Voyager Digital Reports Fiscal 2021 Second Quarter Results and Provides Business Update

Announces AUM at February End Over US$1.7 Billion Preliminary February Revenue Expected to Exceed US$20 Million

Voyager Digital Ltd. (“Voyager” or the “Company”) (CSE: VYGR) (OTCQB: VYGVF) (FRA: UCD2), today announced financial results for its fiscal 2021 second quarter ended December 31, 2020 and is pleased to provide shareholders with a business and operational update.

“Our December quarter results reflect the continued mainstream acceptance of digital assets and crypto-currencies as more conventional investors embraced Bitcoin and major companies stated their intentions to convert substantial parts of their Treasury into Bitcoin,” said Stephen Ehrlich, Co-founder and CEO of Voyager. “Voyager started to capture significant market share with our customer friendly, easy to use, zero commission agency broker platform for trading and investing in crypto-currencies. Now, we are better positioned than ever to grow our business and reach a broader audience of mainstream investors by educating them about investment opportunities with digital assets and their increasing global acceptance. Voyager is becoming the platform of choice for retail investors, as evidenced by our unprecedented growth in 2021 to date.”

Voyager is pleased to provide stakeholders with an update for the following key metrics for the month ended February 28, 2021:

- Preliminary revenue from operations in excess of US$20 million Net deposits for the month exceeded US$400 million

- Assets Under Management (AUM) exceeded US$1.7 billion

- Trades per day for the month averaged more than 70,000

- New funded accounts for February 2021 were in excess of 70,000, with total funded accounts over 175,000 as of February 28, 2021

- Verified Users on the platform were approximately 605,000 at February 28, 2021

- The value of customer trades for February increased to US$1.6 billion

All figures are preliminary and unaudited and subject to final adjustment. All amounts are in US dollars, unless otherwise indicated.

Mr. Ehrlich continued, “With recently completed capital raises of over US$146 million, our balance sheet is stronger than ever. We are excited to see a rapidly growing group of investors utilizing our platform and look forward to delivering value to all our stakeholders. We intend to deploy capital to accelerate our growth through strategic marketing initiatives, further development of our technology infrastructure, and building staff across all departments to position Voyager as the go to digital financial services firm of the future.”

As part of the scaling of its management team, the Company recently added David Brosgol as General Counsel, Dan Costantino as Chief Information Security Officer, and Jamie Cabezas to lead Voyager’s HR effort. Voyager expects to continue building out its team throughout the course of the year and to triple its workforce in 2021. In addition, in February, Voyager welcomed Krisztian Toth, a partner at the law firm of Fasken Martineau DuMoulin LLP, to the Company’s Board of Directors as part of its efforts to strengthen its corporate governance.

Voyager expects to continue bringing new products to The Voyager platform as well as to advance its geographic expansion. In 2021 and beyond, the Company anticipates adding debit cards, credit cards, stock trading and the ability to trade on margin to its offerings. Complementing this, Voyager will look to grow internationally by expanding into Canada and Europe.

Mr. Ehrlich concluded, “Voyager’s focus on the retail investor is becoming more and more popular and our loyal community’s social media outreach, combined with our own increased marketing activities, is helping to drive users signing up in record numbers on Voyager.”

The Company also announced that Shingo Lavine has resigned from the Board to pursue additional non-competitive opportunities. Philip Eytan, Chairman of Voyager said “On behalf of the Board, I thank Shingo for his contribution to Voyager and for all the work he has done for the Company and wish him well in his new pursuits.”

