Monday, July 12, 2021

Digital, Media & Entertainment Industry

What A Tolerant Fed Implies For Media Stocks

Michael Kupinski, DOR, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to end of report for Analyst Certification & Disclosures

Overview. Historically, consumer cyclical stocks have had trouble during periods of rising inflation and the likelihood of rising interest rates. But, the Fed is telecasting its view that the recent increase in inflation is “transitory” and likely will abate in the second half. Furthermore, the Fed appears “tolerant” of rising inflation for some time. This has favorable implications for media stocks. This report highlights the past quarter performance and our current favorites.

Digital Media: Back in the Saddle and Riding High. Ad Tech stocks recovered from the initial advertising downturn: while 2Q 2020 revenues declined, they rebounded strongly in 3Q and 4Q of 2020, and that strength has continued into the first half of 2021. There was a dramatic increase in M&A activity in 2Q 2021 compared to 2Q 2020. For the second quarter in a row, the most active sector was Digital Content.

Esports: An Eye on the Next Level. The Esports stocks took a breather in the second quarter following a strong first quarter performance. Notably, the stocks have still performed well over the last year beating the general market. The industry is gearing up for a return to “normalcy” with in person tournaments being planned and there is much thought outside the box in terms of venues. We remain constructive on this dynamic growth industry.

Broadcast Radio: Debt Reduction Heightens Interest. While the Noble Radio Index was up significantly in the latest quarter, an increase of 33.7%, there was a mixed performance for individual companies. It was a news driven quarter, with the shares of IHeart, Cumulus Media, and Urban One, having the best performance in the sector. In the absence of “event” news, will the upcoming quarterly results be the catalyst for higher stock valuations or will there be profit taking?

Broadcast Television: Does The FCC Have A Finger On The Scale? Broadcast stocks under performed the general market the last quarter, in part due to the disappointing performance of ViacomCBS, influencing this market cap weighted index. Individual stocks that made acquisitions, like Gray Television and Entravision, performed much better. We ponder whether broadcasters will diversify away from TV as the FCC seems to be tipping the scale in favor of Big Tech.

