Blockchain, Beverages, and Baloney

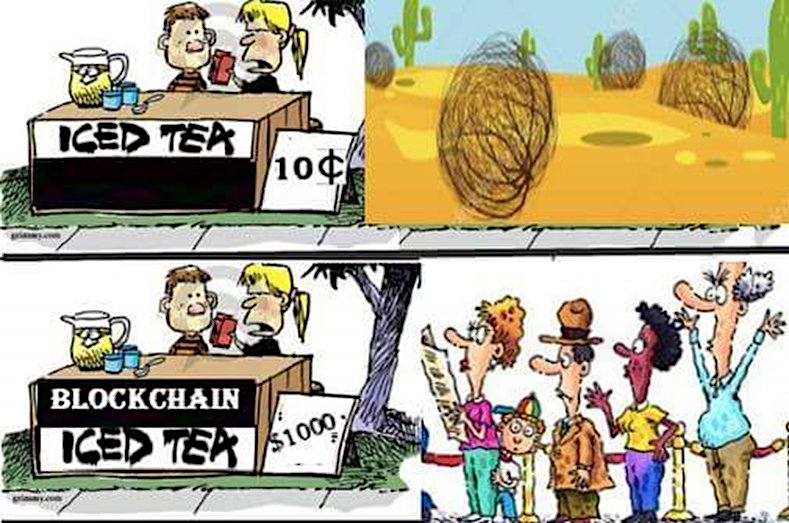

Blockchain is a digital distributed ledger of transactions in a decentralized database. It continuously updates digital records in real-time across a network of computers. As a means of eliminating huge amounts of record-keeping, its use is very powerful. But the word “blockchain” by itself also has power; the very word, at times has taken the lead driving stock price. Just adding it to a company name, has in the past, attracted new investors to the company’s stock. There were times when innocent, unaware investors have been duped.

A Lesson in Blockchain Frenzy

The year was 2017. The cryptocurrency market was experiencing an amazing bull run which drove bitcoin past $20,000 for the first time (by late 2018 it fell back below $4,000). Many speculative digital coin offerings were springing up during this crypto-frenzy. A large percentage of these so-called blockchain projects were barely legitimate or outright scams.

The Long Island Iced Tea Company (OTC: LBCC) was trading at about $3 per share. They decided to rebrand their modestly successful beverage company to perhaps take advantage of capital that was flowing into the digital asset space. The beverage maker made a simple name change to Long Branch Chain Company and had its ticker symbol adjusted from LTEA to LBCC. This move led to an almost immediate tripling of the bottled tea’s stock price.

Other than the name change, the LBCC’s blockchain strategy was never defined. Management had early on stated that it would be “shifting its primary corporate focus toward the exploration of and investment in opportunities that leverage the benefits of blockchain technology.” LBCC had also announced plans to acquire Bitcoin mining hardware. These plans were never carried out. The Nasdaq stock exchange eventually delisted the company, in part because they believed management was not being forthright with investors. This caused the stock that had at one time approached $10 to fall to $1.10 per share. The delisting pushed investors to over-the-counter desks to exchange shares.

Long Island Iced Tea Update

This past week, on February 22, almost three years after the name change, the U.S. Securities and Exchange Commission (SEC) revoked Long Blockchain’s stock registration. This revocation effectively bans or prevents public investors from trading in the company’s shares. The SEC stated that Long Island’s “blockchain business never became operational” and that the firm has failed to report on its financial results for the past 3 years.

The company is still making its beverages, primarily ready-to-drink iced tea and lemonade, under the “Long Island” brand.

Investment Lesson

Information, both trustworthy and dubious is plentiful in today’s digital communication world. We’re now aware of more options of things we can do with our money and we have more ways to investigate. Looking behind the curtain should be easier than ever. Hardly anyone makes a retail purchase like an appliance without reading reviews. Dining out at a new restaurant, for many, involves checking to see how many stars Yelp visitors have given it. Investing in a company is arguably more important than buying a microwave or ordering a poke bowl. Yet, credible company research is often the last place many investors turn, even though it can steer them through hype. There are layers of information from management plans, to accounting methods, to the industry as a whole that investors should, if not understand, find a source of trustworthy research.

Investors chasing companies because the crowd is or because it gives the appearance of being involved in something it isn’t can be avoided. Present-day examples of companies rebranding to attract capital is, of course, the so-called covid stocks. There are many examples of companies rebranding or getting their name viewed as a Covid Stock that probably should not be. The result is a dramatic increase in the volume of shares traded and share price. For example, Kodak (KODK) climbed 2,441% in one week last year by rebranding itself as a covid stock. It wouldn’t surprise me if begin to see the same with “green” publicly traded companies.

It’s more critical than ever to read the “reviews” and find out how many “stars” something is given and why. In the world of trading equities, this means finding company research providers of high integrity and heightened knowledge of the company.

Research, analysis, and company data are reasons why Channelchek’s usage keeps expanding. Registered users on the platform are free to explore what veteran, FINRA registered equity analysts are saying. With tens of thousands of research downloads and even more investors hearing directly from companies’ management on the YouTube channel, regular visitors to Channelchek are apt to improve their chances of being able to read the tea leaves.

Take-Away

Make it your business to know what you’re investing in and know what you own. Find sources of analysis you trust. Treat every investment with more care than a $25 Amazon purchase. Beware of artificially sweetened tea offerings. And, with the current frenzy toward ESG, be cautious, it’s not that easy being green.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading:

Small-Cap Names in a Big Crypto Market

Managing Investment Portfolio Risk

Lithium Ion Battery Recycling Heats Up

Sources:

https://www.sec.gov/Archives/edgar/data/1629261/000149315218001393/ex99-1.htm

https://www.sec.gov/Archives/edgar/data/1629261/999999999721000824/filename1.pdf

https://www.coindesk.com/nasdaq-believes-publicly-traded-firm-long-blockchain-mislead-investors

https://www.coindesk.com/nasdaq-believes-publicly-traded-firm-long-blockchain-mislead-investors

https://stocktwits.com/symbol/LBCC

https://www.coindesk.com/long-blockchain-risk-exchange-removal

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|