|

|

|

Mesoblast CEO & Managing Director Dr Silviu Itescu delivers a formal corporate overview, followed by a Q & A session moderated by a Noble Capital Markets equity research representative. Return to the Investor Forum Event Page

Mesoblast is a world leader in developing allogeneic (off-the-shelf) cellular medicines for the treatment of severe and life-threatening inflammatory conditions. The Company has leveraged its proprietary mesenchymal lineage cell therapy technology platforms, remestemcel-L and rexlemestrocel-L, to establish a broad portfolio of late-stage product candidates which respond to severe inflammation by releasing anti-inflammatory factors that counter and modulate multiple effector arms of the immune system, resulting in significant reduction of the damaging inflammatory process. Mesoblast has a strong and extensive global intellectual property portfolio with protection extending through to at least 2040 in all major markets. The Company’s proprietary manufacturing processes yield industrial-scale, cryopreserved, off-the-shelf, cellular medicines. These cell therapies, with defined pharmaceutical release criteria, are planned to be readily available to patients worldwide. Remestemcel-L is being developed for inflammatory diseases in children and adults including steroid refractory acute graft versus host disease and moderate to severe acute respiratory distress syndrome. Rexlemestrocel-L is being developed for advanced chronic heart failure and chronic low back pain. Two products have been commercialized in Japan and Europe by Mesoblast’s licensees, and the Company has established commercial partnerships in Europe and China for certain Phase 3 assets. Mesoblast has locations in Australia, the United States and Singapore and is listed on the Australian Securities Exchange (MSB) and on the Nasdaq (MESO). For more information, please see www.mesoblast.com, LinkedIn: Mesoblast Limited and Twitter: @Mesoblast |

Month: June 2021

Palladium One Intercepts More High-Grade Nickel Including, 6.0% Nickel_Eq (13.9% Cu_Eq) Over 5.0 Meters at Tyko Nickel-Copper Project, in Ontario, Canada

Palladium One Intercepts More High-Grade Nickel Including, 6.0% Nickel_Eq (13.9% Cu_Eq) Over 5.0 Meters at Tyko Nickel-Copper Project, in Ontario, Canada

- Second conductor confirmed to host high-grade massive to semi massive sulphide mineralization.

- Nickel-copper continuity confirmed along 350-meter, near surface, strike length.

- 9.5% Ni_Eq over 1.7 meters, within 6.0% Ni_Eq over 5.0 meters, from 66 meters down hole (TK21-034).

- 9.0% Ni_Eq over 0.9 meters, within 7.8% Ni_Eq over 3.1 meters, from 31 meters down hole (TK21-029).

- 7.7% Ni_Eq over 1.1 meters, within 7.0% Ni_Eq over 3.5 meters, from 45 meters down hole (TK21-030).

Toronto, Ontario–(Newsfile Corp. – June 17, 2021) – Initial results have been received from the Phase II Tyko drill program said Palladium One Mining (TSXV: PDM) (FRA: 7N11) (OTCQB: NKORF) (“Palladium One” or the “Company”) today. The Phase II program was designed to test the down dip continuity of the EM Maxwell Plate “Plates” that were modelled subsequent to the Q4 2020 Phase I drill program.

A total of 14 holes were completed, 11 of which intersected massive and/or semi-massive sulphide mineralization at the Smoke Lake Zone, which previously returned up to 9.9% Nickel equivalent (23% Copper equivalent, 30.1 g/t Gold equivalent*) (8.1% Ni, 2.9% Cu, 0.61g/t Pd, 0.71g/t Pt, and 0.02g/t Au) over 3.8 metres (see press release January 19, 2021). This release contains the results for the first 6 holes of the Phase II program.

President and CEO, Derrick Weyrauch commented, “Smoke Lake continues to deliver exceptional nickel grades. These results, notably hole TK21-034 indicate that the upper and lower plates are in fact one continuous sulphide lens. Additionally, evidence exists that the high-grade mineralization has been remobilized, thus seeking the source of mineralization is our top priority.”

The most important result of Phase II drill program was the strike length extension to 350-meters combined with linking high-grade massive sulphide mineralization between the ‘upper conductor’ with the ‘lower conductor’ (see hole TK21-034 which returned 6.0% Ni_Eq (13.9% Copper equivalent, 18.6 g/t Gold equivalent*) over 5.0 meters (Figure 1 and 2)).

The Phase II drill program indicates a continuous elongate lens of high-grade sulphide mineralization that dips to the west and plunges to the northwest. Significantly, the sulphide mineralization appears to be remobilized and injected into the tonalite host rocks, cross cutting the foliation in the tonalite and containing well-rounded tonalite and biotite altered hornblendite clasts.

A total of 14 holes totaling 1,370 meters were completed before a significant drill breakdown combined with the onset of early spring conditions forced the suspension of the drill program. Drilling is planned to resume once Geotech’s VTEMmax airborne EM survey and the summer field program have been concluded.

Table 1: Tyko 2021 Phase II Drill Results from the Smoke Lake Zone

| Hole | From (m) | To (m) | Width (m) | Ni_Eq % | Cu_Eq % | Au_Eq g/t* | Ni % | Cu % | Co % | PGE g/t (Pd+Pt+Au) | Pd g/t | Pt g/t | Au g/t |

| TK21-029 | 30.4 | 37.0 | 6.6 | 3.97 | 9.25 | 12.29 | 3.08 | 1.59 | 0.04 | 0.56 | 0.30 | 0.25 | 0.01 |

| Inc. | 31.1 | 34.1 | 3.1 | 7.80 | 18.21 | 24.07 | 6.22 | 2.77 | 0.08 | 1.10 | 0.61 | 0.48 | 0.02 |

| Inc. | 31.1 | 33.3 | 2.2 | 8.65 | 20.19 | 26.52 | 7.13 | 2.51 | 0.09 | 1.29 | 0.72 | 0.55 | 0.02 |

| Inc. | 31.1 | 32.0 | 0.9 | 9.05 | 21.12 | 27.38 | 7.90 | 1.52 | 0.11 | 1.30 | 0.75 | 0.53 | 0.02 |

| TK21-030 | 45.0 | 59.2 | 14.1 | 2.21 | 5.15 | 6.79 | 1.76 | 0.71 | 0.03 | 0.38 | 0.16 | 0.22 | 0.01 |

| Inc. | 45.0 | 48.5 | 3.5 | 6.97 | 16.27 | 21.35 | 5.68 | 2.19 | 0.08 | 0.89 | 0.45 | 0.42 | 0.02 |

| Inc. | 46.4 | 47.6 | 1.1 | 7.72 | 18.02 | 23.14 | 6.93 | 0.97 | 0.09 | 0.91 | 0.52 | 0.37 | 0.02 |

| And | 58.2 | 59.2 | 1.0 | 4.43 | 10.33 | 13.73 | 3.38 | 0.93 | 0.12 | 1.95 | 0.58 | 1.35 | 0.02 |

| Inc. | 58.2 | 58.8 | 0.6 | 5.88 | 13.72 | 18.21 | 4.49 | 1.12 | 0.17 | 2.75 | 0.78 | 1.95 | 0.03 |

