Travelzoo Reports First Quarter 2021 Results

- Consolidated revenue of

$14.3 million , down 30% year-over-year and up 14% quarter-over-quarter - Non-GAAP consolidated operating profit of

$0.6 million - Earnings per share (EPS) of (

$0.14 ) attributable to

Travelzoo from continuing operations - Cash flow from operations of

$11.9 million

The reported net loss attributable to

Non-GAAP operating profit was

“We see continued improvement in our business.

Cash Position

As of

Reserve

Reported revenues include a reserve of

Jack’s

On

Licensing

In

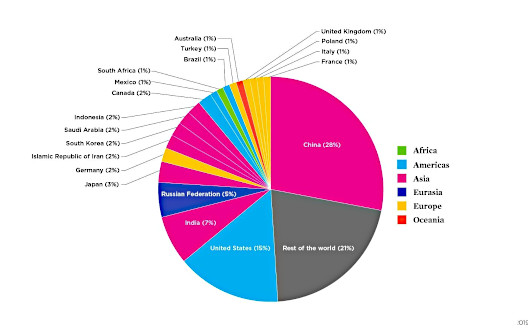

Members and Subscribers

As of

Discontinued Operations

As announced in a press release on

Income Taxes

Income tax expense was

Non-GAAP Financial Measures

Management calculates non-GAAP operating income when evaluating the financial performance of the business. Travelzoo’s calculation of non-GAAP operating income, also called “non-GAAP operating profit” in this press release and today’s earnings conference call, excludes the following items: impairment of intangibles and goodwill, amortization of intangibles, stock option expenses, and severance-related expenses. This press release includes a table which reconciles GAAP operating income to the calculation of non-GAAP operating income. Non-GAAP operating income is not required by, or presented in accordance with, generally accepted accounting principles in

Looking Ahead

We currently expect for Q2 2021 to report significantly higher revenue and profitability. We see a trend of recovery of our revenue. We have been able to reduce our operating expenses, and we believe we can contain many of the lower costs in the foreseeable future.

Conference Call

About

Travelzoo® provides our 30 million members insider deals and one-of-a-kind experiences personally reviewed by one of our deal experts around the globe. We have our finger on the pulse of outstanding travel, entertainment, and lifestyle experiences. For over 20 years we have worked in partnership with more than 5,000 top travel suppliers—our long-standing relationships give

Certain statements contained in this press release that are not historical facts may be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934. These forward-looking statements may include, but are not limited to, statements about our plans, objectives, expectations, prospects and intentions, markets in which we participate and other statements contained in this press release that are not historical facts. When used in this press release, the words “expect”, “predict”, “project”, “anticipate”, “believe”, “estimate”, “intend”, “plan”, “seek” and similar expressions are generally intended to identify forward-looking statements. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements, including changes in our plans, objectives, expectations, prospects and intentions and other factors discussed in our filings with the

Condensed Consolidated Statements of Operations (Unaudited) (In thousands, except per share amounts) |

|||||||

| Three months ended | |||||||

| 2021 | 2020 | ||||||

| Revenues | $ | 14,284 | $ | 20,327 | |||

| Cost of revenues | 3,018 | 2,703 | |||||

| Gross profit | 11,266 | 17,624 | |||||

| Operating expenses: | |||||||

| Sales and marketing | 6,790 | 13,094 | |||||

| Product development | 683 | 1,428 | |||||

| General and administrative | 4,560 | 5,522 | |||||

| Impairment of intangible asset and goodwill | — | 2,920 | |||||

| Total operating expenses | 12,033 | 22,964 | |||||

| Operating loss | (767 | ) | (5,340 | ) | |||

| Other income (loss), net | (166 | ) | (6 | ) | |||

| Loss from continuing operations before income taxes | (933 | ) | (5,346 | ) | |||

| Income tax expense (benefit) | 742 | (517 | ) | ||||

| Loss from continuing operations | (1,675 | ) | (4,829 | ) | |||

| Loss from discontinued operations, net of tax | (15 | ) | (2,919 | ) | |||

| Net loss | (1,690 | ) | (7,748 | ) | |||

| Net loss attributable to non-controlling interest | (48 | ) | (1,139 | ) | |||

| Net loss attributable to |

$ | (1,642 | ) | $ | (6,609 | ) | |

| Net loss attributable to Travelzoo—continuing operations | $ | (1,627 | ) | $ | (3,690 | ) | |

