Palladium One Expands the Tyko Sulphide Nickel-Copper Project to 24,500 hectares and Completes VTEM Survey

KEY HIGHLIGHTS

- Two Earn-in agreements expand the Tyko Nickel-Copper Project by 950 hectares

- Additionally, 3,500 hectares were purchased from the original Optionors of the Tyko Project.

- Tyko Nickel-Copper Project currently over 24,500 hectares

- 3,100-kilometer airborne Electro Magnetic (VTEMmax) geophysical survey completed

- Summer exploration field crews are onsite conducting reconnaissance mapping, prospecting and soil sampling. The first 1,000 soil samples have been sent for assaying, results pending

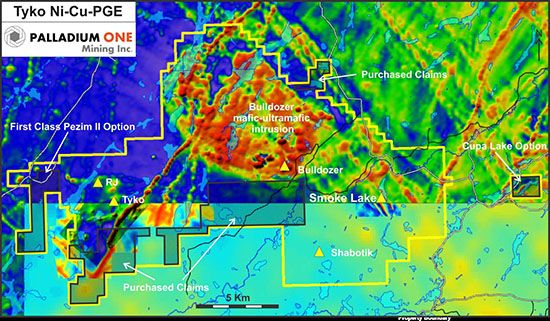

July 27, 2021 – Toronto, Ontario – The footprint of the Tyko Nickel-Copper Project, which returned drill intercepts from massive magmatic sulphide of up to 9.9% Nickel equivalent (“Ni_Eq”), (23.0% Copper equivalent, 30.1 g/t Gold equivalent*) over 3.8 meters in hole TK21-023 (Table 1) has been expanded by 4,400 hectares, said Palladium One Mining (“Palladium One” or the “Company”) (TSXV: PDM, FRA: 7N11, OTC: NKORF) today.

Tyko has grown from 20,100 hectares to over 24,500 hectares since the Phase II drill program was completed.

An option agreement with First Class Metals Ltd, for the Pickle Lake property, consists of 700 hectares located on the west side of the Tyko project and is proximal to the historic RJ zone which returned up to 1.2% Ni_Eq (2.78% Cu_Eq and 3.6g/t Au_Eq*) over 16.2 meters in hole TK16-002 (see news release April 12, 2016). A second option agreement for the Cupa Lake property with a local prospector consists of 250 hectares and is located 8km east of the Smoke Lake Zone.

President and CEO, Derrick Weyrauch commented, “Tyko continues to impress and warrants increased levels of expenditure and exploration. Results to date demonstrate robust mineralization spread over at least 18 kilometers, yet the area has seen virtually no government mapping or exploration. We believe that in addition to the high-grade Smoke Lake zone, there are new zones off nickel-copper mineralization yet to be discovered. We are awaiting result from the 3,100-kilometer airborne Electro Magnetic (VTEMmax) survey which will guide further exploration.”

200-square kilometer, VTEMmax survey

Geotech’s Versatile Time Domain Electromagnetic airborne system (VTEMmax) survey has been completed across the entire Tyko project. The survey comprised greater than 3,100-line kilometers of closely spaced (100-meter) flight lines. It is the most comprehensive and sensitive airborne geophysical survey ever flown on the Tyko property and covered large areas for which no airborne Electro Magnetic surveys had ever been flown, including the area surrounding the Shabotik showing, having up to 1.0% Nickel, see press release August 19, 2019.

Summer Field Program

Mapping, prospecting and soil sampling is well underway with 1,000 soil samples having already been submitted to the assay lab. This program is designed to ground truth historic and new geophysical anomalies. The vast majority of the Tyko project has seen little to no exploration, or even government mapping.

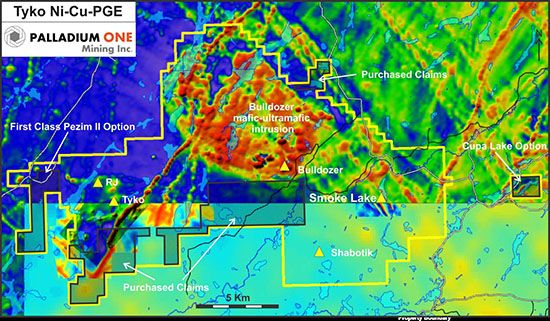

Figure 1. Tyko Project, with various historic total field magnetic surveys as the background. Newly acquired ground is shown in black hatched areas.

