Women’s Investing Involvement is Growing Dramatically

Many consumer trends are driven by women. Fashion, diet, exercise, and even car design are heavily influenced by the gender that spends more time making purchasing decisions; statistically, this is women. As it relates to investing, past data suggest they have not been the trendsetters. When consumer monitoring company Cardingly examined user trends and attitudes toward cryptocurrency and Reddit-driven market moves, men were more likely to be on the “bandwagon” than women.

The Investment Gap is Closing (The Stats)

Using data from the same Cardingly report, the number of women involving themselves is, however, increasing. As a group, women are joining platforms in increasing numbers, transacting in the public markets, and driving a high percentage of the uptick in new account deposits.

| “Our data shows women are increasingly taking control of their financial futures and considering new strategies,” said Esther Park, General Manager of Cardify.ai. “Still, our data reflects an ongoing need for both engagement with the marketplace and equality in the workplace as society takes strides toward equality.” Cardingly.ai |

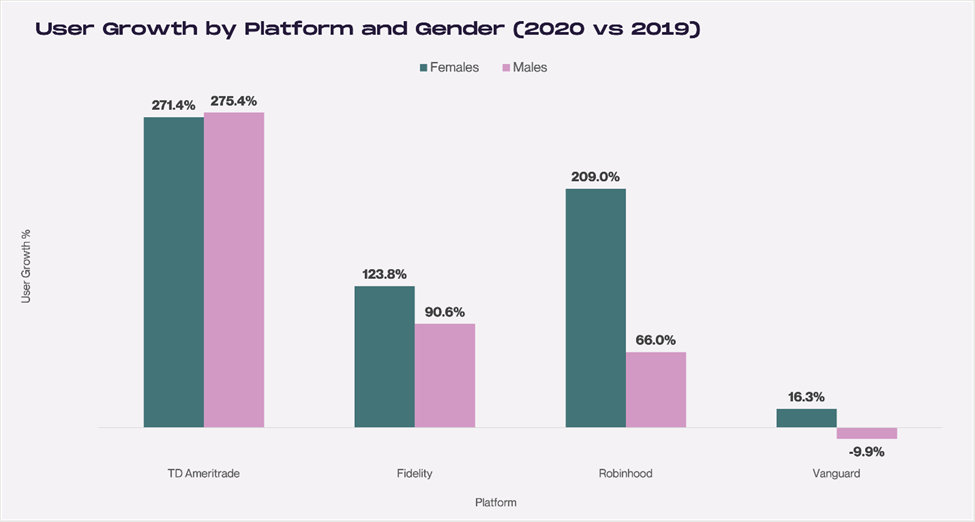

So far in 2021, compared to 2020, women using large popular platforms (TD Ameritrade, Fidelity, Robinhood, and Vanguard) have grown by 318%. The percentage increase from males grew at a slower 234%.

