Ely Gold Royalties (TSXV: ELY, OTCQX: ELYGF) Closes Railroad-Pinion Royalty, Nevada

District Scale Property Currently Being Developed by Gold Standard Ventures

Vancouver, British Columbia, Canada, January 11, 2021. Ely Gold Royalties Inc. (TSXV: ELY, OTCQX: ELYGF) (“Ely Gold” or the “Company”) is pleased to announce that on December 30, 2020 it closed the purchase of private mineral interests on over 8,000 acres of private fee ground in Elko County, Nevada (the “Mineral Interests”).

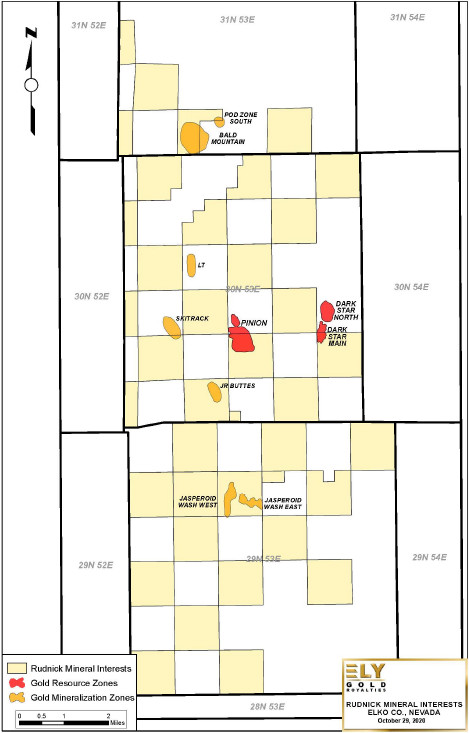

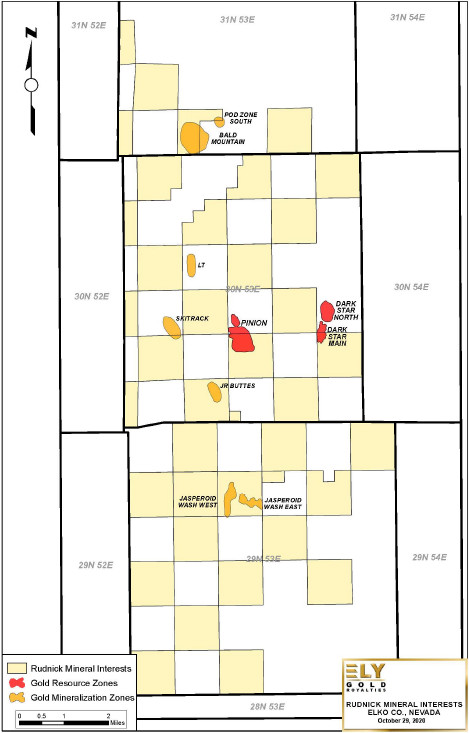

All the fee ground and the Mineral Interests are currently leased to Gold Standard Ventures Corp (NYSE AMERICAN: GSV, TSX: GSV) (“GSV”) and cover certain portions of GSV’s Railroad-Pinion Project currently being developed as a heap-leach mining operation (the “Lease”). The Lease provides for a combined 0.436% net smelter returns royalty (“NSR”) and annual lease payments of US$79,800 (the “OR Transaction”). The Mineral Interests and Leases cover large portions of the Pinion, Dark Star, Jasperoid Wash deposits in the South Railroad Complex as well as portions of the POD and Bald Mountain zones in the North Railroad (see Figure 1). The Company first announced the OR Transaction in a press release dated November 2, 2020 (the 11/2/2020 Press Release”)

The OR Transaction

Ely Gold paid total consideration of US$1,300,000 cash and issued 300,000 common stock warrants (the “Ely Warrants”) for the OR Transaction. The Ely Warrants have a five-year term and will have an exercise price of CDN$1.14. Securities issued under the Ely Warrants will be subject to a four-month hold period. In connection with its assistance with both transactions, Ely Gold has paid a cash finder’s fee to R&R Land, Mineral & Oil LLC (R&R) totaling US$65,000.

