Namaste Technologies Reports Second Quarter 2021 Financial Results

- Three Consecutive Quarters of Improved Gross Margins

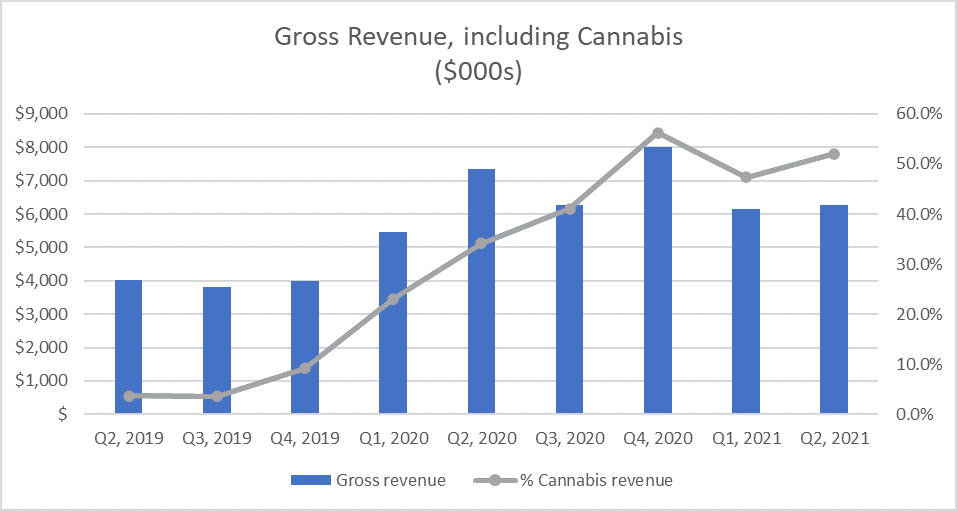

- Cannabis Revenue Increased by 18% in Q2 2021 Compared to Q2 2020

- EBITDA Improvements in All Operating Segments

TORONTO, July 29, 2021 (GLOBE NEWSWIRE) — Namaste Technologies Inc. (“Namaste” or the “Company”) (TSXV: N) (FRANKFURT: M5BQ) (OTCMKTS: NXTTF) a marketplace platform for cannabis and wellness products, today reported its financial results for the second quarter ended May 31, 2021 (“Q2 2021”) with references made to financial results for the second quarter ended May 31, 2020 (“Q2 2020”). All financial figures are in Canadian dollars unless otherwise indicated.

Q2 2021 Highlights:

- Three consecutive quarters of improved gross margins before inventory adjustments as a result of increased sales of higher margin products.

- Gross revenue for Q2 2021 was $6.3 million, of which a strong 52% is attributable to cannabis revenues, with cannabis revenues growing 18% in Q2 2021 compared to Q2 2020.

- Operating expenses for the six-month period decreased by 15% compared to the same period in 2020 and contributed to improved EBITDA in all operating segments. Overall EBITDA across operating segments improved 33% in Q2 2021 and 30% in Q2 YTD 2021.

- Inventories decreased by 14% to $5.2 million in Q2 2021 ($6.0 million in the first quarter ended February 28, 2021) demonstrating continued improved inventory management practices.

- The Company’s working capital position remains strong at $25 million as at May 31, 2021.

Re cent Corporate Highlights:

- The Company’s wholly owned subsidiary CannMart Inc. (“CannMart”), received a Health Canada renewal of its standard licence for processing and sale of cannabis under the applicable regulations.

- CannMart entered into a number of supply agreements including with CannTx Life Sciences Inc. (CannMart exclusive distributor on a SKU-by-SKU basis), Rilaxe Canna Inc. (CannMart exclusive distributor) and Safari Flower Co. to expand its product offering to both its provincial cannabis board buyers and its own medical customers across Canada at CannMart.com.

- The Company’s wholly owned subsidiary CannMart Labs Inc., (“CannMartLabs”) submitted its application for a Health Canada Controlled Drugs and Substances Dealer’s Licence for future storage and distribution of the following controlled substances: psilocybin, psilocin, ketamine, LSD, DMT and MDMA.

- As part of our sustainability initiative, the Company successfully subleased its Toronto office location until expiry of its lease on October 30, 2024, confirming its commitment to finding top talent all over the world. The decision made by the Company is an initial step towards a long-term commitment to developing an Environment, Social and Governance (ESG) plan for meaningful action to protect our planet.

- The Company’s wholly owned Swedish subsidiary Findify AB, achieved its best ever consecutive four months of sales in the first six calendar months of 2021 with revenue per new customer up 54% and subscription sales value up 106% compared to the same period last year.

- CannMart, signed a Master Distribution Agreement with Rapid Dose Therapeutics Corp. (“RDT”) to be the exclusive distributor of their innovative RDT branded products across Canada.

- CannMart Labs in-house brand “Roilty” received its first purchase orders from the provinces of Manitoba and Saskatechewan for its consumer-focused cannabis concentrates.

- SKU listings at CannMart.com increased 589% to over 800 as of the end of Q2 2021, compared to 116 in Q1 2021 as CannMart received a record amount of requests from vendors across North America to list their products onto the CannMart.com platform.

“We are very pleased with the accomplishments we have made on the operating front which include increased margins over the last three quarters as well as an improvement in EBITDA within all our operating segments,” said Meni Morim, CEO of Namaste. “While this is important, revenues were not where we wanted them to be as Covid-19 continued to have an impact on retail establishments. However, with the reduction of Covid-19 restrictions enabling greater access to retail stores, Covid-19 will have less of an impact on future revenues combined with the continuously improving margins will have a synergistic effect on our financials moving forward. In addition, we believe our various initiatives, including the impending launch of CannMart Labs, our in-house “Roilty” shatter brand hitting the shelves in the coming months, the upcoming launch of our nutraceuticals business in Q4 2021 as well as continuing to increase the number of SKUs available at CannMart.com will contribute to sales growth and improved margins over the next few quarters. We continue to be focused on controlling our operating expenses, improving gross margins and selling the right product mix to position Namaste on a clear path and trajectory towards profitability.”