| TK21-031 | 41.9 | 44.6 | 2.7 | 3.88 | 9.05 | 12.15 | 2.88 | 1.78 | 0.04 | 0.70 | 0.34 | 0.33 | 0.03 |

| Inc. | 42.4 | 44.0 | 1.6 | 6.32 | 14.74 | 19.75 | 4.73 | 2.84 | 0.07 | 1.08 | 0.55 | 0.51 | 0.02 |

| Inc. | 42.8 | 44.0 | 1.2 | 8.09 | 18.88 | 25.23 | 6.13 | 3.48 | 0.09 | 1.37 | 0.68 | 0.66 | 0.02 |

| TK21-032 | 63.4 | 69.8 | 6.5 | 1.82 | 4.24 | 5.77 | 1.29 | 0.91 | 0.02 | 0.47 | 0.22 | 0.24 | 0.00 |

| Inc. | 63.4 | 67.6 | 4.2 | 2.49 | 5.81 | 7.91 | 1.76 | 1.25 | 0.03 | 0.65 | 0.31 | 0.33 | 0.01 |

| Inc. | 65.7 | 66.1 | 0.4 | 4.91 | 11.45 | 15.00 | 4.02 | 1.10 | 0.05 | 1.54 | 0.47 | 1.06 | 0.01 |

| TK21-033 | 55.4 | 72.0 | 16.6 | 1.20 | 2.81 | 3.75 | 0.92 | 0.50 | 0.01 | 0.21 | 0.10 | 0.11 | 0.00 |

| Inc. | 61.5 | 68.0 | 6.5 | 2.55 | 5.95 | 7.91 | 1.97 | 1.02 | 0.03 | 0.42 | 0.20 | 0.22 | 0.00 |

| Inc. | 66.3 | 68.0 | 1.8 | 6.58 | 15.36 | 19.69 | 5.91 | 0.84 | 0.06 | 0.94 | 0.39 | 0.55 | 0.01 |

| Inc. | 67.7 | 68.0 | 0.4 | 9.32 | 21.75 | 27.99 | 8.32 | 1.43 | 0.08 | 1.04 | 0.62 | 0.42 | 0.01 |

| TK21-034 | 66.3 | 73.0 | 6.7 | 4.57 | 10.67 | 14.30 | 3.42 | 2.05 | 0.05 | 0.81 | 0.39 | 0.40 | 0.01 |

| Inc. | 66.3 | 71.3 | 5.0 | 5.95 | 13.88 | 18.57 | 4.47 | 2.62 | 0.06 | 1.06 | 0.51 | 0.53 | 0.02 |

| Inc. | 66.3 | 68.8 | 2.5 | 8.42 | 19.65 | 26.18 | 6.45 | 3.52 | 0.08 | 1.37 | 0.67 | 0.68 | 0.02 |

| Inc. | 66.3 | 68.0 | 1.7 | 9.54 | 22.26 | 29.46 | 7.50 | 3.51 | 0.09 | 1.64 | 0.73 | 0.88 | 0.02 |

| Inc. | 67.5 | 68.0 | 0.5 | 9.81 | 22.89 | 29.92 | 8.12 | 2.95 | 0.09 | 1.17 | 0.57 | 0.58 | 0.02 |

| Holes TK21-035 to TK21-043 Results Pending | |||||||||||||

(1) Reported widths are “drilled widths” not true widths.

* Gold Equivalent (Au_Equivalent) is calculated for comparison purposes using recent spot prices, $8lb nickel, $4.4/lb copper, $19/lb cobalt, $2,700/oz palladium, $1,150/oz platinum, $1,900/oz gold.

Figure 1. Smoke Lake plan map showing EM conductor Plates with 2020 and 2021 (blue traces) drill holes overlain on first vertical magnetics. Mineralized intersections for drill holes for which assays are still pending are given in meters, MS = massive sulphide, SM = semi-massive, STR = stringer, DISS = Disseminated.

Figure 2. Smoke Lake cross section showing continuity of the massive sulphide mineralization from the upper to lower EM plates.

Figure 3. Massive and semi-massive magmatic sulphide intersections in holes TK-21-029, 30 and 35. Wall rock is tonalite, and hornblendite.

*Nickel Equivalent (“Ni_Eq”) and Copper Equivalent (“Cu_Eq”)

Nickel and copper equivalent is calculated using US$1,100 per ounce for palladium, US$950 per ounce for platinum, US$1,300 per ounce for gold, US$6,614 per tonne (US$3.00 per pound) for copper, US$15,432 per tonne (US$7.00 per pound) for nickel and US$30,865 per tonne (US$14 per pound) for Cobalt. This calculation is consistent with the commodity prices used in the Company’s September 2019 NI 43-101 Kaukua resource estimate.

QA/QC

The Phase II drilling program was carried out under the supervision of Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company.

Drill core samples were split using a rock saw by Company staff, with half retained in the core box. The drill core samples were transported by company staff the Company’s core handling facility, to Actlabs laboratory in Thunder Bay, Ontario. Actlabs, is an accredited lab and are ISO compliant (ISO 9001:2015, ISO/IEC 17025:2017). PGE analysis was performed using a 30 grams fire assay with an ICP-MS or ICP-OES finish. Multi-element analyses, including copper and nickel were analysed by four acid digestion using 0.5 grams with an ICP-MS or ICP-OES finish.

Certified standards, blanks and crushed duplicates are placed in the sample stream at a rate of one QA/QC sample per 10 core samples. Results are analyzed for acceptance at the time of import. All standards associated with the results in this press release were determined to be acceptable within the defined limits of the standard used.

About Tyko Ni-Cu-PGE Project

The Tyko Ni-Cu-PGE Project, is located approximately 65 kilometers northeast of Marathon Ontario, Canada. Tyko is an early stage, high sulphide tenor, nickel-copper (2:1 ratio) project with the most recent drill hole intercepts returning up to 9.9% Ni_Eq over 3.8 meters (8.1% Ni, 2.9% Cu, 1.3g/t PGE) in hole TK-20-023.

Qualified Person

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43-101.

About Palladium One

Palladium One Mining Inc. is an exploration company targeting district scale, platinum-group-element (PGE)-copper-nickel deposits in Finland and Canada. Its flagship project is the Läntinen Koillismaa or LK Project, a palladium-dominant platinum group element-copper-nickel project in north-central Finland, ranked by the Fraser Institute as one of the world’s top countries for mineral exploration and development. Exploration at LK is focused on targeting disseminated sulfides along 38 kilometers of favorable basal contact and building on an established NI 43-101 open pit resource.

ON BEHALF OF THE BOARD

“Derrick Weyrauch”

President & CEO, Director

For further information contact:

Derrick Weyrauch, President & CEO

Email: info@palladiumoneinc.com

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Palladium One Mining Inc. have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company’s expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, or other similar expressions. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in palladium and other commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and tax consequences to Canadian and U.S. Shareholders. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.

Helius Medical Technologies (HSDT)(HSM:CA) – Andreeff Appointed Full-time CEO, Names New CFO

Thursday, June 17, 2021

Helius Medical Technologies (HSDT)(HSM:CA)

Andreeff Appointed Full-time CEO, Names New CFO

Helius Medical Technologies is a neurotech company focused on neurological wellness. The Company’s purpose is to develop, license and acquire unique and non-invasive platform technologies that amplify the brain’s ability to heal itself. The Company’s first commercial product is the Portable Neuromodulation Stimulator (PoNSTM). For more information, visit www.heliusmedical.com.

