Coinify ApS, Voyager provides crypto payment solutions for both consumers and merchants around the globe. To learn more about the company, please visit https://www.investvoyager.com.

Neither the TSX, the CSE nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release. No securities regulatory authority has either approved or disapproved of the contents of this press release.

About Republic

Republic is a leading alternative investment platform open to all investors. Republic has deployed over $500 million in investments in 500+ companies across one million users in 100 countries. Republic is backed by both strategic capital partners and traditional venture capital firms including Galaxy Digital, Binance and Passport Capital. Founded in 2016, Republic is based in New York City and has 150+ employees. Republic has its own profit-sharing token, the Republic Note. For additional information, visit republic.co, @joinrepublic, and facebook.com/joinrepublic.

Forward Looking Statements

This news release contains “forward-looking statements” that are based on expectations, estimates, projections and interpretations as at the date of this news release. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “seek”, “intend”, “believe”, “anticipate”, “estimate”, “suggest”, “indicate” and other similar words or statements that certain events or conditions “may” or “will” occur. Such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors may include, but are not limited to, those risk factors outlined in the Company’s Management Discussion and Analysis as filed on SEDAR. The Company does not undertake to update any forward-looking information except in accordance with applicable securities laws.

Press Contacts

Voyager Digital, Ltd.

Michael Legg

Chief Communications Officer

(212) 547-8807

mlegg@investvoyager.com

Public Relations Team

pr@investvoyager.com

Republic Crypto, LLC

Kinsa Durst

Marketing Director at Republic Crypto Advisory

kinsa@republicadvisory.io

(510) 703-9898

SOURCE Voyager Digital (Canada) Ltd.