Sierra Metals Reports Q4-2020 Financial Results At Its Sociedad Minera Corona Subsidiary In Peru

Consolidated Financial Results for Sierra Metals to Be Released on March 18, 2021

(All metal prices and amounts reported in USD)

TORONTO–(BUSINESS WIRE)– Sierra Metals Inc. (TSX:SMT, BVL:SMT, NYSE AMERICAN:SMTS) (“Sierra Metals” or the “Company”) announces the filing of Sociedad Minera Corona S.A.’s (“Corona”) unaudited Financial Statements and the Management Discussion and Analysis (“MD&A”) for the fourth quarter of 2020 (“Q4 2020”).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210216005467/en/

The Company holds an 81.8% interest in Corona. All amounts are presented in US dollars unless otherwise stated and have not been adjusted for the 18.2% non-controlling interest.

Corona’s Highlights for the Three Months Ended December 31, 2020

- Revenues of US$45.2 million vs. US$42.2 million in Q42019

- Adjusted EBITDA of US$22.5 million vs. US$17.9 million in Q4 2019

- Total tonnes processed decreased by 3% to 311,946 vs. 321,701 in Q4 2019

- Net production revenue per tonne of ore milled increased by 8% to US$148.13

- Cash cost per copper equivalent payable pound decreased by 1% at US$1.16 in Q4 2020

- All-in sustaining cost (“AISC”) per copper equivalent payable increased 17% to US$2.47 in Q4 2020

- Copper equivalent production of 18.4 million pounds vs. 23.1 million pounds in Q4 2019