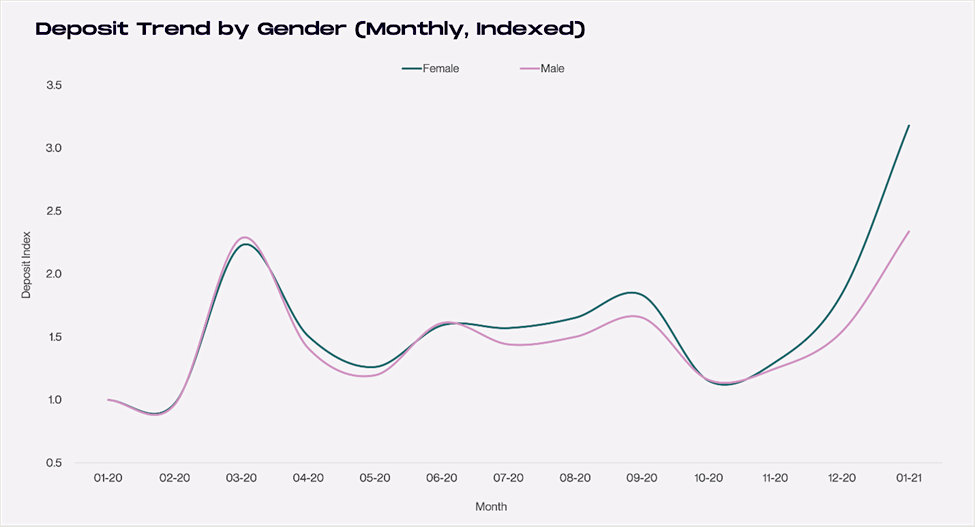

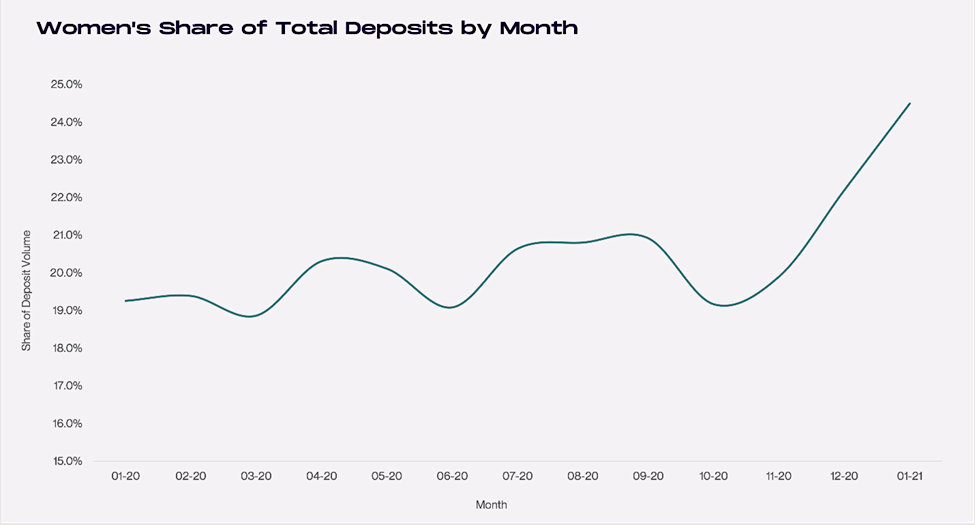

When compared to 2020, deposits in 2021 across popular platforms from women investors have grown by 318%. For the same period, deposits from male investors also spiked, but by a more modest 234%. The graph below demonstrates the percentage increase, on a monthly basis, of growth in account size. While males still have a higher overall deposit base, deposits from female investors accelerated from a 19.3% average in 2020 to 24.5% so far in 2021 (second chart below).

Source: Cardify.ai

Source: Cardingly

In addition to the growth in deposits, user numbers are also rising driven by the increase in women customers. Robinhood, for example, has seen substantial increases among women. User numbers on the app show a 209% increase among women from 2019 to 2020, this is double the 90.6% increase of men. Out of the four popular investment platforms analyzed by Cardingly, only TD Ameritrade experienced a greater increased proportion of men versus women users.

Source: Cardingly

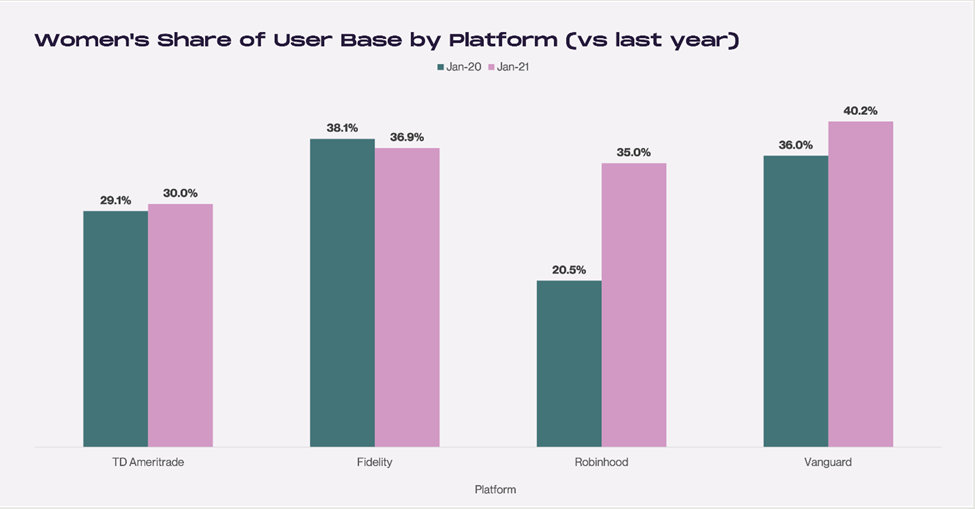

The growth in the women user base continues in 2021. Robinhood has experienced the greatest relative gain

