image credit: Paul Boudreau (Flickr) - Inverted from Original

Four Inflation Growth Possibilities and their Impact on Stocks

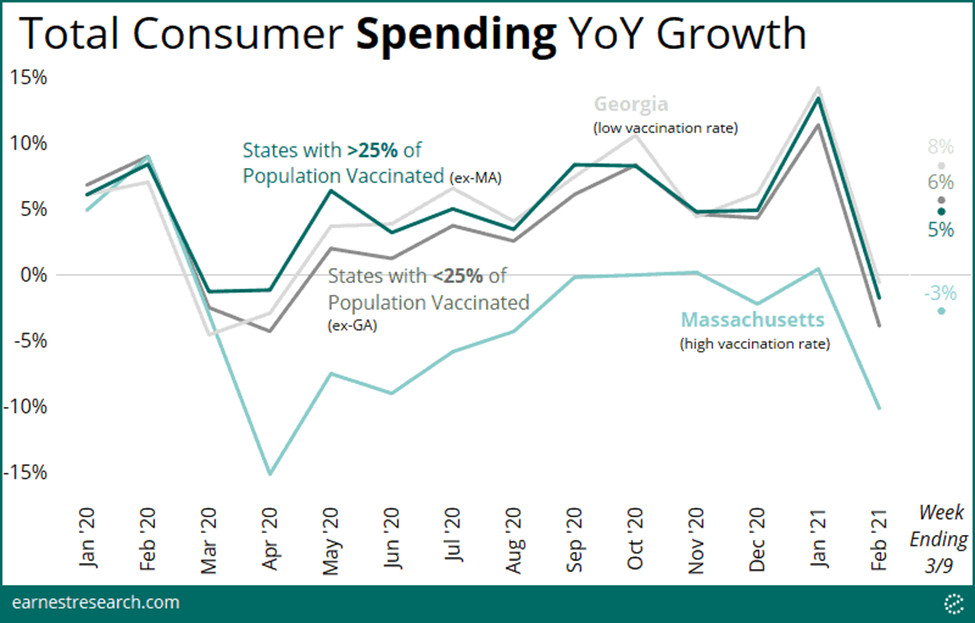

One data point does not make a trend. Yet, after the Bureau of Labor Statistics (BLS) posted a 0.08% increase of the most-watched inflation measure (CPI-U), debates exploded over whether we’re in a dangerous upward trend. If you listen close, they’re not two-sided debates. In my own discussions and observations, I count four positions on the important state-of-inflation question.

Implications of Each Position

Each position has a different implication. There are some that expect the Fed will backtrack significantly on their “low rates for years” language and quickly take the proverbial punch bowl away. These are the voices saying the Fed will notch up rates soon. Another contingent that also argues rates are going up suggests the Fed now has little control. They agree that rates are rising, but they think it will be market-driven and completely outside of intended monetary policy. Then there are those who believe rates will stay down in much the same way we have experienced low rates for the past 12 months – no change. A fourth voice in the debate believes inflation levels will not stay too high, but the Fed would quickly change course if they do.

All four of these have different ramifications for the stock market. Should rates rise or be pushed up, money would be pulled out of the equity markets and reallocated to the more predictable returns of fixed income securities. The next inflation data release is scheduled for June 13; this will either begin to confirm or disprove a trend. Equity market investors should keep an eye on which of the four scenarios are unfolding. Here’s why: In two of the four different scenarios rates rise, however, each is nuanced and could have different effects on stocks. Another two distinct scenarios are where rates stay near current levels, they could also lead to different paths for equity markets.

Low Inflation Contained – Scenario #1

Let’s start with the scenario, of low inflation. Those supporting this forecast see modest price growth as deeply ingrained in economic activity, they believe sharper increases simply won’t happen. They don’t foresee overheating even with the promised 0.00-0.25% interest rates for the next three years. Those embracing this scenario take reassurance that the CPI release that prompted the debate, was clouded by base effects and supply bottlenecks, both of which could be a short-term occurrence.

|

Base Effect:

The impact of an increase in the price level (i.e. previous year’s inflation) over the corresponding rise in price levels in the current year. If the inflation rate was low in the same period last year, then even a small increase in the price index will produce a high rate of inflation in the current year.

|

The supporters of this idea expect “business as usual.” And as we have learned, “usual” means we’ve had cheap money and low rates with no problem – inflation isn’t a concern, the results will continue to be a strong stock market that will march upward. This is the most bullish scenario for stocks (and bond prices).