- US$65.0 million of cash and cash equivalents as at December 31, 2020

- US$92.0 million of working capital as at December 31,2020

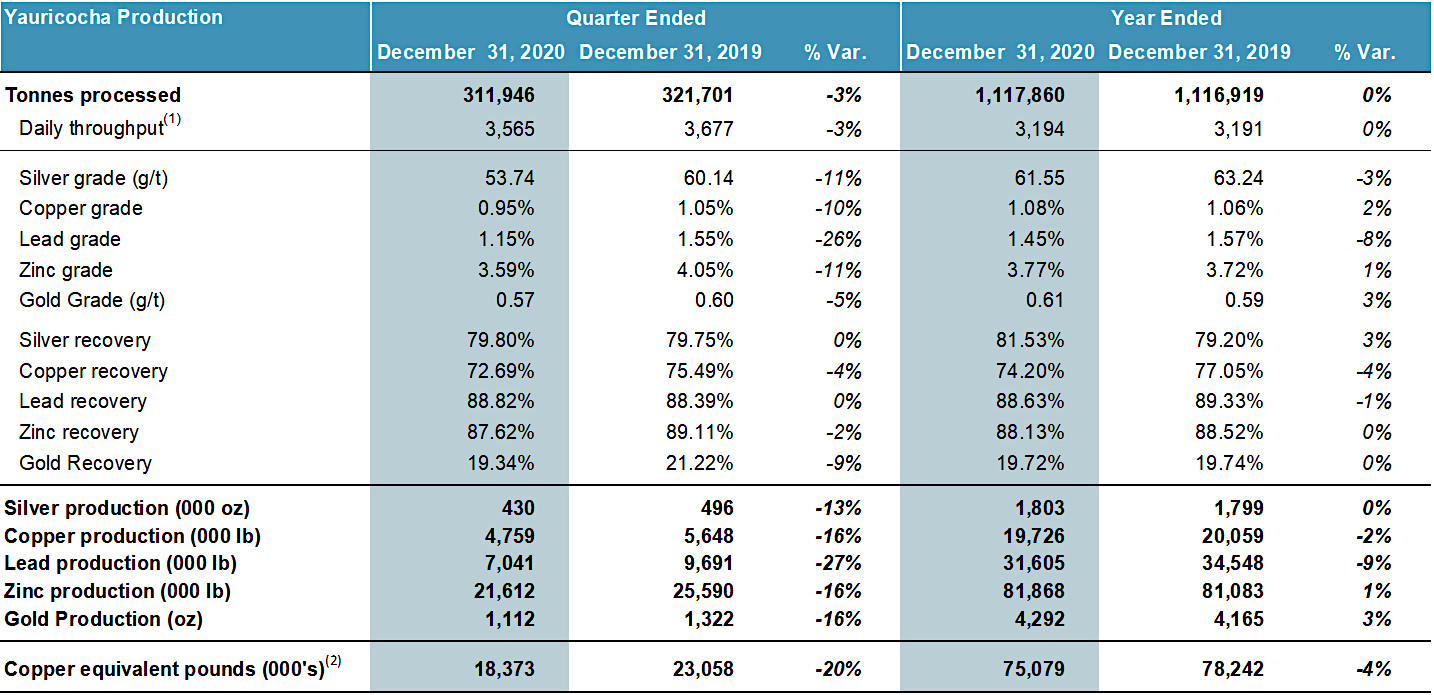

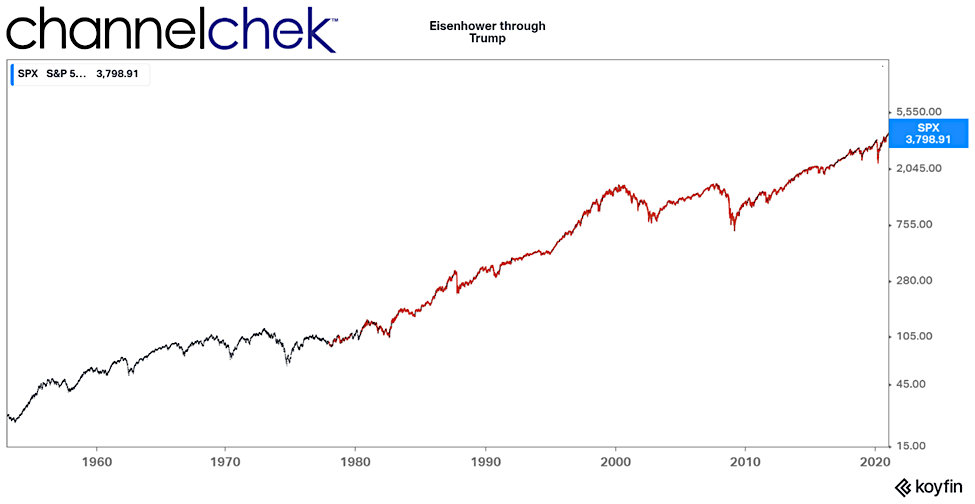

Annual throughput of 1,117,860 was in line with the 2019 annual production, despite the impact of COVID-19 related shutdowns faced in Q2 2020 and other COVID-19 related challenges throughout the year. Throughput for Q4 2020 decreased by 3% as compared to Q4 2019, as a result of operational downtimes and minor production disruptions. Copper and zinc equivalent metal production in Q4 2020 decreased by 20% and 14%, respectively, due to lower throughput and lower head grades. Additionally, lower workforce availability continued to impact mine development, leading to lower ore contribution from the high-grade cuerpos chicos zones. Year over year, copper equivalent production decreased 4% in 2020 compared to the prior year. During 2020, zinc and gold’s annual production increased 1% and 3%, respectively, while copper and lead annual production decreased by 2% and 9%. Silver production for 2020 was in line with the 2019 annual silver production.

Q4 2020 revenues increased by 7% compared to Q4 2019 as a result of higher metal prices realized. Annual revenues were 6% lower due to the impact of a 66% increase in the treatment and refining costs. Adjusted EBITDA increased by 25% and 4% during Q4 2020 and the year respectively compared to the same periods of 2019, as operating costs excluding COVID-19 costs were lower than the prior year.

Cash and cash equivalents increased by $30 million during the year due to a combined result of a 27% increase in operating cash flows and a decrease of 26% in cash used in investing activities, as some capital expenditures were deferred considering the uncertainties related to the impacts of COVID-19. Cash costs per copper equivalent payable pound for 2020 decreased by 10% due to lower operating costs per tonne. AISC per copper equivalent payable pound for 2020 increased 10% primarily due to a 66% increase in treatment and refining costs partially offset by lower cash costs.

Luis Marchese,CEO of Sierra Metals,commented, “I am pleased with Yauricocha’s performance in the fourth quarter of 2020, which saw increases in revenue and adjusted EBITDA compared to the same quarter in 2019. The Company also realized increased EBITDA but lower revenue on a year over year basis primarily due to lower incomes resulting from significant increases to the treatment and refining charges. Overall, the Company performed well and produced solid results, given the challenging year we had due to the effects of dealing with the COVID-19 pandemic. I want to thank all employees for their efforts to help the Company achieve these results.”

He continued, “Looking ahead, 2021 is an exciting time for the Company as we continue advancing important projects, operational improvements, and exploration at Yauricocha. We also look forward to receiving the necessary permits at Yauricocha to increase throughput by 20% to the 3,600 tonne per day level. Furthermore, we recently completed and published a Preliminary Economic Assessment at Yauricocha with favourable economics to examine increasing throughput to 5,500 tonnes per day starting in 2024. We look forward to releasing a Preliminary Feasibility Study in the coming months to support that expansion further.”

