Group 11 Technologies Signs Option Agreement with GFG to Advance the Rattlesnake Hills Gold Project with Revolutionary Technology

Environmentally Friendly Solutions and In Place Mining to Extract Precious Metals

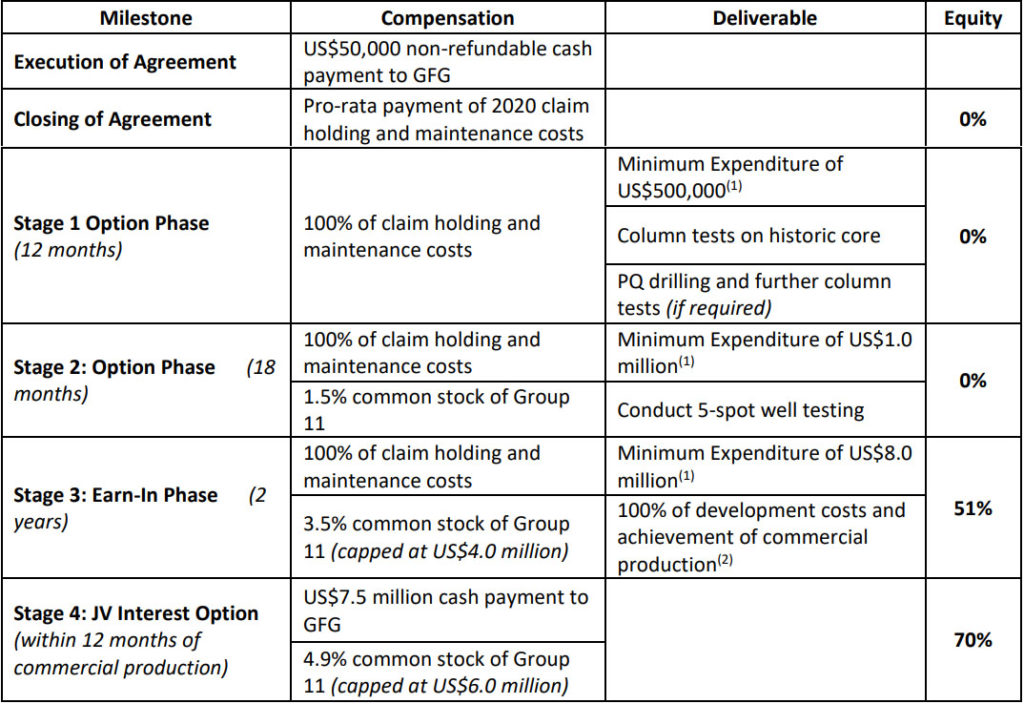

April 14, 2021, Dallas, Texas: Group 11 Technologies Inc. (“Group 11”) is pleased to announce it has signed an option and earn-in agreement (the “Agreement”) with GFG Resources Inc. (TSXV: GFG) (OTCQB: GFGSF) (“GFG”) to advance GFG’s Rattlesnake Hills Gold Project (the “Project”) in Wyoming, United States. Under the terms of the Agreement, Group 11 has the right to acquire, in multiple stages, up to 70% of the Project by completing a series of exploration and development expenditures (“Expenditures”) as summarized below and making staged cash and equity payments to GFG.

Group 11 Technologies Inc. is led by a group of technical pioneers and experts in the development and application of in-situ recovery (“ISR”) with significant experience operating in Wyoming. Group 11’s goal is to combine ISR, a non-invasive extraction technology, with an environmentally friendly water-based chemistry to recover gold and other metals, providing an alternative development path to conventional open pit and underground mineral extraction.

The Rattlesnake Hills Gold Project is viewed as an ideal test project for Group 11 for the following reasons:

- Wyoming is a top United States mining jurisdiction with regulators who understand and effectively legislate ISR better than anywhere else in the US;

- Gold grades throughout the system vary from low to high allowing for testing various grades response to the ISR process;

- Gold occurs in a variety of geological settings, allowing for testing of various styles of mineralization;

- Gold occurs across a large physical area allowing for testing under various lithostatic conditions across and through several rock types and chemistries;

- Gold occurs under relatively accessible topography, an important consideration for wellfield development.