Overview

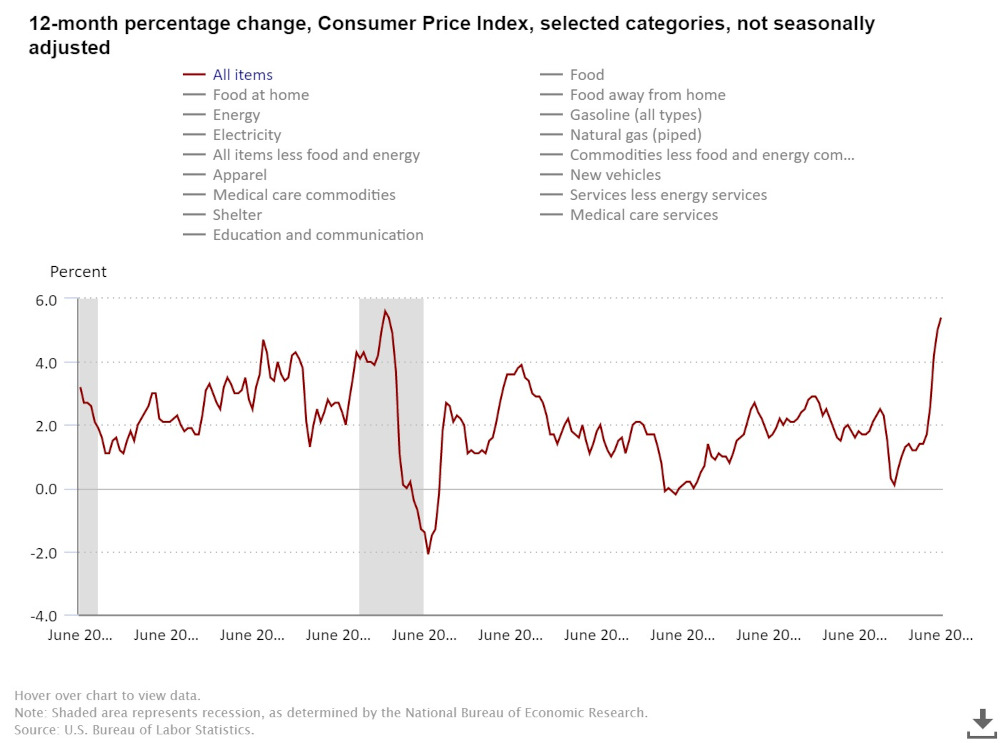

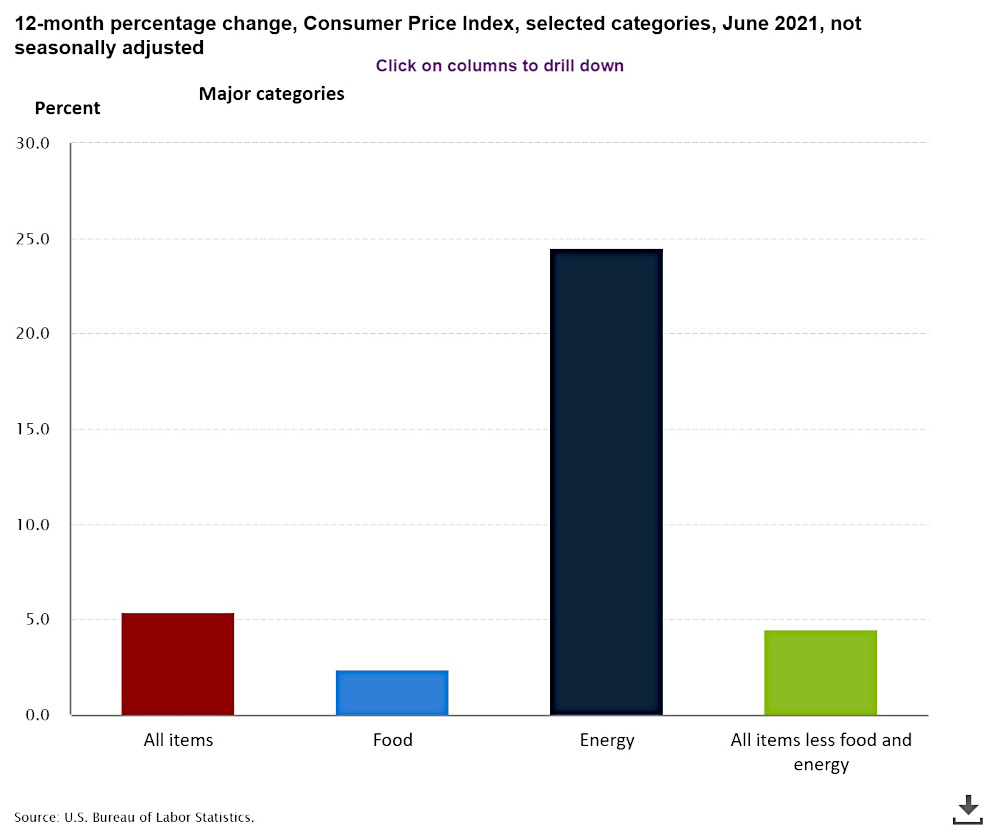

Consumer cyclical stocks typically do well in an early stage economic and advertising recovery. As such, it is no surprise that most Media stocks outperformed the general market in the latest quarter. While the general market, as measured by the S&P 500 Index, was up a solid 8.2%, the Traditional Media stocks outperformed with hefty gains in Radio, up 35.6% and Television, up 16.7%. There was a mixed performance in Digital Media, discussed later in this report. Investors appear optimistic regarding the economy. In the first quarter, GDP grew at an annualized rate of 6.4%, which is above the target growth rate between 2% and 3%. Such a strong GDP growth rate would imply a pick up in inflation and cause investor concern. Inflation is increasing. But, investors appear to have shrugged off the rise in inflation, which may be as much as 5.7% on an annualized basis in the second quarter. Why?