| Net loss attributable to Travelzoo—discontinued operations | $ | (15 | ) | $ | (2,919 | ) | |

| Loss per share—basic | |||||||

| Continuing operations | $ | (0.14 | ) | $ | (0.32 | ) | |

| Discontinued operations | $ | — | $ | (0.26 | ) | ||

| Net loss per share —basic | $ | (0.14 | ) | $ | (0.58 | ) | |

| Loss per share—diluted | |||||||

| Continuing operations | $ | (0.14 | ) | $ | (0.32 | ) | |

| Discontinued operations | $ | — | $ | (0.26 | ) | ||

| Net loss per share—diluted | $ | (0.14 | ) | $ | (0.58 | ) | |

| Shares used in per share calculation from continuing operations—basic | 11,391 | 11,439 | |||||

| Shares used in per share calculation from discontinued operations—basic | 11,391 | 11,439 | |||||

| Shares used in per share calculation from continuing operations—diluted | 11,391 | 11,439 | |||||

| Shares used in per share calculation from discontinued operations—diluted | 11,391 | 11,439 | |||||

Condensed Consolidated Balance Sheets (Unaudited) (In thousands) |

|||||||

2021 |

2020 |

||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 70,862 | $ | 63,061 | |||

| Accounts receivable, net | 7,293 | 4,519 | |||||

| Prepaid income taxes | 1,443 | 931 | |||||

| Deposits | 101 | 137 | |||||

| Prepaid expenses and other | 3,275 | 1,166 | |||||

| Assets from discontinued operations | 123 | 230 | |||||

| Total current assets | 83,097 | 70,044 | |||||

| Deposits and other | 1,351 | 745 | |||||

| Deferred tax assets | 4,400 | 5,067 | |||||

| Restricted cash | 1,157 | 1,178 | |||||

| Operating lease right-of-use assets | 8,474 | 8,541 | |||||

| Property and equipment, net | 1,152 | 1,347 | |||||

| Intangible assets, net | 4,250 | 4,534 | |||||

|

|

10,944 | 10,944 | |||||

| Total assets | $ | 114,825 | $ | 102,400 | |||

| Liabilities and Stockholders’ Equity | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 8,750 | $ | 6,996 | |||

| Merchant payables | 70,094 | 57,104 | |||||

| Accrued expenses and other | 10,827 | 8,649 | |||||

| Deferred revenue | 2,417 | 2,688 | |||||

| Operating lease liabilities | 3,796 | 3,587 | |||||

| PPP notes payable (current portion) | 3,460 | 2,849 | |||||

| Income tax payable | 201 | 326 | |||||

| Liabilities from discontinued operations | 580 | 671 | |||||

| Total current liabilities | 100,124 | 82,870 | |||||

| PPP notes payable | 204 | 814 | |||||

| Deferred tax liabilities | 235 | 357 | |||||

| Long-term operating lease liabilities | 10,558 | 10,774 | |||||

| Other long-term liabilities | 2,027 | 1,085 | |||||

| Total liabilities | 113,148 | 95,900 | |||||

| Non-controlling interest | 4,560 | 4,609 | |||||

| Common stock | 115 | 114 | |||||

|

|

(1,583 | ) | — | ||||

| Additional paid-in capital | 4,279 | 6,239 | |||||

| Retained earnings (accumulated deficit) | (2,045 | ) | (403 | ) | |||

| Accumulated other comprehensive loss | (3,649 | ) | (4,059 | ) | |||

| Total stockholders’ equity | (2,883 | ) | 1,891 | ||||

| Total liabilities and stockholders’ equity | $ | 114,825 | $ | 102,400 | |||

Condensed Consolidated Statements of Cash Flows (Unaudited) (In thousands) |

|||||||

| Three months ended | |||||||

| 2021 | 2020 | ||||||

| Cash flows from operating activities: | |||||||

| Net income (loss) | $ | (1,690 | ) | $ | (7,748 | ) | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||

