Chakana Reports 226 Metres Of 0.34 G/T Gold, 0.36% Copper, And 16.9 G/T Silver (1.11 G/T Au-Eq) From 3 Metres At Paloma East – Soledad Project, Peru

Including 15 Metres of 2.26 g/t Gold and 16.6 g/t Silver (2.48 Au-eq) from 21 Metres

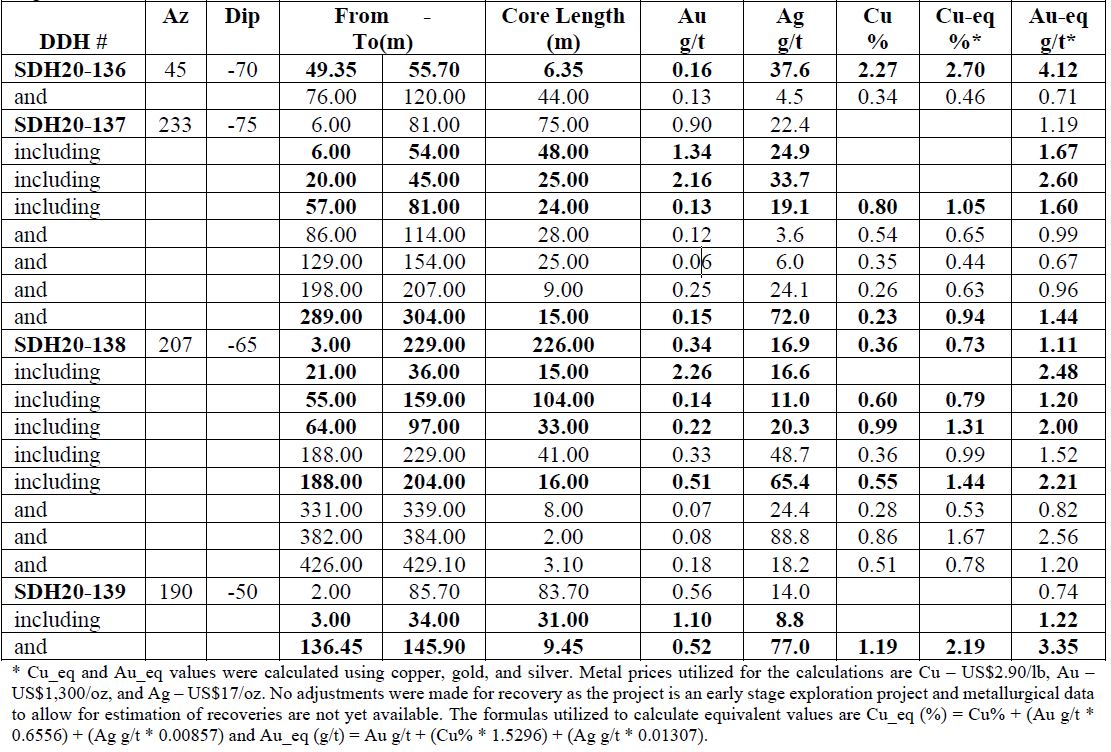

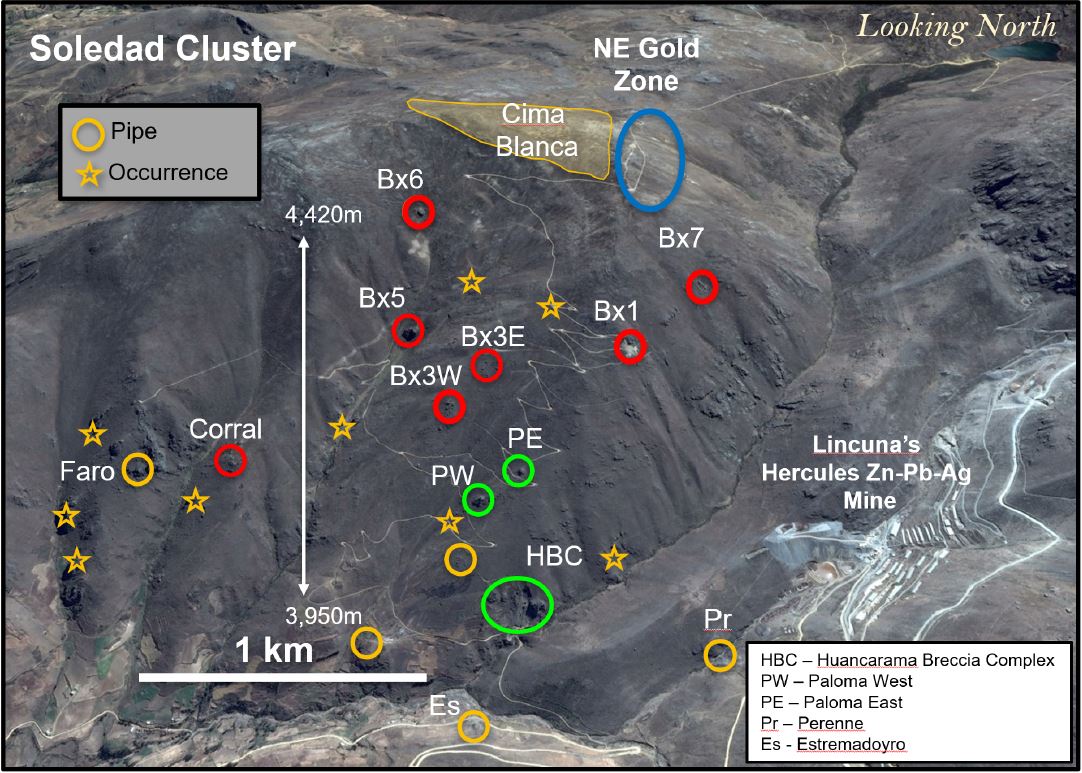

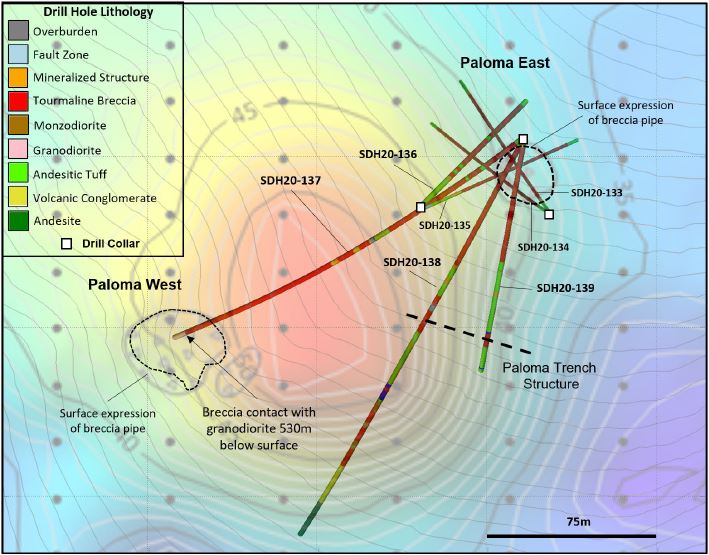