Fed Will Fall Behind – Scenario #2

Let’s look at the other extreme inserted here as scenario two. These folks view the Fed as having an overly dovish bias that will ignore the warning signs until it’s too late. Reeling inflation in, after it takes hold, is more difficult than maintaining stability by staying ahead of it. They are very concerned the Fed is already behind. Under this scenario the Fed loses control, long-term bond yields soar as bond investors require compensation (yields) above the expected level of purchasing-power erosion. The Fed has been able to keep control over short-term rates, but they can lose the ability to impact the longer maturities out on the yield curve. In fact, keeping the short end anchored near zero could spook bond buyers even more.

|

Dovish:

The Fed’s tone of Fed monetary policy and position toward inflation is dovish if it leans more toward inflation is not a problem so economic growth is a higher priority. When the Fed is dovish, they are likely to keep rates low.

The opposite is when the Fed is looking to subdue growth to maintain an inflation target, it is called hawkish.

|

Under this second scenario, stocks react by selling off in many sectors. This is because borrowing costs of businesses rise, importers will have to pay more for their goods, costs they may not be able to fully pass on to customers, dividend-paying stocks will take a hit as competition intensifies with coupon levels paid on bonds. Any poor performance from equities could drive even more money out and into bonds and insured deposits.

Fed too Slow on the Draw – Scenario #3

In a third scenario, there are those who expect the Fed to respond to a climb in inflation pressures, but not in time. These Fed-watchers, pundits, and everyday investors see the central bank as more committed to their forward guidance on rates than to their other pledge to act if core prices stay above their 2% target. My former colleague, ex-Federal Reserve Bank of New York President, Bill Dudley, put himself firmly in that group. In a recent Bloomberg interview, he suggested that the Fed would start chasing inflation’s tail after it ran away and that we would then need much higher nominal rates to get real rates to the levels that would cool growth and inflation pressures. His experienced projection is that policy rates could top 4%.

|

BLS CPI Data Release Dates

|

June 2021

|

Jul. 13, 2021

|

08:30 AM

|

|

July 2021

|

Aug. 11, 2021

|

08:30 AM

|

|

August 2021

|

Sep. 14, 2021

|

08:30 AM

|

|

September 2021

|

Oct. 13, 2021

|

08:30 AM

|

|

October 2021

|

Nov. 10, 2021

|

08:30 AM

|

|

November 2021

|

Dec. 10, 2021

|

08:30 AM

|

|

This scenario would likely cause an erratic stock market. Some days traders and other participants may take solace over the Fed’s occasional calming words and then markets could spike up on other days as it gets spooked by numbers suggesting economic overheating was ignored. This push and pull create opportunities for traders that do better with volatility, most investors prefer clearly trending markets.

The Fed’s Got This – Scenario #4

Janet Yellen, who also has some insight into what goes on behind closed doors at FOMC meetings, hasn’t gone against the official stance, which says that the mega-stimulus meant to encourage full employment won’t push inflation past 2% for any sustained period. She has however noted that if the stimulus is overdone, the Fed can simply start the ball rolling on a gradual climb in rates to preempt a serious overshoot.

This may sound like the first scenario, but in that scenario, the policy action was too late. This last scenario suggests the Fed can and will change if it needs to and everything will turn out fine.

Confidence and trust are important for investors. Should this trust be established and maintained, even in the face of rising inflation and rates, markets will be orderly as investors won’t expect a return to the inflation of the ’70s. Perhaps investors would experience equity indices growing along the more historical trend line.

Take-Away

Anyone who says they know the market is going to have an inevitable outcome may not be worth listening to. Professional money managers form scenario analysis and try to handicap the certainty of each outcome when allocating risk positions. Investors at all levels should view what the possibilities are and observe to see which are unfolding, shifting allocations in response.

We have had a very transparent Fed under Bernanke, Yellen, and the current Chair Powell. It has, in my observation, done everything that has been promised as it relates to conducting policy. One tool the Fed has used consistently since 2009 is the incredible power of their telling the market exactly what their plans are. Promising the markets, they will keep rates very low through next year has acted to keep bond investors from betting against the Fed’s word. Those who have bet against the Fed over the past ten-plus years have probably had bad outcomes. One question that may never be answered is: if the Fed does need to act to raise short-term rates in advance of next year, and they do act, will they lose the power of their promise?

I enjoy hearing from readers; feel free to comment directly to my email by clicking on my name below.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading

Sources:

https://www.bls.gov/news.release/pdf/cpi.pdf

https://www.fincash.com/l/basics/base-effect

https://www.bloomberg.com/news/videos/2021-04-12/dudley-says-fed-will-be-much-slower-to-tighten-video

https://www.wsj.com/articles/yellen-says-interest-rates-may-have-to-rise-to-keep-economy-from-overheating-11620151101#:~:text=Yellen%20told%20The%20Wall%20Street,the%20coming%20months%20will%20subside

Stay up to date. Follow us:

Stay up to date. Follow us: