OpRegen® Clinical Data Continues to Demonstrate Functional and Anatomical Improvements in Patients With Dry AMD With Geographic Atrophy

CARLSBAD, Calif.–(BUSINESS WIRE)–Jul. 20, 2021–

Lineage Cell Therapeutics, Inc.

(NYSE American and TASE: LCTX), a clinical-stage biotechnology company developing allogeneic cell therapies for unmet medical needs, today reported updated interim results from its ongoing, 24-patient Phase 1/2a clinical study of its lead product candidate, OpRegen. OpRegen is an investigational cell therapy consisting of allogeneic retinal pigment epithelium (RPE) cells, administered one time to the subretinal space, for the treatment of dry age-related macular degeneration (AMD) with geographic atrophy (GA). These updated results include a minimum of 6 months of follow-up in all 24 patients treated with OpRegen, including all 12 patients treated in Cohort 4, which had better baseline vision and smaller areas of GA at baseline than earlier cohorts.

“I am excited about the observed changes in visual acuity that show strong trends towards sustained vision improvement in almost all of the treated eyes of Cohort 4 patients as compared to their untreated fellow eyes, which continue to show progression of atrophic AMD and decline of vision,” stated Principal Investigator

Allen C. Ho, M.D. FACS, Wills Eye Hospital Attending Surgeon and Director of

Retina Research, Professor of Ophthalmology,

Thomas Jefferson University. “Based on the observed retinal changes suggestive of restoration of critical tissue in the area of atrophy, the beneficial functional visual improvements may be explained by structural changes as a result of OpRegen therapy and these changes may be durable in effect. We look forward to continuing to follow all study patients and reporting our efficacy and safety observations over time.”

“This update further reinforces our view that a suspension of OpRegen RPE cells can generate clinically meaningful anatomical and functional outcomes in patients with dry AMD with GA, particularly in those with earlier-stage atrophic disease,” stated

Brian M. Culley, Lineage CEO. “Not only has OpRegen generated the only known cases of retinal tissue restoration in previously confirmed atrophic areas in humans, but it also has provided a durable functional benefit of improved visual acuity in the majority of the twelve better vision, earlier-stage patients treated in the ongoing clinical study. As these data continue to mature, we will work with our advisors in preparation for a meeting with the FDA this year, where we intend to discuss our proposed next steps for further clinical development of OpRegen. Our belief is that RPE cell transplants can provide outcomes beyond the reach of traditional pharmaceutical approaches, which are limited to a subset of biological pathways, and which may fail to provide the maximal restorative benefit available to patients. We aim to position OpRegen RPE transplants as the best available option in the race to address the large unmet need in dry AMD with GA and establish Lineage as the pre-eminent allogeneic cell therapy company.”

Overall, 10/12 (83%) of the Cohort 4 patients’ treated eyes continued to be at or above baseline visual acuity at their last assessment, based on per protocol scheduled visits ranging from 6 months to approximately 3 years post-transplant. Improvements in best corrected visual acuity (BCVA) for Cohort 4 patients reached up to +19 letters on the Early Treatment Diabetic Retinopathy Study (ETDRS) chart. In contrast, 10/12 (83%) of the patients’ untreated eyes were below pre-treatment baseline values at the same time points. Among the six Cohort 4 patients treated between September and

November 2020, three (50%) continue to exhibit marked improvements in BCVA ranging from +8 to +18 letters at their last scheduled assessments of at least 6 months. Two additional Cohort 4 patients experienced a gain between +2 and +4 letters from their baseline values. One Cohort 4 patient measured 6 letters below baseline. Previously reported structural improvements in the retina, decreases in drusen density, and a trend toward slower GA progression in treated compared to untreated eyes continued to be present. Overall, OpRegen has been well tolerated with no unexpected adverse events or serious adverse events. Evidence of durable engraftment of OpRegen RPE cells has extended to more than 5 years in the earliest treated patients, supporting the potential for OpRegen to be a one-time treatment.

Three patients with evidence of retinal restoration and confirmed history of GA growth continue to demonstrate areas of retinal restoration as of their last assessment, ranging from 6 months to approximately 3 years after treatment. Notably, on Optical Coherence Tomography (OCT) analyses, the first Cohort 4 patient with evidence of retinal restoration and confirmed history of GA growth, has demonstrated zero growth in the area of atrophy (GA) almost 3 years following treatment with OpRegen. This is unprecedented due to the progressive nature of the disease. Applying the expected rate of progression based on changes from historical images to the baseline assessment, the size of the atrophic lesion at the visit would have been 4.58 mm using square root transformation (SQRT). Instead, the lesion measured at 2.8 mm SQRT, which was the same as it was at baseline, meaning there was no GA growth over almost 3 years, representing a 63.6% (1.78 mm SQRT) smaller area of GA than was expected. The area of GA in this patient’s untreated fellow eye, which was less severely impacted at baseline, progressed as expected from 3.63 mm to 4.01 mm using SQRT, an increase of 10.5% or 0.38 mm. Notably, microperimetry data collected at the Year 2 and Year 3 post-treatment study visits indicated improvements in the patient’s ability to discern different intensities of light and the patient has experienced clinically significant improvement in visual acuity for more than 2 years, at one point gaining 12 letters on an ETDRS scale. In addition to positive anatomical changes, all three patients with evidence of retinal tissue restoration had visual acuity increases above baseline levels within 9 months post-treatment and visual acuity has remained relatively stable over time compared to their fellow eyes.

