Palladium One IP Anomaly Increased over 75%, to more than 7 km at Kaukua South, Finland

Highlights

- Kaukua South IP anomaly expanded to over 7 kilometers in length, from ~4 kilometers.

- IP has proven to be a reliable tool for targeting high-grade mineralization.

- A new and, the largest and strongest

anomaly in the Kaukua area has been discovered immediately west of the NI43-101 Kaukua pit-constrained Resource.

- Additionally, a new large IP anomaly has been discovered on the far east side of Kaukua South. This may represent a new high-grade core zone of mineralization.

- The Kaukua South IP anomaly has been extended northwest and to the south of the Kaukua pit-constrained Resource, thereby potentially allowing for a significant expansion of the envisioned Kaukua open-pit.

- First release of a detailed Kaukua South long section.

July 07, 2021 – Toronto,

Ontario – Two additional Induced Polarization (“IP’) surveys were carried out in the Greater Kaukua Area to expand the known 4-kilometer long Kaukua South IP anomaly on both it’s eastern and western ends (see news release

March

11, 2021). The results of the new surveys confirm an over 75% increase in the Kaukua South IP chargeability anomaly, which is now greater than

7 kilometers in strike length, said Palladium One Mining Inc. (“Palladium One” or the “Company”) (TSXV: PDM, FRA: 7N11, OTC: NKORF) today. Drilling to date has confirmed extensive mineralization over the initial 4-kilometer Kaukua South anomaly, the 3-kilometer expansion suggests a much large resource endowment is possible (see Long Section – Figure 3)

Derrick Weyrauch, President and CEO of Palladium One said, “These new IP survey results highlight how robust the mineralized system is in the greater Kaukua area. In 2019, the Kaukua zone was only 1.2 kilometers long, we have now outlined a zone of over 7 kilometers in length, drilled and proven mineralization over 4 kilometers of strike length and are nearing completion of infill drilling in advance of a maiden NI43-101 resource for a 2-kilometer portion of the Kaukua South zone.”

IP has proven to be a reliable technique for discovering and outlining shallow higher grade PGE-Ni-Cu mineralization at Kaukua and elsewhere on the LK project. The

NI43-101 Kaukua pit constrained Resource and the Kaukua South zone were both

discovered as a result of testing IP chargeability anomalies. The Kaukua Resource only covers a strike length of 1 kilometer, whereas the LK project includes approximately 38 kilometers of strike length of the favourable basal unit in the Koillismaa mafic ultramafic complex.

Kaukua National Instrument

43-101 pit constrained Resource Estimate (see news release September

9, 2019)

|

Class |

Tonne |

Pd |

Pt |

Au g/t |

PGE |

Ni % |

Cu % |

Pd_Eq* |

Spot |

Spot |

|

|

g/t |

Oz |

||||||||||

|

Indicated |

10,985 |

0.81 |

0.27 |

0.09 |

1.17 |

0.09 |

0.15 |

1.80 |

635,600 |

2.02 |

1.32 |

|

Inferred |

10,875 |

0.64 |

0.20 |

0.08 |

0.92 |

0.08 |

0.13 |

1.50 |

525,800 |

1.64 |

1.08 |

Selection of previously

released Kaukua South drill results:

- 63 meters grading 3.5 g/t Palladium

equivalent* (4.1 g/t Gold equivalent**, 2.5% Copper equivalent**) in hole LK20-016 (see news release October 22, 2020) - 53 meters grading 2.1 g/t Palladium

equivalent* (2.3 g/t Gold equivalent**, 1.4% Copper equivalent**) in hole LK20-028 (see news release January 18, 2021)

•

47 meters grading 2.6 g/t

Palladium equivalent* (2.9 g/t

Gold equivalent**, 1.8% Copper equivalent** ) in hole LK20-045 (see news release March 18, 2021)

|

Hole |

From (m) |

To (m) |

Width (m) |

Pd g/t |

Pt g/t |

Au g/t |

Cu % |

Ni % |

|

LK20-016 |

23.5 |

86.2 |

62.7 |

1.84 |

0.64 |

0.14 |

0.18 |

0.15 |

|

LK20-028 |

42.6 |

95.5 |

52.9 |

1.00 |

0.36 |

0.08 |

0.11 |

0.11 |

|

LK20-045 |

122.8 |

170.2 |

47.4 |

1.20 |

0.42 |

0.11 |

0.17 |

0.14 |

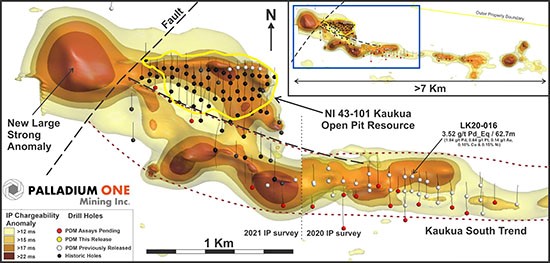

Including the recent surveys, the Company completed a total of 143 kilometers of IP on the LK Project. The 2021 IP surveys were a follow up to the highly successful 2020 survey which resulted in the discovery of Kaukua South. The current surveys consisted of two grids (Figure 1 and 2.).

Kaukua West IP Survey Grid

The objective of this survey was to extend the Kaukua South anomaly further to the west (Figure 1).