Joe Gomes, Senior Research Analyst, Noble Capital Markets, Inc.

Kevin Wahle, Research Associate, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Permanent CEO. Helius has named interim CEO and President Dane Andreeff as full-time CEO and President. Mr. Andreeff was appointed to the interim roles in August 2020. Since assuming the roles, Mr. Andreeff guided Helius to FDA approval of the PoNS treatment for MS in the U.S. and is positioning the Company to capitalize on its key technology. Mr. Andreeff remains a significant owner of Helius with approximately 5% of the outstanding shares through his Maple Leaf Partners fund.

New CFO. In addition, the Board appointed Jeffrey Mathiesen as CFO. Mr. Mathiesen served as a member of Helius’ Board from June 2020 until June 2021. A CPA with over 30 years experience, Mr. Mathiesen brings a solid background as CFO for a number of growth oriented, technology-based companies across a wide range of industries, including biopharmaceutical and medical device companies …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Helius Medical Technologies (HSDT)(HSM:CA) – Andreeff Appointed Full-time CEO Names New CFO

Thursday, June 17, 2021

Helius Medical Technologies (HSDT)(HSM:CA)

Andreeff Appointed Full-time CEO, Names New CFO

Helius Medical Technologies is a neurotech company focused on neurological wellness. The Company’s purpose is to develop, license and acquire unique and non-invasive platform technologies that amplify the brain’s ability to heal itself. The Company’s first commercial product is the Portable Neuromodulation Stimulator (PoNSTM). For more information, visit www.heliusmedical.com.

Joe Gomes, Senior Research Analyst, Noble Capital Markets, Inc.

Kevin Wahle, Research Associate, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Permanent CEO. Helius has named interim CEO and President Dane Andreeff as full-time CEO and President. Mr. Andreeff was appointed to the interim roles in August 2020. Since assuming the roles, Mr. Andreeff guided Helius to FDA approval of the PoNS treatment for MS in the U.S. and is positioning the Company to capitalize on its key technology. Mr. Andreeff remains a significant owner of Helius with approximately 5% of the outstanding shares through his Maple Leaf Partners fund.

New CFO. In addition, the Board appointed Jeffrey Mathiesen as CFO. Mr. Mathiesen served as a member of Helius’ Board from June 2020 until June 2021. A CPA with over 30 years experience, Mr. Mathiesen brings a solid background as CFO for a number of growth oriented, technology-based companies across a wide range of industries, including biopharmaceutical and medical device companies …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

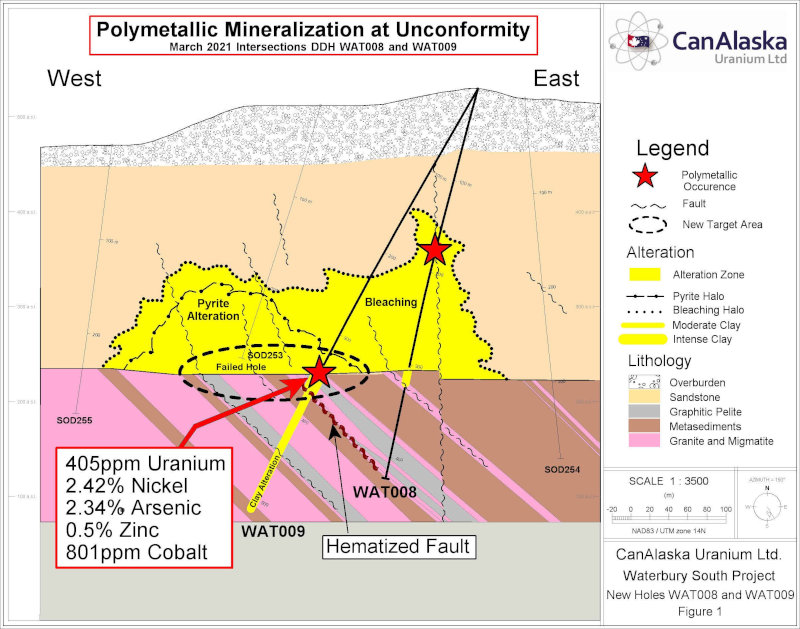

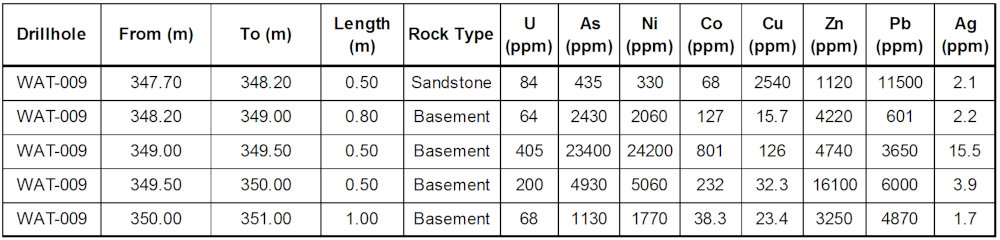

Release – CanAlaska Intersects Polymetallic Mineralization at Waterbury South Uranium Project

CanAlaska Intersects Polymetallic Mineralization at Waterbury South Uranium Project

Unconformity zone with strong Nickel, Arsenic and Cobalt mineralization

Extensive clay alteration in basement rocks below unconformity intersection

Similarities to the nearby Cigar Lake Polymetallic Uranium Deposit

|

|

|

|

|

Release – Gevo hires Kimberly Bowron as Chief Human Resources Officer

Gevo hires Kimberly Bowron as Chief Human Resources Officer

ENGLEWOOD, Colo., June 17, 2021 (GLOBE NEWSWIRE) — Gevo, Inc. (NASDAQ: GEVO), is pleased to announce that Kimberly Bowron has joined Gevo as its Chief Human Resources Officer. Ms. Bowron has served over 20 years in senior management roles in the chemicals, utilities infrastructure, and IT industries. Most recently, Ms. Bowron was the Director of Human Resources at TPC Group and previously the VP of Human Resources at Heath Consultants, where she led all aspects of human resources and training.

“I’m delighted to have Kimberly join the Gevo team. Her diverse background certainly fits into what Gevo needs to continue to build an engaged, inclusive, and high-performing team for our Net-Zero Projects and beyond. Talent and skill acquisition are certainly one of the keys to success. We are going to grow. Kimberly will help us be successful in that growth,” said Dr. Patrick R. Gruber, Gevo’s Chief Executive Officer.

“I am honored to become part of the team behind the groundbreaking work to transform renewable energy into hydrocarbons,” said Ms. Bowron. “I’m excited to help build the talent, leadership, and culture needed for our next phase of growth,” continued Ms. Bowron.

About Gevo

Gevo’s mission is to transform renewable energy and carbon into energy-dense liquid hydrocarbons. These liquid hydrocarbons can be used for drop-in transportation fuels such as gasoline, jet fuel and diesel fuel, that when burned have potential to yield net-zero greenhouse gas emissions when measured across the full life cycle of the products. Gevo uses low-carbon renewable resource-based carbohydrates as raw materials, and is in an advanced state of developing renewable electricity and renewable natural gas for use in production processes, resulting in low-carbon fuels with substantially reduced carbon intensity (the level of greenhouse gas emissions compared to standard petroleum fossil-based fuels across their life cycle). Gevo’s products perform as well or better than traditional fossil-based fuels in infrastructure and engines, but with substantially reduced greenhouse gas emissions. In addition to addressing the problems of fuels, Gevo’s technology also enables certain plastics, such as polyester, to be made with more sustainable ingredients. Gevo’s ability to penetrate the growing low-carbon fuels market depends on the price of oil and the value of abating carbon emissions that would otherwise increase greenhouse gas emissions. Gevo believes that its proven, patented technology enabling the use of a variety of low-carbon sustainable feedstocks to produce price-competitive low-carbon products such as gasoline components, jet fuel and diesel fuel yields the potential to generate project and corporate returns that justify the build-out of a multi-billion-dollar business.