The jump in inflation is expected to be a function of an economy in recovery from a steep recession. A recovering economy on steroids from stimulus, however, that is driving consumer demand, putting pressure on commodity prices. In addition, there appears to be supply restraints driven by labor shortages, in turn fueling higher wages. For now, many investors and analysts believe that inflation will moderate for the balance of the year. This theory assumes that the rebounding economy will moderate on tougher year earlier comparisons and the prospect of slower consumer demand, easing pressure on supply and labor shortages. The Fed has indicated that the rising prices are “transitory” and that it is willing to tolerate a higher level of inflation for some time. Such an environment is favorable for consumer cyclical stocks. But, we would look for some trouble with the Media stocks, if, and when, the Fed changes course on interest rates. Cyclical stocks tend not to perform as well during periods of rising interest rates. As such, there will be an intense investor focus on the pace of the economy and inflation in the second half of this year and early 2022 as investors chart the prospect of a Fed interest rate hike. For now, investors appear willing to look beyond the current higher inflationary trends and the outlook for the Media stocks appear favorable, but likely will be choppy.

The strongest performance in the last quarter was in the Radio sector, up 33.7% in the latest quarter, continuing a streak that now extends a full year. The Radio stocks are up 66.4% over the past 12 months. Radio was one of the worst performing sectors during in the midst of the pandemic as the industry struggled with high debt loads at a time when advertising significantly fell. Investors appear more optimistic now, especially as many companies are aggressively paring down debt. Of the best performing stocks in the Noble Radio Index, most had favorable announcements regarding debt prepayments, including IHeartMedia (up 39.8% in the latest quarter) and, one of our favorites, Cumulus Media (up 60.8% in the latest quarter). Both companies announced debt prepayments of $250 million and $175 million, respectively in the latest quarter.

Overall, we remain constructive on the Media and Digital Media sectors given the favorable environment of improving economy, advertising recovery, and in the absence of a Fed raising interest rates. In addition, investors can look forward toward 2022, another Political advertising year which should boost revenue and cash flow. Such an environment has been favorable for media companies in the past. We encourage investors to be selective, however, given the prospect that the Fed may raise interest rates at some point next year. As such, focus on companies that have a clear path toward debt reduction, those that have diversified businesses or businesses with a strong growth element, and/or compelling stock valuations that do not fully account for the “hidden” value of its businesses. Our favorites include Townsquare Media, Entravision, and eSports Entertainment.

