Owning Bitcoin isn’t the Only Way to Invest in a Burgeoning Cryptocurrency Market

Bitcoin (BTC) in circulation just exceeded one trillion ($USD) in value. Dogecoin (DOGE) is “heading to the moon” thanks to a strong Reddit community of investors and a few tweets from Elon Musk. In its short history, cryptocurrency has already made an impact on global markets. And the investment community has taken notice. Since you’re on Channelchek, you might be looking for the next outperformer like Bitcoin. Does the lovable Shiba-Inu inspired crypto-coin that was started as a joke (DOGE) have the staying power to reach the stratosphere? Time will tell. But the direct holding of cryptocurrency isn’t the only way to benefit from its growth. Currency exchange platforms, blockchain providers, and crypto mining companies all represent their own unique investment opportunities.

Blockchain

Blockchain is the platform that serves as the backbone of cryptocurrency. In the simplest terms, blockchain is a public electronic ledger. Built around a peer-to-peer (P2P) system, multiple users create a series of records in the ledger. These entries may be infinitely amended over time, but each entry is unchangeable. This process creates complete transactional transparency. Every entry, and amendment, can be verified based on this transparency, and every entry is approved by consensus between the participants in the chain. Basically, this platform has created an accounting ledger with no eraser and a nearly infinite supply of auditors.

While blockchain is still technically in its infancy, and its level of global adoption in the future is still in question, it has certainly gained traction in the past five years. Beyond the rise in cryptocurrency popularity, larger public companies have implemented their own private blockchain systems to track internal processes, such as produce from farm to store (Wal-Mart) and diamonds from mine to authenticator to distributor (De Beers).

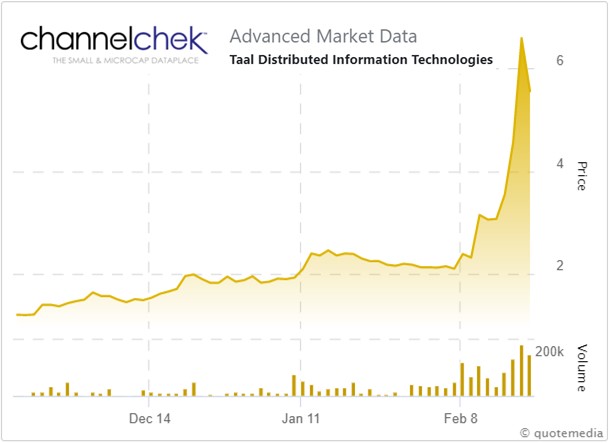

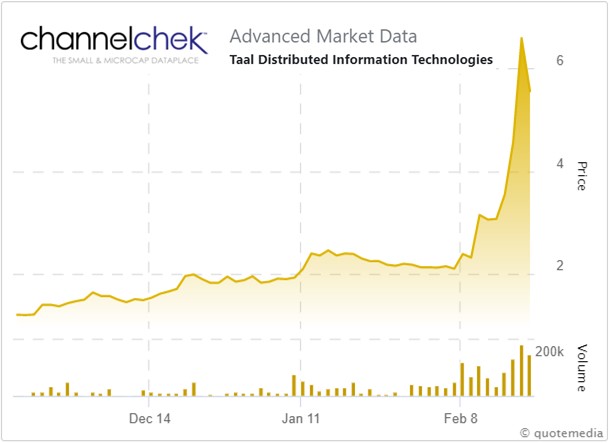

Taal Distributed Information Technologies (TAALF)

TAAL Distributed Information Technologies is a company that provides a wide range of Blockchain/Crypto-related services, including transaction processing, pool management, data storage solutions, and blockchain computing. Their primary focus is on the global adoption of Bitcoin SV (original Bitcoin). TAAL’s vision is ‘New Innovations for the New Economy.”

TAAL Distributed Information Technologies is a company that provides a wide range of Blockchain/Crypto-related services, including transaction processing, pool management, data storage solutions, and blockchain computing. Their primary focus is on the global adoption of Bitcoin SV (original Bitcoin). TAAL’s vision is ‘New Innovations for the New Economy.”

