Indonesia Energy Corporation Successfully Completes the Drilling of First New Well at Kruh Block to Final Total Depth

IEC Will Now Conduct Logging and Production Testing

JAKARTA, INDONESIA and DANVILLE, CA / ACCESSWIRE / June 4, 2021 / Indonesia Energy Corporation (NYSE American:INDO) (“IEC”), an oil and gas exploration and production company focused on Indonesia, today announced that it has successfully completed the drilling of its first new well at its Kruh Block (known as “Kruh 25”) to its final total depth.

The Kruh 25 well was drilled to a depth of 3,368 feet. The going forward program will be to now conduct wireline logging operations on the well (which has already commenced) which should last approximately one week, and then perforation will take place on the well to test production rates. IEC expects these final operations on the well to be completed in about 20 days. Accordingly, IEC will now plan to hold its previously announced Investor Conference call on the well results during the week of June 28, 2021.

Mr. Frank Ingriselli, IEC’s President, commented, “We are excited that our first of our three anticipated back-to-back wells at the Kruh Block has reached total depth and logging and production testing will now commence. IEC’s three back-to-back well drilling campaign is targeted to significantly grow our cash flow as we seek to maximize returns on our investments and grow shareholder value.”

IEC also notes the recently issued equity research coverage on the company by Noble Capital Markets and Stonegate Capital Partners. Links to these research reports can be found under the investor tab on IEC’s website: www.indo-energy.com

Readers are cautioned that all reports on IEC prepared by analysts represent the views of such analysts only and are not necessarily those of IEC. IEC is not responsible for the content or accuracy of any information provided by analysts.