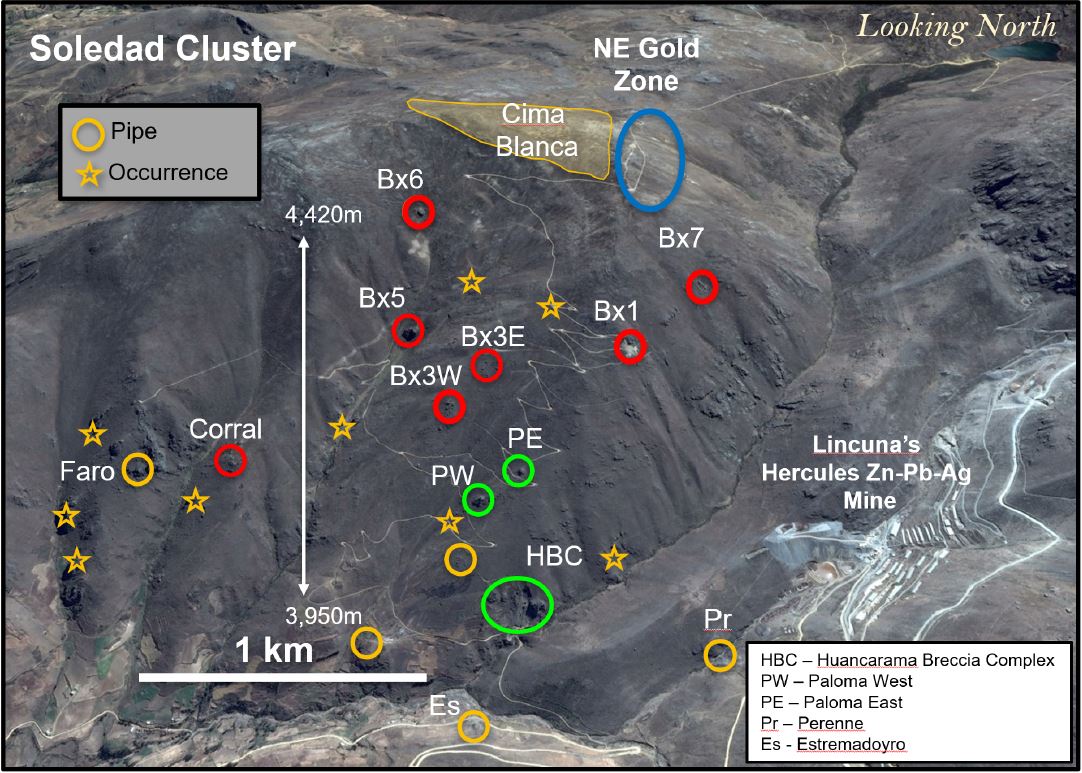

Vancouver, B.C., October 26, 2020 – Chakana Copper Corp. (TSX-V: PERU; OTCQB: CHKKF; FRA: 1ZX) (the “Company” or “Chakana”), is pleased to provide drill results from four additional holes completed at the Paloma East target at the expanded Soledad Project in Ancash, Peru. These results are part of the Phase 3 drill program, a fully funded 15,000 metre drill program that started August 15, 2020. Phase 3 is testing a tight cluster of high-grade, goldenriched tourmaline breccia pipe targets within the high-priority Paloma area and will then continue onto the Huancarama breccia complex (Fig. 1). Drilling is currently underway at Paloma West where eleven holes have been completed thus far.