TAAL recently announced a successful first phase deployment of blockchain computer power at their Alberta facility. Part of their 2021 strategy, this first phase helps TAAL support transaction volume growth and meet scalability requirements, providing the computing power needed for enterprise clients to achieve business advantages using their processing services. “We are pleased to mark this important first step in reaching our operational infrastructure milestone for 2021. Despite the global pandemic challenges, we have successfully begun TAAL’s next-generation blockchain infrastructure operations in Alberta, Canada on schedule. This brings online, trusted, compliant blockchain transaction solutions for global enterprise clients”, commented TAAL CEO, and Executive Chairman, Stefan Matthews,.

TAALF’s stock has experienced a nearly 500% increase over the past three months, reaching a 52 week high on February 18, 2021.

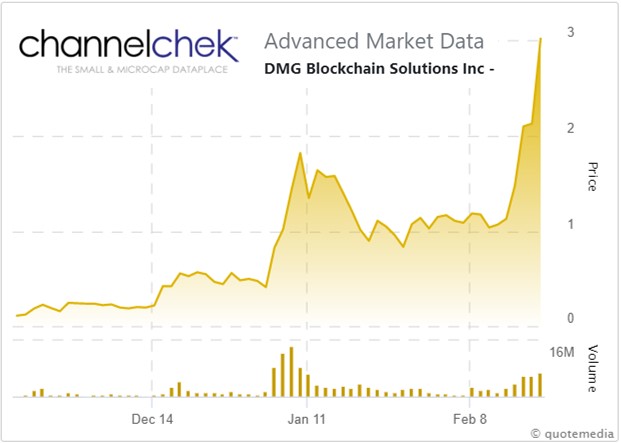

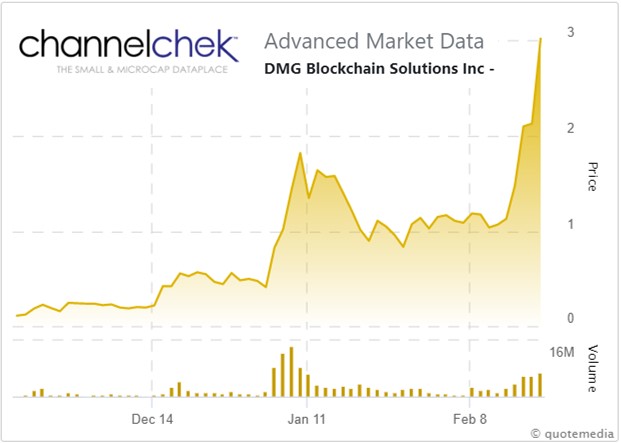

DMG Blockchain Solutions

(DMGGF)

Straddling blockchain and mining sectors of crypto, DMG is a diversified cryptocurrency and blockchain platform company. In the blockchain space, they offer a permissioned blockchain technology focused on developing enterprise software for supply chain management. Other company focal areas include crypto mining, hosting services for mining clients, transaction fees, and data analytics.

Straddling blockchain and mining sectors of crypto, DMG is a diversified cryptocurrency and blockchain platform company. In the blockchain space, they offer a permissioned blockchain technology focused on developing enterprise software for supply chain management. Other company focal areas include crypto mining, hosting services for mining clients, transaction fees, and data analytics.

In January, DMG joined Marathon Patent Group (MARA) to launch North America’s first cooperative mining pool, Digital Currency Miners of North America (DCMNA). The goal of DCMNA is to create North America’s first cooperative mining pool, and to help improve their financial performance. As part of their role in this agreement, DMG will provide their patent-pending technologies to create transaction blocks that omit transactions identified as risky and those that might not meet OFAC standards.

DMGGF has seen a substantial increase in share price over the past 3 months, reaching a 52 week high in February of 2021, trading at an average of over 3 million shares per day over the past 3o days.

