Sierra Metals Reports Record Third Quarter 2020 Production Results, As The Production Ramps Up To Full Capacity At All Three Mines

TORONTO–(BUSINESS WIRE)– Sierra Metals Inc. (TSX: SMT) (BVL: SMT) (NYSE AMERICAN: SMTS) (“Sierra Metals” or “the Company”) is pleased to report third-quarter 2020 production results.

Results are from Sierra Metals’ three underground mines in Latin America: The Yauricocha polymetallic mine in Peru, and the Bolivar copper and Cusi silver Mines in Mexico.

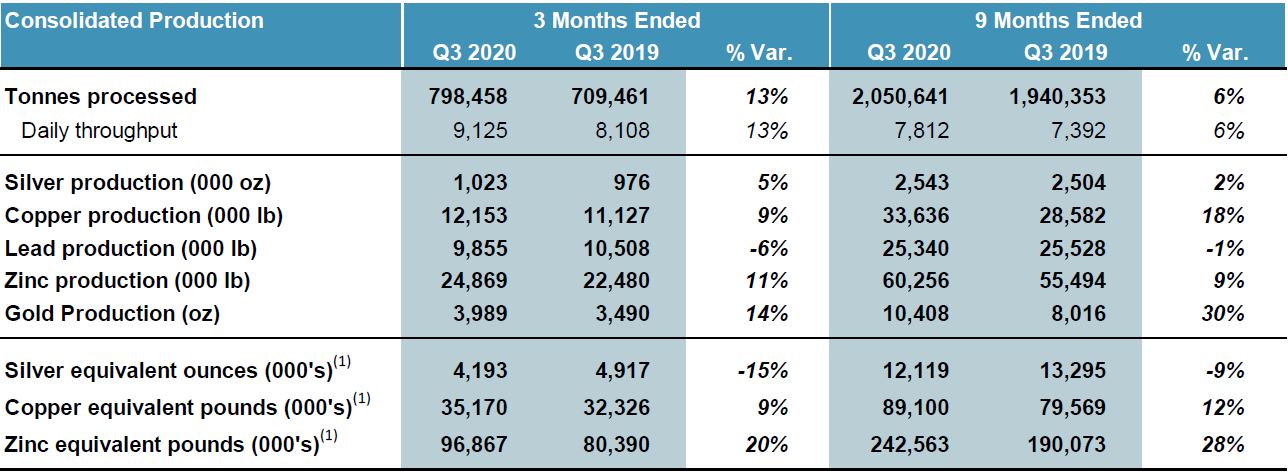

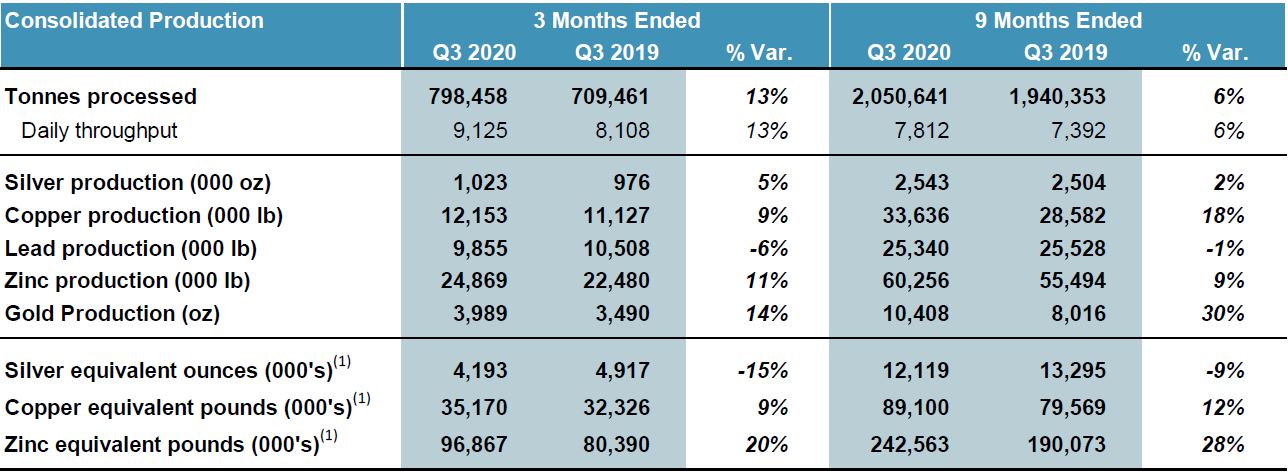

Third Quarter 2020 Consolidated Production Highlights

- Copper production of 12.2 million pounds; a 9% increase from Q3 2019

- Silver production of 1.0 million ounces; a 5% increase from Q3 2019

- Gold production of 3,990 ounces; a 14% increase from Q3 2019

- Zinc production of 24.9 million pounds; an 11% increase from Q3 2019

- Lead production of 9.9 million pounds; a 6% decrease from Q3 2019

- Copper equivalent production of 35.2 million pounds; a 9% increase from Q3 2019

