Getting the Most out of Holding A Virtual Event!

“…how do you create a multi-day conference, which includes networking opportunities, educational sessions, attendee input, with data generated into a virtual event? Then after you do, how do you ensure attendee engagement throughout your event?”

Author: Peter Spoleti, President Vertex Markets

Event Technology will take your Virtual Event to the next level!

The value of face to face interaction will never be underestimated or totally fade away, but sometimes going virtual will be a necessary piece of your event program and your only option for some time to come.

In-person events may be on hiatus, but you can still think strategically about your event program and leverage event technology to make the most out of your virtual events.

Nevertheless, how do you create a multi-day conference, which includes networking opportunities, educational sessions, and attendee input, with data generated into a virtual event? Then after you do, how do you ensure attendee engagement throughout your even

Hosting a virtual event requires equal attention and care as an in-person event. In both cases, you must market your event, create an environment that promotes attendee engagement, create memorable times for attendees, then measure and demonstrate event success.

What is a Virtual Event?

If you’ve been doing business these last five months, it’s likely that you’ve attended a webinar online, participated in a video conference more than once, have taken your workout online competing against people around the world, you may have even attended a conference from your home office. These are all classified as virtual events.

Virtual events have been happening long before COVID; over 100,000 have attended online presentations (webinars) for 13 years. But the definition of “virtual events” has evolved quickly. For our purposes we’ve defined them as a collection of live and/or prerecorded presentations typically organized by topic. Virtual events are typically gated, requiring attendees to either pay or be granted access by providing personal information in lieu of payment.

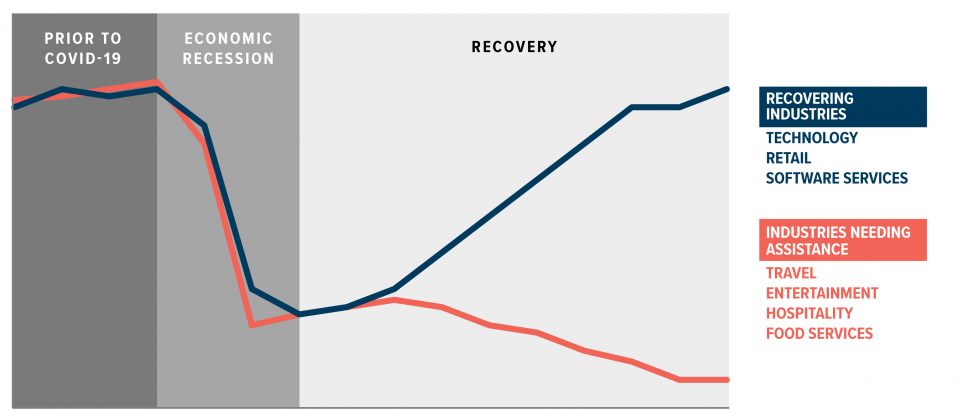

COVID accelerated the popularity of virtual events.

COVID accelerated the use of virtual events, they’re being used as businesses sought a professional alternative to stay connected with their professional communities, clients, and prospects

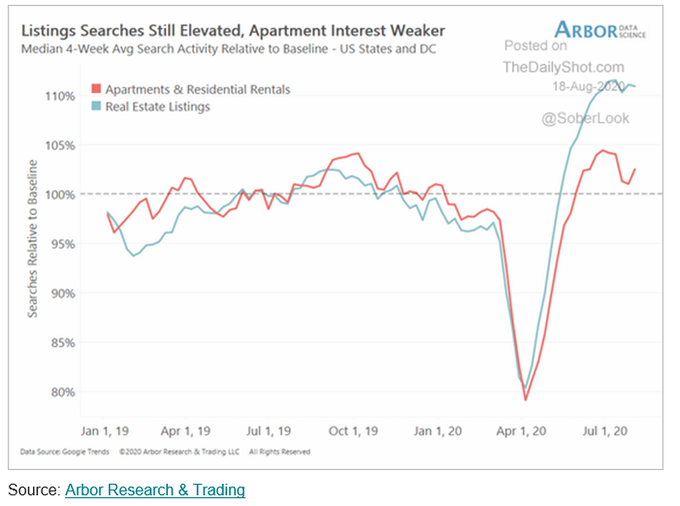

The use of virtual events is likely to remain high, as the uncertainty and desire for a return to in-person events remain in question. Marketers and attendees are reluctant to attend large gatherings, some surveys reporting nearly 70% asked said they won’t attend an in-person event through the first half of 2021.

Main Types of Virtual Events.