He concluded, “Corona continues to have a solid balance sheet and strong liquidity. Management remains optimistic that continued operational efficiencies can be obtained at the Yauricocha Mine as well as capitalizing on further operational and resource growth opportunities.”

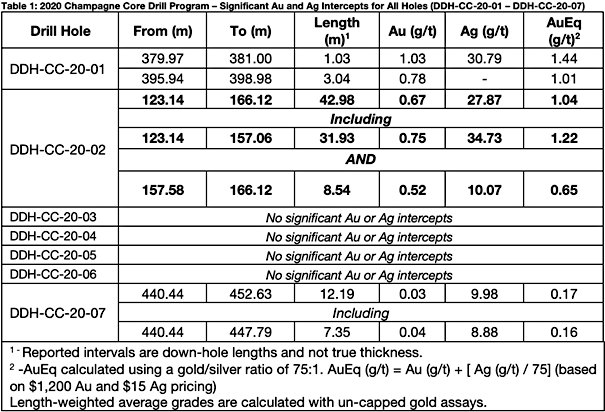

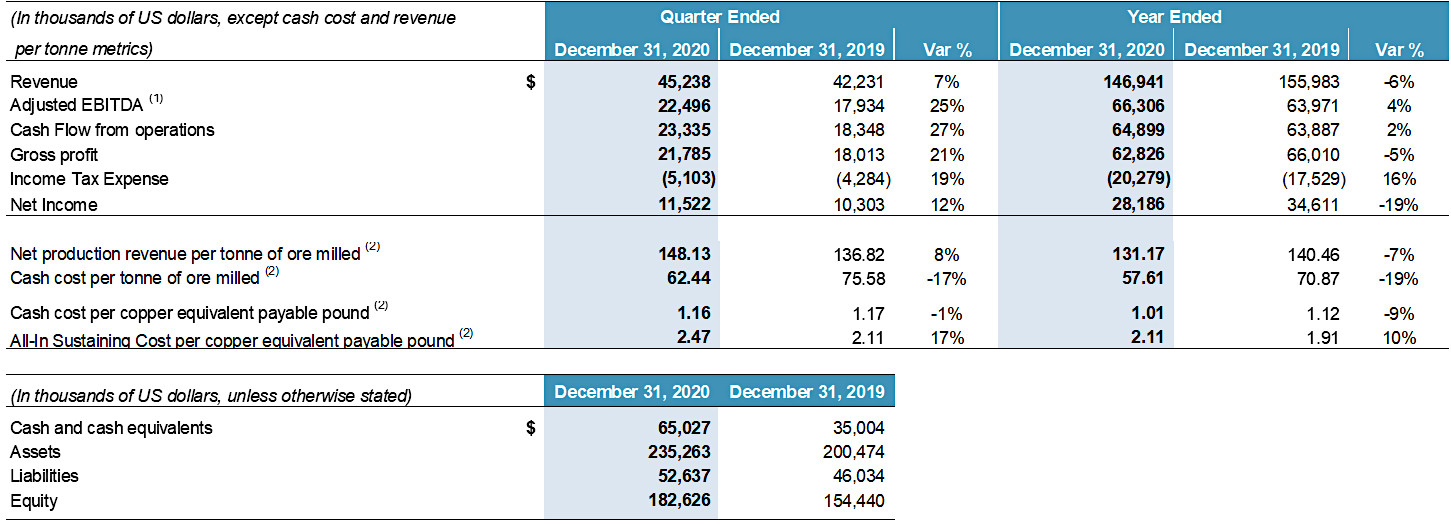

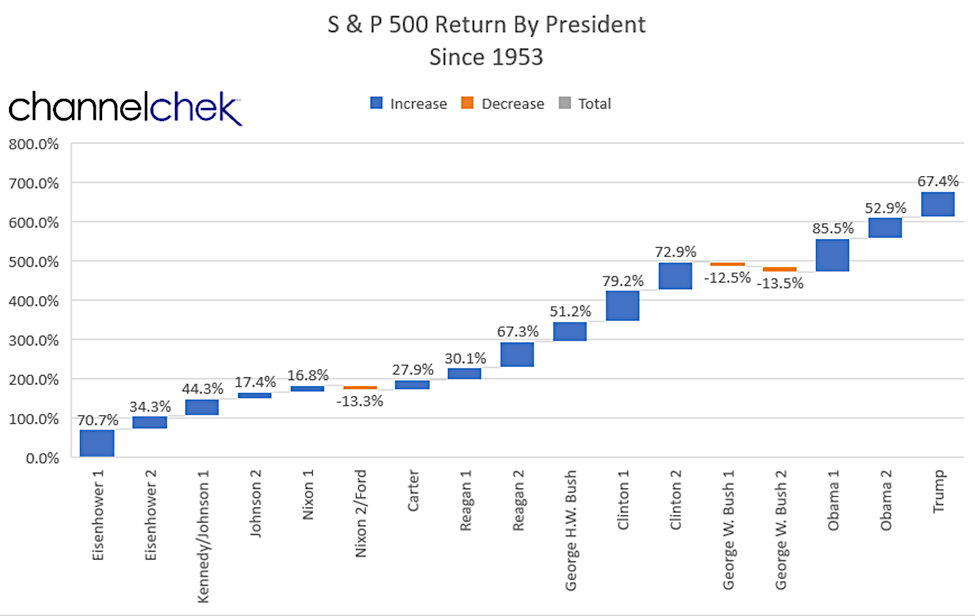

The following table displays selected financial information for the three months and year ended December 31, 2020:

1 Adjusted EBITDA includes adjustments for depletion and depreciation, interest expense and other financing costs, interest income, share-based compensation, Foreign Exchange (gain) loss and income taxes; see non-IFRS Performance Measures section of the Company’s MD&A.

2 All-In Sustaining Cost per copper equivalent pound sold are non-IFRS performance measures and include cost of sales, treatment and refining charges, sustaining capital expenditures, general and administrative expense, and selling expense, and exclude workers’ profit sharing, depreciation, and other non-cash provisions; Cash cost per copper equivalent pound sold, net production revenue per tonne of ore milled, and cash cost per tonne of ore milled are non- IFRS performance measures; see non-IFRS Performance Measures section of the Company’s MD&A.

Corona’s Financial Highlights for the Three Months and Year Ended December 31, 2020

- Revenues of $45.2 million for Q4 2020 compared to $42.2 million in Q4 2019 and revenues of $146.9 million for the year ended December 31, 2020, compared to $156.0 million for the same period in 2018. The increase in revenues during Q4 2020 compared to Q4 2019 was primarily driven by higher realized prices for all metals except lead. Revenues were higher for the quarter despite significant increases in the treatment and refining charges and lower metal sales resulting from lower throughput and grades. Revenues for the year ended December 31, 2020, were 6% lower than the same period in 2019 due to the 66% increase in treatment and refining charges offset by the increase in the average realized sale price for gold (9%) and zinc (4%). Average realized prices in 2020 were higher for copper (3%), silver (26%) and gold (26%), but lower for zinc (10%) and lead (9%) as compared to the average realized prices in 2019.