Digital Media

Ad Tech: Back in the Saddle and Riding High

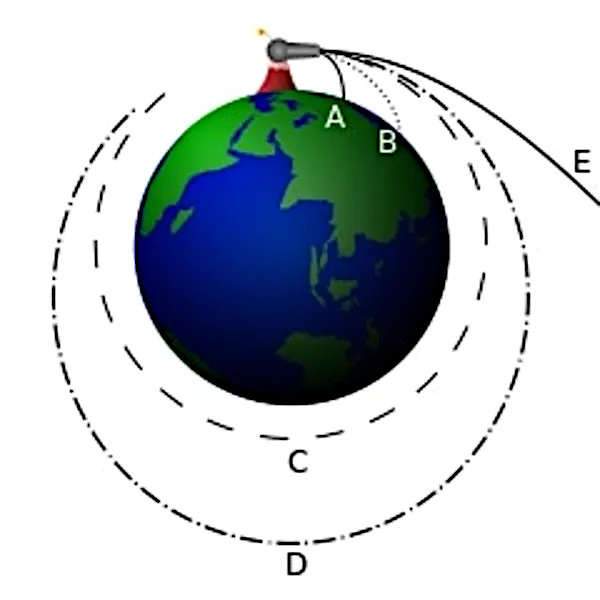

Last quarter, we noted that advertising technology (Ad Tech) stocks were the strongest performing sector over the previous 12-month period. The average stock in the Ad Tech sector at the end of the first quarter of 2021 was up 339% over the prior year. Part of this reflected the starting point: at the end of March 2020, concerns about Covid-19 and its impact on advertising had caused the average stock in the sector to decline by 27%. The other part of the story is how well Ad Tech stocks recovered from the initial advertising downturn: while 2Q 2020 revenues declined, they rebounded strongly in 3Q and 4Q of 2020, and that strength has continued into the first half of 2021. Figure #1 illustrates the stock performance in the Digital sectors in the latest quarter.

Figure #1

Digital Media Q2 Stock Performance

The strong recovery in operating results combined with the strong stock price recovery has led to a rebound in the Ad Tech IPO market. The first half of 2021 saw Pubmatic (PUBM), Viant (DSP), AppLovin (APP), DoubleVerify (DV) and Integral Ad Science (IAS) go public, while Outbrain and Teads filed to go public. Meanwhile, IronSource, Taboola and Innovid all agreed to go public via a reverse merger with a SPAC (Special Purpose Acquisition Company).

It hasn’t always been this way. In fact, the first group of Ad Tech companies to go public in the 2010-2016 time frame did not perform well on average. Ad Tech “1.0” companies saw an average decline of 4% one-year after their IPO. One reason some of these companies didn’t do well is that they missed expectations or guidance often within 2-3 quarters after going public. Another reason the group didn’t perform well is that 6 of the 9 Ad Tech 1.0 companies that went public were not profitable on an EBITDA basis, and many struggled to demonstrate a path to profitability.

It is interesting to note that the only three Ad Tech companies that remain public today from the 2010-2016 IPO group (The Trade Desk, Criteo, and Magnite, formerly The Rubicon Project) are the three companies that were EBITDA positive at the time they launched their IPO.

Two years ago, we noted that most Ad Tech companies were trading at 1.0x revenue or less, well below the 7.0x average IPO revenue multiple or 4.8x median IPO revenue multiple. The Ad Tech “2.0” IPOs (those that went public earlier this year) have performed quite well, with the average stock price return up 51% since their offering date. More importantly, Ad Tech valuations are at their highest levels ever. The 2021 Ad Tech IPO group has seen companies go public at 12.6x trailing twelve-month revenue. With these types of valuations, we expect to see more Ad Tech companies file to go public in the second half of 2021.

What accounts for the disparity between the Ad Tech “1.0” returns vs. the “2.0” returns? First of all the 2021 vintage of Ad Tech IPOs reflects a more mature set of companies than the Ad Tech 1.0 companies, with average LTM revenue 4.0x greater and median LTM revenue 2x greater than their Ad Tech 1.0 counterparts. Secondly, the 2021 vintage of Ad Tech companies is profitable. The average EBITDA margin of this year’s IPO group is 19%, versus an average EBITDA margin of 2% for the Ad Tech 1.0 group.

Besides the sector having more mature companies, another factor is how market has evolved from a desktop display advertising market to a mobile or video-centric/connected TV market. With viewership of video content moving from linear TV to on-demand viewing, Ad Tech companies are well positioned to benefit from the migration to IP-delivered content and ads. In March 2021, there were 54.4 million non-pay TV households in the U.S., up from 37.3 million three years ago. eMarketer estimates that by 2024, the number of non-pay TV households will eclipse the number of pay TV households. This should result in a massive advertising opportunity for Ad Tech companies that are well positioned to take advantage of the continued shift to streaming video.

SPACs Get in the Game

The Ad Tech sector has also caught the attention of SPACs. The multiples that SPACs are paying are even higher than the ones that Ad Tech companies have received through traditional IPOs. Of the three announced Ad Tech deals with SPACs, the average LTM revenue multiple is 16.6x and the median revenue multiple is 13.4x. The higher multiple typically reflects the higher revenue growth opportunities for the acquired company. For example, ironSource posted 83% revenue growth in 2020 and is projecting 37% growth in 2021.