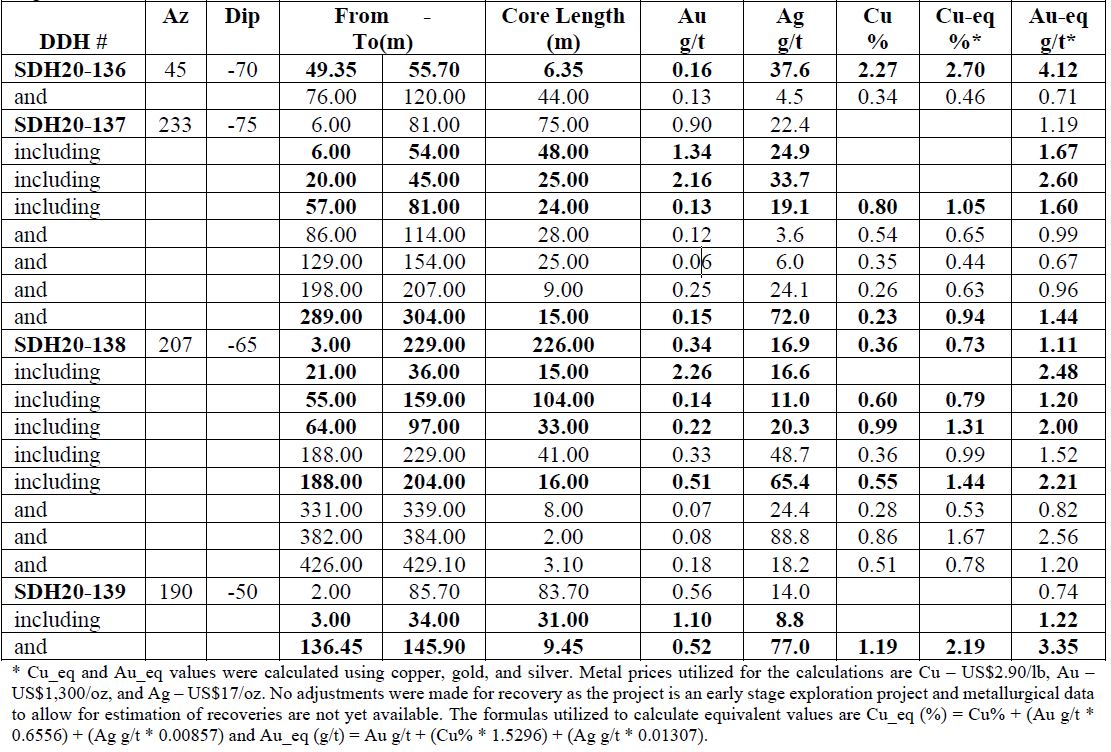

Significant mineralized intervals from these four holes at Paloma East include:

Significant intervals of mineralization were encountered in all four holes.

- Elevated gold occurs in the top of holes SDH20-137, SDH20-138, and SDH20-139 with intercepts of 51.0 metres with 1.27 g/t gold and 23.9 g/t silver starting from 6.0 metres depth; 15.0 metres with 2.26 g/t gold and 16.6 g/t silver beginning at 21.0 metres depth; and 31.0 metres with 1.10 g/t gold and 8.8 g/t silver from 3.0 metres depth, respectively.

- In SDH20-138 – a long interval of moderate grade mineralization was intersected with 226.0 metres with 0.34 g/t gold, 0.36 % copper and 16.9 g/t silver (1.11 g/t gold equivalent) from 3.0 metres.

- Higher grade copper intercepts occur in each hole with 6.35 metres of 2.27% copper in SDH20-136 from 49.35 metres; 24.00 metres with 0.80% copper in SDH20-137 from 57.00 metres; 33.00 metres of 0.99% copper in SDH20-138 from 64.00 metres; and 9.45 metres of 1.19% copper in SDH20-139 from 136.45 metres.

Examples of drill core from these holes are shown in Figures 5 and 6.

David Kelley, President and CEO commented, “these four scout drill holes provide additional support for an extensive mineralized breccia system at Paloma. The long runs of mineralized breccia starting near surface and extending to approximately 200 metres depth is encouraging, particularly with indications of high-grade zones within the breccia. The shape of the breccia expands at depth, similar to what we have seen in several other breccia pipes.”