The ORTT Transaction

The 11/2/2020 Press Release also included the acquisition of additional mineral interests and leases (the “ORTT Transaction”) for total payment of US$2,509,543 cash. The ORTT Transaction included leases that provided for a 0.71% NSR as well as annual advance royalty payments. After further due diligence and lastminute negotiations by certain owners, Ely Gold has opted to terminate the ORTT Transaction. Ely Gold has paid R&R a break fee of US$134,000 in connection with this termination.

Railroad-Pinion Project

The Railroad-Pinion Project is an advanced stage gold project with a favorable structural, geological and stratigraphic setting situated at the southeast end of the Carlin Trend of north-central Nevada, adjacent to and south of Nevada Gold Mines’ Rain Mining District.

On February 18, 2019, Gold Standard announced an updated Pre-Feasibility Study for The South Railroad portion of the Railroad-Pinion project consisting of the Dark Star deposit and the Pinion Deposit. Key Highlights of the Updated Base Case South Railroad PFS include: (all currencies are shown in US dollars):

- Pre-tax net present value (“NPV”) of $331.4M at a 5% discount rate and an after tax NPV of $265.0M at a $1,400 gold price and a $17.11 silver price, with a mineral reserve pit designs based on a gold price $1,250 per ounce and a silver price of $15.30 per ounce.

- Proven and probable mineral reserves of 1.246 million ounces of gold and 2.705 million ounces of silver.

- Average annual gold placement of 156,000 ounces of gold per year over an initial 8-year mine life.

- Average life of mine cash cost of $582 per ounce after by-product credit, and all in sustaining costs (“AISC”) of $707 per ounce.

- Initial capital expenditures of $132.9M

Details of the Pre-Feasibility study can be found in Form 43-101F1 Technical Report Updated Preliminary Feasibility Study Elko County, Nevada at the following link:

https://goldstandardv.com/site/assets/files/4408/m3_gsv_revised_pfs_23_03_2020.pdf

On July 16, 2020 GSV announced the entering into a binding letter of intent with Orion Mine Finance relating to a series of transactions, totaling approximately US$22.5 million, including a term sheet to provide up to US$200 million of financing support to GSV, to help finance the construction of the South Railroad Project.

On December 2, 2020 and January 5, 2021, GSV announced the appointment of new senior management with strong experience in Capital Markets and mine development and construction.

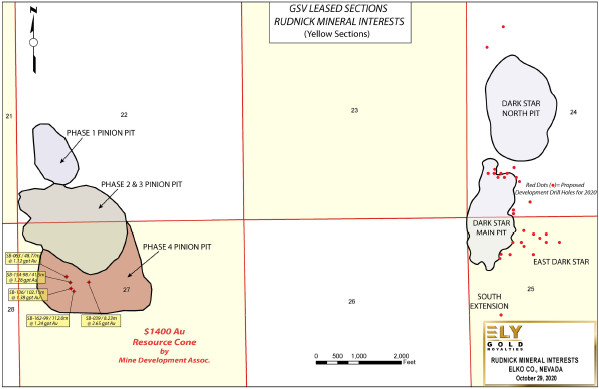

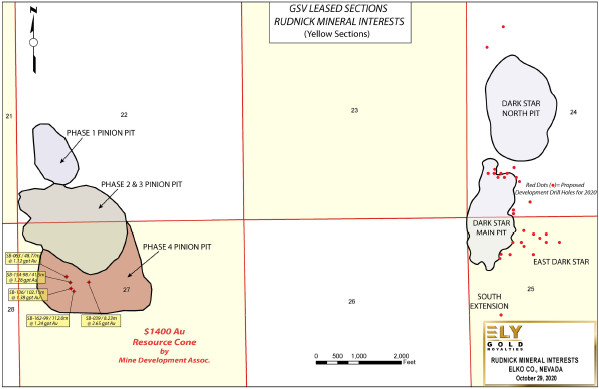

On November 12, 2020 GSV announced encouraging drill results from 24 of 75 holes in the 2020 Pinion deposit development program. Oxide results include:

42.7m of 0.92 g Au/t, including 7.6m of 2.69 g Au/t in hole PR20-14; 38.1m of 0.97 g Au/t in PR20-15;

64.0m of 0.81 g Au/t, including 22.9m of 1.20 g Au/t in hole PR20-19; and 29.0m of 0.77 g Au/t, including 12.2m of 1.28 g Au/t in PR20-23.

Objectives of the 2020 Pinion development program include: 1) decreasing drill spacing on the Pinion Phase 4 ($1400 pit) inferred oxide resource for potential conversion to Measured and Indicated; 2) provide material for metallurgical testing; and 3) tighten the drill spacings near historic Cameco holes SB-136, an RC hole that intersected 102.1m of 1.38 g Au/t, and SB-162-99, a core hole that twinned and verified theSB-136 results with an intercept of 112.0m of 1.24 g Au/t.

On November 18, 2020, GSV released results from six holes targeting and intersecting up-dip, near-surface oxide mineralization to the east of GSV’s drilling at Main Dark Star Deposit. The results from step out holes DR20-01 through DR20-06 intersected thick intervals of oxide mineralization to the east of the existing GSV drilling at Main Dark Star including hole DR20-02 that intersected 61.0m of 0.66 g Au/t including 24.4m of 1.03 g Au/t. This mineralization begins at the current topographic surface and remains open to the east along a strike length of approximately 330m. These results indicate the possibility to expand the Main Dark Star deposit to the east with low strip up front ounces during early production.

All drill holes in the 2020 Pinion & Dark Star Main development programs are located on the Mineral Interests being purchased by Ely Gold. (see Figure 2)

Mineral Interests & Leased Claims

Figure 1

GSV Expansion Drilling

Figure 2

Qualified Person

Stephen Kenwood, P. Geo, is director of the Company and a Qualified Person as defined by NI 43-101. Mr. Kenwood has reviewed and approved the technical information in this press release.

About Ely Gold Royalties Inc.

Ely Gold Royalties Inc. is a Nevada focused gold royalty company. Its current portfolio includes royalties at Jerritt Canyon, Goldstrike and Marigold, three of Nevada’s largest gold mines, as well as the Fenelon mine in Quebec, operated by Wallbridge Mining. The Company continues to actively seek opportunities to purchase producing or near-term producing royalties. Ely Gold also generates development royalties through property sales on projects that are located at or near producing mines. Management believes that due to the Company’s ability to locate and purchase third-party royalties, its strategy of organically creating royalties and its gold focus, Ely Gold offers shareholders a favourable leverage to gold prices and low-cost access to long-term gold royalties in safe mining jurisdictions.

On Behalf of the Board of Directors

Signed “Trey Wasser”

Trey Wasser, President & CEO

For further information, please contact:

Trey Wasser, President & CEO

trey@elygoldinc.com

972-803-3087

Joanne Jobin, Investor Relations Officer

jjobin@elygoldinc.com

647 964 0292

FORWARD-LOOKING CAUTIONS: This press release contains certain “forward-looking statements” within the meaning of Canadian securities legislation, including, but not limited to, statements regarding completion of the Transaction. Forwardlooking statements are statements that are not historical facts; they are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “aims,” “potential,” “goal,” “objective,” “prospective,” and similar expressions, or that events or conditions “will,” “would,” “may,” “can,” “could” or “should” occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the Company’s inability to control whether the buy-down right will ever be exercised, and whether the right of first refusal will ever be triggered, uncertainty as to whether any mining will occur on the property covered by the Probe Royalty such that the Company will receive any payment therefrom, and the general risks and uncertainties relating to the mineral exploration, development and production business. The reader is urged to refer to the Company’s reports, publicly available through the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effect.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Source: Ely Gold Royalties