After a couple of rough years in the market, during which Ad Tech stocks were shunned by Wall Street and the public companies traded at 1.0x revenues on average, finally it is good to be an Ad Tech company again.

While the digital content sector had the largest transaction value for the quarter, the mobile gaming and game developer sector had the largest number of transactions (21), and accounted for $7.8 billion in M&A during the quarter. Notable transactions include two reverse mergers into SPACs, including Super Group via Sports Entertainment Acquisition Corp (SEAH) for $4.6 billion and Jam City reverse merging with DPCM Capital in a $1.3 billion transaction. Take-Two Interactive was acquisitive with the $1.4 billion acquisition of Playdemic and the $380 million acquisition of soccer game developer Nordeus.

M&A Picks Up Considerably in 2Q 2021 vs. 2Q 2020

Not surprisingly, there was a dramatic increase in M&A activity in 2Q 2021 compared to 2Q 2020. Noble tracked 146 deals worth $30.0 billion in the Internet & Digital Media sector in 2Q 2021 vs. 100 deals worth $12.9 billion in 2Q 2020. For the second quarter in a row, the most active sector was Digital Content, with 54 transactions, followed by Marketing Technology transactions (38), and Information transactions (17).

From a deal value perspective, Digital Content deals led with $17.8 billion in transaction value, followed by the MarTech with $3.7 billion in deal value, followed by Agency & Analytics with $2.6 in deal value. Within the digital media sector, there were several subsectors that were active. Noble tracked 10 digital content deals worth $9.7 billion during the quarter, the largest of which are shown below, and includes Appollo Global’s $5.5 billion acquisition of Verizon Media (and its heritage properties Yahoo! and AOL).

Finally, the podcast sector remained active, with 7 transactions announced in the second quarter, with large media companies such as Spotify, Amazon, iHeart and Sony continuing to stake their claim in the sector.

While we are under represented in the Digital Technology and Marketing Technology space, we encourage investors to look at our closely followed company in the space, Harte Hanks. The HRTH shares trade at a steep discount to its peers on the basis of EV to Revenue and EV to EBITDA, 0.4 times versus the industry at 6.6 times. We believe that the company is on the road toward recovery, which is not fully reflected in its share price.

Esports: An Eye On The Next Level

As the previous Figure #1 illustrates, the Noble Esports Index under performed the general market in the latest quarter, down 12.7% versus an 8.2% gain for the general market. While this is certainly a disappointing performance, the Noble Esports Index is still up an impressive 45.2% for the last 12 months, outperforming the general market’s 38.6% advance. We believe that the weak Q2 performance was a victim of the success in Q1 and previous quarters. Only 3 of 16 stocks in the sector were up in the second quarter, but 9 are up for the year. We would note that there continues to be “hot” interest in the space with a large number of transactions. Of the 21 gaming deals, there were 4 esports transactions in the latest quarter.

Esports gained attention during the Covid crisis as gaming increased during stay at home mandates during the pandemic and as starved networks sought Esports programming in lieu of cancelled traditional sporting events. But, in many cases the industry struggled given the lack of in-person tournament play. As the economy has now reopened, large in-person events are now being scheduled. We believe that this will gain interest among consumers and advertisers, raising the visibility of this industry. It is important to note that in-person play is still novel and developing. Esports Entertainment’s Helix venues are just now getting back to normal, increasing capacity from as low as 25% during the pandemic. Furthermore, the industry is looking forward toward developing events at traditional movie cinemas. Why would cinemas consider esports tournament play? Large number of affluent consumers! While there are logistic issues regarding the technological aspect of this prospect, it is an example of the forward thinking for venue growth in the industry. We believe that expansion in platforms and infrastructure will be a key driver for growth in consumers and advertising support.

