U.S. Gold Corp. Provides a PFS Update and Surface Sample Results up to 11.9 g/t Gold at the CK Gold Project in Wyoming

Pre-Feasibility Study (PFS) and additional technical studies well underway

ELKO, Nev., Nov. 5, 2020 /PRNewswire/ — U.S. Gold Corp. (NASDAQ: USAU) (the “Company”), a gold exploration and development company, is pleased to provide an update on the Pre-Feasibility Study (PFS) in progress at the CK Gold Project, located just outside of Cheyenne, Wyoming. Field activities have been ongoing since August, 2020.

Surface Sample Results

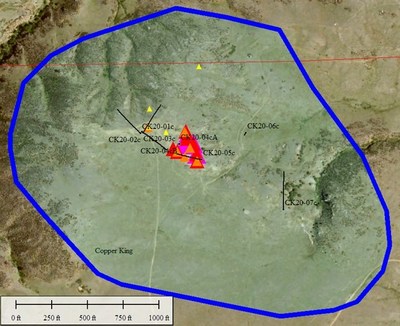

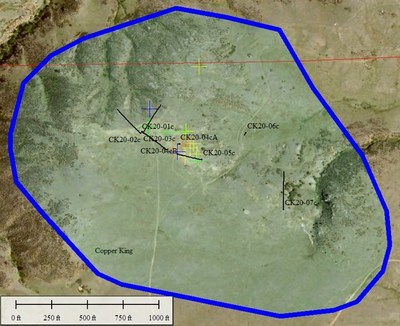

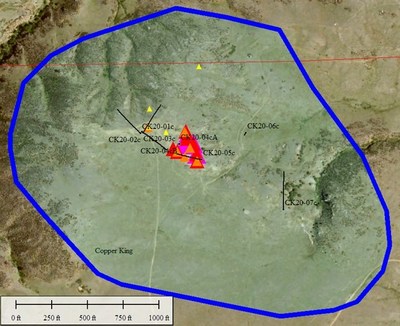

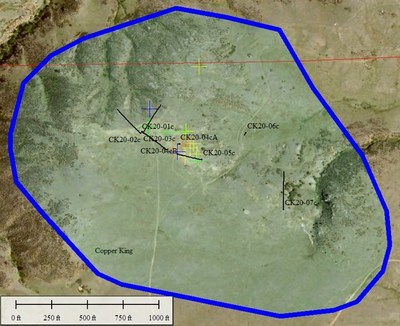

The attached maps show gold and copper values from a series of 21 surface samples taken at the start of current field season activities. Values shown are plotted on an image along with the outline of the open pit mine limit derived from the Preliminary Economic Assessment completed in 2017 by Mine Development Associates. See the news release dated January 11, 2017 for additional information. The Company anticipates that following drilling in 2017, 2018 and the current 2020 drill program, there will be an updated block model and new pit limit as part of the final PFS report, expected in the first half of 2021. In the attached maps the following symbols relate to the gold and copper grades encountered:

Figure 1: CK Gold Project – Gold in rock

Gold: > 0.3 g/t yellow triangles, > 1 g/t orange triangles, > 3.0 g/t red triangles, > 10.0 g/t magenta triangle

Figure 2: CK Gold Project – Copper in rock

Copper: 0.5 % yellow crosses, > 1.0% orange crosses, > 2.0% red crosses

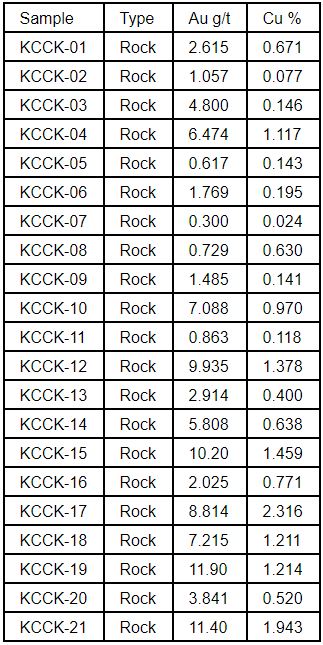

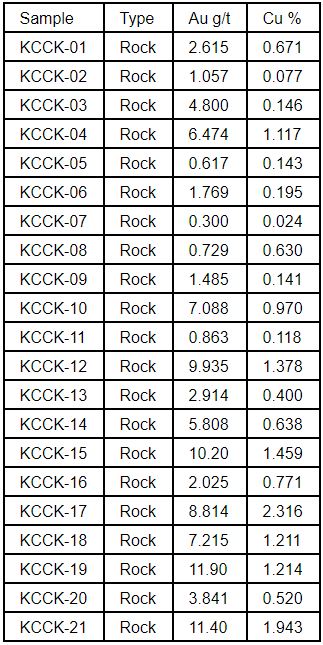

Table 1. CK Gold Project Rock Samples

Surface samples taken at the CK Gold Project represent samples of interest that may have originated from either surface outcrop, surface erosional float or dump material discarded from an old 80 ft shaft, lateral development or adits into the near surface portion of the resource. The grades of the samples, while encouraging and indicative of values that might be encountered in the deposit, do not necessarily reflect any significant change to the overall resource grade as reported in the Preliminary Economic Assessment completed in 2017 by Mine Development Associates. See the news release dated January 11, 2017 for additional information.