Live Webcast – April 15, 2021

Management of GFG and Group 11 will host a webcast on Thursday, April 15 at 10:00 am Eastern Standard

Time (7:00 am Pacific Standard Time) to discuss the Agreement, Group 11’s innovative technology, the

upcoming programs and to answer any questions from shareholders. Shareholders, analysts, investors, and media are invited to join the live webcast by registering using the link below.

Link: https://6ix.com/event/gfg-and-group11/

After registering, you will receive a confirmation email containing details to access the webinar via conference call or webcast. A replay of the webcast will be available following the conclusion of the call.

“Group 11 is very excited to establish its first anchor project with GFG and the Rattlesnake Hills Gold Project. Rattlesnake hosts all the necessary parameters, in a well-established jurisdiction, to test and apply the combination of ISR technology and our exclusive use of EnviroLeach’s non-cyanide water based chemistry for ISR applications,” said Janet Lee-Sheriff, President of Group 11. “We already have successfully tested the EnviroLeach non-cyanide chemistry on sulfide concentrates and achieved optimal results in shorter timelines than cyanide. The recyclability of the environmentally-friendly chemistry makes it an attractive ingredient in ISR technology and an alternative to cyanide for gold recovery. Group 11 will commence first stage lab test work on drill core in the summer of 2021 and we look forward to advancing our work to develop new solutions for the mineral extraction industry.”