Gevo believes that the Argonne National Laboratory GREET model is the best available standard of scientific-based measurement for life cycle inventory or LCI.

Learn more at Gevo’s website: www.gevo.com

Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to a variety of matters, without limitation, including the hiring of Kimberly Bowron, Gevo’s technology, Gevo’s products, Gevo’s ability to produce products with “net-zero” greenhouse gas emissions, and other statements that are not purely statements of historical fact. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of the management of Gevo and are subject to significant risks and uncertainty. Investors are cautioned not to place undue reliance on any such forward-looking statements. All such forward-looking statements speak only as of the date they are made, and Gevo undertakes no obligation to update or revise these statements, whether as a result of new information, future events or otherwise. Although Gevo believes that the expectations reflected in these forward-looking statements are reasonable, these statements involve many risks and uncertainties that may cause actual results to differ materially from what may be expressed or implied in these forward-looking statements. For a further discussion of risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of Gevo in general, see the risk disclosures in the Annual Report on Form 10-K of Gevo for the year ended December 31, 2020, and in subsequent reports on Forms 10-Q and 8-K and other filings made with the U.S. Securities and Exchange Commission by Gevo.

Investor and Media Contact

+1 720-647-9605

IR@gevo.com

Release – Lineage Announces Exclusive Option Agreement With Amasa Therapeutics For Supply And Use Of Clinical-Grade Hystem

Lineage Announces Exclusive Option Agreement With Amasa Therapeutics For Supply And Use Of Clinical-Grade Hystem®

(NYSE American and TASE: LCTX), a clinical-stage biotechnology company developing allogeneic cell therapies for unmet medical needs, today announced it granted an exclusive option to

(Amasa), a privately-held biopharmaceutical company focused on the development of novel cell-based targeted biological therapeutics to treat cancer patients with unmet need, to acquire an exclusive, royalty-bearing license to use Lineage’s HyStem technology for the development and commercialization of therapies for local treatment of solid tumors under pre-negotiated terms. Under the option agreement, Amasa will purchase certain amounts of Lineage’s existing supply of clinical-grade HyStem biomaterial and has the right to purchase additional amounts in connection with its up to 12-month option to acquire the exclusive license. Lineage will receive an upfront cash payment and, if the option is exercised, would be entitled to additional payments, including event-specific payments, royalties on net sales and sublicense fees and royalties.

“Lineage is a clinical-stage cell therapy company supported by a vast intellectual property portfolio. From this portfolio, we continue to find opportunities to unlock value from non-core assets through option and license agreements for assets such as HyStem,” stated

HyStem is a patented biomaterial that is made from and structurally mimics naturally occurring extracellular matrix, the structural network of molecules surrounding cells in organs and tissues that is essential to cellular function and tissue structure. The technology underlying the HyStem hydrogels is based on a unique thiol cross-linking strategy. Building upon this technology, the HyStem family of hydrogels are novel biomaterials that offer unique strategies for cell therapy and bioactive molecule delivery. A distinctive feature of the HyStem hydrogel is that it allows the mixture of cells with the matrix in a liquid form such that the cells and matrix can be injected easily through a small gauge syringe, and then the matrix can polymerize around the cells to create a three-dimensional tissue within the body. When implanted in HyStem hydrogels, cells remain attached and localized within the hydrogel and slowly degrade the implanted matrix and replace it with their natural extracellular matrices. Current research at leading medical institutions has shown that HyStem is compatible with a wide variety of cells and tissue types including brain, bone, skin, cartilage, vascular and heart tissues.

“We believe use of Lineage’s clinical-grade HyStem hydrogels will allow us to quickly move candidates into the clinic with our novel approach of using receptor-targeted cell therapies to address intractable solid tumors such as glioblastoma,” stated

About HyStem®

Lineage has developed a family of hyaluronan based hydrogels (HyStem) that mimics the natural extracellular matrix and has potential applications in

About

Amasa Therapeutics is a biopharmaceutical company focused on the development of novel stem cell-based targeted biological therapeutics to treat cancer patients with unmet need. With a vision to develop innovative off-the-shelf cellular therapies possessing wide applicability, Amasa is committed to improving quality of life and increasing progression-free survival for all patients suffering from a variety of advanced cancers, starting with malignant brain tumor, glioblastoma. Amasa’s technology is built upon a unique platform of receptor-targeted cell-based therapies intended to treat the greatest unmet needs within oncology. For more information visit: https://www.amasatx.com/.

About

Forward-Looking Statements

Lineage cautions you that all statements, other than statements of historical facts, contained in this press release, are forward-looking statements. Forward-looking statements, in some cases, can be identified by terms such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “expect,” “could,” “can,” “plan,” “potential,” “predict,” “seek,” “should,” “would,” “contemplate,” project,” “target,” “tend to,” or the negative version of these words and similar expressions. Such statements include, but are not limited to, statements relating to opportunities to add value to Lineage by licensing non-core assets, including HyStem, HyStem’s potential to serve as a safe and effective delivery vehicle for cell therapies and potential payments to Lineage under its option agreement and potential license agreement with Amasa. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Lineage’s actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by the forward-looking statements in this press release, including risks and uncertainties inherent in Lineage’s business and other risks in Lineage’s filings with the

(ir@lineagecell.com)

(442) 287-8963

Solebury Trout IR

(Gogawa@soleburytrout.com)

(646) 378-2949

Nic.johnson@russopartnersllc.com

David.schull@russopartnersllc.com

(212) 845-4242

Source:

Release – Comtech Telecommunications Corp. Awarded 5 Million Contract to Deploy a Next Generation 911 Solution

Comtech Telecommunications Corp. Awarded $5.0 Million Contract to Deploy a Next Generation 911 Solution to a U.S. Government End Customer

Comtech Solacom will provide a full turnkey solution, including all hardware and software, installation, and training for a multi-node, geographically dispersed Guardian call management system. The Guardian solution will be deployed in a redundant, multi-geo-diverse configuration ensuring the highest possible service availability with an intuitive user interface allowing call takers to quickly assess, prioritize and handle landline, wireless and VoIP emergency calls. Call takers can quickly create conferences, transfer calls, determine the location of callers and replay recently recorded conversations.

“Comtech’s commitment to innovative next generation emergency communication solutions has been recognized by the selection of the Solacom Guardian solution to modernize the 911 operations of a major

Comtech Solacom emergency call handling and management solutions are built on more than 30 years of research and innovation in the application of advanced hardware and software technologies for public safety. For more information, visit: www.solacom.com.