- Record quarterly ore throughput, and copper and gold production at the Bolivar Mine in Mexico

- Record quarterly silver production at the Cusi Mine in Mexico, despite being in care and maintenance for part of the quarter

The Company achieved record quarterly consolidated equivalent copper production and ore throughput, driven by strong operational performance at its three mines despite the difficulties arising from the COVID-19 pandemic.

Luis Marchese, CEO of Sierra Metals commented: “I am very pleased to report that the Company continues to strengthen its performance in 2020 with the achievement of production records on a Company consolidated basis and at the Bolivar Mine for quarterly equivalent metal production as well as for ore throughput. At Yauricocha, we continue to process throughput at increased levels which has helped us to recover some of the lower production experienced during the Q2 COVID-19 shutdowns. At Cusi we recommenced production in late July and operated for 65 days during the third quarter with ore throughput reaching over 1,000 tonnes per day during that period.”

He continued, “The COVID-19 situation in Mexico and Peru is still very serious and remains an important factor in our daily operations at the mines. We are continuing to adhere to strict health protocols to protect our employees, the communities in which we operate and our operations. Testing and quarantining has helped us to identify and keep active cases from the mines but as a result we are operating with a lower head count than optimal. I would like to thank our employees for the hard work in holding safe, helping the mines to run efficiently, and helping to maintain the strong production levels as noted in the third quarter results.”

He concluded, “As we continue to ramp up operations, we have been able to reinitiate on the backlog of exploration and infrastructure projects at the mines. This will help us to improve mine operations and operating efficiencies while continuing to discover and develop mineral resources. We are also proceeding with expansion studies at all mines based on the current large mineral resource levels and probable future discoveries of additional mineral resources at all mines. Precluding any further COVID-19 work interruptions the fourth quarter should continue advancing production throughput to capacity levels and help us to realize a strong finish for the year.”

Consolidated Production Results

(1) Silver equivalent ounces and copper and zinc equivalent pounds for Q3 2020 were calculated using the following realized prices: $24.89/oz Ag, $2.97/lb Cu, $1.08/lb Zn, $0.85/lb Pb, $1,916/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for Q3 2019 were calculated using the following realized prices: $17.28/oz Ag, $2.63/lb Cu, $1.06/lb Zn, $0.94/lb Pb, $1,481/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for 9M 2020 were calculated using the following realized prices: $19.35/oz Ag, $2.63/lb Cu, $0.97/lb Zn, $0.80/lb Pb, $1,742/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for 9M 2019 were calculated using the following realized prices: $15.91/oz Ag, $2.74/lb Cu, $/1.16lb Zn, $0.91/lb Pb, $1,370/oz Au.