Table 1: Select 2020 & 2021 Drill Results from the Smoke Lake

|

Hole

|

From

(m)

|

To

(m)

|

Width

(m)

|

Ni_E

%

|

Cu_

%

|

Au_

g/t*

|

Ni

%

|

Cu

%

|

Co

%

|

PGE g/t

(Pd+Pt

Au)

|

Pd

g/t

|

Pt

g/t

|

Au

g/t

|

|

TK20-016

|

29.0

|

32.8

|

3.8

|

8.74

|

20.38

|

27.16

|

6.65

|

3.70

|

0.09

|

1.51

|

0.67

|

0.81

|

0.03

|

|

Inc.

|

29.8

|

32.5

|

2.7

|

9.80

|

22.86

|

30.45

|

7.47

|

4.16

|

0.10

|

1.64

|

0.74

|

0.87

|

0.03

|

|

TK20-022

|

46.8

|

51.0

|

4.2

|

7.46

|

17.40

|

23.05

|

5.83

|

2.74

|

0.09

|

1.28

|

0.56

|

0.70

|

0.01

|

|

Inc.

|

48.5

|

50.6

|

2.1

|

8.78

|

20.48

|

26.68

|

7.26

|

2.34

|

0.12

|

1.30

|

0.48

|

0.81

|

0.01

|

|

TK20-023

|

5.3

|

12.8

|

7.5

|

6.07

|

14.15

|

18.94

|

4.49

|

2.86

|

0.06

|

1.01

|

0.44

|

0.55

|

0.02

|

|

Inc.

|

8.9

|

12.8

|

3.8

|

9.87

|

23.02

|

30.10

|

8.13

|

2.88

|

0.11

|

1.33

|

0.61

|

0.71

|

0.02

|

|

Inc.

|

8.9

|

10.5

|

1.6

|

11.05

|

25.79

|

33.08

|

9.80

|

1.67

|

0.13

|

1.27

|

0.54

|

0.72

|

0.01

|

|

TK21-034

|

66.3

|

73.0

|

6.7

|

4.57

|

10.67

|

14.30

|

3.42

|

2.05

|

0.05

|

0.81

|

0.39

|

0.40

|

0.01

|

|

Inc.

|

66.3

|

71.3

|

5.0

|

5.95

|

13.88

|

18.57

|

4.47

|

2.62

|

0.06

|

1.06

|

0.51

|

0.53

|

0.02

|

|

Inc.

|

66.3

|

68.0

|

1.7

|

9.54

|

22.26

|

29.46

|

7.50

|

3.51

|

0.09

|

1.64

|

0.73

|

0.88

|

0.02

|

|

TK21-035

|

4.9

|

9.3

|

4.5

|

7.45

|

17.38

|

22.98

|

5.89

|

2.70

|

0.08

|

1.06

|

0.54

|

0.50

|

0.02

|

|

Inc.

|

6.0

|

7.7

|

1.7

|

10.17

|

23.73

|

30.51

|

9.09

|

1.23

|

0.13

|

1.34

|

0.73

|

0.59

|

0.02

|

|

TK21-041

|

130.4

|

132.8

|

2.4

|

5.96

|

13.91

|

18.45

|

4.74

|

1.97

|

0.07

|

1.15

|

0.60

|

0.52

|

0.02

|

|

Inc.

|

131.2

|

132.8

|

1.7

|

8.28

|

19.31

|

25.53

|

6.65

|

2.60

|

0.09

|

1.52

|

0.78

|

0.71

|

0.03

|

(1) Reported widths are “drilled widths” not true widths.

(2) * Au_Equivalent is calculated for comparison purposes using recent spot prices, $8lb nickel, $4.4/lb copper, $19/lb cobalt, $2,700/oz palladium, $1,150/oz platinum, $1,900/oz gold.

(3) **Italicised orange highlighted results are previously released results see news release June 23, 2021

*Nickel Equivalent (“Ni_Eq”) and Copper Equivalent (“Cu_Eq”)

Nickel and copper equivalent is calculated using US$1,100 per ounce for palladium, US$950 per ounce for platinum, US$1,300 per ounce for gold, US$6,614 per tonne (US$3.00 per pound) for copper, US$15,432 per tonne (US$7.00 per pound) for nickel and US$30,865 per tonne (US$14 per pound) for Cobalt. This calculation is consistent with the commodity prices used in the Company’s September 2019 NI 43-101 Kaukua resource estimate.

Transaction Details

First Class Metals Ltd. – Pickle Lake (formerly, Pezim II) Property – 700 hectares – Grant of Earn-In Right

The Company can earn up to an 80% undivided working interest and a royalty Buy-Back Right, in the Earn-In Properties, over a 3-year earn-in period by incurring Canadian Exploration Expenses as follows:

Year 1 – an amount of not less than C$25,000 on or before the 1st anniversary of the Effective Date:

Year 2 – an amount of not less than C$135,000 (for an aggregate amount of $160,000) on or before the second anniversary of the Effective Date to earn a 51% interest; and

Year 3 – an amount of not less than C$165,000 (for an aggregate amount of not less than $325,000) and by preparing a National Instrument 43-101 (“NI43-101”) Technical Report with respect to the Earn-In Properties on or before the third anniversary of the Effective Date to earn an additional 29% (for a total aggregate 80% interest).