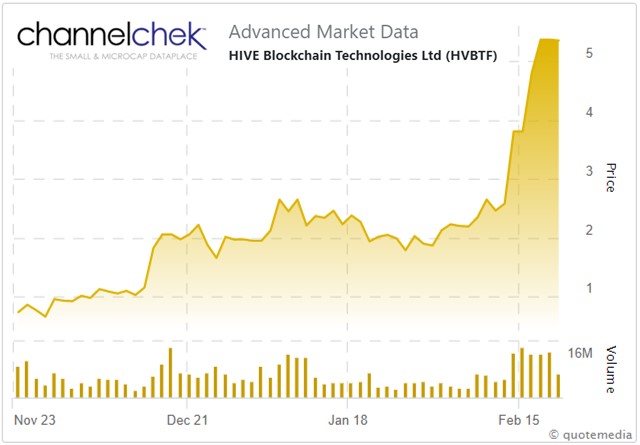

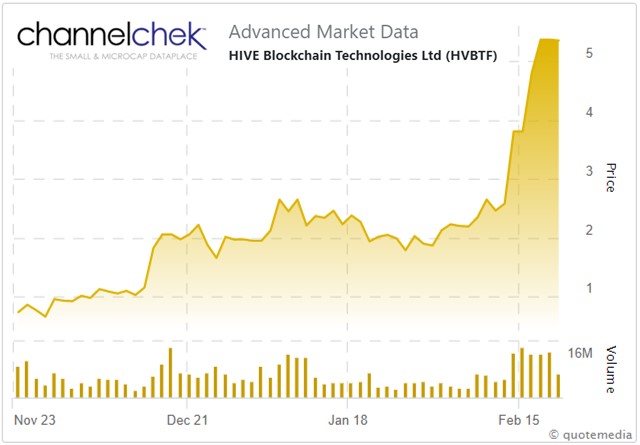

HIVE Blockchain Technologies (HVBTF)

Shareholders of HIVE Blockchain Technologies, Ltd. own a pure-play blockchain investment. HIVE creates newly minted cryptocurrencies continuously on the cloud through their data center facilities in Canada, Sweden, and Iceland.

Shareholders of HIVE Blockchain Technologies, Ltd. own a pure-play blockchain investment. HIVE creates newly minted cryptocurrencies continuously on the cloud through their data center facilities in Canada, Sweden, and Iceland.

HIVE recently announced plans to expand their Ethereum footprint by 30% using 6MW of green energy to mine. This expansion involves a $9M investment in GPU chips and associated mining computers and refitting their Sweden facility. As part of the announcement, HIVE proclaimed they would continue to “utilize cash flow to make opportunistic investments in ASIC and GPU new and next-generation mining equipment that can provide positive gross mining margins.”

HVBTF has seen a 500% increase in share price over the past 3 months, resting at a 52 week high in February 2021.

Cryptocurrency Mining

Cryptocurrency mining is a process where a computer (or a group of computers) complete a series of math equations as a computational task, generally processing other cryptocurrency transactions. In exchange for their assistance in performing these tasks, the “miners” are rewarded cryptocurrency. This process is akin to credit card processing fees. The various frameworks required to process a credit card transaction, from bank fees to computational requirements, lead to transaction fees. Generally, these fees are passed on to the merchant. In cryptocurrency mining, the miners take on some of these computational requirements, allowing merchants to absorb a lower fee.

While home users can use their own PCs and electricity to participate in crypto mining, the payoff is generally small, and not outweighed by electricity and equipment cooling costs. This is especially true as transaction processing demands increase. In modern-day crypto-mining the majority of the work is done by data farms – large data rooms filled with GPU-rich computers with the single purpose of processing transactions. (profit potential)

Hut 8 Mining Corp (HUTMF)

Hut 8 Mining Corp focuses entirely on Bitcoin mining, operating 56 BlackBox datacenters (all operating at a maximum capacity of 65 MW) in Medicine Hat, Alberta, and another 38 operating at 42MW in Drumheller, Alberta. Hut 8 aims to provide a secure and simple way to invest directly in bitcoin.