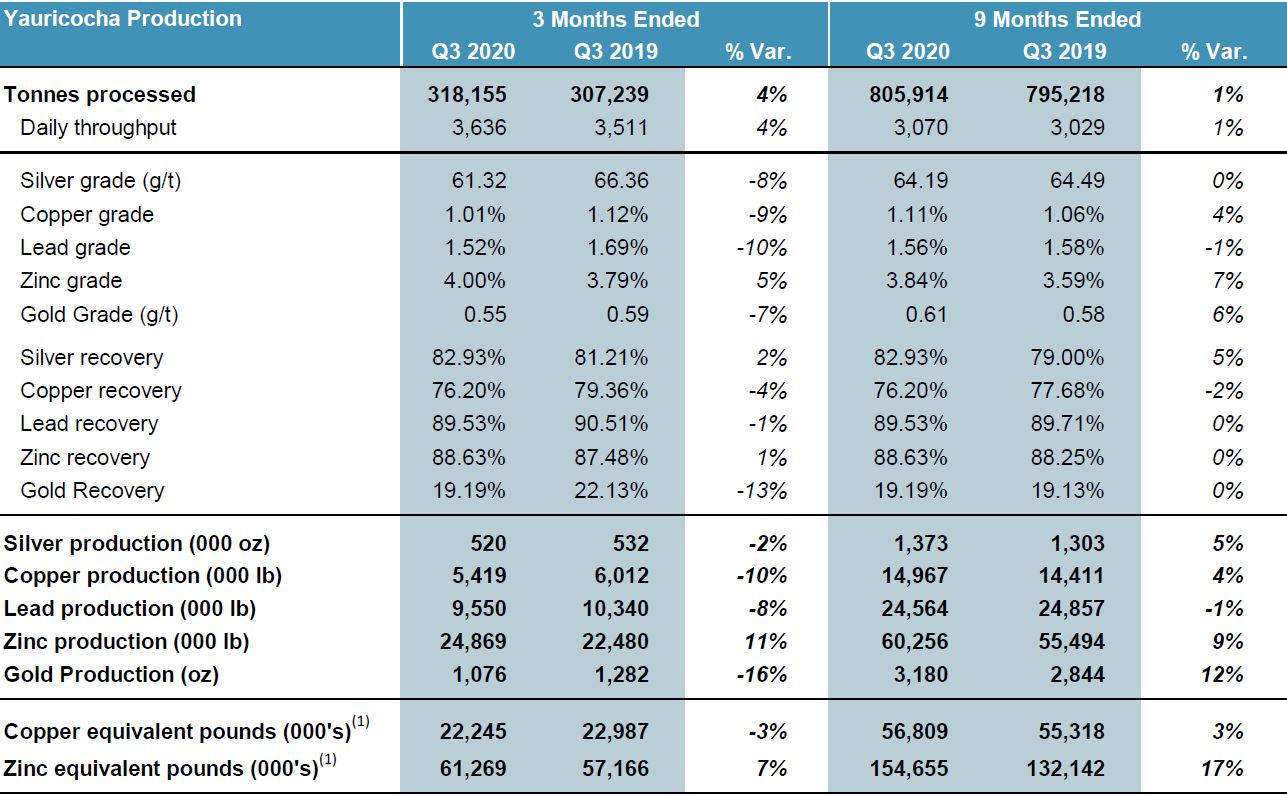

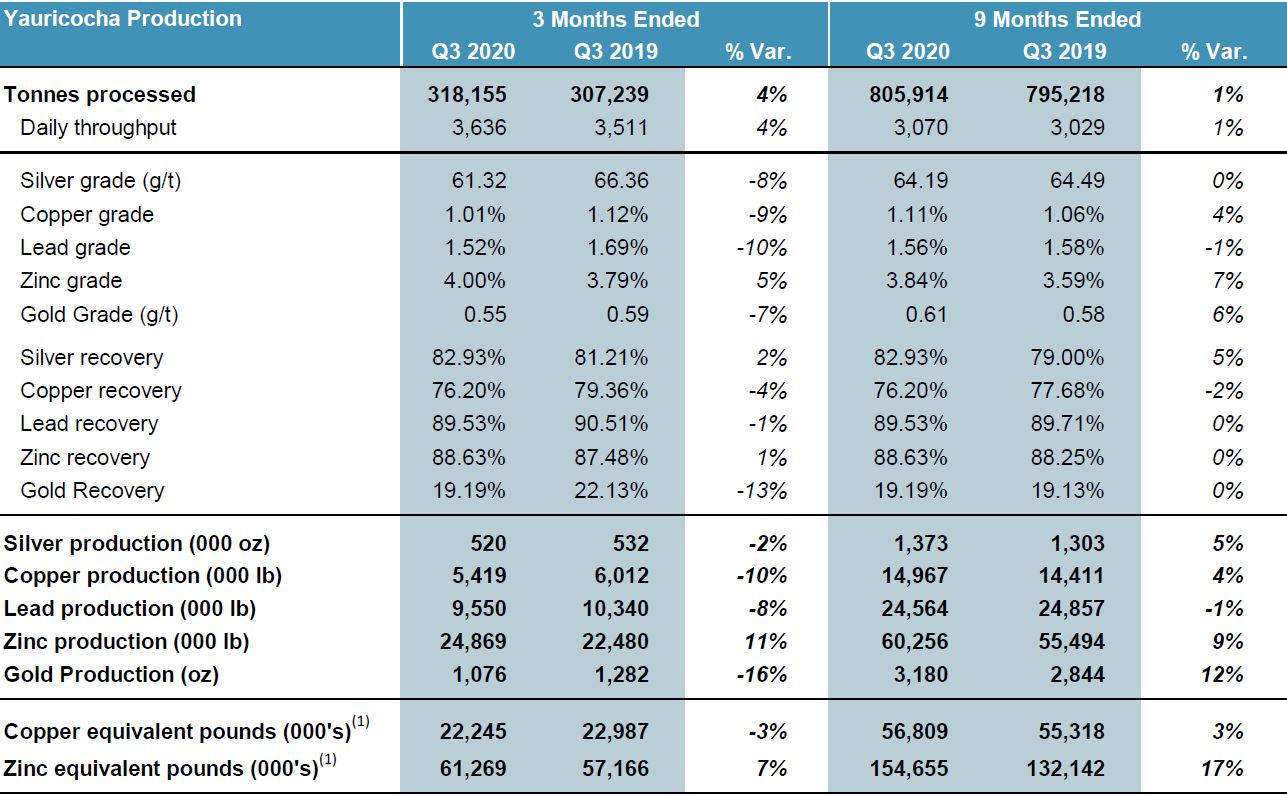

Yauricocha Mine, Peru

The Yauricocha Mine processed 318,155 tonnes during Q3 2020, representing a 4% increase compared to Q3 2019. Daily ore throughput averaged 3,636 tpd during the quarter, as the mine continued its efforts to recover some of its annual production lost due to the COVID-19 related shutdown in Peru.

Grades for all metals, except zinc, declined for the quarter due to lower proportion of ore coming from the high-grade cuerpos chicos, as compared to Q3 2019. Zinc grades were higher during Q3 2020 due to mining in the Cachi Cachi zone. Recoveries were negatively impacted by the lower head grades as well as to the slightly reduced residence capacity in the flotation, resulting from the higher throughput. With the commissioning of the new DR-180 cells and related automated controls of the flotation process, the Company anticipates improvement in recoveries when the new cells are commissioned.

A summary of production from the Yauricocha Mine for Q3 2020 is provided below:

(1) Silver equivalent ounces and copper and zinc equivalent pounds for Q3 2020 were calculated using the following realized prices: $24.89/oz Ag, $2.97/lb Cu, $1.08/lb Zn, $0.85/lb Pb, $1,916/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for Q3 2019 were calculated using the following realized prices: $17.28/oz Ag, $2.63/lb Cu, $1.06/lb Zn, $0.94/lb Pb, $1,481/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for 9M 2020 were calculated using the following realized prices: $19.35/oz Ag, $2.63/lb Cu, $0.97/lb Zn, $0.80/lb Pb, $1,742/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for 9M 2019 were calculated using the following realized prices: $15.91/oz Ag, $2.74/lb Cu, $/1.16lb Zn, $0.91/lb Pb, $1,370/oz Au.