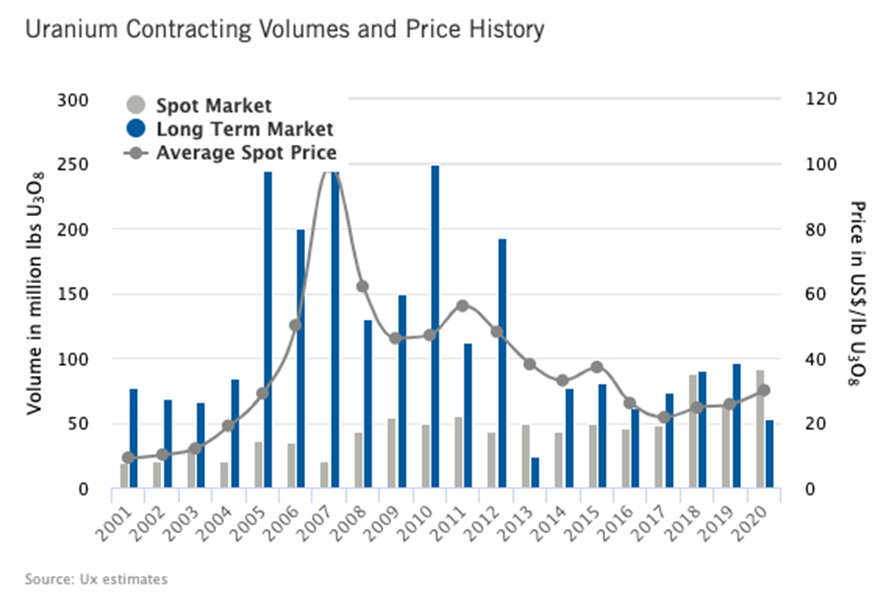

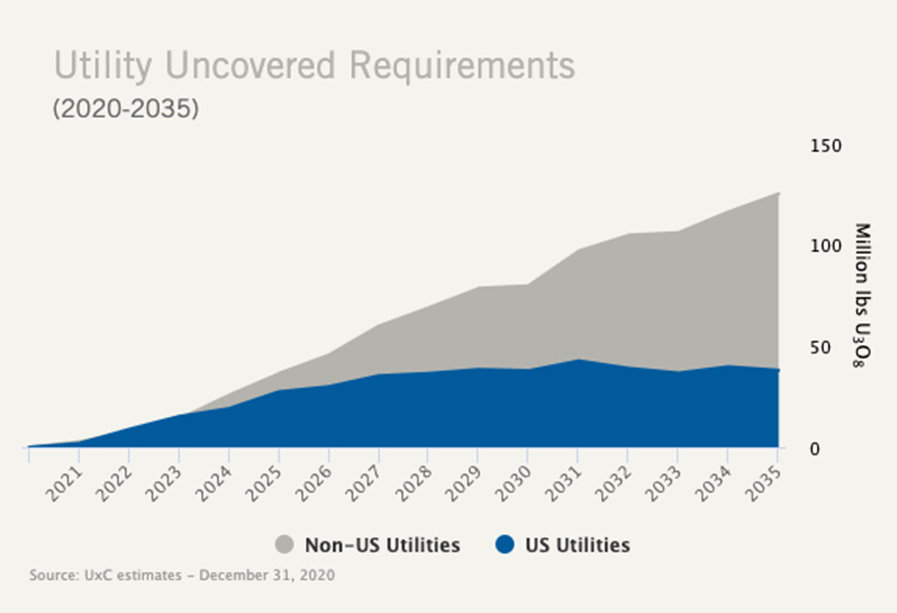

“We are excited to have entered into a partnership with Group 11 to advance our Rattlesnake Hills Gold Project and be part of a technology that could revolutionize the gold mining industry,” stated Brian Skanderbeg, President and CEO of GFG. “Our Project is the ideal asset to test and optimize Group 11’s technology given the character of the mineralized systems, significant zones of gold mineralization and the established permitting path for ISR mining in Wyoming. This is an exciting development for our shareholders and stakeholders as we work with our partners to develop and apply ISR technology to gold systems. Over the last several decades, this technology has been successfully applied in both uranium and copper mining, driving significantly reduced development timeframes, lower capital intensity and materially reduced environmental impacts. We believe in its potential to be equally applicable to the gold space.”