Upon the Company earning either a 51% or 80% working interest in the Earn-In Properties, a Joint Venture Agreement shall be formed and the Company shall be the operator. Should either party not fully participate in future expenditures, its ownership interest shall be diluted and if one party is diluted to a 10% working interest, that party (“NSR Holder”) shall be granted a 1% NSR Royalty in respect of the Earn-In Properties, while the Surviving Party shall be granted a 100% undivided working interest. The Surviving Party shall have the right at any time to purchase from the NSR Holder the 1% NSR Royalty by way of a one-time payment to the NSR Holder of $1,000,000 for the full 1% NSR.

A 2% NSR royalty (“Existing NSR) right in the Earn-In Properties is subject to a 100% Buy-Back Right in favor of the Joint Venture or Surviving Party. Each 1% of the NSR royalty can be bought back and extinguished at a fixed price of C$500,000.

Prospector –Cupa Lake Property – 250 hectare – Grant of Earn-In Right

The Company will earn a 100% working interest in the Prospector Earn-In Properties by incurring exploration expenses in relation to the properties, paying both cash and common share consideration, and granting a 1% Net Smelter Return Royalty (the “NSR Royalty”), as follows:

(i) Upon signing this agreement – Optionee to pay the Optionor $4,000 in cash and shall issue to the Optionor 10,000 common shares of Palladium One Mining Inc.

(ii) Year 1 – Canadian Exploration Expenses in the amount of not less than $20,000, and paying the Optionor $6,000 in cash and issuing the Optionor 20,000 common shares of Palladium One Mining Inc. on or before the 1st anniversary of the Effective Date;

(iii) Year 2 – additional Canadian Exploration Expenses in the amount of not less than $40,000 (for an aggregate amount of $60,000) and paying the Optionor $12,000 in cash and issuing the Optionor 30,000 common shares of Palladium One Mining Inc. on or before the second anniversary of the Effective Date; and

(iv) Year 3 – additional Canadian Exploration Expenses in the amount of not less than $120,000 (for an aggregate amount of not less than $180,000) and paying the Optionor $36,000 in cash and issuing the Optionor 30,000 common shares of Palladium One Mining Inc. on or before the third anniversary of the Effective Date

The Company shall maintain the right at any time to purchase from the Prospector one-half (50%) of the 1% NSR royalty interest by way of a one-time payment to the Prospector of $1,000,000.

Claim Purchase

The Company has acquired 3,500 hectares of new clams by re-imbursing staking costs to the original optionors of the Tyko Project. These new claims are considered part of the original option agreement and thus are subject to a 3% NSR for which one half (50%) can be purchased at any time for $1,500,000.

QA/QC

The Phase II drilling program was carried out under the supervision of Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company.

Drill core samples were split using a rock saw by Company staff, with half retained in the core box. The drill core samples were transported by company staff the Company’s core handling facility, to Actlabs laboratory in Thunder Bay, Ontario. Actlabs, is an accredited lab and are ISO compliant (ISO 9001:2015, ISO/IEC 17025:2017). PGE analysis was performed using a 30 grams fire assay with an ICP-MS or ICP-OES finish. Multi-element analyses, including copper and nickel were analysed by four acid digestion using 0.5 grams with an ICP-MS or ICP-OES finish.

Certified standards, blanks and crushed duplicates are placed in the sample stream at a rate of one QA/QC sample per 10 core samples. Results are analyzed for acceptance at the time of import. All standards associated with the results in this press release were determined to be acceptable within the defined limits of the standard used

About Tyko Ni-Cu-PGE Project

The Tyko Ni-Cu-PGE Project, is located approximately 65 kilometers northeast of Marathon Ontario, Canada. Tyko is an early stage, high sulphide tenor, nickel-copper (2:1 ratio) project with the most recent drill hole intercepts returning up to 9.9% Ni_Eq over 3.8 meters (8.1% Ni, 2.9% Cu, 1.3g/t PGE) in hole TK-20-023.

Qualified Person

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43-101.

About Palladium One

Palladium One Mining Inc. is an exploration company targeting district scale, platinum-group-element (PGE)-copper-nickel deposits in Finland and Canada. Its flagship project is the Läntinen Koillismaa or LK Project, a palladium-dominant platinum group element-copper-nickel project in north-central Finland, ranked by the Fraser Institute as one of the world’s top countries for mineral exploration and development. Exploration at LK is focused on targeting disseminated sulfides along 38 kilometers of favorable basal contact and building on an established NI 43-101 open pit resource.

ON BEHALF OF THE BOARD

“Derrick Weyrauch”

President & CEO, Director

For further information contact:

Derrick Weyrauch, President & CEO

Email: info@palladiumoneinc.com

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Palladium One Mining Inc. have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company’s expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, or other similar expressions. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in palladium and other commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and tax consequences to Canadian and U.S. Shareholders. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.