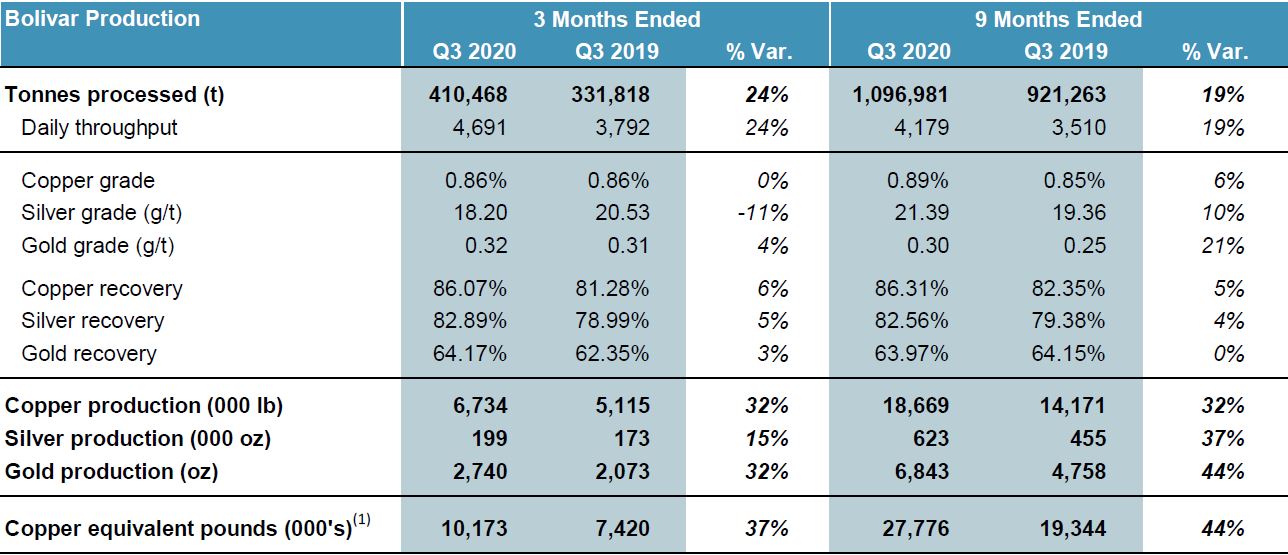

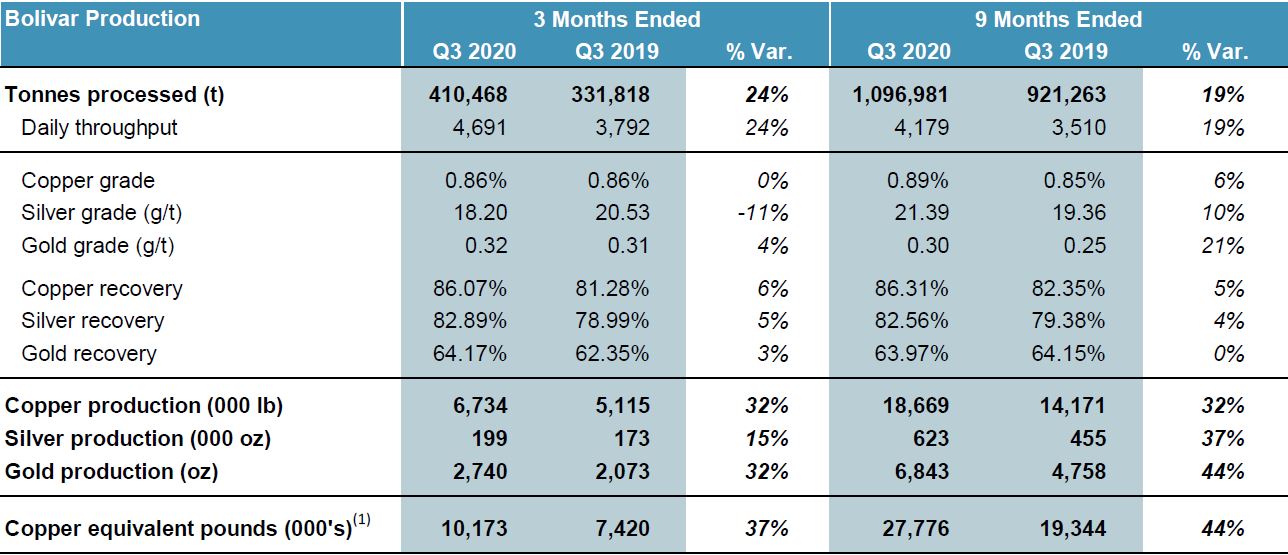

Bolivar Mine, Mexico

The Bolivar Mine processed a quarterly record of 410,468 tonnes in Q3 2020, representing a 24% increase over Q3 2019. The average daily ore throughput realized during the quarter was approximately 4,691 tpd, and the Company remains on track to reach the targeted 5,000 tpd during Q4 2020. The 24% increase in throughput, higher gold head grades, and higher recoveries partially offset by lower silver grades resulted in a 37% increase in copper equivalent pounds produced during Q3 2020 compared to Q3 2019. In Q3 2020, copper production increased by 32% to 6,734,000 pounds, silver production increased 15% to 199,000 ounces, and gold production increased 32% to 2,740 ounces compared to Q3 2019.

Development and infrastructure improvements continue in the effort to achieve ore throughput at Bolivar of 5,000 TPD during Q4 2020. Increased throughput and the use of massive mining methods have increased dilution at the stopes, reducing head grade to the plant. Target mining areas will be the El Gallo Mine and Bolivar W. Infill drilling will continue on the Bolivar West and Gallo Inferior areas, while mine development will focus on the Gallo Inferior and Bolivar W zones, with priority towards deepening of the ramps. This work will allow the Company to increase the number of minable stopes available in order to increase ore throughput at the plant.

