Palladium One Intersects 2.1 g/t Pd_Eq over 38 Meters in the Lower Zone and Expands the Upper Zone at Kaukua South, Finland

May 11, 2021 – Toronto,

Ontario – Drilling continues to intersect impressive widths and grades of Platinum Group Elements (“PGE”) including

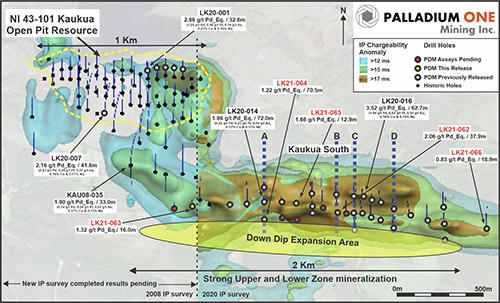

38 meters at 2.1 g/t Palladium equivalent (“Pd_Eq”) (Hole LK21-062) in the Lower Zone at Kaukua South, on the Läntinen Koillismaa (“LK”) PGE-Ni-Cu project in Finland, said Palladium One Mining Inc. (“Palladium One” or the “Company”) (TSXV: PDM, FRA: 7N11, OTC: NKORF) today. Drilling has also expanded the strike length of the Upper Zone having intersected robust mineralization which returned 51 meters @ 0.9 g/t Pd_Eq (Hole LK21-064).

46 holes (9,469 metres) have been drilled as part of the 17,500-meter Phase II Resource Definition drill program at Kaukua South, including today’s results 34 have been released, while results for 12 holes await assays. Additionally, assay results are pending for 12 drill holes at the Haukiaho Zone, where the Company completed infill drilling in advance of a NI43-101 resource estimate. Drilling is currently in hiatus for the spring thaw and is schedule to resume in later May.

When drilling resumes the intent is to target open pit resource definition of the Lower mineralized zone (down to 300 meters) on the western side of Kaukua South, and to extend mineralization immediately south of the existing Kaukua NI43-101 Open Pit constrained resource estimate.

“Our understanding of an Upper Zone of mineralization continues to expand and so does our realization that it could add a significant amount of resources to the planned NI43-101 resource estimate.

The Upper Zone lies in the hanging wall of the high-grade Lower Zone which has been the primary focus of the Phase II drill program.

The Upper Zone’s position could have a significant positive economic influence on the any future open pit scenario; and as evidenced by hole LK21-064 it can locally carry substantial grades.” said Derrick Weyrauch, President and CEO.

Highlights

- Results to date are highly encouraging and show a clear path toward a

maiden open pit resource at Kaukua South.

- Drilling demonstrates

significant continuity of open pit grades and widths

in both the Upper and Lower Zones at Kaukua South.

- 2.06

g/t Pd_Eq over 37.9 meters in hole LK21-062 (Lower Zone)

- 1.22

g/t Pd_Eq over 70.5 meters in hole LK21-064 (Lower Zone)

- 0.92

g/t Pd_Eq over 50.6 meters in hole LK21-064 (Upper Zone)

- Drilling in Kaukua south has consistently returned grades and widths, over 2 kilometers of strike length, similar to those in the Kaukua NI43-101 Open Pit constrained resource estimated immediately to the northwest.

Kaukua South Infill

Drilling

Kaukua South infill drilling continues to demonstrate consistent open

pit grades and widths. A total of 34 holes from the Phase II infill drill program on Kaukua South have now been released with intersections such as 47

meters at 2.6 g.t Pd_Eq in hole LK21-045 (see press release March 18, 2021) and 53 meters at 2.1

g/t Pd_Eq*, in hole LK20-028 (see press release January 18, 2021).