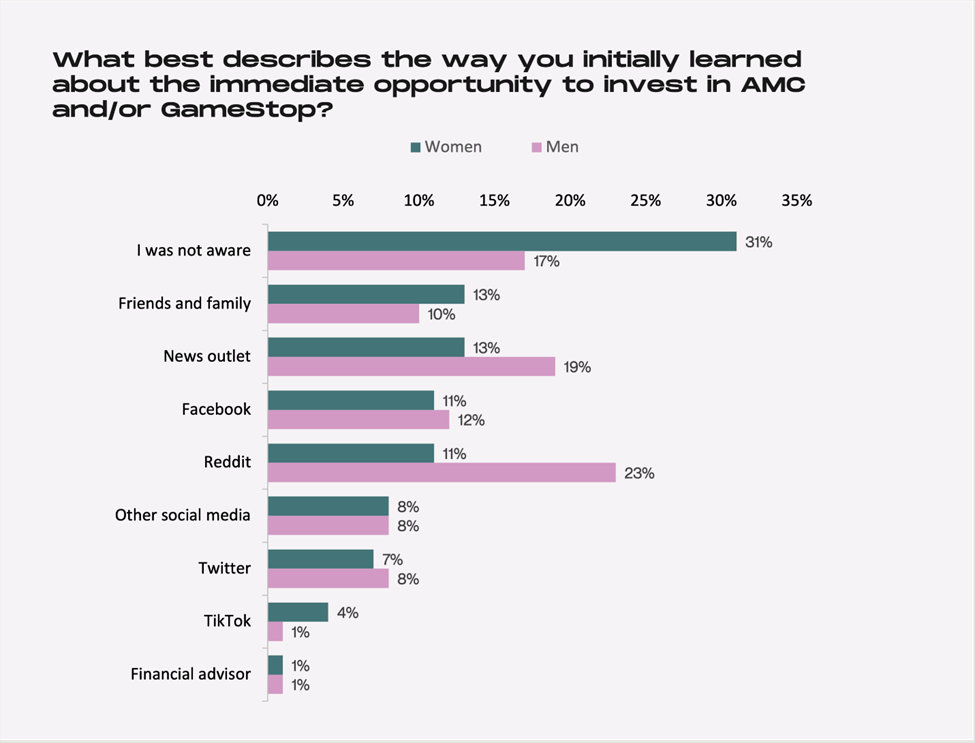

A survey of retail investors suggests information awareness is at different levels between men and women. One example shown is that over 30% of women responded they were not aware of the AMC and Gamestop trading frenzy in early 2021. This compares to 17% of men who responded they had no idea of the news story.

Cryptocurrency Trends

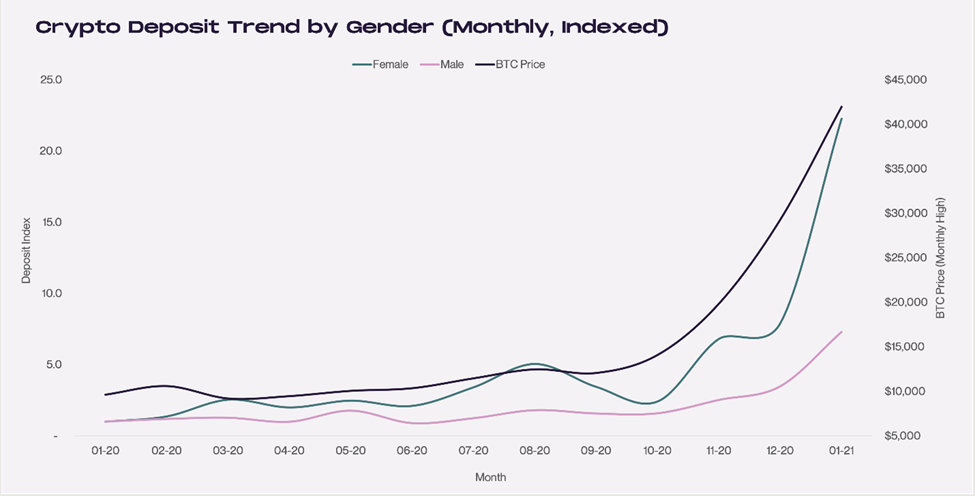

Women are not as experienced with crypto trading as men — 26% of women compared to 16% of men surveyed said they made their first cryptocurrency investment during the last six months. Similar to their investment accounts, deposits in cryptocurrency from women investors have jumped. Men’s deposits in crypto trading accounts have not grown at nearly the pace.