Pre-Feasibility and Project Study Progress

The following bullet points outline progress to date

- August initiated PFS Study for the CK Gold Project with associated consultants

- August 5th commenced complete re-log of historic drill core with oversight from highly experience consulting geologists

- September 5th kick-off meeting with diamond drill crew at project site

- October 2nd completed last of seven diamond core drill holes totaling 4,651 ft (1,418 m) to gather metallurgical samples from representative areas of the known resource

- October 3rd initiated the first of five planned geotechnical and hydrological diamond core holes to be completed in early November. Approximately 4,800 ft planned

- October 15th R/C drill rig on site to commence drilling on 6 well/monitoring holes for site water characterization and up to 10 exploratory holes aimed at infill drilling to convert inferred resource to measured/indicated category, as well as expand limits of known resources. Drilling will continue into November dependent on weather and progress and we anticipate a total footage of 12,000 ft before we demobilize for winter

- Contracted hydrological consultants to characterize local groundwater hydrology, open pit hydrology and surface hydro-geochemistry. Also, to establish project baseline for the natural hydrological conditions. Falling head and packer testing is ongoing during the drilling program

- Contracted geotechnical consultants to establish open pit stability and design parameters. Specific geotechnical logging, point load testing and lab sample selection is ongoing during the drilling program

- Contracted local environmental and permitting specialist to assist with environmental baseline program design and capture, permit application preparation. This includes the deployment of a monitoring station and assessment of drainages for any potential wetland impact

- Monitoring the delivery, chain of custody and QA/QC for assay values at the laboratory, prioritizing metallurgical samples to allow metallurgical work to commence later in the year as soon as representative composites can be identified once assay results are in

In commenting on the sample values received and the progress to date, George Bee, President of U.S. Gold Corp. stated, “We are grateful for the collaboration that we have had from all our consultants and drill contractors. They are doing an outstanding, safe and responsible job. We also thank our local hosts, including the respective Wyoming agencies who have been very helpful to date and the local ranch owner who holds grazing rights on our mineral leases.” Mr. Bee went on to say; “It is very encouraging to see the good grade samples from outcrops on surface that support our thesis about the project. We are also going well beyond the minimal PFS requirements and capturing baseline data to put the company into a position to rapidly advance the project once we have the PFS results in hand.”

COVID-19 Policy

U.S. Gold Corp. recognizes the heightened health risks associated with the current pandemic. At this stage of the CK Gold Project development, focusing largely on the gathering of information from the field, our personnel, contractors and consultants do not need to come into close contact with others apart from work within individual pods such as the drill crew and core logging personnel. Much of our work is conducted outdoors and physically separated. Meetings are conducted from remote locations using available video conferencing software. When it is necessary for individuals to meet or visit facilities, health guidelines are followed to avoid and minimize the risk of spreading the COVID-19 virus. We take the health and safety all those associated with our activities very seriously. If necessary we will suspend activities and observe quarantine regimens until any health uncertainty passes.

Note on Qualified Person

QP Review: This statement has been reviewed by Kevin Francis, P Geo, RM, Principle of Mineral Resource Management LLC who has inspected the data furnished in this announcement and has knowledge of the activities outlined in the CK Gold Project update. Acting within the scope of his expertise, Mr. Francis as a Qualified Person, has reviewed the information provided and finds it to be accurate and reflecting facts.

About U.S. Gold Corp.

U.S. Gold Corp. is a publicly traded, U.S. focused gold exploration and development company. U.S. Gold Corp. has a portfolio of exploration properties. Copper King, now the CK Gold Project, is located in Southeast Wyoming and has a Preliminary Economic Assessment (PEA) technical report, which was completed by Mine Development Associates. Keystone and Maggie Creek are exploration properties on the Cortez and Carlin Trends in Nevada. The Challis Gold Project is located in Idaho. For more information about U.S. Gold Corp., please visit www.usgoldcorp.gold

Safe Harbor

Certain statements in this press release are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of forward-looking words such as “anticipate,” “believe,” “forecast,” “estimated,” and “intend,” among others. These forward-looking statements are based on U.S. Gold Corp.’s current expectations, and actual results could differ materially from such statements. There are a number of factors that could cause actual events to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, risks arising from: the prevailing market conditions for metal prices and mining industry cost inputs, environmental and regulatory risks, risks faced by junior companies generally engaged in exploration activities, whether U.S. Gold Corp. will be able to raise sufficient capital to implement future exploration programs, COVID-19 uncertainties, and other factors described in the Company’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the Securities and Exchange Commission, which can be reviewed at www.sec.gov. The Company has based these forward-looking statements on its current expectations and assumptions about future events. While management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory, and other risks, contingencies, and uncertainties, most of which are difficult to predict and many of which are beyond the Company’s control. The Company makes no representation or warranty that the information contained herein is complete and accurate and we have no duty to correct or update any information contained herein.

For additional information, please contact:

U.S. Gold Corp. Investor Relations: +1 800 557 4550

ir@usgoldcorp.gold

www.usgoldcorp.gold

SOURCE U.S. Gold Corp.

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 online investors. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 online investors. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you