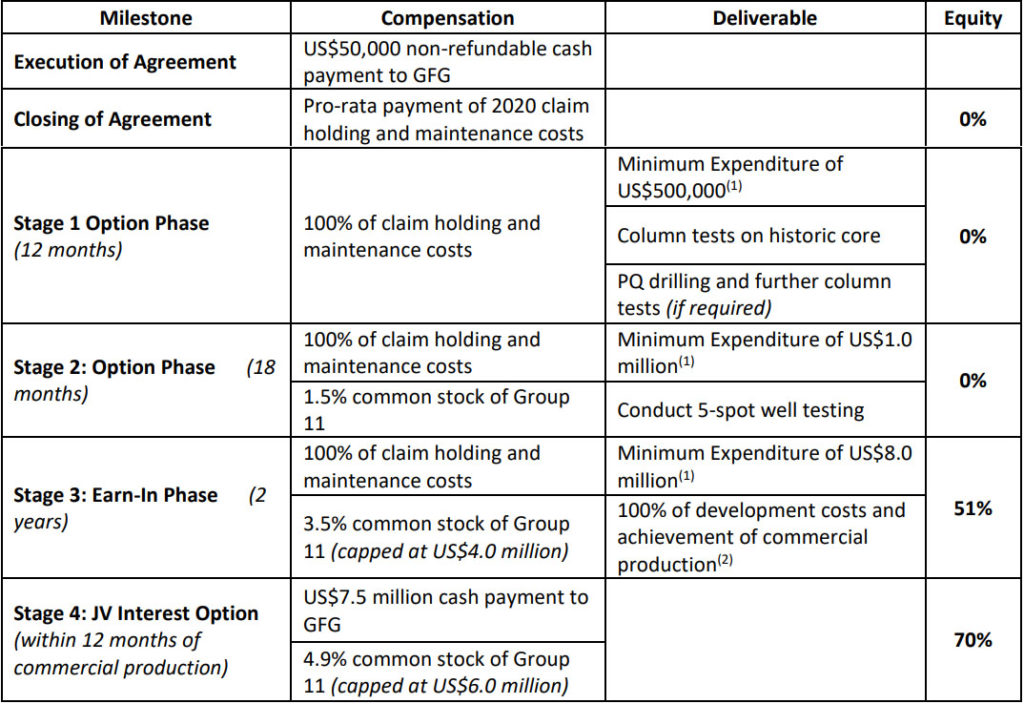

Terms of the Agreement

Under the terms of the Agreement, Group 11 has a right to earn 70% interest in the Project over a six- year period by:

- Incurring a minimum of US$9.5 million in Expenditures.

- Paying 100% of holding and maintenance costs related to the Project.

- Covering all Expenditures to advance the Project into commercial production.

- Making staged equity payments to GFG of Group 11 common stock of up to 9.9% of Group 11’s common shares issued and outstanding on a fully-diluted basis.

- Making a cash payment of US$7.5 million.

Summary of Agreement Stages

(1) Minimum expenditures exclude holding and maintenance costs.

(2) Commercial production is deemed as a rate of not less than 50% of the feasibility study-rated annual capacity.

Additional terms:

- Closing of the Agreement is conditional upon Group 11 raising a minimum of US$1.5 million within 45 days after the execution of the Agreement.

- The Agreement contains pre-emptive rights provisions should either party elect to sell its interest in the Project.

- Group 11 has the option to extend any stage for 12 additional months by making a US$500,000 cash payment to GFG.

- Group 11 will act as manager on the Project.

The Rattlesnake Hills Gold Project

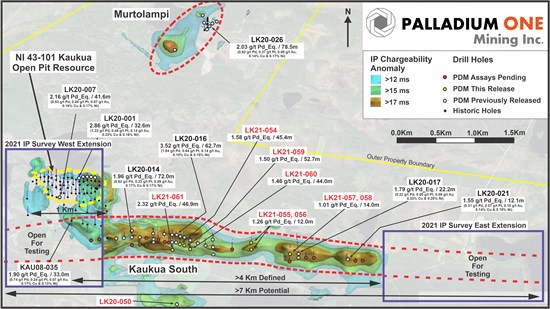

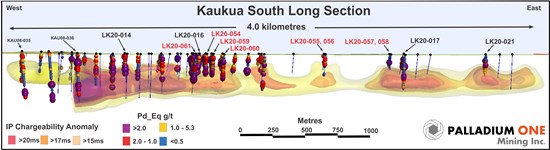

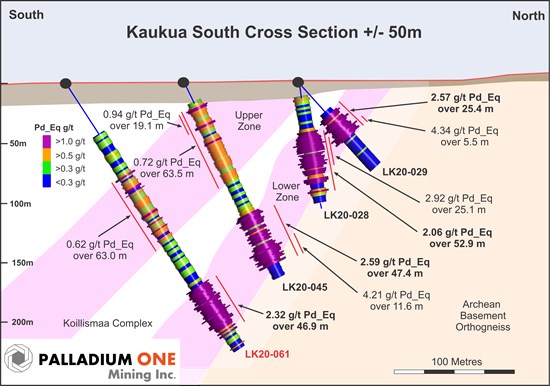

The Rattlesnake Hills Gold Project is a district-scale gold exploration project located in central Wyoming approximately 100 kilometres southwest of Casper. Geologically, the Project is centrally located within a roughly 1,500-kilometre-long belt of alkalic intrusive complexes that occur along the eastern side of the Rocky Mountains from Montana to New Mexico, several of which are associated with multiple gold deposits.