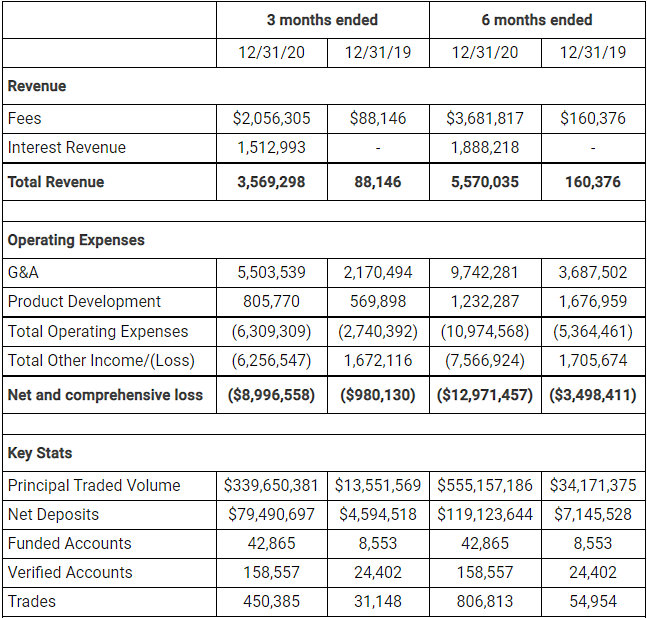

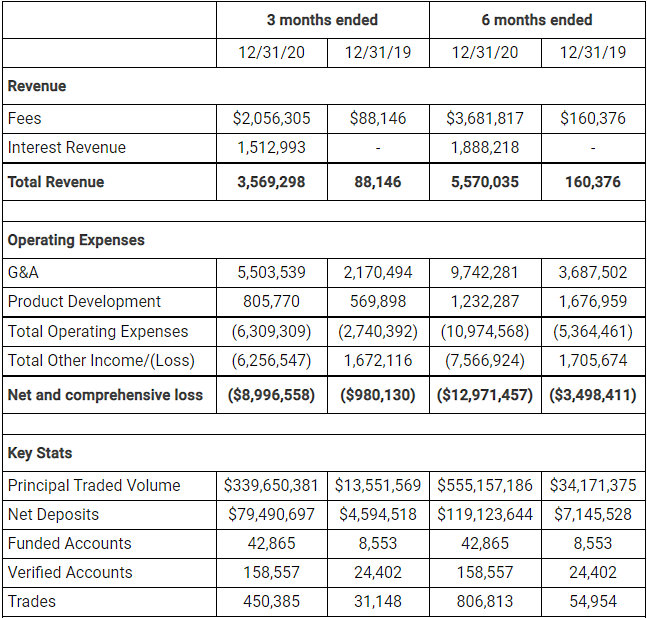

Q2 Fiscal Year 2021 Highlights

For the fiscal quarter ended December 31, 2020, the Company recorded revenues of US$3.6 million and ended the quarter with approximately 40,000 customer funded accounts. As of December 31, 2020, AUM was over US$230 million, placing Voyager in a strong position for the new calendar year. For more detailed information, the Company encourages investors to read its interim financial statements and related Management Discussion & Analysis (“MD&A”) for the three and six months ended December 31, 2020, which will be filed with SEDAR today.

Note: Total Other Income / (Loss) includes: (a) $5.2 million and $5.5 million of gains on digital asset exchange for the three and six months ended December 31, 2020, respectively and $0.2 million and $0.1 million of losses of digital asset exchange for the three and six months ended December 31, 2019; (b) $10.6 million for change in fair value of investment for both the three and six months ended December 31, 2020; (c) ($6.2) million for change in fair value of digital currency loan payable for both the three and six months ended December 31, 2020; and (d) ($15.6 million) and ($17.1 million) for change in fair value of warrant liability for the three and six months ended December 31, 2020, respectively and ($0.2) million for both the three and six months ended December 31, 2020.

Conference Call

The Company will conduct a conference call today at 5:00 p.m. (Eastern Time) to review the results as well as provide an overview of the Company’s recent milestones and growth strategy. A live webcast of the conference call can be accessed through the following link: Voyager Webcast Link

For more information on Voyager Digital, please visit https://www.investvoyager.com. The Voyager App is available for Android and iPhone.

About Voyager Digital Ltd.

Voyager Digital Ltd. is a crypto-asset broker that provides retail and institutional investors with a turnkey solution to trade crypto assets. Voyager offers customers best execution and safe custody on a wide choice of popular crypto-assets. Voyager was founded by established Wall Street and Silicon Valley entrepreneurs who teamed to bring a better, more transparent and cost-efficient alternative for trading crypto-assets to the marketplace. Please visit us at https://www.investvoyager.com for more information and to review the latest Corporate Presentation.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release. No securities regulatory authority has either approved or disapproved of the contents of this press release.

Forward Looking Statements

Certain information in this press release, including, but not limited to, statements regarding future growth and performance of the business, momentum in the businesses, future adoption of digital assets, and the Company’s anticipated results may constitute forward looking information (collectively, forward-looking statements), which can be identified by the use of terms such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” (or the negatives) or other similar variations. Because of various risks and uncertainties, including those referenced below, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. Forward looking statements are subject to the risk that the global economy, industry, or the Company’s businesses and investments do not perform as anticipated, that revenue or expenses estimates may not be met or may be materially less or more than those anticipated, that trading momentum does not continue or the demand for trading solutions declines, customer acquisition does not increase as planned, product and international expansion do not occur as planned and those other risks contained in the Company’s public filings, including in its Management Discussion and Analysis and its Annual Information Form (AIF). Factors that could cause actual results of the Company and its businesses to differ materially from those described in such forward-looking statements include, but are not limited to, a decline in the digital asset market or general economic conditions; the failure or delay in the adoption of digital assets and the blockchain ecosystem by institutions; a delay or failure in developing infrastructure for the trading businesses or achieving mandates and gaining traction; failure to grow assets under management, an adverse development with respect to an issuer or party to the transaction or failure to obtain a required regulatory approval. In connection with the forward-looking statements contained in this press release, the Company has made assumptions that no significant events occur outside of the Company’s normal course of business and that current trends in respect of digital assets continue. Forward-looking statements, past and present performance and trends are not guarantees of future performance, accordingly, you should not put undue reliance on forward-looking statements, past performance or current trends. Information identifying assumptions, risks and uncertainties relating to the Company are contained in its filings with the Canadian securities regulators available at www.sedar.com. The forward-looking statements in this press release are applicable only as of the date of this release or as of the date specified in the relevant forward-looking statement and the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. Readers are cautioned that past performance is not indicative of future performance and current trends in the business and demand for digital assets may not continue and readers should not put undue reliance on past performance and current trends. All figures are in U.S. dollars unless otherwise noted.

Investor Relations:

Michael Legg

(212) 547-8807

mlegg@investvoyager.com

Phil Carlson / Scott Eckstein

(212) 896-1233 / (212) 896-1210

pcarlson@kcsa.com / seckstein@kcsa.com

Media:

Anthony Feldman / Raquel Cona

(347) 487-6194 / (212) 896-1204

afeldman@kcsa.com / rcona@kcsa.com

Angus Campbell

44 7881 625098

angus@nominis.co

Source: Voyager Digital Ltd.