Kaukua South Upper

Mineralized Zone

Kaukua South consists of two subparallel mineralized zones, the very continuous Lower Zone near the base of the Intrusion, which is very similar to the Kaukua deposit with high PGE tenors, has been the main focus of the current drill program. The Upper Zone occurs in the hanging wall of the Lower Zone and is characterised by higher Cu-Ni values and lower PGEs (Table 1). The Upper Zone is typically more sporadic than the Lower Zone but can exhibit great widths such as seen in hole LK21-064 which returned 50.6

meters grading 0.92 g/t Pd-Eq (Figure 2). It’s position in the hanging wall relative to the Lower Zone is key and has significant positive

implications for the open pit potential of Kaukua South as it could

reduce the strip ratio and allow the pit to

extend to greater depths than originally contemplated and thereby improve project economics. As such, the Company is planning to define the Lower Zone down to a 300-meters depth in areas with strong Upper Zone mineralization (Figure 1.).

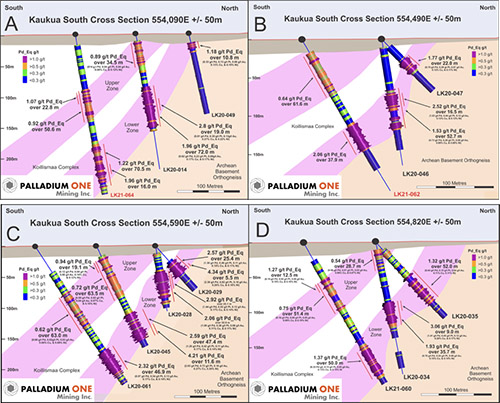

Figure 1. Western Kaukua South plan map, showing current NI 43-101 Kaukua Deposit conceptual pit outline (dashed yellow), IP chargeability anomalies, and Palladium One drill hole locations. Holes labels in red form part of this release.

Figure 2. Cross Sections A, B, C and D showing in Figure 1. Illustrating the Upper and Lower Zones in Kaukua South. Holes from this release are labelled in red.