| Depreciation and amortization | 484 | 551 | |||||

| Stock-based compensation | 882 | 23 | |||||

| Deferred income tax | 541 | (609 | ) | ||||

| Impairment of intangible assets and goodwill | — | 2,920 | |||||

| Loss on long-lived assets | — | 437 | |||||

| Loss on equity investment in WeGo | — | 195 | |||||

| Net foreign currency effects | (152 | ) | (681 | ) | |||

| Provision of loss on accounts receivable and other | (454 | ) | 1,441 | ||||

| Changes in operating assets and liabilities, net of acquisitions: | |||||||

| Accounts receivable | (2,229 | ) | 2,509 | ||||

| Income tax receivable | (545 | ) | 989 | ||||

| Prepaid expenses and other | (2,357 | ) | 862 | ||||

| Accounts payable | 1,727 | 547 | |||||

| Merchant payables | 13,212 | (6,940 | ) | ||||

| Accrued expenses and other | 2,199 | 704 | |||||

| Income tax payable | (126 | ) | (333 | ) | |||

| Other liabilities | 412 | 2,077 | |||||

| Net cash provided by operating activities | 11,904 | (3,056 | ) | ||||

| Cash flows from investing activities: | |||||||

| Acquisition of business, net of cash acquired | — | (679 | ) | ||||

| Purchases of property and equipment | (7 | ) | (131 | ) | |||

| Net cash provided by (used in) investing activities | (7 | ) | (810 | ) | |||

| Cash flows from financing activities: | |||||||

| Repurchase of common stock | (1,583 | ) | (1,205 | ) | |||

| Payment of promissory notes | — | (1,000 | ) | ||||

| Proceeds from exercise of stock options, net of taxes for net share settlement | (2,840 | ) | — | ||||

| Net cash used in financing activities | (4,423 | ) | (2,205 | ) | |||

| Effect of exchange rate on cash, cash equivalents and restricted cash | 270 | (272 | ) | ||||

| Net increase in cash, cash equivalents and restricted cash | 7,744 | (6,343 | ) | ||||

| Cash, cash equivalents and restricted cash at beginning of period | 64,385 | 20,710 | |||||

| Cash, cash equivalents and restricted cash at end of period | $ | 72,129 | $ | 14,367 | |||

Segment Information from Continuing Operations (Unaudited) (In thousands) |

|||||||||||||||||||

| Three months ended |

North America |

Jack’s Flight Club |

Elimination | Consolidated | |||||||||||||||

| Revenue from unaffiliated customers | $ | 9,828 | $ | 3,569 | $ | 887 | $ | — | $ | 14,284 | |||||||||

| Intersegment revenue | (9 | ) | 9 | — | — | — | |||||||||||||

| Total net revenues | 9,819 | 3,578 | 887 | — | 14,284 | ||||||||||||||

| Operating income (loss) | $ | 39 | $ | (696 | ) | $ | (110 | ) | $ | — | $ | (767 | ) | ||||||

| Three months ended |

North America |

Jack’s Flight Club |

Elimination | Consolidated | |||||||||||||||

| Revenue from unaffiliated customers | $ | 12,549 | $ | 7,103 | $ | 683 | $ | (8 | ) | $ | 20,327 | ||||||||

| Intersegment revenue | 148 | (156 | ) | — | 8 | — | |||||||||||||

| Total net revenues | 12,697 | 6,947 | 683 | — | 20,327 | ||||||||||||||

| Operating loss | $ | (976 | ) | $ | (1,341 | ) | $ | (3,015 | ) | $ | (8 | ) | $ | (5,340 | ) | ||||

Reconciliation of GAAP to Non-GAAP Information (Unaudited) (In thousands, except per share amounts) |

|||||||

| Three months ended |

|||||||

| 2021 | 2020 | ||||||

| GAAP operating expense | $ | 12,033 | $ | 22,964 | |||

| Non-GAAP adjustments: | |||||||

| Impairment of intangible and goodwill (A) | — | 2,920 | |||||

| Amortization of intangibles (B) | 284 | 215 | |||||

| Stock option expenses (C) | 882 | 23 | |||||

| Severance-related expenses (D) | 223 | 217 | |||||

| Non-GAAP operating expense | 10,644 | 19,589 | |||||

| GAAP operating income (loss) | (767 | ) | (5,340 | ) | |||

| Non-GAAP adjustments (A through D) | 1,389 | 3,375 | |||||

| Non-GAAP operating income (loss) | 622 | (1,965 | ) | ||||

Investor Relations:

ir@travelzoo.com

Source: Travelzoo