Phase 3 Drill Program Update – Paloma Target Area

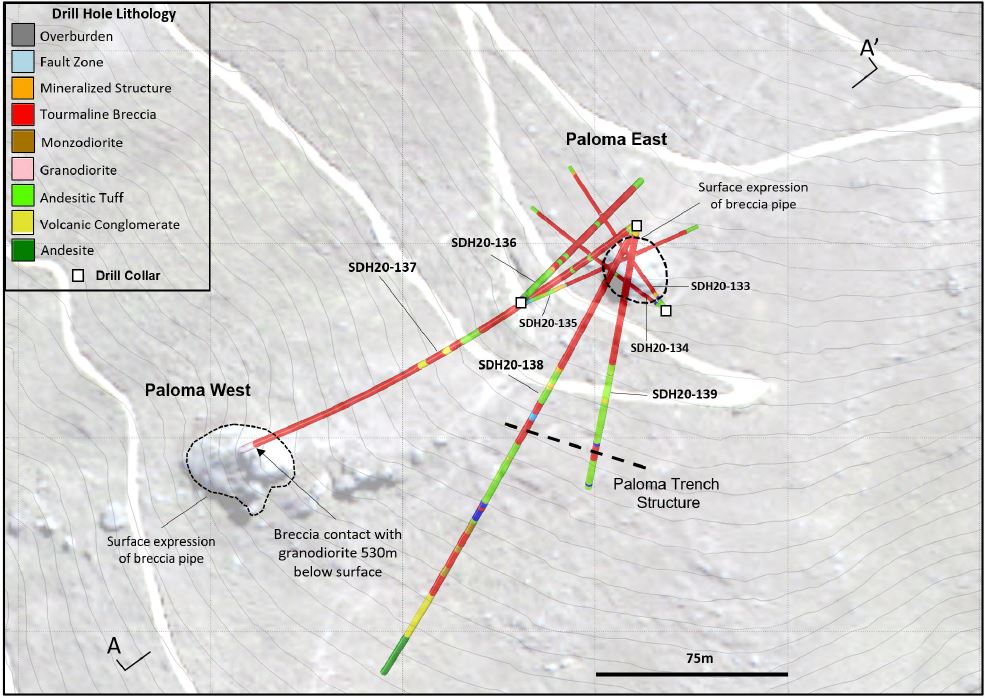

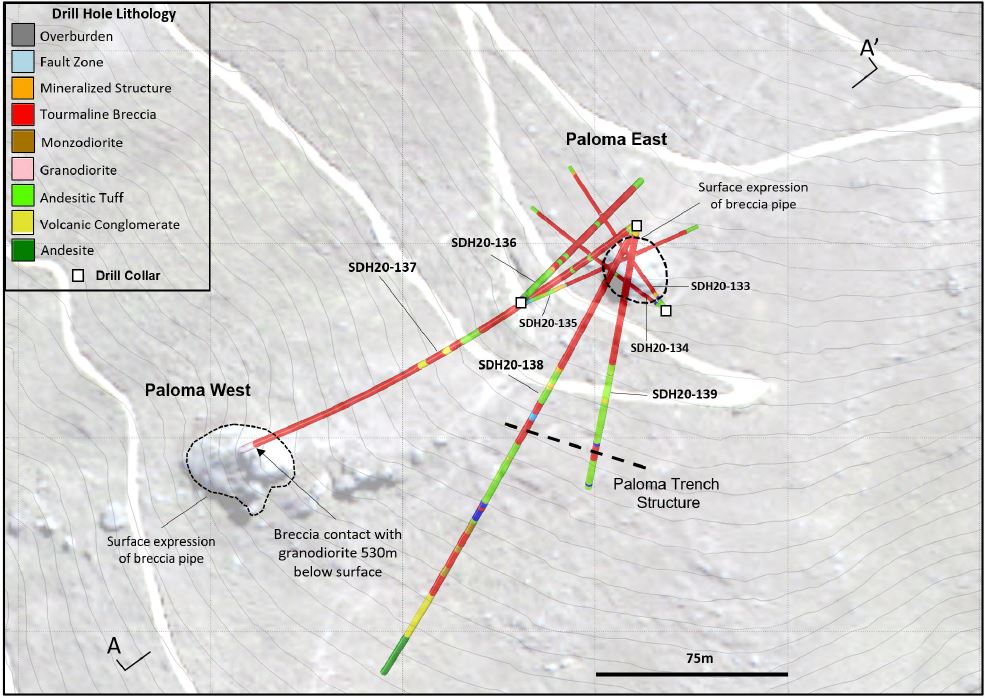

The Paloma target area consists of two mapped outcropping breccia pipes, Paloma East and Paloma West (Fig. 2) and at least one breccia dike. Previous surface rock sampling confirmed strong anomalous gold concentrations in both the targeted breccia pipes as well as within several scattered small exposures of breccia and vein-like structures in the Paloma area. The Paloma East target is interpreted as the very top of a breccia pipe with a surface footprint of 25 metres in diameter. All seven holes completed at the Paloma East target (totaling 2,038 metres) have encountered mineralized tourmaline breccia (see news release dated September 17, 2020 for the first three holes).

