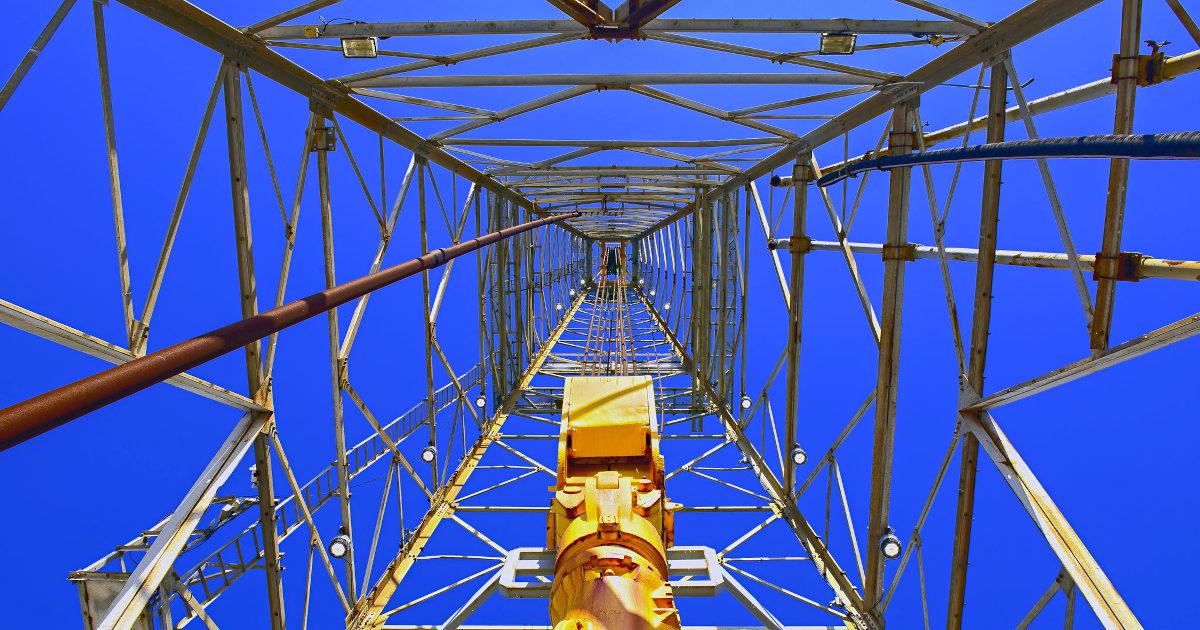

Image Credit: Jerry and Pat Donaho (flickr)

Oil Market Conditions May Change as We Enter the Second Half of 2021

The end of the pandemic-driven standstill in commerce and the current economic global reopening has meant a resumption in demand for oil products. The Organization of Petroleum Exporting Countries and their allies (OPEC+) will meet most of this weekend and through Thursday to review oil market conditions. There are high expectations that they will want to roll back further some of their crude output decreases that were decided upon over the past year.

OPEC Plus Meetings

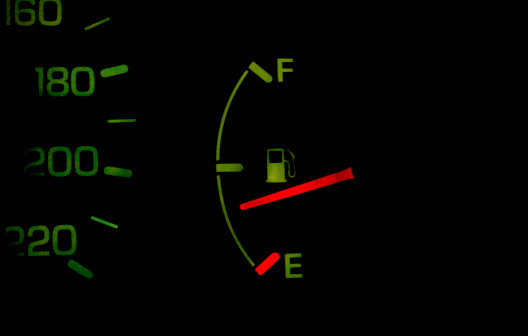

At the beginning of the second quarter, OPEC+ met and agreed to return to a gradual rollback of previous output cuts beginning May and extending through July. At the time, Saudi Arabia also made clear its intention to unwind the voluntary cuts the kingdom had been making. OPEC+ had been holding back roughly eight million barrels a day of output at the time, one million of which represents the Saudis’ voluntary cut. The move to increase production levels didn’t cause weakening in the crude markets. In fact, the global benchmark for Brent crude on Friday (June 25) and the U.S. price for West Texas Intermediate (WTI) were each at their highest levels since October 2018 (front-month contracts $76.18 and $74.05, respectively).

On Tuesday, July 6 and Wednesday, OPEC+ will be convening for technical meetings to review the oil market, in preparation for the “official meeting” via videoconference on Thursday of the full OPEC+. It is during this meeting that they will formalize their decision on production levels.

|

Who is OPEC Plus? The Organization of the Petroleum Exporting Countries Plus (OPEC+) is a loosely affiliated body consisting of a cartel of 13 OPEC members along with 10 non-OPEC large oil-producing nations. The objective of OPEC+ is to orchestrate world oil production so as to target price levels. |

Wild Card is OPEC+ Doesn’t Increase

Although the cartel sees that oil consumption is rising and expected to continue throughout the year, there’s another “wrinkle” that might alter the expected decision to roll back previous output reductions. The wrinkle is Iran. The U.S. and Iran have been engaging indirectly to move toward restoring the 2015 nuclear deal. This arrangement had been aimed at limiting Iran’s military-focused nuclear development. It may be that the final agreement includes guidance in case the Iran talks advance and cause the U.S. to lift sanctions that had been imposed during the Spring of 2018. This would allow Iran to increase its oil sales.

The probability of the U.S. / Iran restoring the nuclear deal and lifting oil sanctions has been complicated by the recent election of a more conservative Iranian President.

Take-Away

Any agreed upon OPEC+ production increase is likely to impact long-term oil prices that remain high. Current global economic growth, barring a renewed shutdown, may be absorbed just as easily as the increases decided upon earlier this year. Oil markets and the related oil company and alternative fuel stocks may still get a jolt late next week as traders will watch closely and react to perceptions of where they believe this takes us.

|

Virtual Roadshow Replay with Indonesia Energy President Frank Ingriselli This Virtual Road Show Replay features a formal corporate presentation from Indonesia Energy President Frank Ingriselli. Afterward, he is joined by Noble Capital Markets Senior Research Analyst Michael Heim for a Q & A session featuring questions asked by the live audience throughout the event. Watch the replay, and get Noble’s research on INDO, as well as news and advanced market data at the link below. |

Suggested Reading:

|

|

The US Has Solidified Its Support for Battery Technology

|

Official US Price and Inventory Oil Forecast for the Second Half of 2021

|

|

|

Investment Opportunities in Hydrogen

|

The Bill Gates / Warren Buffett Natrium Reactor Risks and Benefits

|

Sources:

https://www.iea.org/reports/oil-market-report-june-2021

https://www.opec.org/opec_web/en/311.htm

https://en.wikipedia.org/wiki/United_States_withdrawal_from_the_Joint_Comprehensive_Plan_of_Action

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|