The Project has approximately 100,000 metres (“m”) of historic drilling which has outlined three significant zones of alteration and precious metal mineralization that are associated with Eocene age alkalic intrusions at North Stock, Antelope Basin and Blackjack. The majority of the drilling has focused on near-surface, open pit mineralization in the North Stock and Antelope Basin deposits with highlights that include intercepts(3) of 1.85 grams of gold per tonne (g/t Au) over 236.2 m hole length; 4.20 g/t Au over

77.7 m hole length; 2.08 g/t Au over 150.9 m hole length and 0.82 g/t Au over 99.1 m hole length. In addition to the outlined zones of mineralization, the Company believes that the district is highly

prospective and has outlined several kilometre-scale greenfield targets that have never been drill tested. These greenfield targets were generated from the Company’s geophysical and geochemical programs and host strong similarities to the North Stock and Antelope Basin systems.

(3) Gold intervals reported are based on a 0.20 g/t or 0.50 g/t Au cutoff. Weighted averaging has been used to calculate all reported intervals. True widths are estimated at 60-100% of drilled thicknesses.

Qualified Persons

Brian Skanderbeg, P.Geo. and M.Sc., serves as President and CEO of GFG, and is a “qualified person” within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Skanderbeg has reviewed the respective core intervals, sampling and QA/QC procedures and results thereof as verification of the historical drilling data disclosed above and has approved the information contained in this news release.

About GFG Resources Inc.

GFG Resources is a North American precious metals exploration company focused on district scale gold projects in tier one mining jurisdictions, Ontario and Wyoming. In Ontario, the Company owns 100% of the Pen and Dore gold projects, two large and highly prospective gold properties west of the prolific gold district of Timmins, Ontario, Canada. The Pen and the Dore gold projects have similar geological settings that host most of the gold deposits found in the Timmins Gold Camp which have produced over 70 million ounces of gold. The Company also owns 100% of the Rattlesnake Hills Gold Project, a district scale gold exploration project located approximately 100 kilometres southwest of Casper, Wyoming, U.S. The geologic setting, alteration and mineralization seen in the Rattlesnake Hills are similar to other gold deposits of the Rocky Mountain alkaline province which, collectively, have produced over 50 million ounces of gold.

About Group 11 Technologies Inc.

Group 11 is a private US-based company committed to the development and application of environmentally and socially responsible precious metals mineral extraction. The combination of in-situ recovery extraction (ISR) technology and environmentally friendly water based chemistry to recover gold and other metals provides a promising alternate solution to conventional open pit and underground mineral extraction. The goal of advancing sustainable extraction considers growing concerns surrounding water use and discharge, carbon footprint, energy consumption, community stakeholders and workplace safety while addressing a growing global need for metals in our daily lives. Group 11 was founded by Enviroleach Technologies Inc. (CSE: ETI; OTCQB: EVLLF), Encore Energy Corp. (TSXV: EU; OTCQB: ENCUF) and Golden Predator Mining Corp. (TSXV: GPY; OTCQB: NTGSF).

Group 11 is a group of elements in the periodic table, also known as the coinage metals, consisting of gold (Au), silver (Ag) and copper (Cu).

For additional information: Group 11 Technologies Inc.

Janet Sheriff, President

214-304-9552

info@gr11tech.com www.gr11tech.com

GFG Resources Inc.

Brian Skanderbeg, President & CEO or

Marc Lepage, Vice President, Business Development Phone: (306) 931-0930

info@gfgresources.com www.gfgresources.com

Cautionary Note Regarding Forward-Looking StatementsThis news release includes certain forward-looking statements within the meaning of applicable securities laws including transactions and other properties, and the potential advancement thereof. Forward- looking statements are statements that relate to future, not past, events. In this context, forward- looking statements often address expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, or other similar expressions. Estimates of mineral resources and reserves are also forward looking statements because they constitute projections regarding the amount of minerals that may be encountered in the future. All statements, other than statements of historical fact, included herein including, without limitation; statements about the terms and completion of the transaction are forward-looking statements. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the respective companies undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.