Chakana Copper Accelerates Drill Program With Second Rig, Provides Exploration Update at Soledad, Peru

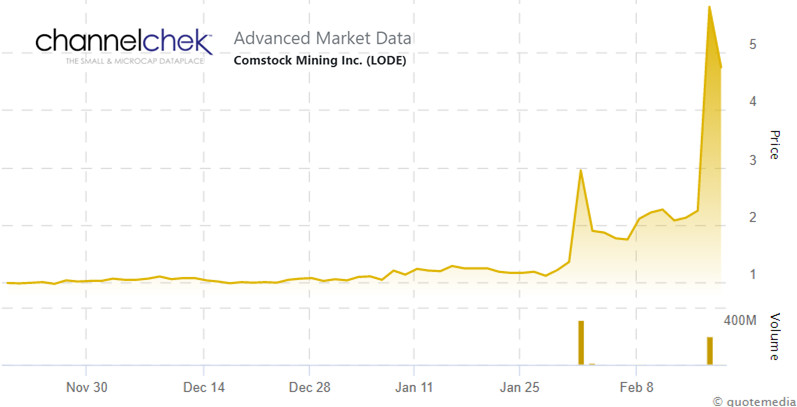

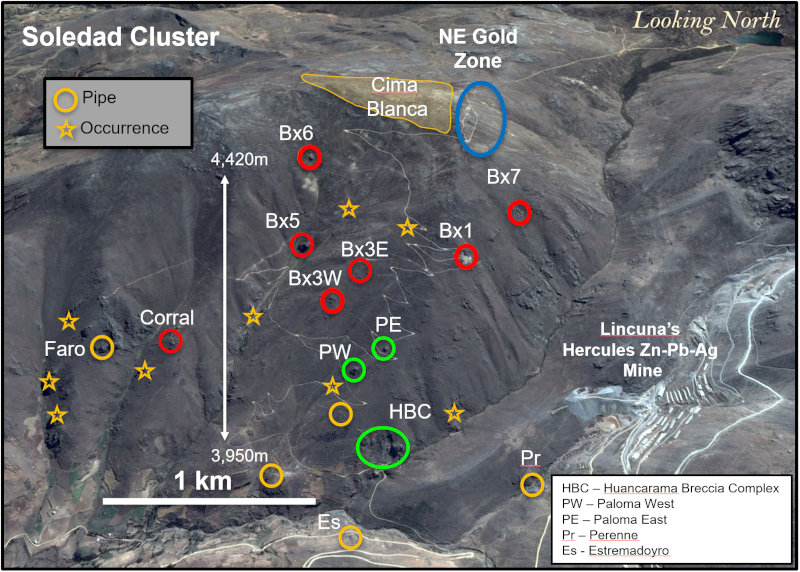

Vancouver, B.C., February 18, 2021– Chakana Copper Corp. (TSX-V: PERU; OTCQB: CHKKF; FRA: 1ZX) (the “Company” or “Chakana”), has added a second drill rig to its Soledad project located in Ancash, Peru in order to accelerate both the exploration and resource drilling programs. The Board of Directors has approved an expanded 26,000m drill program for the 2021 calendar year, with 16,000m of resource drilling for inclusion in the Company’s Soledad maiden resource estimate expected later this year. Resource drilling will focus on recent discoveries at Paloma East, Paloma West, and Huancarama (Fig. 1). Resource drilling is expected to also be completed on Breccia 7 (Bx 7), a previous discovery announced in 2019 (see news release dated July 29, 2019). An additional 10,000m of scout drilling will be allocated to test numerous high quality exploration targets that have already been identified. Resource definition drilling includes both step-out and in-fill core holes in close proximity to known mineralization of possible economic interest.

Currently, one drill rig continues to conduct scout drilling on the west side of the Huancarama Breccia Complex where recent drilling has confirmed a blind breccia pipe immediately north of the H5 breccia body exposed at surface (Fig. 2). A total of twenty-five drill holes have now been completed at Huancarama. Once scout drilling is completed, this drill rig will focus on resource definition drilling at Huancarama. The second drill rig has been deployed to the Paloma area where resource drilling has been initiated at Paloma East (Fig. 3). Resource drilling is also planned for Paloma West, and additional exploration drilling will be conducted in the greater Paloma area. A third drill rig dedicated to exploration drilling is scheduled to arrive on the property in early April 2021.

David Kelley, President and CEO commented: “Adding a second drill rig at Soledad, to accelerate the project, is an exciting development. We are now fully funded for our 26,000m drill program in 2021 with $9.3 million in treasury. We look forward to releasing additional exploration results from Huancarama, and resource drilling results from Paloma in the near future.”

About Chakana Copper

Chakana Copper Corp is a Canadian-based minerals exploration company that is currently advancing the high-grade gold-copper-silver Soledad Project located in the Ancash region of Peru, a highly favorable mining jurisdiction with supportive communities. The Soledad Project consists of high-grade gold-copper-silver mineralization hosted in tourmaline breccia pipes. A total of 33,353 metres of drilling has been completed to-date, testing nine (9) of twenty-three (23) confirmed breccia pipes with more than 92 total targets. Chakana’s investors are uniquely positioned as the Soledad Project provides exposure to several metals including copper, gold, and silver. For more information on the Soledad project, please visit the website a www.chakanacopper.com.

ON BEHALF OF THE BOARD

(signed) “David Kelley”

David Kelley

President and CEO

For further information contact:

Joanne Jobin, Investor Relations Officer

Phone: 647 964 0292

Email: jjobin@chakanacopper.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statement Advisory: This release may contain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Chakana to be materially different from any future results, performance, or achievements expressed or implied by the forward looking statements. Forward looking statements or information relates to, among other things, the interpretation of the nature of the mineralization at the Soledad copper-gold-silver project (the “Project”), the potential to expand the mineralization, and to develop and grow a resource within the Project, the planning for further exploration work, the ability to de-risk the potential exploration targets, and our belief in the potential for mineralization within unexplored parts of the Project. These forward-looking statements are based on management’s current expectations and beliefs but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward- looking statements or information. The Company disclaims any obligation to update, or to publicly announce, any such statements, events or developments except as required by law.

Figure 1 – View looking north showing breccia pipes and occurrences within the northern Soledad cluster. Pipes that have been drilled in previous campaigns are shown in red. Targets shown in green are the focus on this 15,000m drill campaign. Other pipes and occurrences remain to be tested by drilling. Additional breccia pipes occur on the south half of the property and are not shown here.

Figure 2 – Drone image looking north-northeast at the Huancarama Breccia Complex showing drill rig set up on the west side of the complex.

Figure 3 – Drone image looking east showing second drill rig initiating resource drilling at Paloma East (prominent outcrop in center of image). Note the Hercules mine in the upper right side of the image (1.5 km distant).

SOURCE: Chakana Copper