Endeavour Silver Closes Sale of El Cubo Mine to VanGold Mining

VANCOUVER, British Columbia, April 12, 2021 (GLOBE NEWSWIRE) —

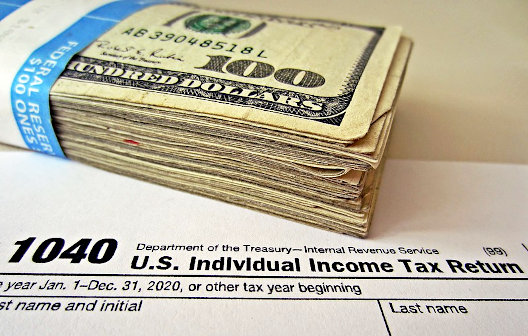

Endeavour Silver Corp. (TSX: EDR, NYSE: EXK) (“Endeavour”) announces that it has now closed the sale of the El Cubo Mine in Guanajuato, Mexico to VanGold Mining Corp. (“VanGold”) for $15 million in cash and share payments plus up to $3 million in future contingent payments (all dollar amounts in US dollars unless otherwise noted) (the “Transaction”).

VanGold paid $15,000,000 to Endeavour as follows:

- $7.5 million cash on closing.

- $5.0 million (C$6,399,317.40) in VanGold common shares (“VanGold Shares”) on closing, priced at $0.2344 (C$0.30) per VanGold Share for a total of 21,331,058 VanGold Shares (“Consideration

Shares”) representing approximately 10.9% of the issued and outstanding VanGold Shares. - $2.5 million promissory note due 12 months from closing.

VanGold has also agreed to pay Endeavour up to an additional $3,000,000 in contingent payments based on the following:

- $1.0 million upon VanGold producing 3,000,000 silver equivalent ounces from the El Cubo mill, derived from either the El Cubo or El Pinguico project, $500,000 of which may, in VanGold’s discretion, be paid in VanGold Shares.

- $1.0 million if the price of gold closes at or above $2,000 per ounce for 20 consecutive trading days within two years after the closing date of the Transaction.

- A further $1.0 million if the price of gold closes at or above $2,200 per ounce for 20 consecutive trading days within three years after the closing date of the Transaction.

Bradford Cooke, Endeavour CEO and Director, commented, “We are pleased to close this transaction and I congratulate VanGold for helping make it a win-win deal for both companies. They are in the best position to create more value out of the El Cubo assets given their emerging El Pinguico project located very close to El Cubo, and we now become the largest shareholder of VanGold. I look forward to supporting VanGold in their efforts to become the next junior silver-gold producer in Mexico!”

On the closing of the Transaction, Endeavour acquired 21,331,058 VanGold Shares. Based on 194,931,838 VanGold Shares outstanding as of the closing date of the Transaction, the Consideration Shares represent 10.9% of the outstanding VanGold Shares on an undiluted basis. Prior to the closing date of the Transaction, Endeavour did not own any VanGold Shares or other securities of VanGold. Endeavour has agreed to abstain from voting its shares of VanGold, other than as recommended by VanGold’s management, for a period of 2 years, and to a 12-month restriction on the resale of any VanGold shares acquired in this Transaction.

Endeavour acquired its interest in the Consideration Shares for long term investment purposes and will continue to monitor the business, prospects, financial condition and potential capital requirements of VanGold. Endeavour may acquire additional securities of VanGold including on the open market or through private acquisitions or sell securities of VanGold including on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors.

About Endeavour Silver – Endeavour Silver Corp. is a mid-tier precious metals mining company that owns and operates three high-grade, underground, silver-gold mines in Mexico. Endeavour is currently advancing the Terronera mine project towards a development decision and exploring its portfolio of exploration and development projects in Mexico and Chile to facilitate its goal to become a premier senior silver producer. Our philosophy of corporate social integrity creates value for all stakeholders.

SOURCE Endeavour Silver Corp.

Endeavour will file an early warning report in connection with the Transaction on SEDAR at www.sedar.com. A copy of the report may be obtained by contacting Galina Meleger at:

Contact Information

Galina Meleger, Director Investor Relations

Toll free: (877) 685-9775

Tel: (604) 640-4804

Email: gmeleger@edrsilver.com

Website: www.edrsilver.com

Follow Endeavour Silver on Facebook, Twitter, Instagram and LinkedIn

Cautionary Note Regarding Forward-Looking Statements

This

news release contains “forward-looking statements” within the meaning of the

United States private securities litigation reform act of 1995 and

“forward-looking information” within the meaning of applicable Canadian

securities legislation. Such forward-looking statements and information herein

include but are not limited to statements regarding future prospects of the El

Cubo and El Pinguico projects and future acquisitions or dispositions of

VanGold Shares. The Company does not intend to and does not assume any obligation

to update such forward-looking statements or information, other than as

required by applicable law.

Forward-looking

statements or information involve known and unknown risks, uncertainties and

other factors that may cause the actual results, level of activity, production

levels, performance or achievements to be materially different from those

expressed or implied by such statements. Such factors include but are not

limited to the ultimate impact of the COVID 19 pandemic on operations and

results, changes in production and costs guidance, national and local

governments, legislation, taxation, controls, regulations and political or

economic developments in Canada and Mexico; financial risks due to precious

metals prices, operating or technical difficulties in mineral exploration,

development and mining activities; risks and hazards of mineral exploration, development

and mining; the speculative nature of mineral exploration and development and

risks in obtaining necessary licenses and permits,

Forward-looking

statements are based on assumptions management believes to be reasonable,

including but not limited to: the continued exploration and mining operations,

no material adverse change in the market price of commodities, mining

operations will operate and the mining products will be completed in accordance

with management’s expectations and achieve their stated production outcomes,

and such other assumptions and factors as set out herein. Although the Company

has attempted to identify important factors that could cause actual results to

differ materially from those contained in forward-looking statements or information,

there may be other factors that cause results to be materially different from

those anticipated, described, estimated, assessed or intended. There can be no

assurance that any forward-looking statements or information will prove to be

accurate as actual results and future events could differ materially from those

anticipated in such statements or information. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

Source: Endeavour Silver Corporation