There are a large number of companies vying for investor attention in the esports/igaming space as Figure #2 illustrates. We anticipate that the number of public companies will diminish as size and financial capability to invest in this fast growing industry will be important. As such, investors may consider buying a basket of stocks in the industry, rather than placing a bet on just one or two. We encourage investors to view Esports Entertainment Group, one of our closely followed companies in the sector, among those in the basket. Esports Entertainment is becoming a vertically integrated company in the space, which includes sports betting and igaming.

Notably, on May 25th, Esports received the long-awaited approval from New Jersey Division of Gaming Enforcement of its gaming license. While the approval does not distinguish between sports and esports betting, the company entered its application with one of the largest states for gambling in an effort to become the preeminent platform for esports betting. The company’s Vie gambling software platform will go through regulatory testing labs to determine if the software is compliant and meets regulatory standards. We believe that the company could be up and running as soon as August. We estimate that the impact from the New Jersey license on fiscal 2022 revenues will be somewhat small, possibly $1 million in fiscal 2022, but grow meaningfully from there. Importantly, we believe that the company will pursue additional license opportunities in other States.

As Figure #2 highlights, Esports Entertainment trades among the cheapest in the industry on the basis of Enterprise Value to Revenues, the best comparable to its industry peers. The estimates do not incorporate the recently announced transactions. Management anticipates that fiscal 2022 revenue will be in the range of $100 million to $105 million. Our estimates will be reviewed upon closing of the announced transactions. Overall, we encourage investors to keep an eye on this developing space.

Figure #2

Broadcast Radio: Debt Reduction Heightens Interest

The Noble Radio Index had strong performance in the latest quarter, driven by “event” news. The Radio Index increased a strong 33.9% versus the general market, as measured by the S&P 500 Index, up 8.2%, in the latest quarter, as the following Figure #3 illustrates. The quarterly performance boosted the annual gains to an impressive 66.4% gain. A handful of stocks contributed to the latest quarter gains; IHeart, increased 39.8%; Cumulus Media was up 60.8%; and, Urban One, was up 186.9%. Aside from Urban One, which is discussed later, the thread for the industry’s outperformance was debt reduction. On June 22, IHeart announced that it made a prepayment of $250 million on its debt. Cumulus Media made a $175 million prepayment on June 25. A portion of the $175 million, ($140 million), came from the sale of its remaining towers and land in Bethesda, Maryland. Debt levels are relatively high for the industry. As Figure #4 illustrates, average debt to cash flow is an uncomfortable 9.1 times for the industry. With the stocks trading on average 10.7 times EV to EBITDA on 2021 estimates, debt reduction should have a meaningful impact on improving equity values. In addition, we believe that heightened interest in Radio stocks were related to the likelihood of strong revenue and cash flow gains in the quarter.

Figure #3

Traditional Media Q2 Stock Performance

The pandemic hit the Radio industry hard in the second quarter 2020. Stay at home mandates significantly reduced Radio advertising, especially in important drive times. Radio second quarter 2020 advertising dropped a whopping 55% on average. Given a rebounding economy, Radio advertising is expected to have a comeback in the second quarter 2021, estimated to be up an average of 44.8% year over year. EBITDA is estimated to be up an average of 356.8% in the second quarter, obviously from a very low base last year. The improving fundamentals should allow for solid debt reduction throughout the balance of the year.

In addition to the debt reduction theme, many companies are diversifying from its traditional Radio roots into other businesses. Urban One’s exceptional quarterly stock performance was driven by a city council approval in May of the company’s proposed $600 million casino project in Richmond, Virginia. The city council will need to vote on the terms of the agreement at a meeting to be held November 2 and voters will need to approve the November referendum.

