Energy Fuels Now Debt-Free; Unique in Uranium Sector

LAKEWOOD, Colo., Oct. 6, 2020 /CNW/ – Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) (“Energy Fuels” or the “Company”), the leading uranium producer in the United States, is pleased to announce that today the Company became debt-free, following the retirement of its remaining Cdn$10,430,000 of floating rate convertible unsecured subordinated debentures (the “Debentures“). As of today, no Debentures remain outstanding, and they have ceased to be listed on the Toronto Stock Exchange. Further, the Company currently has no other remaining short- or long-term debt.

“While many uranium and other natural resource companies have significant debt burdens, Energy Fuels is proud to announce that today we became debt free,” stated Mark S. Chalmers, President and CEO of Energy Fuels.

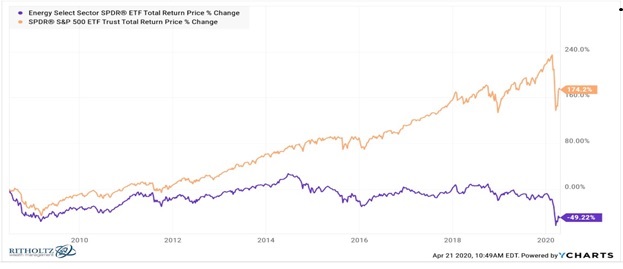

“Being debt-free distinguishes Energy Fuels not only from many of our peers in the uranium and natural resource sectors, but also from many public companies in general. Having no debt reduces costs and allows Energy Fuels to better weather market volatility. Coupled with our strong working capital position, this also provides us with a ‘clean slate’ from which to increase uranium production when warranted and to launch the exciting rare earth element initiative we are pursuing.

“We have a number of opportunities in front of us right now, any one of which could result in significant cash flows for the Company. Critical minerals, including uranium, rare earth elements, and vanadium, are front-and-center in the U.S. right now, including bipartisan support in the U.S. government. We are continuing to work with our allies in the Administration and Congress to create a strategic U.S. uranium reserve to enhance national security and energy security. As the leading uranium miner in the U.S., with more production facilities, capacity, expertise and in-ground resources than any other U.S. uranium producer, we expect to be one of the prime beneficiaries of any U.S. government support.

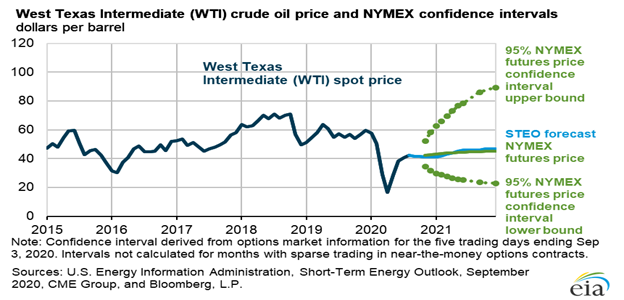

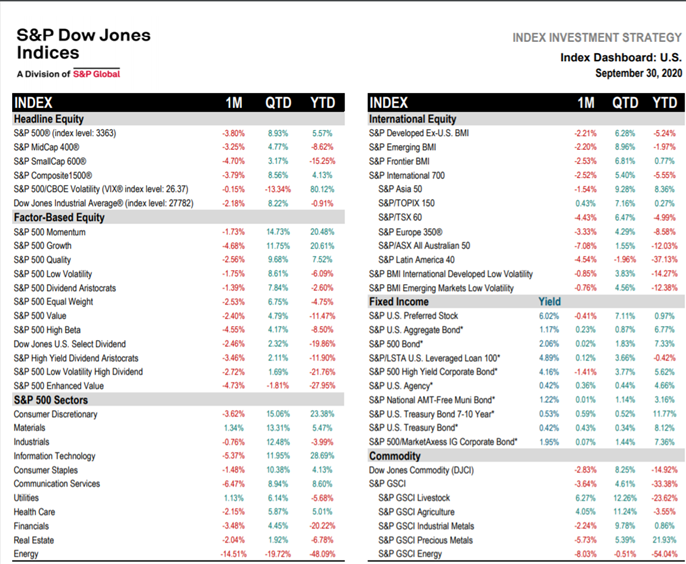

“We were also pleased that the U.S. Department of Commerce was recently able to reduce uranium and nuclear fuel imports into the U.S. from Russia over the long-term, thereby eliminating the specter of more state-owned uranium imports entering the U.S. President Trump’s Executive Orders on critical minerals last week may be an important step toward the U.S. government providing tangible support and/or funding to producers and processors of critical minerals, including the uranium and vanadium we currently produce, and the rare earth elements we hope to produce in the future. And of course, global uranium markets, where spot prices are up over 20% this year, appear poised to continue their bounce-back, due to significant global production cutbacks and the fact that current spot and term pricing cannot sustain new or existing primary supply. Energy Fuels has created a number of significant, potentially ‘game changing,’ catalysts while also maintaining a strong working capital position and eliminating debt. We look forward to continuing to provide updates in the coming weeks and months on several of these initiatives.”