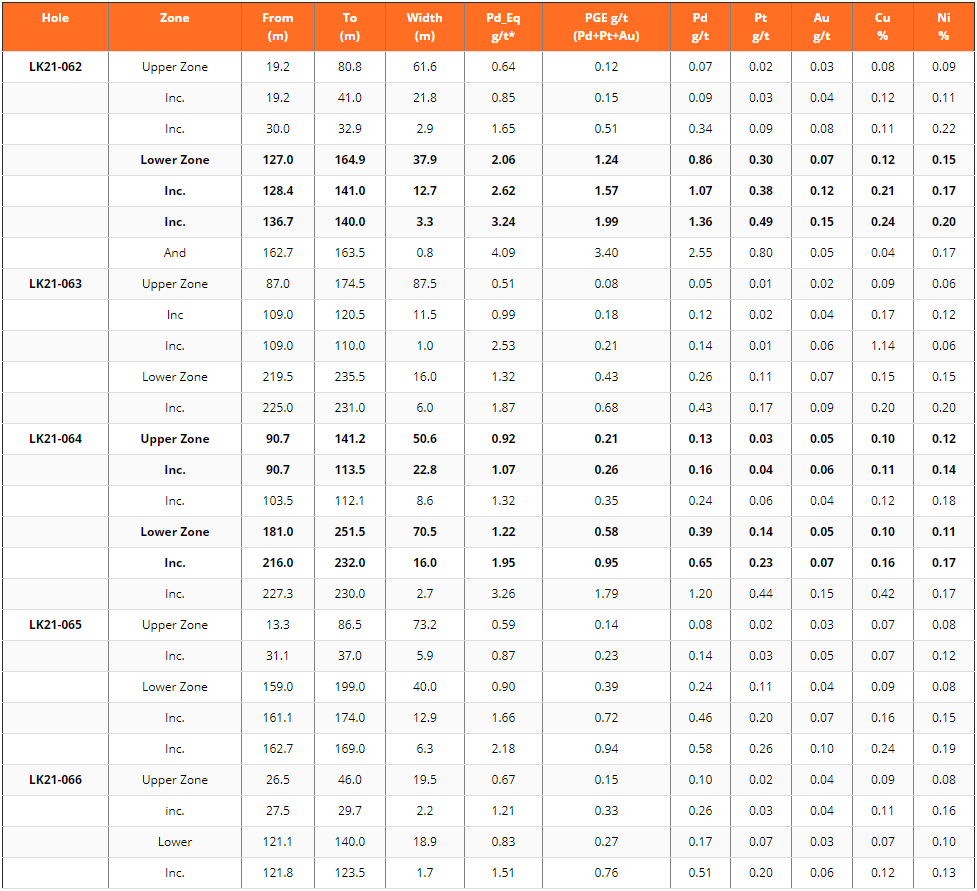

Table 1: Phase II infill

drill results on Kaukua South released herein

* Reported widths are “drilled widths” not true widths.

*Palladium Equivalent

Palladium equivalent is calculated using US$1,100 per ounce for palladium, US$950 per ounce for platinum, US$1,300 per ounce for gold, US$6,614 per tonne for copper, and US$15,4332 per tonne for nickel. This calculation is consistent with the calculation in the Company’s September 2019 NI 43-101 Kaukua resource estimate. Additionally, US$1,100 per ounce for palladium is consistent with the UBS January 2021 long-term consensus price forecast even though the current price of palladium is approximately US$3,000 per ounce.

QA/QC

The Phase I drilling program was carried out under the supervision of Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company.

Drill core samples were split using a rock saw by Company staff, with half retained in the core box and stored indoors in a secure facility, in Taivalkoski, Finland. The drill core samples were transported by courier from the Company’s core handling facility in Taivalkoski, Finland, to ALS Global (“ALS”) laboratory in Outokumpu, Finland. ALS, is an accredited lab and are ISO compliant (ISO 9001:2008, ISO/IEC 17025:2005). PGE analysis was performed using a 30 grams fire assay with an ICP-MS or ICP-AES finish. Multi-element analyses, including copper and nickel were analysed by four acid digestion using 0.25 grams with an ICP-AES finish.

Certified standards, blanks and crushed duplicates are placed in the sample stream at a rate of one QA/QC sample per 10 core samples. Results are analyzed for acceptance at the time of import. All standards associated with the results in this press release were determined to be acceptable within the defined limits of the standard used

Qualified Person

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43-101.

About Palladium One

Palladium One Mining Inc. is an exploration company targeting district scale, platinum-group-element (PGE)-copper nickel deposits in Finland and Canada. Its flagship project is the Läntinen Koillismaa or LK Project, a palladium dominant platinum group element-copper-nickel project in north-central Finland, ranked by the Fraser Institute as one of the world’s top countries for mineral exploration and development. Exploration at LK is focused on targeting disseminated sulfides along 38 kilometers of favorable basal contact and building on an established NI 43-101 open pit resource.

ON BEHALF OF THE BOARD

“Derrick Weyrauch”

President & CEO, Director

For further information

contact: Derrick Weyrauch, President & CEO

Email: info@palladiumoneinc.com

Neither the TSX Venture

Exchange nor its Market Regulator (as that term is defined in the policies of

the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy

of this release.

This press release includes

“forward-looking information” that is subject to a few assumptions,

risks and uncertainties, many of which are beyond the control of the Company.

Statements regarding listing of the Company’s common shares on the TSXV are

subject to all of the risks and uncertainties normally incident to such events.

Investors are cautioned that any such statements are not guarantees of future

events and that actual events or developments may differ materially from those

projected in the forward-looking statements. Such forward-looking statements

represent management’s best judgment based on information currently available.

Factors that could cause the actual results to differ materially from those in

forward-looking statements include regulatory actions and general business

conditions. Such forward-looking information reflects the Company’s views with

respect to future events and is subject to risks, uncertainties and

assumptions, including those set out in the Company’s annual information form

dated April 29, 2020 and filed under the Company’s profile on SEDAR at

www.sedar.com. The Company does not undertake to update forward?looking statements or forward?looking information, except as required by law.

Investors are cautioned that any such statements are not guarantees of future

performance and actual results or developments may differ materially from those

projected in the forward-looking statements.