Source: Cardingly

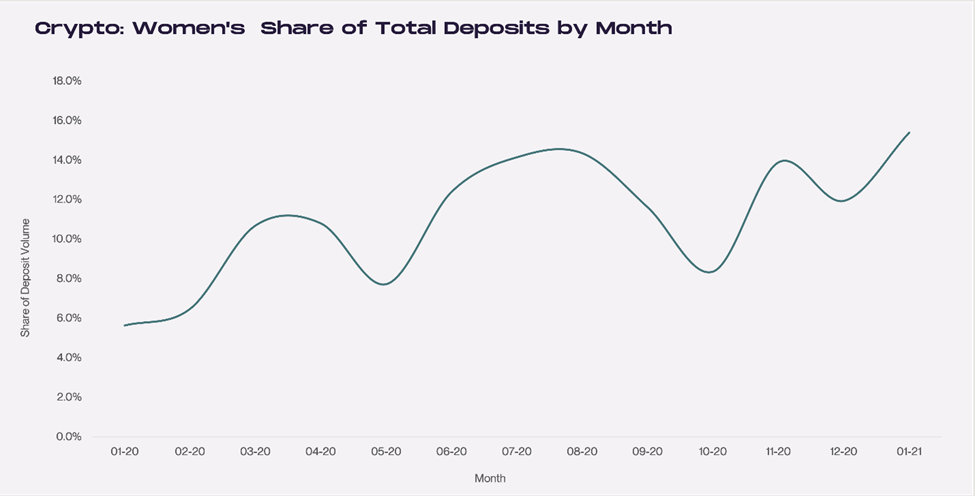

To better understand the magnitude of growth, in January 2020 women had total deposits in crypto accounts representing 5.6% of total deposits. By the following January, women represented 15% of all deposits.

Source: Cardingly

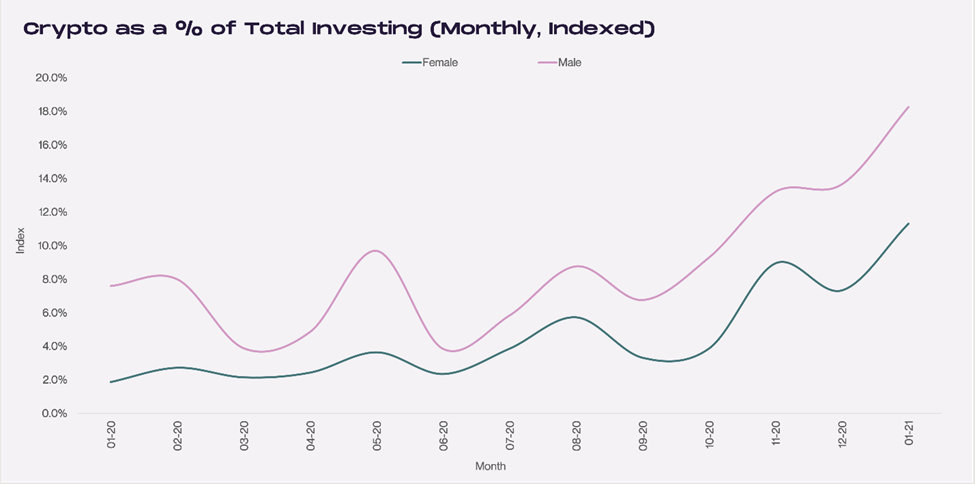

Cryptocurrency allocations are now a bigger portion of women’s total portfolio. In 12 months, crypto went from 2% to 11%.