- Cash cost per copper equivalent pound sold at the Yauricocha Mine of $1.16 for Q4 2020 compared to $1.17 for Q4 2019; and $1.01 for the year ended December 31, 2020, compared to $1.12 for the same period in 2019. All-in sustaining cost (“AISC”) per copper equivalent pound sold of $2.47 for Q4 2020 compared to $2.11 for Q4 2019 and $2.11 for the year ended December 31, 2020, comparedto $1.91 for the same period in 2019. The increase in the AISC per copper equivalent payable pound for Q4 2020 and full year 2020 comparedto the same periods in 2019 was a combined result of higher treatment and refining charges and lower copper equivalent payable pounds sold.

- Adjusted EBITDA of $22.5 million for Q4 2020 compared to $17.9 million for Q4 2019 and $66.3 million for the year ended December 31, 2020, comparedto $64.0 million for the same period in 2019.

- Operating cash flows before movements in working capital was $23.3 million for Q4 2020, compared to US$18.3 million for Q4 2019, and $65.0 million for the year ended December 31, 2020, compared to $63.9 million for the same period in 2019. An increase in operating cash flows resulted from an increase in gross margins compared to 2019, mainly due to lower workforce and contractor costs.

- Cash and cash equivalents of $65.0 million as at December 31, 2020, compared to $35.0 million as at December 31, 2018. The increase in cash and cash equivalents was driven largely by operating cash flows of $48.6 million (after movement in working capital) offset by capital expenditures of $19.2 million.

- Net income of $11.5 million, or $0.32 per share for Q4 2019, compared to net income of $10.3 million, or $0.29 per share for Q4 2019. Net income of $28.2 million, or $0.78 per share, for the year ended December 31, 2020, compared to $34.6 million, or $0.96 per share, for the same period in 2019.