For further details, the complete Financial Statements for the second quarter ended May 31, 2021 and the related Management’s Discussion & Analysis can be accessed on the Company’s SEDAR profile at www.sedar.com.

NON IFRS FINANCIAL MEASURES

Management evaluates the Company’s performance using a variety of measures, including “Net loss before income tax, depreciation and amortization” and “Adjusted EBITDA”. The non-IFRS measures discussed below should not be considered as an alternative to or to be more meaningful than revenue or net loss. These measures do not have a standardized meaning prescribed by IFRS and therefore they may not be comparable to similarly titled measures presented by other publicly traded companies and should not be construed as an alternative to other financial measures determined in accordance with IFRS.

The Company believes these non-IFRS financial measures provide useful information to both management and investors in measuring the financial performance and financial condition of the Company.

Management uses these and other non-IFRS financial measures to exclude the impact of certain expenses and income that must be recognized under IFRS when analyzing consolidated underlying operating performance, as the excluded items are not necessarily reflective of the Company’s underlying operating performance and make comparisons of underlying financial performance between periods difficult. From time to time, the Company may exclude additional items if it believes doing so would result in a more effective analysis of underlying operating performance. The exclusion of certain items does not imply that they are non-recurring.

(i) Current and deferred income taxes, depreciation and amortization, and share-based compensation were excluded from the Adjusted EBITDA calculation as they do not represent cash expenditures.

(ii) Other income consisting of gain on disposal of subsidiary, interest income, realized gain on disposition of AFS investments, unrealized gain on derivatives and other miscellaneous non-recurring income were excluded from Adjusted EBITDA calculation.

(iii) Non-recurring costs related to restructuring and legacy issues were excluded from Adjusted EBITDA calculation.

(iv) Impairment loss relating to goodwill, customer list, domains and brand names were excluded from Adjusted EBITDA calculation.

(v) Impairment loss relating to receivable is a provision for expected credit loss to an associate and was excluded from Adjusted EBITDA calculation.

(vi) Share of associates loss, net of tax, is excluded due to lack of control.

About Namaste Technologies Inc.

Namaste Technologies is a marketplace platform for cannabis and wellness products. At CannMart.com, the Company provides Canadian medical customers with a diverse selection of hand-picked products from a multitude of federally licensed cultivators and US customers with access to hemp-derived CBD and smoking accessories. The Company also distributes licensed and in-house branded cannabis and cannabis derived products in Canada through a number of provincial government control boards and retailing bodies and facilitates licensed cannabis retailer sales online in Saskatchewan. Namaste’s global technology and continuous innovation address local needs in a burgeoning cannabis industry requiring smart solutions.

Information on the Company and its many products can be accessed through the links below:

NamasteTechnologies.com

NamasteMD.com

Cannmart.com

For more information please contact:

Namaste Technologies Inc.

Meni Morim, CEO

Edward Miller, VP Investor Relations

Ph: 647-362-0390

Email: ir@namastetechnologies.com

Source: Namaste Technologies Inc

FORWARD-LOOKING INFORMATION – This news release contains “forward-looking information” within the meaning of applicable securities laws. All statements contained herein that are not historical in nature contain forward-looking information. Forward-looking information can be identified by words or phrases such as “may”, “expect”, “likely”, “should”, “would”, “plan”, “anticipate”, “intend”, “potential”, “proposed”, “estimate”, “believe” or the negative of these terms, or other similar words, expressions and grammatical variations thereof, or statements that certain events or conditions “may” or “will” happen.

The forward-looking information contained herein, including, without limitation, statements related to the Company’s expectations relating to increasing top line revenue, its intended adjustment to its product mix, the Company’s expected launch of new products and the creation of its new nutraceutical division, the Company’s continued focus on improving margins toward its goal to be profitable, are made as of the date of this press release and are based on assumptions management believed to be reasonable at the time such statements were made, including, without limitation, Namaste’s ability to maintain momentum of expanding its business, its ability to broaden its total addressable market and to evolve into a recognized wellness company, the Company’s expectation that the nutraceutical and wellness market and potentially the market for psychedelics will develop as currently anticipated, the nutraceutical market will continue to be a multi-billion dollar high-margin market, the introduction of new products and brands will generate additional revenue, the ability of the Company to turn inventory as anticipated, the impact and duration of covid-19 lockdowns on the business of the Company diminishing in the future, as well as other considerations that are believed to be appropriate in the circumstances. While the Company considers these assumptions to be reasonable based on information currently available to management, there is no assurance that such expectations will prove to be correct. By its nature, forward-looking information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities will not be achieved. A variety of factors, including known and unknown risks, many of which are beyond our control, could cause actual results to differ materially from the forward-looking information in this press release. Such factors include, without limitation: the inability of the Company to develop its business as anticipated and to increase revenues and/or its profitable margin on such revenues, unanticipated changes to current regulations that would adversely impact the Company’s business and proposed business and other regulatory risks, risks relating to the Company’s ability to execute its business strategy and the benefits realizable therefrom and risks specifically related to the Company’s operations. Additional risk factors can also be found in the Company’s current MD&A and annual information form, both of which have been filed under the Company’s SEDAR profile at www.sedar.com. Readers are cautioned not to put undue reliance on forward-looking information. The Company undertakes no obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable law. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release or has in any way approved or disapproved of the contents of this press release.

Source: Namaste Technologies Inc.