Outer retinal layer restoration, which was observed using clinical high-resolution OCT, was evidenced by the presence of new areas of RPE monolayer with overlying ellipsoid zone, external limiting membrane, and outer nuclear layer, which were not present at the time of baseline assessment. These findings suggest integration of the new RPE cells with functional photoreceptors in areas that previously showed no presence of these cells. These effects were most prominent in the transitional areas around the primary area of GA.

These findings of retinal restoration have been confirmed utilizing multiple imaging technologies. The use of multiple imaging modalities differs from traditional assessment of GA progression, which employs only fundus autofluorescence (FAF) to assess changes in the total surface area of the apparent GA over time. Using only FAF may fail to identify structural changes that can be observed only with the addition of OCT imaging. The use of OCT allows for a more precise determination of changes in retinal thickness, organization, and overall health of the retina in areas of potential atrophy, benefits which are possible with cell transplant therapy.

The loss of RPE cells over time creates progressively larger areas of atrophy in the adult retina, leading to impaired vision or complete blindness, a condition known as atrophic AMD. Humans lack the innate ability to regenerate retinal tissue and replace lost retina cells, which led to a presumption that progression of GA may someday be slowed or halted but could not be reversed. The unique findings from the ongoing OpRegen clinical study support a different view, in which an RPE cell transplant can potentially replace or rescue retinal cells in patients who suffer from retinal lesions or degeneration. The totality of these findings supports the view that atrophic AMD is not an irreversible, degenerative condition and that some portion of diseased retinal tissue may be recoverable.

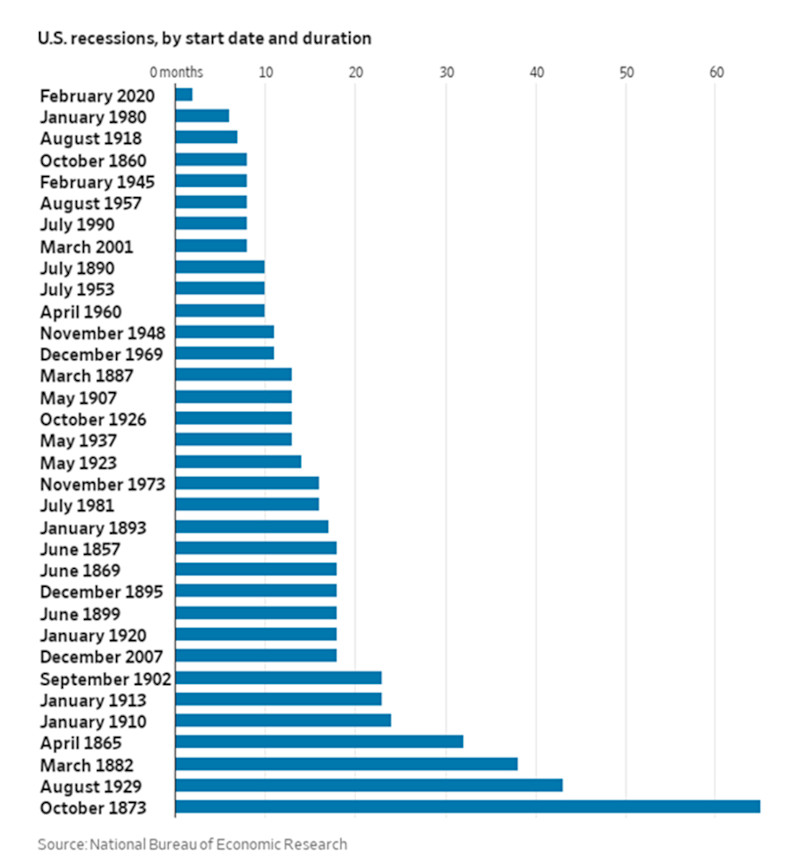

Improvements in Visual Acuity Observed with OpRegen RPE Transplant. The graph represents the mean changes in Best Corrected Visual Acuity (BCVA) for Cohort 4 patients’ treated eye when compared to their fellow eye over a period of 12 months.