Certain information in this press release contains statements that are forward-looking in nature and involve certain significant risks and uncertainties. Actual results could differ materially from such forward-looking information. The Company’s

Media Contact:

631-962-7000

info@comtechtel.com

Source:

Release – Palladium One Intercepts More High-Grade Nickel at Tyko Nickel-Copper Project in Ontario Canada

Palladium One Intercepts More High-Grade Nickel Including, 6.0% Nickel_Eq (13.9% Cu_Eq) Over 5.0 Meters at Tyko Nickel-Copper Project, in Ontario, Canada

- Second conductor confirmed to host high-grade massive to semi massive sulphide mineralization.

- Nickel-copper continuity confirmed along 350-meter, near surface, strike length.

- 9.5% Ni_Eq over 1.7 meters, within 6.0% Ni_Eq over 5.0 meters, from 66 meters down hole (TK21-034).

- 9.0% Ni_Eq over 0.9 meters, within 7.8% Ni_Eq over 3.1 meters, from 31 meters down hole (TK21-029).

- 7.7% Ni_Eq over 1.1 meters, within 7.0% Ni_Eq over 3.5 meters, from 45 meters down hole (TK21-030).

Toronto, Ontario–(Newsfile Corp. – June 17, 2021) – Initial results have been received from the Phase II Tyko drill program said Palladium One Mining (TSXV: PDM) (FRA: 7N11) (OTCQB: NKORF) (“Palladium One” or the “Company”) today. The Phase II program was designed to test the down dip continuity of the EM Maxwell Plate “Plates” that were modelled subsequent to the Q4 2020 Phase I drill program.

A total of 14 holes were completed, 11 of which intersected massive and/or semi-massive sulphide mineralization at the Smoke Lake Zone, which previously returned up to 9.9% Nickel equivalent (23% Copper equivalent, 30.1 g/t Gold equivalent*) (8.1% Ni, 2.9% Cu, 0.61g/t Pd, 0.71g/t Pt, and 0.02g/t Au) over 3.8 metres (see press release January 19, 2021). This release contains the results for the first 6 holes of the Phase II program.

President and CEO, Derrick Weyrauch commented, “Smoke Lake continues to deliver exceptional nickel grades. These results, notably hole TK21-034 indicate that the upper and lower plates are in fact one continuous sulphide lens. Additionally, evidence exists that the high-grade mineralization has been remobilized, thus seeking the source of mineralization is our top priority.”

The most important result of Phase II drill program was the strike length extension to 350-meters combined with linking high-grade massive sulphide mineralization between the ‘upper conductor’ with the ‘lower conductor’ (see hole TK21-034 which returned 6.0% Ni_Eq (13.9% Copper equivalent, 18.6 g/t Gold equivalent*) over 5.0 meters (Figure 1 and 2)).

The Phase II drill program indicates a continuous elongate lens of high-grade sulphide mineralization that dips to the west and plunges to the northwest. Significantly, the sulphide mineralization appears to be remobilized and injected into the tonalite host rocks, cross cutting the foliation in the tonalite and containing well-rounded tonalite and biotite altered hornblendite clasts.

A total of 14 holes totaling 1,370 meters were completed before a significant drill breakdown combined with the onset of early spring conditions forced the suspension of the drill program. Drilling is planned to resume once Geotech’s VTEMmax airborne EM survey and the summer field program have been concluded.

Table 1: Tyko 2021 Phase II Drill Results from the Smoke Lake Zone

| Hole | From (m) | To (m) | Width (m) | Ni_Eq % | Cu_Eq % | Au_Eq g/t* | Ni % | Cu % | Co % | PGE g/t (Pd+Pt+Au) | Pd g/t | Pt g/t | Au g/t |

| TK21-029 | 30.4 | 37.0 | 6.6 | 3.97 | 9.25 | 12.29 | 3.08 | 1.59 | 0.04 | 0.56 | 0.30 | 0.25 | 0.01 |

| Inc. | 31.1 | 34.1 | 3.1 | 7.80 | 18.21 | 24.07 | 6.22 | 2.77 | 0.08 | 1.10 | 0.61 | 0.48 | 0.02 |

| Inc. | 31.1 | 33.3 | 2.2 | 8.65 | 20.19 | 26.52 | 7.13 | 2.51 | 0.09 | 1.29 | 0.72 | 0.55 | 0.02 |

| Inc. | 31.1 | 32.0 | 0.9 | 9.05 | 21.12 | 27.38 | 7.90 | 1.52 | 0.11 | 1.30 | 0.75 | 0.53 | 0.02 |

| TK21-030 | 45.0 | 59.2 | 14.1 | 2.21 | 5.15 | 6.79 | 1.76 | 0.71 | 0.03 | 0.38 | 0.16 | 0.22 | 0.01 |

| Inc. | 45.0 | 48.5 | 3.5 | 6.97 | 16.27 | 21.35 | 5.68 | 2.19 | 0.08 | 0.89 | 0.45 | 0.42 | 0.02 |

| Inc. | 46.4 | 47.6 | 1.1 | 7.72 | 18.02 | 23.14 | 6.93 | 0.97 | 0.09 | 0.91 | 0.52 | 0.37 | 0.02 |

| And | 58.2 | 59.2 | 1.0 | 4.43 | 10.33 | 13.73 | 3.38 | 0.93 | 0.12 | 1.95 | 0.58 | 1.35 | 0.02 |

| Inc. | 58.2 | 58.8 | 0.6 | 5.88 | 13.72 | 18.21 | 4.49 | 1.12 | 0.17 | 2.75 | 0.78 | 1.95 | 0.03 |

| TK21-031 | 41.9 | 44.6 | 2.7 | 3.88 | 9.05 | 12.15 | 2.88 | 1.78 | 0.04 | 0.70 | 0.34 | 0.33 | 0.03 |

| Inc. | 42.4 | 44.0 | 1.6 | 6.32 | 14.74 | 19.75 | 4.73 | 2.84 | 0.07 | 1.08 | 0.55 | 0.51 | 0.02 |

| Inc. | 42.8 | 44.0 | 1.2 | 8.09 | 18.88 | 25.23 | 6.13 | 3.48 | 0.09 | 1.37 | 0.68 | 0.66 | 0.02 |

| TK21-032 | 63.4 | 69.8 | 6.5 | 1.82 | 4.24 | 5.77 | 1.29 | 0.91 | 0.02 | 0.47 | 0.22 | 0.24 | 0.00 |

| Inc. | 63.4 | 67.6 | 4.2 | 2.49 | 5.81 | 7.91 | 1.76 | 1.25 | 0.03 | 0.65 | 0.31 | 0.33 | 0.01 |

| Inc. | 65.7 | 66.1 | 0.4 | 4.91 | 11.45 | 15.00 | 4.02 | 1.10 | 0.05 | 1.54 | 0.47 | 1.06 | 0.01 |

| TK21-033 | 55.4 | 72.0 | 16.6 | 1.20 | 2.81 | 3.75 | 0.92 | 0.50 | 0.01 | 0.21 | 0.10 | 0.11 | 0.00 |

| Inc. | 61.5 | 68.0 | 6.5 | 2.55 | 5.95 | 7.91 | 1.97 | 1.02 | 0.03 | 0.42 | 0.20 | 0.22 | 0.00 |

| Inc. | 66.3 | 68.0 | 1.8 | 6.58 | 15.36 | 19.69 | 5.91 | 0.84 | 0.06 | 0.94 | 0.39 | 0.55 | 0.01 |

| Inc. | 67.7 | 68.0 | 0.4 | 9.32 | 21.75 | 27.99 | 8.32 | 1.43 | 0.08 | 1.04 | 0.62 | 0.42 | 0.01 |