During COVID, virtual events have become a replacement for other types of events and will be the main thrust of your event program until things get back to normal, at that time, they can be added to your mix of events going forward. Below are some of the main types of virtual events.

- Webinars.

Presenting webinars virtually allow for attendees worldwide to join and listen to your content. Many are free but require attendees to register for the event and provide personal information to the company providing the webinar. They typically last somewhere between 45 – 90 minutes, many provide a Q&A session at the end, and a recording of the event sent to participants and/or used for additional marketing on company social platforms. They can be used for marketing company products or services, and internal or external training.

- Virtual Conferences.

Virtual conferences, similar to in-person conferences are designed around a live, intricate agenda, including keynote speakers, educational sessions, breakouts, networking, and more. Virtual conferences include multiple content-driven sessions and can include networking and community engagement tools, meant to enhance the conference experience.

There are many communication platforms available for use creating virtual conferences; these include video & phone conferencing, and the lesser know 3D virtual world conferences.

Most of us are familiar with the more traditional video & phone conferencing. So, perhaps a brief description of the lesser-known, 3D Virtual World is warranted. A 3D virtual world is a collaborative environment in which users interact as avatars, digital representations of themselves, in a simulated digital world. Think of it as your favorite conference meets Call of Duty, but instead of being immersed in a battlefield protecting the free world, you’re walking through a virtual campus, possibly stopping to have a conversation to other conference attendees in real-time, on your way to be seated in a virtual lecture hall with a 1000 other attendees to listen to a live lecture on a relevant topic of your interest.

- Internal Hybrid Events.

In this category are sales kick-offs, company-wide work-sessions, training, department meetings, or any other company-wide event. Today’s “social distancing” etiquette with employers having to adjust a large percentage of their employees to work remotely, or with more businesses finding their best employees living elsewhere, and even corporations with their employees spread out through nationwide offices; internal hybrid events are used to share a company-wide message to all of their employees

- External Hybrid Events.

As the name suggests, these are events held outside of your company. They can be used for industry or user conferences for marketing, branding, or educational tools. They require a greater level of planning and production quality. Best Practices suggest they should utilize a higher level of communication platform that is designed to handle the multiple components often necessary with this type of event. The requirements of processing a large number of attendees, large amounts of educational content presented, and the higher production levels to ensure a greater attendee experience.

Why Host a Virtual Event?

You hold a virtual event for the same reasons you hold an in-person event to communicate your company’s message, generate leads, increase sales, drive adoption, and build company branding.

Due to COVID, virtual events are the only way to host a large event. But there are benefits of a virtual event, and when done right, all your event goals can still meet.