As we look forward toward the second half, revenue comparisons will become more difficult given the improving revenue trends last year, especially given the lift from Political advertising in Q3 and Q4 2020. As such, there will likely be a deceleration in the rate of revenue growth in the second half from the second quarter revenue growth rate. Since cyclical stocks tend to follow revenue trends, we would not rule out the prospect of some profit taking in Radio stocks on the good news of the second quarter. Such a prospect would be viewed as an attractive opportunity to build positions. We expect that revenue trends will improve in 2022, especially given the influence of Political advertising in that year. In addition, we continue to expect that managements will continue to focus on aggressive debt reduction, which should help equity values. As such, we remain constructive on the industry and our favorites, which include Townsquare Media, Cumulus Media, and Salem Media.

Figure #4

Broadcast Television: Does The FCC Have A Finger On The Scale?

The Noble Television Index under performed the general market in the latest quarter, up a modest 3.1% versus the general market, as measured by the S&P 500 Index, up 8.2%. We view the performance as a breather from the strong gains achieved over the past year, up a solid 68.9% versus the general market, as measured by the S&P 500 Index, up 38.6% in the comparable time frame. As Figure #5 illustrates, the early 2021 stock performance was fueled by the strong gains from ViacomCBS, which collapsed in March, falling over 50%, following an announced equity raise, Wall Street downgrades, and Archegos Capital Management liquidating its entire position. With the Noble Television Index market cap weighted, the ViacomCBS performance adversely affected the performance of the Index. Given the sideways performance of ViacomCBS, the Noble Television Index has been lackluster in the quarter. This has masked the individual stock performance in the sector.

Figure #5

Trailing 12 Month Performance

Investors seem deal hungry. One of the strongest performers in the sector in the last quarter was Gray Television. In the latest quarter, Gray Television made back to back M&A announcements to acquire Quincy Media (Feb. 1st) and then Meredith’s broadcast television stations (May 3rd). The company revised upward the price for the Meredith transaction on June 3rd. Combined, after divestitures, these proposed acquisitions total $3.3 billion in transaction value. The Gray Television shares performed well in the quarter, outperforming the general market and many of its industry peers, up 27.2%.

While Gray plans to sell stations that it overlaps in order to avoid regulatory issues in closing the transactions, the company was recently dealt a warning from the FCC. The FCC proposed to fine Gray $518,000 for evading local TV limits. The FCC stated that its ownership of KTUU, an NBC affiliate, and KYES-TV in Anchorage, Alaska was in violation of local ownership rules. The FCC alleges that Gray-owned KYES ran programming that previously appeared on the CBS station, KTVA, which was owned by Denali Media, effectively running the number 1 and 2 network affiliated stations in a market. Gray notified the FCC that it has subsequently moved the CBS programming from KYES to a low power translator station and will air that programming on KTUU’s sub channel. The FCC issued a stern warning that future violations will be subject to divestiture or enforcement action. We believe that this “dust up” is a publicity nightmare for Gray while it is seeking approval for its recent acquisitions. Importantly, we do not believe that it will hinder regulatory approval for the acquisitions.

Given that the fine is the statutory maximum for a single violation that the FCC can impose, we believe that the move illustrates the regulatory scrutiny that the industry faces, even after the FCC relaxed some local media ownership rules. We are concerned that the FCC’s unwillingness and lack of leadership to further lift local and national ownership restrictions and caps on the broadcast television industry may constrain its ability to compete with the likes of Big Tech companies, which largely are unchecked. The FCC’s recent relaxation of media ownership rules, particularly the cross ownership restrictions, appear to us to be too little and too late. In my view, the FCC is largely to blame for the decimation of the newspaper industry. So, far, the Broadcast Television industry has attractive avenues for growth, but the inability to gain national scale and compete locally against far larger companies could be problematic in the future.

Another company in the sector, Entravision, diversified away from its Broadcast TV roots. In the latest quarter, the company announced the planned purchase of MediaDonuts, an Asian based digital marketing services company. With the planned acquisition, Entravision will have shifted its revenue composition from one leaning on its TV business just a few years ago toward its Digital Media businesses accounting, for 75% of total company revenues. In the TV group, Entravision had the strongest performance, up a solid 65.3%, leading all television stocks in the latest quarter.