Hut 8 Mining Corp focuses entirely on Bitcoin mining, operating 56 BlackBox datacenters (all operating at a maximum capacity of 65 MW) in Medicine Hat, Alberta, and another 38 operating at 42MW in Drumheller, Alberta. Hut 8 aims to provide a secure and simple way to invest directly in bitcoin.

In February 2021, they reached a milestone of 400 minters installed, following the scheduled delivery of the first batch of 5400 machines ordered in January 2021. “Guaranteeing our access to new, cutting-edge mining equipment while market demand greatly outweighs supply has solidified our position as one of the only miners operating at full capacity, taking full advantage of today’s economics,” said Jaime Leverton, CEO, Hut 8.

In the past three months, HUTMF has surged over 800%, trading at a 30-day average of over 2M shares/day.

Marathon Patent Group (MARA)

Marathon Patent Group is a digital asset company and one of the first Nasdaq-listed Cryptocurrency mining companies. Marathon mines cryptocurrencies, with a focus on the blockchain ecosystem. They currently operate a proprietary mining facility operating at 105 MW in Montana, as well 2000+ ASIC Bitcoin Miners at a co-hosted facility in North Dakota.

Marathon Patent Group is a digital asset company and one of the first Nasdaq-listed Cryptocurrency mining companies. Marathon mines cryptocurrencies, with a focus on the blockchain ecosystem. They currently operate a proprietary mining facility operating at 105 MW in Montana, as well 2000+ ASIC Bitcoin Miners at a co-hosted facility in North Dakota.

Marathon recently announced that 4000 miners had shipped from Bitmain to their Montana facility. Once installed, their mining fleet will consist of over 6500 miners. “This shipment of 4,000 S-19 Pro miners is the first of many we will be receiving from Bitmain in 2021 as we build towards becoming one the largest and most efficient miners in North America,” said Merrick Okamoto, Marathon’s chairman, and CEO.

Over the last 90 days, MARA has increased from just over $3.00/share to a February 19th closing price of $43.27.

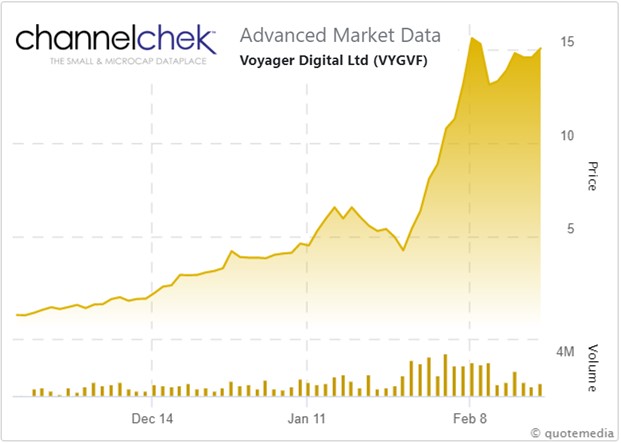

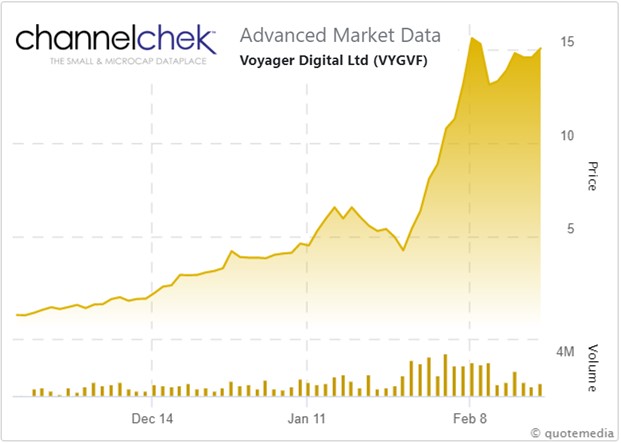

Voyager Digital (VYGVF)

Voyager Digital allows users to build their cryptocurrency portfolio by facilitating the purchase and trade of over 50 digital assets through the platform, which includes an app for Apple and Android smartphones. Voyager offers users a layer of security with advanced fraud protection and FDIC insurance up to $250,000.