Corona’s Operational Highlights for the Three Months and Year Ended December 31, 2020

The following table displays the production results for the three months and year ended December 31, 2020, for further production details please refer the Company’s Q4 production press release dated January 18, 2021:

1 Daily throughput is calculated using 350 operating days for the year.

2 Copper equivalent pounds were calculated using the following realized prices: for Q4 2020 – $24.30/oz Ag, $3.32/lb Cu, $1.22/lb Zn, $0.89/lb Pb, $1,859/oz Au, for Q4 2019 – $17.42/oz Ag, $2.69/lb Cu, $1.07/lb Zn, $0.92/lb Pb, $1,506/oz Au, for full year 2020 – $20.59/oz Ag, $2.80/lb Cu, $1.03/lb Zn, $0.83/lb Pb, $1,771/oz Au, for full year 2019 – $16.29/oz Ag, $2.73/lb Cu, $/1.14lb Zn, $0.91/lb Pb, $1,404/oz Au.

Sierra Metals to release Q4/YE 2020 Financial Results on March 18, 2021

The Company will release Q4-2020 financial results on Thursday March 18, 2021, after the Market close. Senior Management will also host a webcast and conference call on Friday March 19, 2021, at 10:30am EDT. Details of the Conference Call and Webcast are as follows:

Via Webcast:

A live audio webcast of the meeting will be available on the Company’s website:

https://event.on24.com/wcc/r/2947459/6CFF80ECA94506BA22260486A6292C76

The webcast, along with presentation slides, will be archived for 180 days on www.sierrametals.com.

Via phone:

To register for this conference call, please use the link provided below. A confirmation will be sent through email, including dial-in details and unique conference call codes for entry after registering.

Registration is open throughout the live call; however, to ensure you are connected for the entire call, we suggest registering a day in advance or at minimum 10 minutes before the start of the call.

Conference Call Registration Link:

http://www.directeventreg.com/registration/event/4514269

Quality Control

All technical data contained in this news release has been reviewed and approved by:

Américo Zuzunaga, FAusIMM CP (Mining Engineer) and Vice President of Corporate Planning is a Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Augusto Chung, FAusIMM CP (Metallurgist) and Vice President of Metallurgy and Projects to Sierra Metals is a Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Sierra Metals

Sierra Metals Inc. is a diversified Canadian mining company focused on the production and development of precious and base metals from its polymetallic Yauricocha Mine in Peru, and Bolivar and Cusi Mines in Mexico. The Company is focused on increasing production volume and growing mineral resources. Sierra Metals has recently had several new key discoveries and still has many more exciting brownfield exploration opportunities at all three Mines in Peru and Mexico that are within close proximity to the existing mines. Additionally, the Company also has large land packages at all three mines with several prospective regional targets providing longer-term exploration upside and mineral resource growth potential.

The Company’s Common Shares trade on the Bolsa de Valores de Lima and on the Toronto Stock Exchange under the symbol “SMT” and on the NYSE American Exchange under the symbol “SMTS”.

For further information regarding Sierra Metals, please visit www.sierrametals.com or contact:

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com | Twitter: sierrametals | Facebook: SierraMetalsInc | LinkedIn: Sierra Metals Inc

Forward-Looking Statements

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of Canadian and U.S. securities laws (collectively, “forward-looking information”). Forward-looking information includes, but is not limited to, statements with respect to the date of the 2020 Shareholders’ Meeting and the anticipated filing of the Compensation Disclosure. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential” or variations thereof, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking information.

Forward-looking information is subject to a variety of risks and uncertainties, which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the risks described under the heading “Risk Factors” in the Company’s annual information form dated March 30, 2020 for its fiscal year ended December 31, 2019 and other risks identified in the Company’s filings with Canadian securities regulators and the United States Securities and Exchange Commission, which filings are available at www.sedar.com and www.sec.gov, respectively.

The risk factors referred to above are not an exhaustive list of the factors that may affect any of the Company’s forward-looking information. Forward-looking information includes statements about the future and is inherently uncertain, and the Company’s actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking information due to a variety of risks, uncertainties and other factors. The Company’s statements containing forward-looking information are based on the beliefs, expectations and opinions of management on the date the statements are made, and the Company does not assume any obligation to update such forward-looking information if circumstances or management’s beliefs, expectations or opinions should change, other than as required by applicable law. For the reasons set forth above, one should not place undue reliance on forward-looking information.

Mike McAllister

Vice President, Investor Relations

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Email: info@sierrametals.com

Luis Marchese

CEO

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Source: Sierra Metals Inc.