A summary of production for the Bolivar Mine for Q3 2020 is provided below:

(1) Silver equivalent ounces and copper and zinc equivalent pounds for Q3 2020 were calculated using the following realized prices: $24.89/oz Ag, $2.97/lb Cu, $1.08/lb Zn, $0.85/lb Pb, $1,916/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for Q3 2019 were calculated using the following realized prices: $17.28/oz Ag, $2.63/lb Cu, $1.06/lb Zn, $0.94/lb Pb, $1,481/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for 9M 2020 were calculated using the following realized prices: $19.35/oz Ag, $2.63/lb Cu, $0.97/lb Zn, $0.80/lb Pb, $1,742/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for 9M 2019 were calculated using the following realized prices: $15.91/oz Ag, $2.74/lb Cu, $/1.16lb Zn, $0.91/lb Pb, $1,370/oz Au.

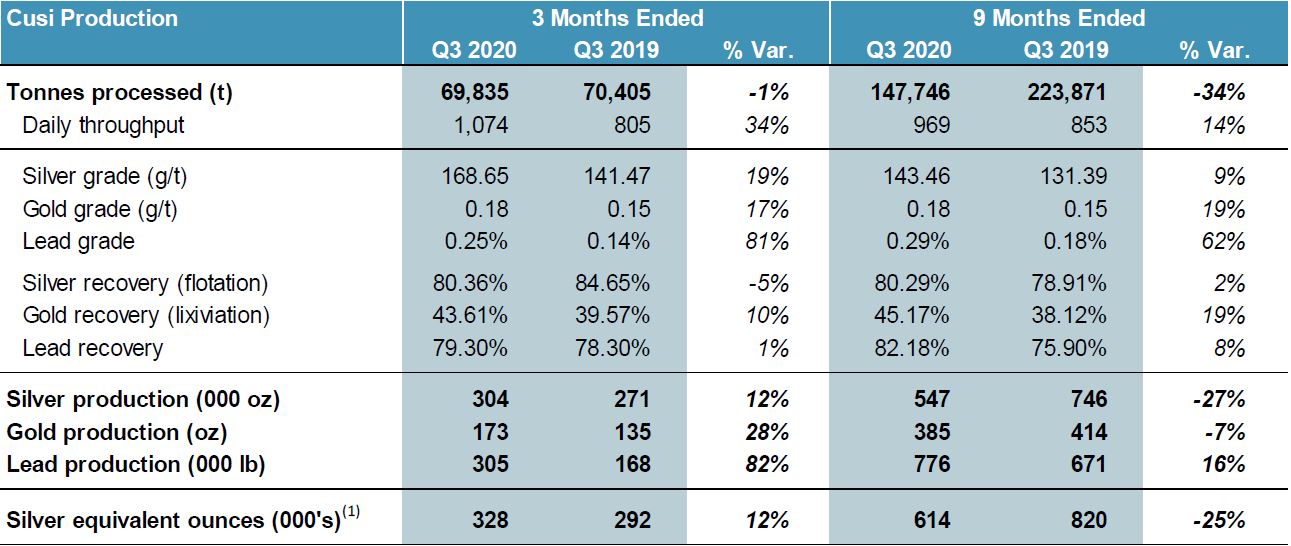

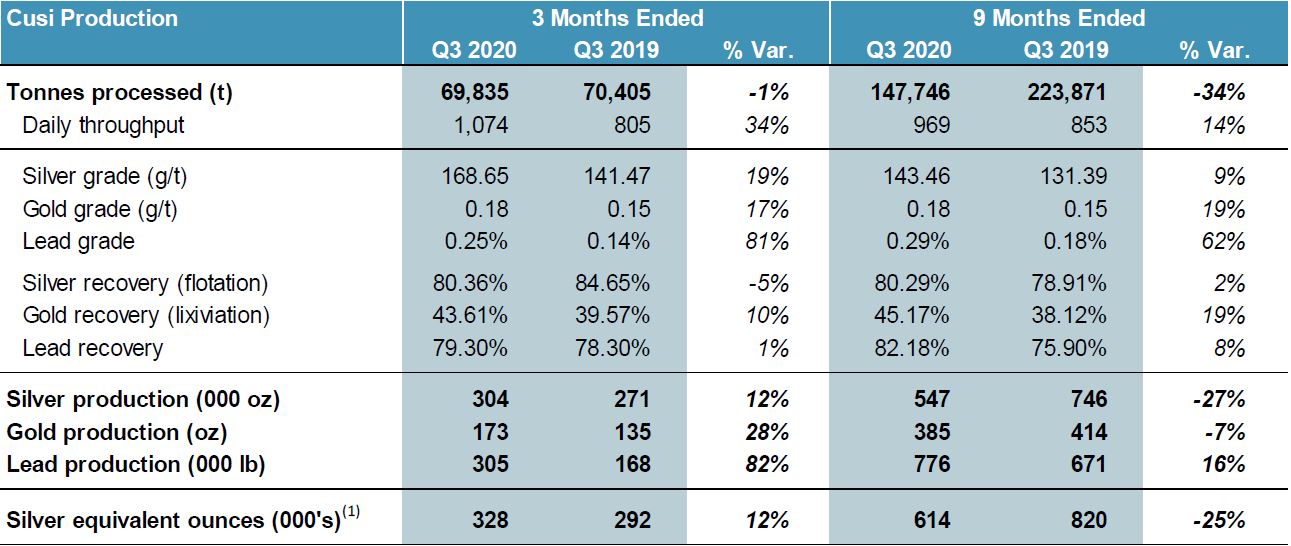

Cusi Mine, Mexico

The Cusi mine produced a record 304,000 ounces of silver during the quarter, despite being in care and maintenance for part of the quarter. The mine resumed operations on July 28, 2020 and operated for 65 days during the quarter. Ore throughput reached approximately 1,074 tpd during Q3 2020, which was 34% higher than throughput rate achieved in Q3 2019. The mine continues to work towards reaching full capacity during Q4 2020. Total quarterly throughput was 69,835 tonnes which was 1% below the Q3 2019 throughput due to lower number of operating days in Q3 2020. Higher silver and gold grades, and higher gold recoveries were partially offset by 5% lower silver recoveries during Q3 2020 resulting in a 12% increase in silver equivalent ounces produced, despite slightly lower throughput.

Mine development and production were also focused on the Northeast Southwest vein system, as exploration results indicated higher grades (please refer to press release dated June 18, 2020 – Sierra Metals confirms new high-grade silver zone at its Cusi Mine). Ore processed from the NE SW vein system negatively impacted recoveries as the presence of pyrite reduced the flotation capacity at the plant. The Company is conducting metallurgical research to be able to adapt the process to this condition.