For now, the fundamental environment for the broadcast television industry appear favorable, with advertising rebounding. In addition, we anticipate that investors will begin to focus on the biennial elections and the influx of Political advertising. Typically, the broadcast stocks perform best the year prior to an election year, up an average of nearly 20%. This year, the stocks appear to be on track to exceed the average performance, a combination of a steep advertising recovery, compelling stock valuations, and heightened M&A activity. Notably, the M&A activity has also diversified many of the broadcasters. The recent acquisitions by E.W. Scripps positioned that company in the growing OTT market. Most recently, Entravision transformed its company in a series of Digital Media acquisitions that now account for 75% of its revenues. As ownership caps are reached, we believe that more companies will seek growthier opportunities outside of the traditional Television space. We remain constructive on the television stocks, given compelling valuations and a favorable fundamental outlook, as indicated in Figure #6. Our current favorites include E.W. Scripps, Gray Television and Entravision, which are among the cheapest in its peer set. In our view, these stocks are deserving of higher stock valuations given the above average revenue and cash flow growth opportunities.

Figure #6

Companies mentioned in this report:

Cumulus Media

E.W. Scripps

Entravision

Esports Entertainment

Gray Television

Harte Hanks

Salem Media

Townsquare Media

GENERAL DISCLAIMERS

All statements or opinions contained herein that include the words “we”, “us”, or “our” are solely the responsibility of Noble Capital Markets, Inc.(“Noble”) and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results.

Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES

This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. (“Noble”). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst’s judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report.

The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

Noble is not a market maker in any of the companies mentioned in this report. Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) with any or all of the companies mentioned in this report within the next 3 months

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Director of Research. Senior Equity Analyst specializing in Media & Entertainment. 34 years of experience as an analyst. Member of the National Cable Television Society Foundation and the National Association of Broadcasters. BS in Management Science, Computer Science Certificate and MBA specializing in Finance from St. Louis University.

Named WSJ ‘Best on the Street’ Analyst six times.

FINRA licenses 7, 24, 66, 86, 87

WARNING

This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to Noble Capital Markets, Inc. by an investment advisor, that advisor may receive a benefit in respect of transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by Noble Capital Markets, Inc.. This report may not be reproduced, distributed or published for any purpose unless authorized by Noble Capital Markets, Inc.

RESEARCH ANALYST CERTIFICATION

Independence Of View

All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation

No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public

appearance and/or research report.

Ownership and Material Conflicts of Interest

Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.

| NOBLE RATINGS DEFINITIONS |

% OF SECURITIES COVERED |

% IB CLIENTS |

| Outperform: potential return is >15% above the current price |

83% |

31% |

| Market Perform: potential return is -15% to 15% of the current price |

3% |

1% |

| Underperform: potential return is >15% below the current price |

0% |

0% |

NOTE: On August 20, 2018, Noble Capital Markets, Inc. changed the terminology of its ratings (as shown above) from “Buy” to “Outperform”, from “Hold” to “Market Perform” and from “Sell” to “Underperform.” The percentage relationships, as compared to current price (definitions), have remained the same.

Additional information is available upon request. Any recipient of this report that wishes further information regarding the subject company or the disclosure information mentioned herein, should contact Noble Capital Markets, Inc. by mail or phone.

Noble Capital Markets, Inc.

225 NE Mizner Blvd. Suite 150

Boca Raton, FL 33432

561-994-1191

Noble Capital Markets, Inc. is a FINRA (Financial Industry Regulatory Authority) registered broker/dealer.

Noble Capital Markets, Inc. is an MSRB (Municipal Securities Rulemaking Board) registered broker/dealer.

Member – SIPC (Securities Investor Protection Corporation)

Report ID: 23816