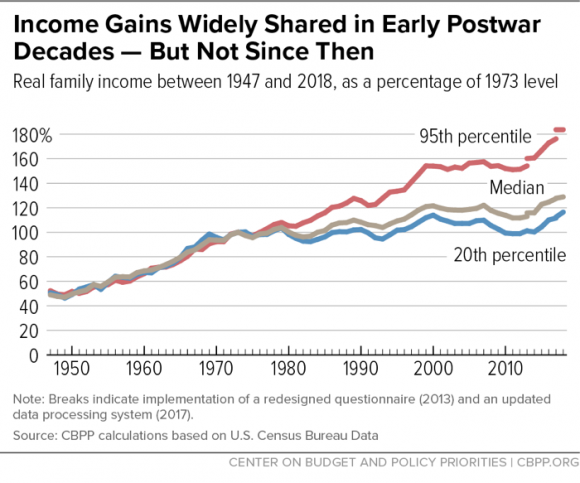

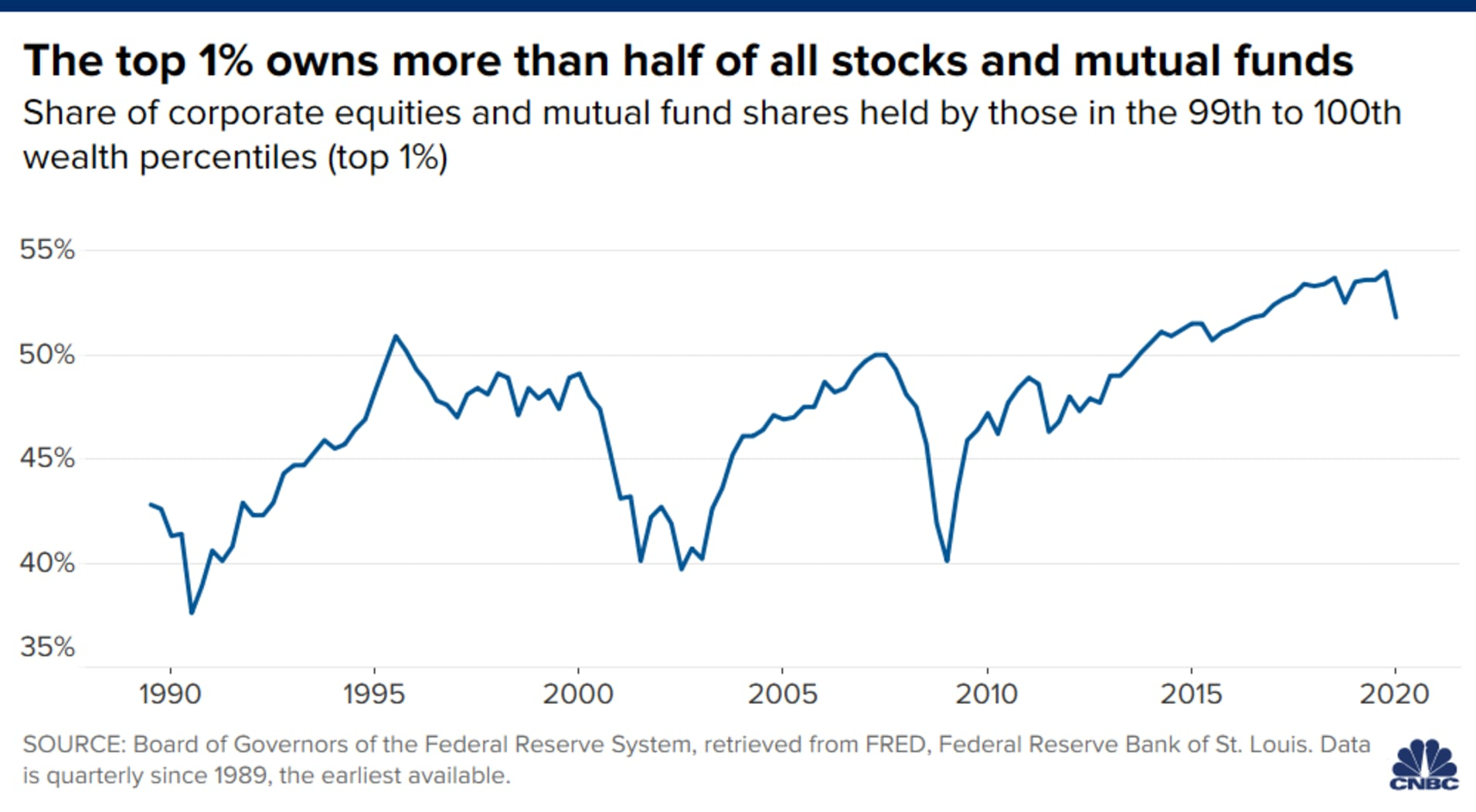

- Budget: The current economic uncertainty has many companies watching their budget and cautious about spending. Virtual events are budget-friendly to both the event planning company as well as the attendees.

- Accessibility:

Virtual events allow you to attract attendees worldwide, broadening the potential number of attendees. They are usually better attended than in-person events.

Promoting Networking at a Virtual Event!

Creating rewarding and engaging networking opportunities that meet the expectations of all participants of a virtual event is a challenging task to overcome.

That isn’t justification for event producers of virtual events, whether they be trade shows or conferences, from doing appropriate research and implementing the necessary tools to make networking at their event successful for all of its participants.

Virtual or in-person, there are many categories of networking at any event.

- Attendee to attendee

- Exhibitor to attendee

- Speaker to attendee

- Exhibitor to exhibitor

- Press to exhibitor

- Show Producers to Everyone

- Etc.

For exhibitors, networking usually is defined as filling the sales funnel, meeting potential prospects, centers of influences, business partners, etc. Exhibitors use engagement, prospecting, and networking, interchangeably to describe these activities. They will use all their event activities as “networking” with the goal of introducing exhibitors with potential buyers.

Meanwhile, attendees define “networking” vastly different, depending on the type of event they are attending. If they are attending a trade show, their motivation may be primarily commercial (looking for vendors and new product information to purchase necessary products or services to benefit their business), while industry education and networking are lesser priorities.

At conferences dominated by educational sessions and keynote addresses, attendees may define networking as meeting like-minded professionals during activities, in-between sessions, and at meals. They may also be interested in asking questions of presenters during and after sessions or arrange a one-on-one meeting with a speaker or other attendee.

Considering the diversities of networking expectations from these various groups participating in your virtual event, it’s not surprising online event producers struggle to fulfill their networking expectations. Reports have found that fifty percent of producers surveyed said their top frustration with virtual events was providing the same level of engagement provided by an in-person event.