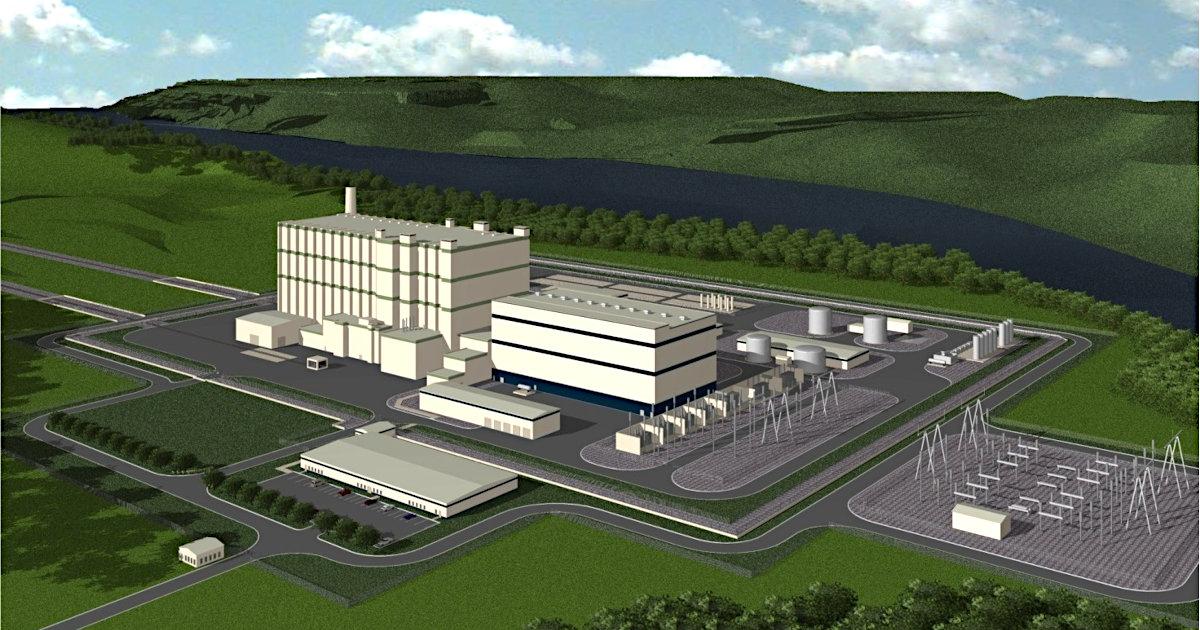

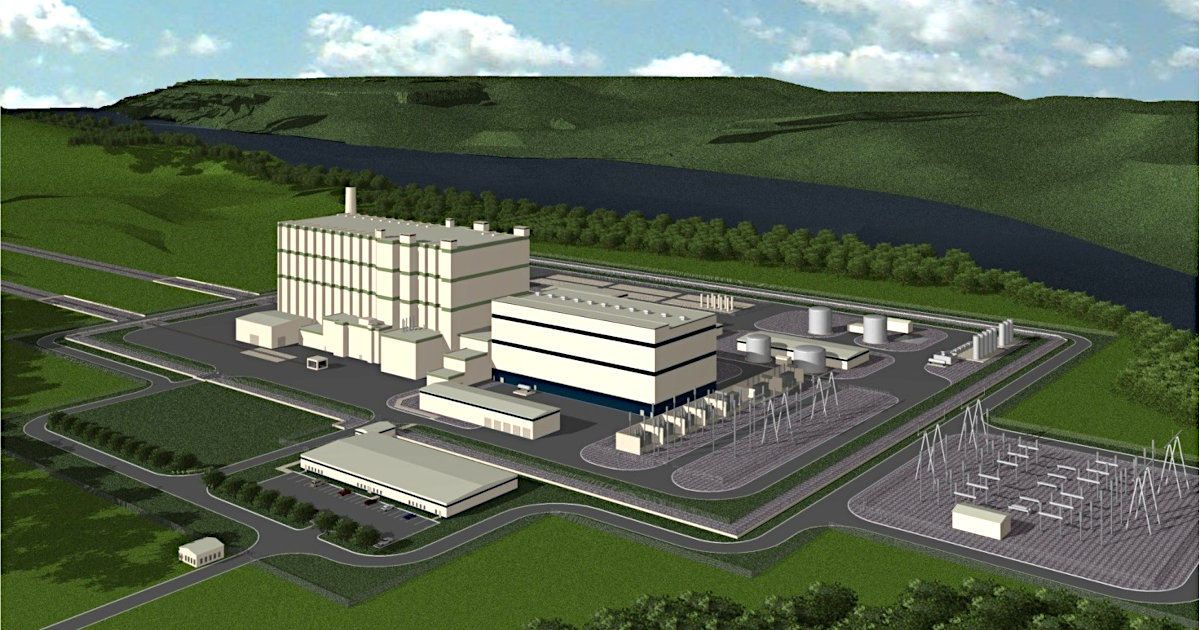

About Indonesia Energy Corporation Limited

Indonesia Energy Corporation Limited (NYSE American:INDO) is a publicly traded energy company engaged in the acquisition and development of strategic, high growth energy projects in Indonesia. IEC’s principal assets are its Kruh Block (63,000 acres) located onshore on the Island of Sumatra in Indonesia and its Citarum Block (1,000,000 acres) located onshore on the Island of Java in Indonesia. IEC is headquartered in Jakarta, Indonesia and has a representative office in Danville, California. For more information on IEC, please visit www.indo-energy.com.

Cautionary Statement Regarding Forward-Looking Statements

All statements in this press release of Indonesia Energy Corporation Limited (“IEC”) and its representatives and partners that are not based on historical fact are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Acts”). In particular, when used in the preceding discussion, the words “estimates,” “believes,” “hopes,” “expects,” “intends,” “on-track”, “plans,” “anticipates,” or “may,” and similar conditional expressions are intended to identify forward-looking statements within the meaning of the Acts and are subject to the safe harbor created by the Acts. Any statements made in this news release other than those of historical fact, about an action, event or development, are forward-looking statements. While management has based any forward-looking statements contained herein on its current expectations, the information on which such expectations were based may change. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties, and other factors, many of which are outside of the IEC’s control, that could cause actual results (including the results of IEC’s drilling activities at Kruh Block as described herein) to materially and adversely differ from such statements. Such risks, uncertainties, and other factors include, but are not necessarily limited to, those set forth in the Risk Factors section of the Company’s annual report on Form 20-F for the fiscal year ended December 31, 2020 filed on May 17, 2021 with the Securities and Exchange Commission (SEC). Copies are of such documents are available on the SEC’s website, www.sec.gov. IEC undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

Company Contact:

Frank C. Ingriselli

President, Indonesia Energy Corporation Limited

Frank.Ingriselli@Indo-Energy.com

SOURCE: Indonesia Energy Corporation Limited