| TK21-034 | 66.3 | 73.0 | 6.7 | 4.57 | 10.67 | 14.30 | 3.42 | 2.05 | 0.05 | 0.81 | 0.39 | 0.40 | 0.01 |

| Inc. | 66.3 | 71.3 | 5.0 | 5.95 | 13.88 | 18.57 | 4.47 | 2.62 | 0.06 | 1.06 | 0.51 | 0.53 | 0.02 |

| Inc. | 66.3 | 68.8 | 2.5 | 8.42 | 19.65 | 26.18 | 6.45 | 3.52 | 0.08 | 1.37 | 0.67 | 0.68 | 0.02 |

| Inc. | 66.3 | 68.0 | 1.7 | 9.54 | 22.26 | 29.46 | 7.50 | 3.51 | 0.09 | 1.64 | 0.73 | 0.88 | 0.02 |

| Inc. | 67.5 | 68.0 | 0.5 | 9.81 | 22.89 | 29.92 | 8.12 | 2.95 | 0.09 | 1.17 | 0.57 | 0.58 | 0.02 |

| Holes TK21-035 to TK21-043 Results Pending | |||||||||||||

(1) Reported widths are “drilled widths” not true widths.

* Gold Equivalent (Au_Equivalent) is calculated for comparison purposes using recent spot prices, $8lb nickel, $4.4/lb copper, $19/lb cobalt, $2,700/oz palladium, $1,150/oz platinum, $1,900/oz gold.

Figure 1. Smoke Lake plan map showing EM conductor Plates with 2020 and 2021 (blue traces) drill holes overlain on first vertical magnetics. Mineralized intersections for drill holes for which assays are still pending are given in meters, MS = massive sulphide, SM = semi-massive, STR = stringer, DISS = Disseminated.

Figure 2. Smoke Lake cross section showing continuity of the massive sulphide mineralization from the upper to lower EM plates.

Figure 3. Massive and semi-massive magmatic sulphide intersections in holes TK-21-029, 30 and 35. Wall rock is tonalite, and hornblendite.

*Nickel Equivalent (“Ni_Eq”) and Copper Equivalent (“Cu_Eq”)

Nickel and copper equivalent is calculated using US$1,100 per ounce for palladium, US$950 per ounce for platinum, US$1,300 per ounce for gold, US$6,614 per tonne (US$3.00 per pound) for copper, US$15,432 per tonne (US$7.00 per pound) for nickel and US$30,865 per tonne (US$14 per pound) for Cobalt. This calculation is consistent with the commodity prices used in the Company’s September 2019 NI 43-101 Kaukua resource estimate.

QA/QC

The Phase II drilling program was carried out under the supervision of Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company.

Drill core samples were split using a rock saw by Company staff, with half retained in the core box. The drill core samples were transported by company staff the Company’s core handling facility, to Actlabs laboratory in Thunder Bay, Ontario. Actlabs, is an accredited lab and are ISO compliant (ISO 9001:2015, ISO/IEC 17025:2017). PGE analysis was performed using a 30 grams fire assay with an ICP-MS or ICP-OES finish. Multi-element analyses, including copper and nickel were analysed by four acid digestion using 0.5 grams with an ICP-MS or ICP-OES finish.

Certified standards, blanks and crushed duplicates are placed in the sample stream at a rate of one QA/QC sample per 10 core samples. Results are analyzed for acceptance at the time of import. All standards associated with the results in this press release were determined to be acceptable within the defined limits of the standard used.

About Tyko Ni-Cu-PGE Project

The Tyko Ni-Cu-PGE Project, is located approximately 65 kilometers northeast of Marathon Ontario, Canada. Tyko is an early stage, high sulphide tenor, nickel-copper (2:1 ratio) project with the most recent drill hole intercepts returning up to 9.9% Ni_Eq over 3.8 meters (8.1% Ni, 2.9% Cu, 1.3g/t PGE) in hole TK-20-023.

Qualified Person

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43-101.

About Palladium One

Palladium One Mining Inc. is an exploration company targeting district scale, platinum-group-element (PGE)-copper-nickel deposits in Finland and Canada. Its flagship project is the Läntinen Koillismaa or LK Project, a palladium-dominant platinum group element-copper-nickel project in north-central Finland, ranked by the Fraser Institute as one of the world’s top countries for mineral exploration and development. Exploration at LK is focused on targeting disseminated sulfides along 38 kilometers of favorable basal contact and building on an established NI 43-101 open pit resource.

ON BEHALF OF THE BOARD

“Derrick Weyrauch”

President & CEO, Director

For further information contact:

Derrick Weyrauch, President & CEO

Email: info@palladiumoneinc.com

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Palladium One Mining Inc. have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company’s expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, or other similar expressions. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in palladium and other commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and tax consequences to Canadian and U.S. Shareholders. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.

Release – Onconova Therapeutics Announces The Peer-Reviewed Publication Of Preclinical Data Demonstrating The Synergistic Anti-Cancer Activity Of Rigosertib

Onconova Therapeutics Announces The Peer-Reviewed Publication Of Preclinical Data Demonstrating The Synergistic Anti-Cancer Activity Of Rigosertib Combined With Immune Checkpoint Blockade

igosertib synergistically combined with immune checkpoint blockade (ICB) to improve tumor growth inhibition and survival in a murine melanoma model that did not respond to ICB alone

Rigosertib’s anti-cancer activity was due to its ability to reverse immunosuppressive tumor microenvironments

Data support the clinical evaluation of rigosertib in combination with immune checkpoint inhibitors

NEWTOWN, Pa., June 17, 2021 (GLOBE NEWSWIRE) — Onconova Therapeutics, Inc. (NASDAQ: ONTX) (“Onconova”), a clinical-stage biopharmaceutical company focused on discovering and developing novel products for patients with cancer, today announced the publication of a preclinical study in the journal Molecular Cancer. The study, entitled “Novel induction of CD40 expression by tumor cells with RAS/RAF/PI3K pathway inhibition augments response to checkpoint blockade,” showed that rigosertib synergistically enhanced the efficacy of ICB in a murine melanoma model via the induction of immune-mediated cancer cell death.

“The data from this recent publication demonstrate rigosertib’s potential to address a pressing unmet need, as many patients do not respond to immune checkpoint blockade due to immunosuppressive tumor microenvironments,” said Ann Richmond, Ph.D., Ingram Professor of Pharmacology and Medicine at the Vanderbilt University School of Medicine and lead author of the study. “By reversing immunosuppressive tumor microenvironments, rigosertib overcame pro-tumor resistance mechanisms and synergistically enhanced the efficacy of immune checkpoint blockade in a difficult-to-treat murine melanoma model. These compelling findings provide preclinical proof-of-concept for rigosertib-immune checkpoint blockade combination therapy and strongly support its evaluation in clinical trials.”

Key data and conclusions from the recent publication include:

- Rigosertib treatment enhanced the activation of anti-cancer immune cells and increased the frequency of these cells in the tumor microenvironment (TME).

- Rigosertib treatment reduced the frequency of pro-tumor CD206+ M2-like macrophages in the TME.

- Rigosertib monotherapy rapidly reduced PI3K signaling with induction of CD40 expression, leading to melanoma cell death and inhibition of tumor growth in vivo due to its ability to promote the tumor infiltration of activated anti-cancer immune cells.