The Exhibitor-Attendee connection.

Just like any other lead generation method, when trying to connect with virtual event attendees, it’s frequently centered on an exchange of value. While seeking attendee’s attention and an agreement to share their contact and personal information, exhibitors offer something of value to them.

Relevant educational content is the most often used method to open communication with prospects. It’s the responsibility of the exhibitor to offer effectively promoted sessions as drivers of attendance to communicate that message.

As soon as an attendee accesses your content or presentation, the ball is in your court. The opportunities to engage are yours to initiate. Offer real-time chat and Q&A; the opportunity to book a demo, ask questions, and polling are just a few of the in-screen presentation connections that can be accomplished. Inquire with the show promoter to make sure these tools are available at their event.

While you have the attendee’s, attention take that opportunity to promote supplemental experiences, such as small-group chats, one-on-one meetings with speakers, if possible, in your area, invite them to visit your virtual booth.

Let’s keep in mind its not a live event! The benefits of attending an in-person event are, they are conducive to participation in the event, physically being with others with similar interests, and engaging in a common experience. When an event is properly produced, it is a gratifying experience for all participants.

Unfortunately, the in-person benefits do not exist in a virtual event. Take notice of those disadvantages and implement tools to overcome them.

Gamification and offering incentives (a version of gamification) is a way to encourage attendee engagement and promote event attention. Goodie packages, gift cards, giveaways can all be done virtually. Registration and event data provided can be used post-event to invite attendees to a supplemental activity or to continue the conversation. This data, which is usually more extensive then what can be received from in-person events and is always a key to help ensure post-event success.

Invest in technology that promotes making connections.

Producer and exhibitors need to understand the difficulties associated with fostering engagement in a virtual event. Be mindful that opportunities to network are possible in a virtual event, but just like everything else, it needs to be assisted by technology to achieve the desired goals.

If your virtual event is truly live, make sure that during group chat, Q&A, and virtual booths are staffed during show hours. Employees must be present and able to respond to requests from all attendees who are interested in engaging at that time.

Additionally, make sure your virtual booth is set up to gather prospect information; some platforms offer reporting and analytics that track every move an attendee makes. You know how they came, where they went, what they did, with whom they chatted, what they tweeted, which videos they watched, etc. Take advantage of that data to drive lead generation.

On the lead nurturing front, you can even run analytics on content located in the event. By knowing how many attendees viewed and/or downloaded a piece of collateral, you can tailor your future content and conversations around the content that your qualified leads found valuable.

Networking in a virtual event is tricky, but there are networking technology producers can implement to drive matchmaking between like-minded individuals before and after the sessions and off the virtual auditoriums & showroom floor. Technology tools are available from A.I. networking companies such as Vertex Markets, implementing a community-based networking A.I. platform, used to aid your pre-event marketing, event engagement, and post-event marketing & engagement. Vertex’s platform is specifically designed to match and introduce event attendees with shared interests and needs, promoting event engagement and interaction, before, during, and after your event.

They provide an event customized networking algorithm that connects all participants who share similar interests, mutual opportunities, and industry experiences. Then help to facilitate introductions, valuable follow up opportunities, allowing participants to find and continue to build relationships with connections made at the event.

Even after the event, participants can continue taking advantage of the A.I. community platform long after the event has ended, using the platform as a new lead generation tool, promote continued conversations with their new event relationships, knowledge sharing with likeminded members, and most valuable the A.I. platform continues to operate as an ongoing source for new networking connection and brand building. The platforms A.I. matchmaking engine continues generating new “one to one” relevant & valuable connections for event participants long after the event has passed.

Regardless of how you connect, be mindful of attendees’ willingness to engage. Just because someone gave permission to be contacted, participated in a virtual session, attended a networking event, or visited a virtual booth doesn’t mean they’re a buyer. Similar to an in-person event or any new connection, all contacts need to be qualified before they are sold to.

Making connections at virtual events undoubtedly present challenges which producers, exhibitors and attendees need to overcome going forward. However, these challenges have solutions; they just need to be researched and implemented to ensure a better event experience for everyone involved.

From time to time, Channelchek will publish articles from experts on topics of interest to our readers.

Vertex Markets, Inc. provides the next-generation networking website which uses algorithms to help ensure effortless, top-notch 1-on-1 introductions.

The above article is courtesy of Peter Spoleti, President of Vertex Markets, Inc.

Vertex Markets Inc.

A.I. Powered B2B Networking Community Platform

If you missed any of Noble Capital Markets Virtual road Show Events, or C-Suite Series, you can watch them now here.

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you