The survey indicates Kaukua South swings northwest and possibly parallel the Kaukua Resource Pit. This is an important drill target as little drilling has been done in this area, and if mineralization is found it could substantially widen the existing Kaukua Pit.

Additionally, this survey detected a significant IP anomaly to the west of a fault that was thought to cut off the Kaukua Resource Pit. This is the strongest

IP response within the whole Greater Kaukua Area and could represent the chance

to discover high-grade mineralization that could support an underground

PGE-Ni-Cu mine.

Figure 1. Western half of > 7 kilometer Long IP chargeability anomaly. Showing the new Kaukua West survey area.

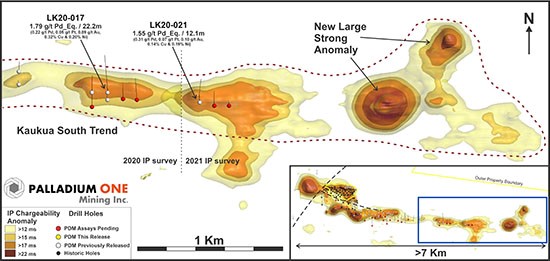

Kaukua East IP Survey Grid

The objective of this survey was to extend the Kaukua South anomaly at least two kilometers to the east (Figure 2).

Regional airborne magnetic data strongly suggested that favourable Kaukua-style mafic-ultramafic hosts rocks extend into this area. This hypothesis appears to be correct with a strong chargeability anomaly located on the far eastern side of the grid. This anomaly is a significant drill target and may represent another higher-grade core zone similar to the western portion of Kaukua South.

Figure 2. Eastern half of the > 7 kilometer IP chargeability anomaly showing the Kaukua East survey area

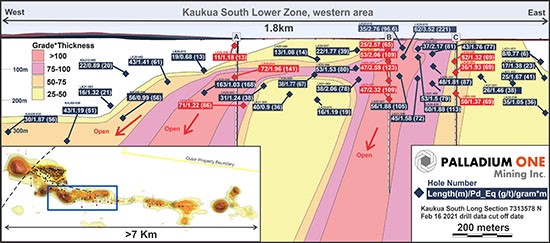

Figure 3. Kaukua South Long Section having a drill data cut-off date of February 16, 2021 (hole LK20-066). This section covers only the western portion of Kaukua South for which the Company plans to report an initial NI43-101 resource estimate in Q1 2022. The section is a vertical slice representing only the ~55° south dipping Lower Zone of Kaukua South. Intercepts are represented in both width (meters) and palladium equivalent (Pd_Eq*) grade as well as gram*meters (grade*width).

*Palladium

Equivalent (Pd_Eq)

Palladium equivalent is calculated using US$1,100 per ounce for palladium, US$950 per ounce for platinum, US$1,300 per ounce for gold, US$6,614 per tonne for copper, and US$15,4332 per tonne for nickel. This calculation is consistent with the calculation in the Company’s September 2019 NI 43-101 Kaukua resource estimate. Additionally, US$1,100 per ounce for palladium is consistent with the UBS January 2021 long-term consensus price forecast even though the current price of palladium is approximately US$2,800 per ounce.

**Spot Palladium, Copper and

Gold Equivalent

Spot palladium and gold equivalents are calculated using recent spot prices for comparison purposes using US$2,730 per ounce for palladium, US$1,090 per ounce for platinum, US$1,790 per ounce for gold, US$9,259 per tonne for copper, and US$18,298 per tonne for nickel

Qualified

Person

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43-101.

About Palladium One

Palladium One Mining Inc. is an exploration company targeting district scale, platinum-group-element (PGE)-copper nickel deposits in Finland and Canada. Its flagship project is the Läntinen Koillismaa or LK Project, a palladium dominant platinum group element-copper-nickel project in north-central Finland, ranked by the Fraser Institute as one of the world’s top countries for mineral exploration and development. Exploration at LK is focused on targeting disseminated sulfides along 38 kilometers of favorable basal contact and building on an established NI 43-101 open pit resource.

ON

BEHALF OF THE BOARD

“Derrick Weyrauch”

President & CEO,

Director

For

further information contact: Derrick Weyrauch, President & CEO

Email: info@palladiumoneinc.com

Neither

the TSX Venture Exchange nor its Market Regulator (as that term is defined in

the policies of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

This

press release includes “forward-looking information” that is subject

to a few assumptions, risks and uncertainties, many of which are beyond the

control of the Company. Statements regarding listing of the Company’s common

shares on the TSXV are subject to all of the risks and uncertainties normally

incident to such events. Investors are cautioned that any such statements are

not guarantees of future events and that actual events or developments may

differ materially from those projected in the forward-looking statements. Such

forward-looking statements represent management’s best judgment based on

information currently available. Factors that could cause the actual results to

differ materially from those in forward-looking statements include regulatory

actions and general business conditions. Such forward-looking information

reflects the Company’s views with respect to future events and is subject to

risks, uncertainties and assumptions, including those set out in the Company’s

annual information form dated April 29, 2020 and filed under the Company’s

profile on SEDAR at www.sedar.com.

The Company does not undertake to update forward?looking statements or forward?looking information, except as

required by law. Investors are cautioned that any such statements are not

guarantees of future performance and actual results or developments may differ

materially from those projected in the forward-looking statements.