- Rigosertib’s ability to remodel the TME enabled it to synergistically combine with ICB and improve tumor growth inhibition and survival in a mouse model of melanoma that did not respond to ICB alone, or a clinically used combination of ICB plus BRAF and MEK inhibitors.

Steven M. Fruchtman, M.D., President and Chief Executive Officer of Onconova, added, “We are very pleased with these recently published results, which will inform the data driven approach guiding our clinical rigosertib investigator-initiated study program. They provide strong mechanistic support for both the ongoing KRAS mutated non-small cell lung cancer trial of rigosertib in combination with a check point inhibitor and a potential trial in patients with advanced melanoma evaluating a rigosertib-checkpoint inhibitor combination that is under active consideration. Looking ahead, we plan to continue leveraging our collaborations with leading institutions such as Vanderbilt University as we pursue opportunities for rigosertib while maintaining our primary focus and resources on our lead ON 123300 multi-kinase inhibitor program.”

About Onconova Therapeutics, Inc.

Onconova Therapeutics is a clinical-stage biopharmaceutical company focused on discovering and developing novel products for patients with cancer. The Company has proprietary targeted anti-cancer agents designed to disrupt specific cellular pathways that are important for cancer cell proliferation.

Onconova’s novel, proprietary multi-kinase inhibitor ON 123300 is being evaluated in two separate and complementary Phase 1 dose-escalation and expansion studies. These trials are currently underway in the United States and China.

Onconova’s product candidate rigosertib is being studied in an investigator-initiated study program, including in a dose-escalation and expansion Phase 1 investigator-initiated study targeting patients with KRAS+ non-small cell lung cancer with oral rigosertib in combination with nivolumab. In addition, Onconova continues to conduct preclinical work investigating rigosertib in COVID-19.

For more information, please visit www.onconova.com.

Forward-Looking Statements

Some of the statements in this release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, and involve risks and uncertainties. These statements relate to Onconova’s expectations regarding the timing of Onconova’s and investigator-initiated clinical development plans, and the mechanisms and indications for Onconova’s product candidates. Onconova has attempted to identify forward-looking statements by terminology including “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately” or other words that convey uncertainty of future events or outcomes. Although Onconova believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, expectations may prove to have been materially different from the results expressed or implied by such forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors, including the success and timing of Onconova’s clinical trials and regulatory agency and institutional review board approvals of protocols, the timing of the Company’s annual stockholder meeting, market conditions and those discussed under the heading “Risk Factors” in Onconova’s most recent Annual Report on Form 10-K and quarterly reports on Form 10-Q. Any forward-looking statements contained in this release speak only as of its date. Onconova undertakes no obligation to update any forward-looking statements contained in this release to reflect events or circumstances occurring after its date or to reflect the occurrence of unanticipated events.

Company Contact:

Avi Oler

Onconova Therapeutics, Inc.

267-759-3680

ir@onconova.us

https://www.onconova.com/contact/

Investor Contact:

Bruce Mackle

LifeSci Advisors, LLC

646-889-1200

bmackle@lifesciadvisors.com

Therapeutic Companies will get 3.2 Billion in R and D Support

Companies Developing Therapeutics to Fight Covid-19 Will get a $3.2 Billion Injection

Some antiviral pills related to coronavirus will get a $3.2 billion shot in the arm to help accelerate testing and development of therapeutics to combat the Covid-19 virus. This was announced (6/17/21) by the Department of Health and Human Services.

“New antivirals that prevent serious Covid-19 illness and death, especially oral drugs that could be taken at home early in the course of disease, would be powerful tools for battling the pandemic and saving lives,” said President Biden’s, chief medical adviser, Dr. Anthony Fauci.

The $3.2 billion allocated will be from the $1.9 trillion coronavirus relief package Biden signed into law in March. Dr. Fauci said the funding could accelerate clinical trials “already in progress” for some antiviral pills and potentially make candidates available by year’s end. He noted that antiviral pills that patients can use to self-treat at home would serve as an important compliment to vaccinations in preventing severe illness or hospitalization.

There are a number of small and microcap biopharmaceutical companies that are in various stages of exploring new antiviral treatments for Covid and other threats. With Washington’s $3.2 billion as yet unallocated support, perhaps some of these are worth visiting.

CoCrystal Pharma, Inc. (Nasdaq:COCP) is a clinical-stage biotechnology company employing its unique structure-based technologies and Nobel Prize-winning expertise to create and develop first- and best-in-class broad-spectrum antiviral drugs for serious and/or chronic diseases. These technologies are designed to efficiently deliver small-molecule therapeutics that target the viral replication process and are safe, effective and convenient to administer. Cocrystal’s development programs include influenza, COVID-19, hepatitis C and gastroenteritis caused by norovirus.

52 Week Range $0.76-$3.46

CytoDyn, Inc. (OTC:QB CYDY) Inc. is US-based clinical-stage biotechnology company which focuses on the clinical development and potential commercialization of humanized monoclonal antibodies to treat Human Immunodeficiency Virus (HIV) infection. IPIX will hold a webcast on June 21 to Discuss Unblinded Data from COVID-19 Long-Haulers Trial and Other Developments .

52 week price range $1.63-$10.01

Avalon GloboCare Corp. (Nasdaq:AVCO) Avalon GloboCare, a leading biotechnology company focusing on cell-based technology and therapeutics, is about to launch clinical trials of its novel blood filtration system to mitigate symptoms of a cytokine storm in COVID-19 patients and a mucosal intranasal spray vaccination against SARS-CoV-2.

52 week price range $0.87- $2.16

Too Many to List

Other companies at various stages of testing development can be found below the article by scrolling down. Click on the tickers for more details on their work and data on the company.

Suggested Reading:

|

|

Capitalism Vs Coronavirus (April 2020)

|

Stem Cell Based Therapies for Alzheimer’s Disease

|

|

|

Avalon GloboCare at the World Stem Cell Summit

|

HealthyLynked at the World Stem Cell Summit

|

Sources:

https://www.nature.com/articles/d43747-020-01139-4

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|

Therapeutic Companies will get $3.2 Billion in R & D Support

Companies Developing Therapeutics to Fight Covid-19 Will get a $3.2 Billion Injection

Some antiviral medicines related to coronavirus will get a $3.2 billion shot in the arm to help accelerate testing and development of therapeutics to combat the Covid-19 virus. This was announced (6/17/21) by the Department of Health and Human Services.

“New antivirals that prevent serious Covid-19 illness and death, especially oral drugs that could be taken at home early in the course of disease, would be powerful tools for battling the pandemic and saving lives,” said President Biden’s, chief medical adviser, Dr. Anthony Fauci.

The $3.2 billion allocated will be from the $1.9 trillion coronavirus relief package Biden signed into law in March. Dr. Fauci said the funding could accelerate clinical trials “already in progress” for some antiviral pills and potentially make candidates available by year’s end. He noted that antiviral pills that patients can use to self-treat at home would serve as an important complement to vaccinations in preventing severe illness or hospitalization.

There are a number of small and microcap biopharmaceutical companies that are in various stages of exploring new antiviral treatments for Covid and other threats. With Washington’s $3.2 billion as yet unallocated support, perhaps some of these are worth visiting.