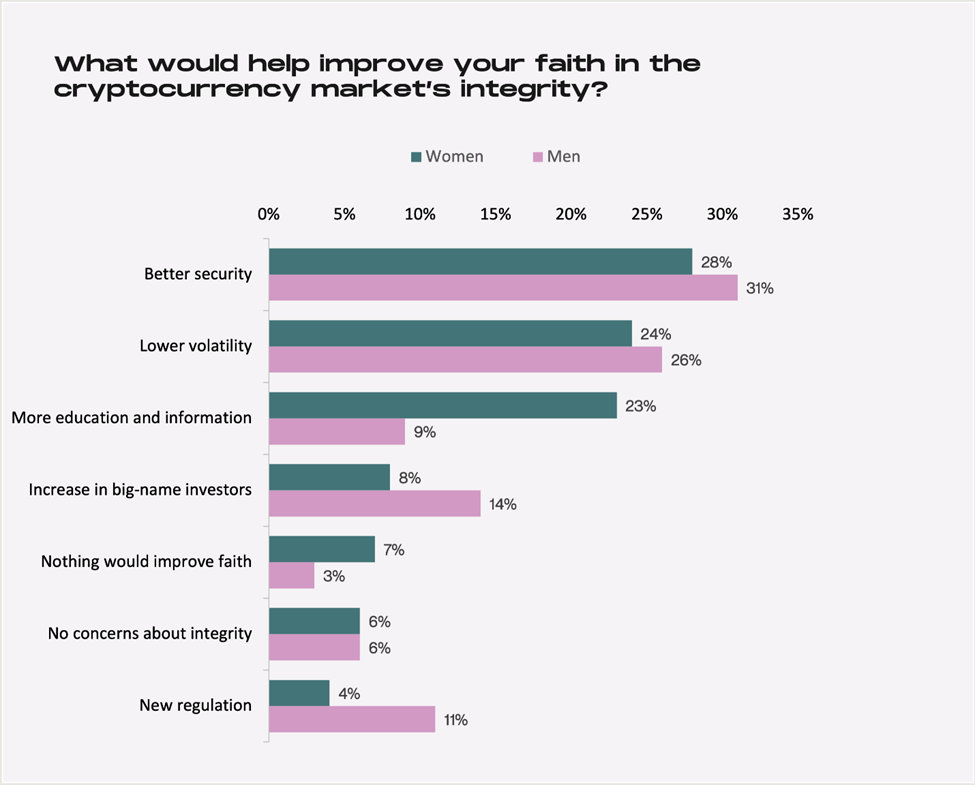

Results of the survey show women felt they were less informed related to crypto. A full 23% said their faith in crypto could increase with more information compared to 9% of men.

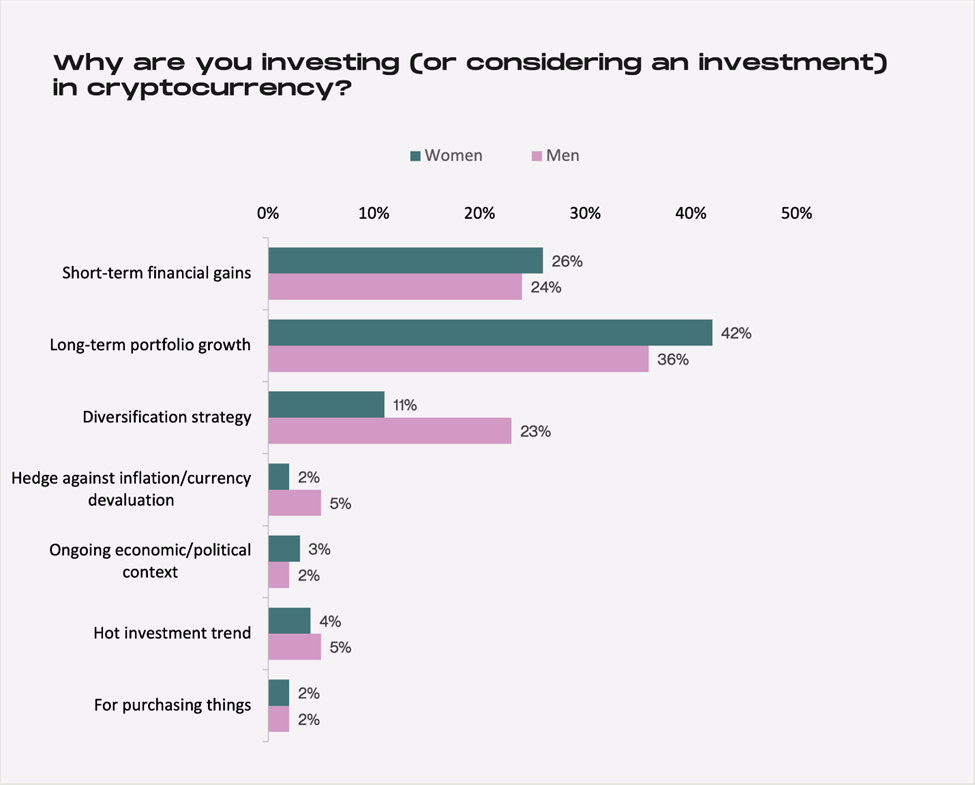

Men as a whole seem to have more faith in the longevity of the crypto market, with 35% of male respondents adopting a hold “forever” approach and noting that they will keep their cryptocurrency for longer than five years. This squares with the finding that men are more interested than women in investing in cryptocurrency to diversify their portfolios.

Source: Cardify

Take-Away

As trends continuously change over time, investors are best served by staying aware of the landscape and evaluating how demand for different opportunities may also evolve. A flow of “new” money into the markets, and presumably out of bank accounts or discretionary income, will impact where the money is coming from and where it is moving to.

Channelchek is always keeping an eye on trends and reporting to our readers. Be sure to register and stay aware of what we see that may impact your investment outcomes.

Suggested Reading:

|

|

The Value of “FinTock” “Finfluencers”

|

The Benefits of DeFi

|

|

|

Does the Russell reconstitution Impact Small Cap Performance?

|

Casual Dining and Fast Serve Restaurants Benefit from Back to Work

|

Sources:

https://www.cardify.ai/reports/international-womens-day

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|