Silver production of 304,000 ounces increased 12%, gold production of 173 ounces increased 28%, and lead production of 305,000 pounds increased 82% in Q3 2020 compared to Q3 2019.

A summary of production for the Cusi Mine for Q3 2020 is provided below:

(1) Silver equivalent ounces and copper and zinc equivalent pounds for Q3 2020 were calculated using the following realized prices: $24.89/oz Ag, $2.97/lb Cu, $1.08/lb Zn, $0.85/lb Pb, $1,916/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for Q3 2019 were calculated using the following realized prices: $17.28/oz Ag, $2.63/lb Cu, $1.06/lb Zn, $0.94/lb Pb, $1,481/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for 9M 2020 were calculated using the following realized prices: $19.35/oz Ag, $2.63/lb Cu, $0.97/lb Zn, $0.80/lb Pb, $1,742/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for 9M 2019 were calculated using the following realized prices: $15.91/oz Ag, $2.74/lb Cu, $/1.16lb Zn, $0.91/lb Pb, $1,370/oz Au.

Expansion Studies

The Company is undertaking Expansion studies to determine the best growth options for its operations in Mexico and Peru.

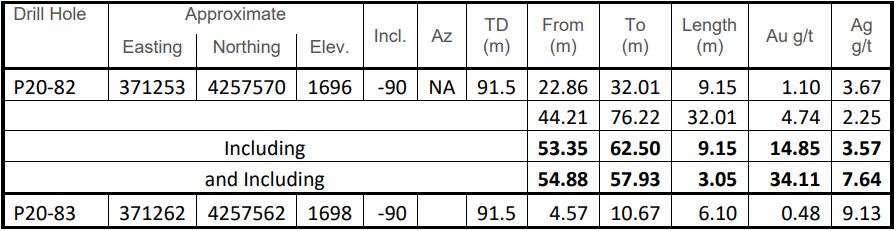

Quality Control

All technical data contained in this news release has been reviewed and approved by Americo Zuzunaga, FAusIMM CP (Mining Engineer) and Vice President of Corporate Planning is a Qualified Person and chartered professional qualifying as a Competent Person under the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources, and Ore Reserves.

Augusto Chung, FAusIMM CP (Metallurgist) and Vice President of Metallurgy and Projects to Sierra Metals is a Qualified Person and chartered professional qualifying as a Competent Person on metallurgical processes.