About Energy Fuels: Energy Fuels is the leading U.S.-based uranium mining company, supplying U3O8 to major nuclear utilities. The Company also produces vanadium from certain of its projects, as market conditions warrant, and is evaluating the potential to recover rare earth elements at its White Mesa Mill. Its corporate offices are near Denver, Colorado, and all of its assets and employees are in the United States. Energy Fuels holds three of America’s key uranium production centers – the White Mesa Mill in Utah, the Nichols Ranch in-situ recovery (“ISR”) Project in Wyoming, and the Alta Mesa ISR Project in Texas. The White Mesa Mill is the only conventional uranium mill operating in the U.S. today, has a licensed capacity of over 8 million pounds of U3O8 per year, and has the ability to produce vanadium when market conditions warrant. The Nichols Ranch ISR Project is on standby and has a licensed capacity of 2 million pounds of U3O8 per year. The Alta Mesa ISR Project is also on standby and has a licensed capacity of 1.5 million pounds of U3O8 per year. In addition to the above production facilities, Energy Fuels has one of the largest NI 43-101 compliant uranium resource portfolios in the U.S. and several uranium and uranium/vanadium mining projects on standby and in various stages of permitting and development. The primary trading market for Energy Fuels’ common shares is the NYSE American under the trading symbol “UUUU,” and the Company’s common shares are also listed on the Toronto Stock Exchange under the trading symbol “EFR.” Energy Fuels’ website is www.energyfuels.com.

Cautionary Note Regarding Forward-Looking Statements: This news release contains certain “Forward-Looking Information” and “Forward-Looking Statements” within the meaning of applicable United States and Canadian securities legislation, which may include, but are not limited to, statements with respect to: any expectation that the Company will maintain its position as the leading uranium producer in the United States; any expectation that being debt free will allow the Company to better weather market volatility, or allow the Company to increase uranium production when warranted or launch its rare earth element initiative; any expectation that the Company has a number of opportunities or catalysts in front of it which could result in significant cash flows for the Company; any expectation that the Administration and Congress may create a strategic U.S. uranium reserve, or that the Company may be one of the prime beneficiaries of any U.S. government support; any expectation that the recent actions of the U.S. Department of Commerce may reduce uranium and nuclear fuel imports into the U.S. from Russia over the long-term and eliminate the specter of more state-owned uranium imports entering the U.S.; any expectation that President Trump’s recent Executive Orders on critical minerals may be an important step toward the U.S. government providing tangible support and/or funding to producers and processors of critical minerals; any expectation that current spot and term uranium pricing cannot sustain new or existing primary supply; and any expectation that global uranium markets may continue their bounce-back. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans,” “expects,” “does not expect,” “is expected,” “is likely,” “budgets,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates,” “does not anticipate,” or “believes,” or variations of such words and phrases, or state that certain actions, events or results “may,” “could,” “would,” “might” or “will be taken,” “occur,” “be achieved” or “have the potential to.” All statements herein, other than statements of historical fact, are considered to be forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance of or achievements of the Company to be materially different from any future results, performance, or achievements, express or implied, by the forward-looking statements. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements include risks associated with: any expectation that the Company will maintain its position as the leading uranium producer in the United States; any expectation that being debt free will allow the Company to better weather market volatility, or allow the Company to increase uranium production when warranted or launch its rare earth element initiative; any expectation that the Company has a number of opportunities or catalysts in front of it which could result in significant cash flows for the Company; any expectation that the Administration and Congress may create a strategic U.S. uranium reserve, or that the Company may be one of the prime beneficiaries of any U.S. government support; any expectation that the recent actions of the U.S. Department of Commerce may reduce uranium and nuclear fuel imports into the U.S. from Russia over the long-term and eliminate the specter of more state-owned uranium imports entering the U.S.; any expectation that President Trump’s recent Executive Orders on critical minerals may be an important step toward the U.S. government providing tangible support and/or funding to producers and processors of critical minerals; any expectation that current spot and term uranium pricing cannot sustain new or existing primary supply; any expectation that global uranium markets may continue their bounce-back; and the other factors described under the caption “Risk Factors” in the Company’s most recently filed Annual Report on Form 10-K, which is available for review on EDGAR at www.sec.gov/edgar.shtml, on SEDAR at www.sedar.com, and on the Company’s website at www.energyfuels.com. Forward-looking statements contained herein are made as of the date of this news release, and the Company disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or as a result of changes in management’s estimates or opinions, or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. The Company assumes no obligation to update the information in this communication, except as otherwise required by law.

SOURCE Energy Fuels Inc.

For further information: Energy Fuels Inc., Curtis Moore – VP – Marketing & Corporate Development, (303) 974-2140 or Toll free: (888) 864-2125, investorinfo@energyfuels.com,

www.energyfuels.com

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meetings intrigue you

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meetings intrigue you