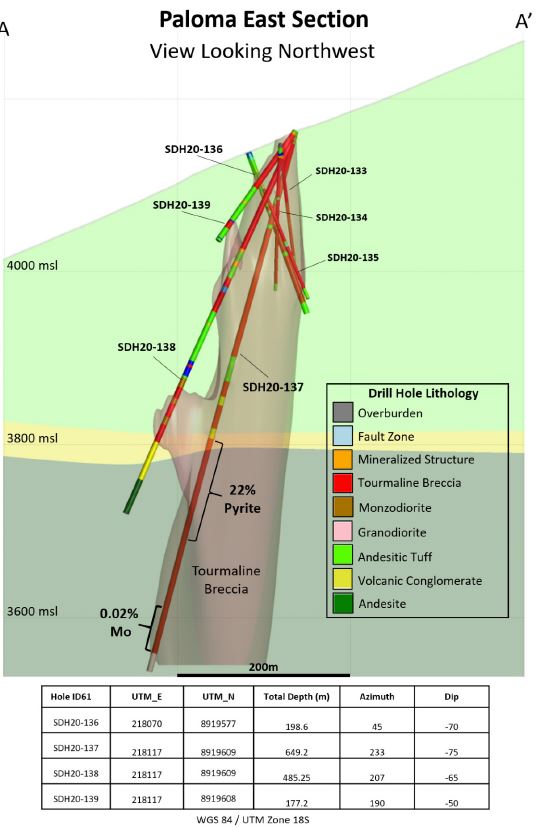

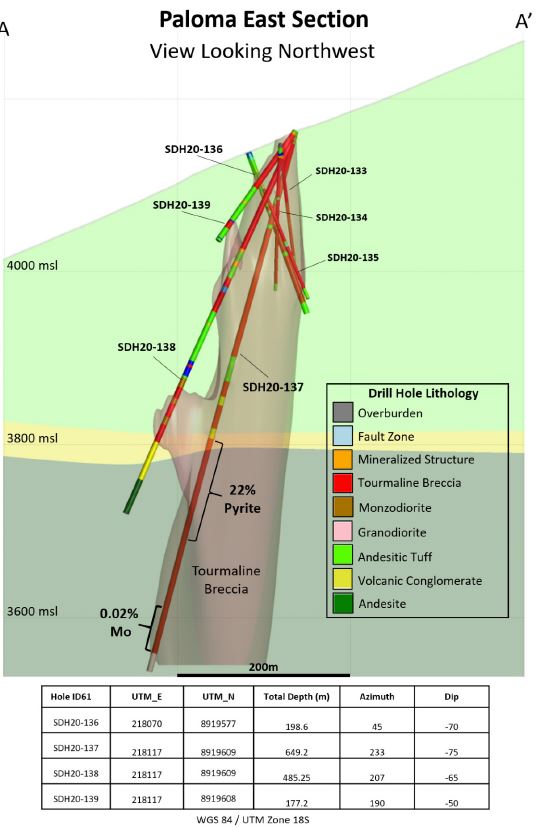

Based on modeling, the breccia pipe increases from a diameter of 25 metres at surface to approximately 90 metres by 65 metres at a level 160 metres below surface where there is sufficient drill density to assess the geometry (Fig. 3). The main zone of gold-copper-silver mineralization starts at surface and extends to approximately 200 metres depth and is open in several directions. South of the main breccia pipe, two drill holes intersected a related mineralized breccia dike that is below and coincident with the PT Structure (Paloma Trench, Fig. 2), defining a vertical feature with a westnorthwest strike. At surface, nine rock chip breccia samples collected in the trench average 1.96 g/t gold, and 16.3 g/t silver. Directly beneath the trench at 72 metres depth, hole SDH20-139 intersected 9.45 metres with 0.52 g/t gold, 1.19% copper, and 77.0 g/t silver. These two zones correlate with the intercept in SDH20-138, 90 metres to the westnorthwest, of 16.00 metres 0.51 g/t gold, 0.55% copper, and 65.4 g/t silver.

As reported on September 17, 2020, hole SDG20-137, drilled to the southwest from Paloma East toward Paloma West, intersected tourmaline breccia from 14.75 metres to 627 metres depth, excluding a few internal intervals of wallrock interpreted to be large blocks within the breccia. This hole has several mineralized intervals down to 304 metres. Below this point the breccia contains high concentrations of pyrite, calculated to average 22% pyrite from 380 to 498 metres (Fig. 5d). This increase in pyrite occurs within and below the unconformable contact with the volcanic conglomerate and into the lower andesite unit (Fig. 3). Pyrite-rich breccia within the lower andesite seen in Bx 5 and Bx 6 hosts high grade copper zones where late copper fluids have replaced the pyrite (see news releases dated April 2, 2019 and September 10, 2019). This style of replacement mineralization is also noted elsewhere at Paloma East reported here (Fig. 5b, 5f, 5h). The last 53 metres of breccia in this hole, from 574.0-627.0m, has elevated molybdenum, reaching 1,430 ppm and averaging 204 ppm (0.02% Mo) over this interval (Fig. 3). This is interpreted to be related to proximity to an underlying intrusion. The significance of hole SDH20-137 is a significantly expanded breccia system, high concentrations of pyrite where copper replacement may occur, association with a large late-time TDEM anomaly (see below), and evidence of proximity to an underlying intrusion.