About OpRegen

OpRegen is currently being evaluated in a Phase 1/2a open-label, dose escalation safety and efficacy study of a single injection of human retinal pigment epithelium cells derived from an established pluripotent cell line and transplanted subretinally in patients with advanced dry AMD with GA. The study enrolled 24 patients into 4 cohorts. The first 3 cohorts enrolled only legally blind patients with BCVA of 20/200 or worse. The fourth cohort enrolled 12 better vision patients (BCVA from 20/65 to 20/250 with smaller mean areas of GA). Cohort 4 also included patients treated with a new “thaw-and-inject” formulation of OpRegen, which can be shipped directly to sites and used immediately upon thawing, removing the complications and logistics of having to use a dose preparation facility. The primary objective of the study is to evaluate the safety and tolerability of OpRegen as assessed by the incidence and frequency of treatment emergent adverse events. Secondary objectives are to evaluate the preliminary efficacy of OpRegen treatment by assessing the changes in ophthalmological parameters measured by various methods of primary clinical relevance. OpRegen has been well tolerated to date and there have been no new, unexpected ocular or systemic adverse events or serious adverse events that have not been previously reported. OpRegen is a registered trademark of

Cell Cure Neurosciences Ltd., a majority-owned subsidiary of

Lineage Cell Therapeutics, Inc.

About Age-Related Macular Degeneration

Age-related macular degeneration (AMD) is an eye disease that can blur the sharp, central vision in patients and is the leading cause of vision loss in people over the age of 60. There are two forms of AMD: dry (atrophic) AMD and wet (neovascular) AMD. Dry (atrophic) AMD is the more common of the two forms, accounting for approximately 85-90% of all cases. In atrophic AMD, parts of the macula get thinner with age and accumulations of extracellular material between Bruch’s membrane and the RPE, known as drusen, increase in number and volume, leading to a progressive loss of central vision, typically in both eyes. Global sales of the two leading wet AMD therapies were in excess of

$10 billion in 2019. Nearly all cases of wet AMD eventually will develop the underlying atrophic AMD if the newly formed blood vessels are treated correctly. There are currently no

U.S. Food and Drug Administration (FDA), or

European Medicines Agency, approved treatment options available for patients with atrophic AMD.

About Lineage Cell Therapeutics, Inc.

Lineage Cell Therapeutics is a clinical-stage biotechnology company developing novel cell therapies for unmet medical needs. Lineage’s programs are based on its robust proprietary cell-based therapy platform and associated in-house development and manufacturing capabilities. With this platform Lineage develops and manufactures specialized, terminally differentiated human cells from its pluripotent and progenitor cell starting materials. These differentiated cells are developed to either replace or support cells that are dysfunctional or absent due to degenerative disease or traumatic injury or administered as a means of helping the body mount an effective immune response to cancer. Lineage’s clinical programs are in markets with billion dollar opportunities and include three allogeneic (“off-the-shelf”) product candidates: (i) OpRegen®, a retinal pigment epithelium transplant therapy in Phase 1/2a development for the treatment of dry age-related macular degeneration, a leading cause of blindness in the developed world; (ii) OPC1, an oligodendrocyte progenitor cell therapy in Phase 1/2a development for the treatment of acute spinal cord injuries; and (iii) VAC2, an allogeneic dendritic cell therapy produced from Lineage’s VAC technology platform for immuno-oncology and infectious disease, currently in Phase 1 clinical development for the treatment of non-small cell lung cancer. For more information, please visit www.lineagecell.com or follow the Company on Twitter @LineageCell.

Forward-Looking Statements

Lineage cautions you that all statements, other than statements of historical facts, contained in this press release, are forward-looking statements. Forward-looking statements, in some cases, can be identified by terms such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “expect,” “could,” “can,” “plan,” “potential,” “predict,” “seek,” “should,” “would,” “contemplate,” “project,” “target,” “tend to,” or the negative version of these words and similar expressions. Such statements include, but are not limited to, statements relating to the potential benefits of treatment with OpRegen in dry AMD patients with GA, the significance of clinical data reported to date from the ongoing Phase 1/2a study of OpRegen, including the findings of retinal tissue restoration, plans to meet with the FDA in 2021 to discuss OpRegen’s clinical development, and Lineage’s potential to become the pre-eminent allogeneic cell therapy company. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Lineage’s actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by the forward-looking statements in this press release, including risks and uncertainties inherent in Lineage’s business and other risks in Lineage’s filings with the

Securities and Exchange Commission (SEC). Lineage’s forward-looking statements are based upon its current expectations and involve assumptions that may never materialize or may prove to be incorrect. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. Further information regarding these and other risks is included under the heading “Risk Factors” in Lineage’s periodic reports with the

SEC, including Lineage’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the

SEC and its other reports, which are available from the SEC’s website. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were made. Lineage undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

Lineage Cell Therapeutics, Inc. IR

Ioana C. Hone

(ir@lineagecell.com)

(442) 287-8963

Solebury Trout IR

Gitanjali Jain Ogawa

(Gogawa@soleburytrout.com)

(646) 378-2949

Russo Partners – Media Relations

Nic Johnson or

David Schull

Nic.johnson@russopartnersllc.com

David.schull@russopartnersllc.com

(212) 845-4242

Source:

Lineage Cell Therapeutics, Inc.