CoCrystal Pharma, Inc. (Nasdaq:COCP) is a clinical-stage biotechnology company employing its unique structure-based technologies and Nobel Prize-winning expertise to create and develop first- and best-in-class broad-spectrum antiviral drugs for serious and/or chronic diseases. These technologies are designed to efficiently deliver small-molecule therapeutics that target the viral replication process and are safe, effective, and convenient to administer. Cocrystal’s development programs include influenza, COVID-19, hepatitis C and gastroenteritis caused by norovirus.

52 Week Range $0.76-$3.46

CytoDyn, Inc. (OTC:QB CYDY) Inc. is US-based clinical-stage biotechnology company that focuses on the clinical development and potential commercialization of humanized monoclonal antibodies to treat Human Immunodeficiency Virus (HIV) infection. IPIX will hold a webcast on June 21 to discuss unblinded data from the COVID-19 Long-Haulers Trial and other developments .

52 week price range $1.63-$10.01

Avalon GloboCare Corp. (Nasdaq:AVCO) is a leading biotechnology company focusing on cell-based technology and therapeutics, is about to launch clinical trials of its novel blood filtration system to mitigate symptoms of a cytokine storm in COVID-19 patients and a mucosal intranasal spray vaccination against SARS-CoV-2.

52 week price range $0.87- $2.16

Too Many to List

Other companies at various stages of testing development can be found below the article by scrolling down. Click on the tickers for more details on their work and data on the company.

Suggested Reading:

|

|

Capitalism Vs Coronavirus (April 2020)

|

Stem Cell Based Therapies for Alzheimer’s Disease

|

|

|

Avalon GloboCare at the World Stem Cell Summit

|

HealthyLynked at the World Stem Cell Summit

|

Sources:

https://www.nature.com/articles/d43747-020-01139-4

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|

Onconova Therapeutics Announces The Peer-Reviewed Publication Of Preclinical Data Demonstrating The Synergistic Anti-Cancer Activity Of Rigosertib Combined With Immune Checkpoint Blockade

Onconova Therapeutics Announces The Peer-Reviewed Publication Of Preclinical Data Demonstrating The Synergistic Anti-Cancer Activity Of Rigosertib Combined With Immune Checkpoint Blockade

igosertib synergistically combined with immune checkpoint blockade (ICB) to improve tumor growth inhibition and survival in a murine melanoma model that did not respond to ICB alone

Rigosertib’s anti-cancer activity was due to its ability to reverse immunosuppressive tumor microenvironments

Data support the clinical evaluation of rigosertib in combination with immune checkpoint inhibitors

NEWTOWN, Pa., June 17, 2021 (GLOBE NEWSWIRE) — Onconova Therapeutics, Inc. (NASDAQ: ONTX) (“Onconova”), a clinical-stage biopharmaceutical company focused on discovering and developing novel products for patients with cancer, today announced the publication of a preclinical study in the journal Molecular Cancer. The study, entitled “Novel induction of CD40 expression by tumor cells with RAS/RAF/PI3K pathway inhibition augments response to checkpoint blockade,” showed that rigosertib synergistically enhanced the efficacy of ICB in a murine melanoma model via the induction of immune-mediated cancer cell death.

“The data from this recent publication demonstrate rigosertib’s potential to address a pressing unmet need, as many patients do not respond to immune checkpoint blockade due to immunosuppressive tumor microenvironments,” said Ann Richmond, Ph.D., Ingram Professor of Pharmacology and Medicine at the Vanderbilt University School of Medicine and lead author of the study. “By reversing immunosuppressive tumor microenvironments, rigosertib overcame pro-tumor resistance mechanisms and synergistically enhanced the efficacy of immune checkpoint blockade in a difficult-to-treat murine melanoma model. These compelling findings provide preclinical proof-of-concept for rigosertib-immune checkpoint blockade combination therapy and strongly support its evaluation in clinical trials.”

Key data and conclusions from the recent publication include:

- Rigosertib treatment enhanced the activation of anti-cancer immune cells and increased the frequency of these cells in the tumor microenvironment (TME).

- Rigosertib treatment reduced the frequency of pro-tumor CD206+ M2-like macrophages in the TME.

- Rigosertib monotherapy rapidly reduced PI3K signaling with induction of CD40 expression, leading to melanoma cell death and inhibition of tumor growth in vivo due to its ability to promote the tumor infiltration of activated anti-cancer immune cells.

- Rigosertib’s ability to remodel the TME enabled it to synergistically combine with ICB and improve tumor growth inhibition and survival in a mouse model of melanoma that did not respond to ICB alone, or a clinically used combination of ICB plus BRAF and MEK inhibitors.

Steven M. Fruchtman, M.D., President and Chief Executive Officer of Onconova, added, “We are very pleased with these recently published results, which will inform the data driven approach guiding our clinical rigosertib investigator-initiated study program. They provide strong mechanistic support for both the ongoing KRAS mutated non-small cell lung cancer trial of rigosertib in combination with a check point inhibitor and a potential trial in patients with advanced melanoma evaluating a rigosertib-checkpoint inhibitor combination that is under active consideration. Looking ahead, we plan to continue leveraging our collaborations with leading institutions such as Vanderbilt University as we pursue opportunities for rigosertib while maintaining our primary focus and resources on our lead ON 123300 multi-kinase inhibitor program.”

About Onconova Therapeutics, Inc.

Onconova Therapeutics is a clinical-stage biopharmaceutical company focused on discovering and developing novel products for patients with cancer. The Company has proprietary targeted anti-cancer agents designed to disrupt specific cellular pathways that are important for cancer cell proliferation.

Onconova’s novel, proprietary multi-kinase inhibitor ON 123300 is being evaluated in two separate and complementary Phase 1 dose-escalation and expansion studies. These trials are currently underway in the United States and China.

Onconova’s product candidate rigosertib is being studied in an investigator-initiated study program, including in a dose-escalation and expansion Phase 1 investigator-initiated study targeting patients with KRAS+ non-small cell lung cancer with oral rigosertib in combination with nivolumab. In addition, Onconova continues to conduct preclinical work investigating rigosertib in COVID-19.

For more information, please visit www.onconova.com.

Forward-Looking Statements

Some of the statements in this release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, and involve risks and uncertainties. These statements relate to Onconova’s expectations regarding the timing of Onconova’s and investigator-initiated clinical development plans, and the mechanisms and indications for Onconova’s product candidates. Onconova has attempted to identify forward-looking statements by terminology including “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately” or other words that convey uncertainty of future events or outcomes. Although Onconova believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, expectations may prove to have been materially different from the results expressed or implied by such forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors, including the success and timing of Onconova’s clinical trials and regulatory agency and institutional review board approvals of protocols, the timing of the Company’s annual stockholder meeting, market conditions and those discussed under the heading “Risk Factors” in Onconova’s most recent Annual Report on Form 10-K and quarterly reports on Form 10-Q. Any forward-looking statements contained in this release speak only as of its date. Onconova undertakes no obligation to update any forward-looking statements contained in this release to reflect events or circumstances occurring after its date or to reflect the occurrence of unanticipated events.

Company Contact:

Avi Oler

Onconova Therapeutics, Inc.

267-759-3680

ir@onconova.us

https://www.onconova.com/contact/

Investor Contact:

Bruce Mackle

LifeSci Advisors, LLC

646-889-1200

bmackle@lifesciadvisors.com