Voyager Digital allows users to build their cryptocurrency portfolio by facilitating the purchase and trade of over 50 digital assets through the platform, which includes an app for Apple and Android smartphones. Voyager offers users a layer of security with advanced fraud protection and FDIC insurance up to $250,000.

Recent mergers and acquisitions have brought Voyager more users and have fueled high growth over the past few months. Voyager recently announced that assets under management had surpassed $1.1 billion ($USD), up 500% from $230 million at the close of 2020. “Voyager could not have reached this important milestone of AUM exceeding $1 billion without the support of our loyal community. With our recent capital raises in 2021 totaling US$146 million and our strong cash balance of approximately US$156 million, Voyager is better positioned than ever to grow our team, expand internationally and offer new exciting products to our users. We thank all of our stakeholders for their support on this momentous occasion,” said Stephen Ehrlich, Co-founder, Director and CEO of Voyager.

VYGVF has jumped from just under $1/share in mid-November 2020 to over $15/share in mid-February, with daily volume steadily increasing over the same period.

Currency Exchanges

A cryptocurrency exchange is a platform that facilitates the exchange of cryptocurrencies for other assets, generally cash. As in the exchange of any other currencies, the cryptocurrency exchange platform makes money through fees for acting as the intermediary.

The majority of current cryptocurrency exchanges are centralized. Centralized exchanges are backed and controlled by a company and provide security and stability for users on both ends of the transaction. Still, and often because of the transactional fees associated with a centralized exchange, some users prefer a decentralized exchange, which allows for direct peer-to-peer transactions.

Take-Away

Direct ownership of cryptocurrency is not the only way to gain exposure to what has been a growing and lucrative play. Technology companies that either mine or provide crypto or blockchain services would allow an equity investment in companies that stand to benefit from the increased acceptance and speculation in cryptocurrencies.

Channelchek can serve as an excellent resource to mine ideas and develop an understanding of small and microcap companies that could benefit from crypto growth.

The sectors and companies mentioned in this article represent a small sample of the various investment opportunities in the world of cryptocurrencies. While recent results look positive, you should always know the risk before investing. No investment decision should be made solely on this or any one article you read. You are solely responsible for deciding whether any investment or transaction is suitable for you based upon your investment goals, financial situation, and tolerance for risk. You must seek independent professional advice to ascertain the investment, legal, tax, accounting, regulatory or other consequences before investing or transacting.

Suggested Reading:

Is the Small Firm Effect for Microcaps Real?

Interest Rate Impact on Investment Sectors

The Fed and MIT are Experimenting with Digital Currency

Sources:

https://www.computerworld.com/article/3191077/what-is-blockchain-the-complete-guide.html

https://www.taal.com/news/taal-alberta-facility-blockchain-computer-power/

https://www.globenewswire.com/fr/news-release/2021/01/05/2153647/0/en/Marathon-Patent-Group-and-DMG-Blockchain-Solutions-to-Form-the-Digital-Currency-Miners-of-North-America-DCMNA-and-Launch-North-America-s-First-Cooperative-Mining-Pool.html

https://www.hiveblockchain.com/news/hive-blockchain-announces-plans-to-expand-ethereum-footprint-by-30-using-6-mw-of-green-energy-to-mine-ethereum/

https://www.bitdegree.org/crypto/tutorials/how-to-mine-cryptocurrency

https://hut8mining.com/hut-8-equips-up-ready-to-match-the-momentum-of-bitcoin-adoption-with-the-successful-installation-of-its-first-batch-of-mining-equipment-on-schedule

https://www.marathonpg.com/news/press-releases/detail/1226/bitmain-ships-4000-antminer-s-19-pro-asic-miners-to

https://corporatefinanceinstitute.com/resources/knowledge/other/cryptocurrency-exchanges/

https://cointelegraph.com/news/voyager-token-vgx-gains-926-as-mergers-and-acquisitions-bring-new-users

https://www.investvoyager.com/pressreleases/voyager-digital-announces-assets-under-management-surpass-ususd1-1-billion