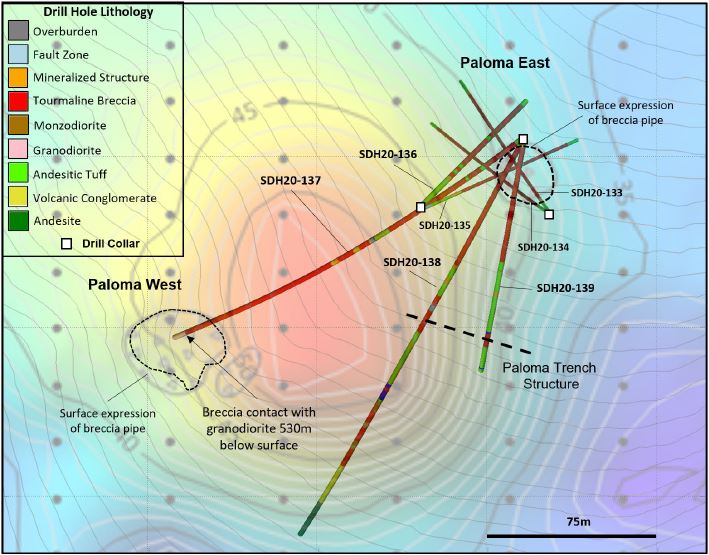

Chakana completed a program of time-domain electromagnetic (TDEM) surveys during 2018 based upon an orientation survey from late 2017. This program involved 37 ground loops mostly situated over known pipes. Readings were taken within the loop, a design intended to provide an optimal configuration to identify conductive bodies with “flat” upper surfaces that were 30 to 60 metres in diameter. This work identified several high priority anomalies and many lesscertain features. In the Paloma area both shallow and deep anomalies were detected, one of which was modelled to occur at the depth and position of the pyrite body beginning at 308 metres (Fig. 4). The anomaly extends beyond the limits of the survey grid and the Paloma area, representing a potential target for future exploration.

Kelley added “The deeper mineralization represented by strong pyrite concentrations expands the footprint of the breccia that is open at depth. Pyrite is commonly zoned outward and away from copper mineralization, which forms in the direction of the heat source. The increase in molybdenum in the last 53 metres of breccia supports this zonation towards higher temperatures. We also know from deeper drilling on Bx 1, Bx 5, and Bx 6, that the pyrite zones can be replaced by chalcopyrite, resulting in very high grades. We see this same replacement process within the shallow Paloma East mineralization and the fluids that cause the high-grade copper emanate from depth, increasing the potential for copper replacement within the pyrite zone. We are excited about the potential of this very large breccia system and look forward to seeing continuing results from the Paloma West drilling.”

About Chakana Copper

Chakana Copper Corp is a Canadian-based minerals exploration company that is currently advancing the high-grade gold-copper-silver Soledad Project located in the Ancash region of Peru, a highly favorable mining jurisdiction with supportive communities. The Soledad Project consists of high-grade gold-copper-silver mineralization hosted in tourmaline breccia pipes. A total of 31,641 metres of drilling has been completed to-date, testing eight (8) of twentythree (23) confirmed breccia pipes with more than 92 total targets. Chakana’s investors are uniquely positioned as the Soledad Project provides exposure to several metals including copper, gold, and silver. For more information on the Soledad project, please visit the website at www.chakanacopper.com.

Sampling and Analytical Procedures

Chakana follows rigorous sampling and analytical protocols that meet or exceed industry standards. Core samples are stored in a secured area until transport in batches to the ALS facility in Callao, Lima, Peru. Sample batches include certified reference materials, blank, and duplicate samples that are then processed under the control of ALS. All samples are analyzed using the ME-MS41 (ICP technique that provides a comprehensive multi-element overview of the rock geochemistry), while gold is analyzed by AA24 and GRA22 when values exceed 10 g/t by AA24. Over limit silver, copper, lead and zinc are analyzed using the OG-46 procedure. Soil samples are analyzed by 4-acid (ME-MS61) and for gold by Fire Assay on a 30g sample (Au-ICP21).