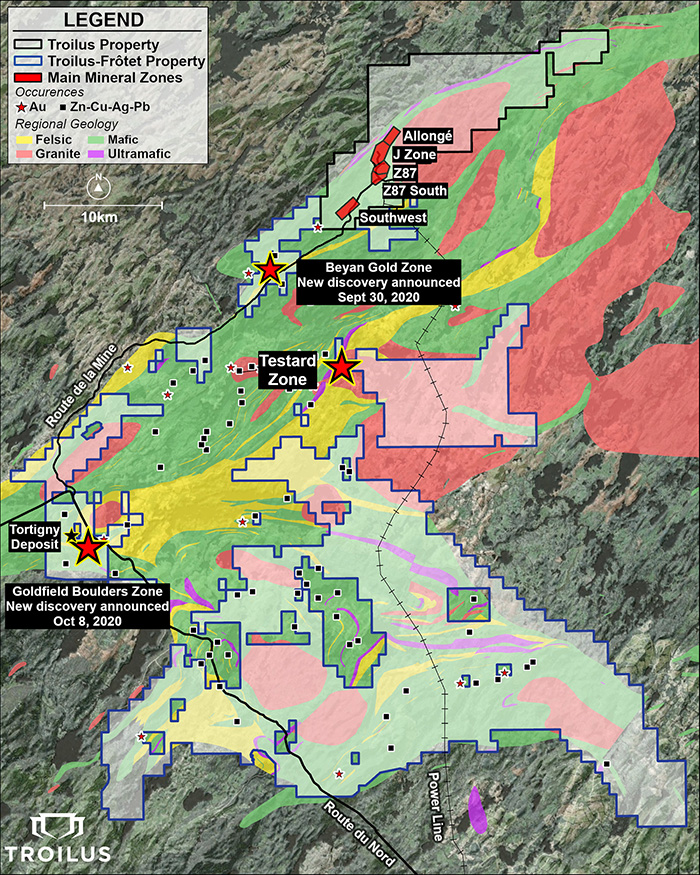

About Sierra Metals

Sierra Metals Inc. is a diversified Canadian mining company focused on the production and development of precious and base metals from its polymetallic Yauricocha Mine in Peru, and Bolivar and Cusi Mines in Mexico. The Company is focused on increasing production volume and growing mineral resources. Sierra Metals has recently had several new key discoveries and still has many more exciting brownfield exploration opportunities at all three Mines in Peru and Mexico that are within close proximity to the existing mines. Additionally, the Company also has large land packages at all three mines with several prospective regional targets providing longer-term exploration upside and mineral resource growth potential.

The Company’s Common Shares trade on the Bolsa de Valores de Lima and on the Toronto Stock Exchange under the symbol “SMT” and on the NYSE American Exchange under the symbol “SMTS”.

For further information regarding Sierra Metals, please visit www.sierrametals.com or contact:

Mike McAllister

Vice President, Investor Relations

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Email: info@sierrametals.com

Luis Marchese

CEO

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com | Twitter: sierrametals | Facebook: SierraMetalsInc | LinkedIn: Sierra Metals Inc

Forward-Looking Statements

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of Canadian and U.S. securities laws (collectively, “forward-looking information“). Forward-looking information includes, but is not limited to, statements with respect to the date of the 2020 Shareholders’ Meeting and the anticipated filing of the Compensation Disclosure. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential” or variations thereof, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking information.

Forward-looking information is subject to a variety of risks and uncertainties, which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the risks described under the heading “Risk Factors” in the Company’s annual information form dated March 30, 2020 for its fiscal year ended December 31, 2019 and other risks identified in the Company’s filings with Canadian securities regulators and the United States Securities and Exchange Commission, which filings are available atwww.sedar.com and www.sec.gov, respectively.

The risk factors referred to above are not an exhaustive list of the factors that may affect any of the Company’s forward-looking information. Forward-looking information includes statements about the future and is inherently uncertain, and the Company’s actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking information due to a variety of risks, uncertainties and other factors. The Company’s statements containing forward-looking information are based on the beliefs, expectations and opinions of management on the date the statements are made, and the Company does not assume any obligation to update such forward-looking information if circumstances or management’s beliefs, expectations or opinions should change, other than as required by applicable law. For the reasons set forth above, one should not place undue reliance on forward-looking information.

Source: Sierra Metals Inc.

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to, and perhaps get your questions answered, see which virtual investor meetings intrigue you

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to, and perhaps get your questions answered, see which virtual investor meetings intrigue you