Stay up to date. Follow us:

TAAL Distributed Information Technologies is a company that provides a wide range of Blockchain/Crypto-related services, including transaction processing, pool management, data storage solutions, and blockchain computing. Their primary focus is on the global adoption of Bitcoin SV (original Bitcoin). TAAL’s vision is ‘New Innovations for the New Economy.”

TAAL Distributed Information Technologies is a company that provides a wide range of Blockchain/Crypto-related services, including transaction processing, pool management, data storage solutions, and blockchain computing. Their primary focus is on the global adoption of Bitcoin SV (original Bitcoin). TAAL’s vision is ‘New Innovations for the New Economy.”  Straddling blockchain and mining sectors of crypto, DMG is a diversified cryptocurrency and blockchain platform company. In the blockchain space, they offer a permissioned blockchain technology focused on developing enterprise software for supply chain management. Other company focal areas include crypto mining, hosting services for mining clients, transaction fees, and data analytics.

Straddling blockchain and mining sectors of crypto, DMG is a diversified cryptocurrency and blockchain platform company. In the blockchain space, they offer a permissioned blockchain technology focused on developing enterprise software for supply chain management. Other company focal areas include crypto mining, hosting services for mining clients, transaction fees, and data analytics.  Shareholders of HIVE Blockchain Technologies, Ltd. own a pure-play blockchain investment. HIVE creates newly minted cryptocurrencies continuously on the cloud through their data center facilities in Canada, Sweden, and Iceland.

Shareholders of HIVE Blockchain Technologies, Ltd. own a pure-play blockchain investment. HIVE creates newly minted cryptocurrencies continuously on the cloud through their data center facilities in Canada, Sweden, and Iceland.

Hut 8 Mining Corp focuses entirely on Bitcoin mining, operating 56 BlackBox datacenters (all operating at a maximum capacity of 65 MW) in Medicine Hat, Alberta, and another 38 operating at 42MW in Drumheller, Alberta. Hut 8 aims to provide a secure and simple way to invest directly in bitcoin.

Hut 8 Mining Corp focuses entirely on Bitcoin mining, operating 56 BlackBox datacenters (all operating at a maximum capacity of 65 MW) in Medicine Hat, Alberta, and another 38 operating at 42MW in Drumheller, Alberta. Hut 8 aims to provide a secure and simple way to invest directly in bitcoin.  Marathon Patent Group is a digital asset company and one of the first Nasdaq-listed Cryptocurrency mining companies. Marathon mines cryptocurrencies, with a focus on the blockchain ecosystem. They currently operate a proprietary mining facility operating at 105 MW in Montana, as well 2000+ ASIC Bitcoin Miners at a co-hosted facility in North Dakota.

Marathon Patent Group is a digital asset company and one of the first Nasdaq-listed Cryptocurrency mining companies. Marathon mines cryptocurrencies, with a focus on the blockchain ecosystem. They currently operate a proprietary mining facility operating at 105 MW in Montana, as well 2000+ ASIC Bitcoin Miners at a co-hosted facility in North Dakota. Voyager Digital allows users to build their cryptocurrency portfolio by facilitating the purchase and trade of over 50 digital assets through the platform, which includes an app for Apple and Android smartphones. Voyager offers users a layer of security with advanced fraud protection and FDIC insurance up to $250,000.

Voyager Digital allows users to build their cryptocurrency portfolio by facilitating the purchase and trade of over 50 digital assets through the platform, which includes an app for Apple and Android smartphones. Voyager offers users a layer of security with advanced fraud protection and FDIC insurance up to $250,000.