Results of previous drilling and additional information concerning the Project, including a technical report prepared in accordance with National Instrument 43-101, are made available on Chakana’s SEDAR profile at www.sedar.com.

Qualified Person

David Kelley, an officer and a director of Chakana, and a Qualified Person as defined by NI 43-101, reviewed and approved the technical information in this news release.

ON BEHALF OF THE BOARD

(signed) “David Kelley”

David Kelley

President and CEO

For further information contact:

Joanne Jobin, Investor Relations Officer

Phone: 647 964 0292

Email: jjobin@chakanacopper.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statement Advisory: This release may contain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Chakana to be materially different from any future results, performance, or achievements expressed or implied by the forward looking statements. Forward looking statements or information relates to, among other things, the interpretation of the nature of the mineralization at the Soledad copper-gold-silver project (the “Project”), the potential to expand the mineralization, and to develop and grow a resource within the Project, the planning for further exploration work, the ability to de-risk the potential exploration targets, and our belief in the potential for mineralization within unexplored parts of the Project. These forward-looking statements are based on management’s current expectations and beliefs but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward- looking statements or information. The Company disclaims any obligation to update, or to publicly announce, any such statements, events or developments except as required by law.

Figure 1 – View looking north showing breccia pipes and occurrences within the northern Soledad cluster. Pipes that have been drilled in previous campaigns are shown in red. Targets shown in green are the focus on this 15,000m drill campaign. Other pipes and occurrences remain to be tested by drilling. Additional breccia pipes occur on the south half of the property and are not shown here.

Figure 2 – Map showing location of outcropping Paloma East and Paloma West breccia pipes and drill hole lithology in holes completed to date. Red represents tourmaline breccia. Note: shape of breccia not shown in plan view due to the need for additional drilling. Location of section line for Figure 3 indicated.

Figure 3 – Section looking northwest showing the modeled breccia pipe for Paloma East. Light red 3D shape is based on Leapfrog model of breccia from all holes drilled to date.

Figure 4 – Map showing 2-D late-time conductivity response from time-domain electromagnetics survey at Paloma (Channel 15 z component, contour units in ohm-m).

Figure 5 – Examples of mineralized core from drill holes reported in this release showing different styles of mineralization found in Paloma East: A) SDH20-136 – mosaic breccia; the interval 49.35-55.70m assays 0.16 g/t Au, 2.27% Cu, and 37.6 g/t Ag; B) SDH20-137 – tourmaline mosaic breccia with pyrite matrix; C) SDH20-138 – oxidized shingle breccia; the interval 21.00-30.00m assays 2.50 g/t Au and 18.0 g/t Ag; D) SDH20-138 – shingle and mosaic breccia; the interval 147.0-153.0m assays 0.15 g/t Au, 1.15% Cu, and 17.0 g/t Ag; E) SDH20-138 – mosaic breccia; the interval 212.0-217.0m assays 0.33 g/t Au, 0.64% Cu, and 139.5 g/t Ag; F) SDH20-139 – mosaic breccia; the interval 140.0-145.9m assays 0.53 g/t Au, 1.28% Cu, and 107.3 g/t Ag.

Figure 6 – Detailed core photos from Paloma East: A) SDH20-136 (75.9m) chaotic shingle breccia with chalcopyrite filling vug; B) SDH20-136 (119.6m) silicified mosaic breccia with clast replaced by chalcopyrite; C) SDH20-137 (13.8m) sheeted veining in andesitic tuff wallrock adjacent to breccia; D) SDH20-137 (437.9m) pyrite-cemented tourmaline mosaic breccia; E) SDH20-137 (92.05m) chalcopyrite replacement in silicified mosaic breccia; F) SDH20-137 (149.8m) mosaic breccia with late chalcopyrite replacement; G) SDH20-137 (522.82m) botryoidal pyrite; H) SDH20-138 (150.6) mosaic breccia with late chalcopyrite replacement.

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you