COVID, Sex, and the Business Cycle

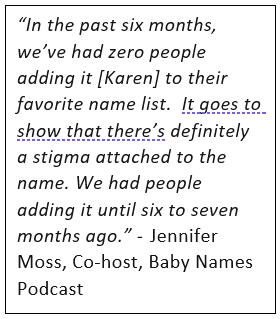

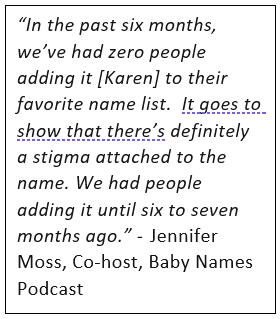

There will be far fewer newborns named Karen in 2021. Overall, in the U.S., there will be far fewer newborns period. This is not because young adults of childbearing age are meme-o-phobic like the Karen-avoiders. More simply, it seems humans just don’t breed well in captivity, or when their finances are challenged.

This runs completely counter to the prognosticators that only a couple of months ago had wryly told us that there would be a baby boom in the coming year. Do you remember reading the articles pushing the notion that sharing space, with little else to do, would lead to babies? At that time, my email inbox was full of “stocks to buy” to take advantage of the coming baby boom. This all made for very interesting conjecture, but it was not real world. To write this column, I went back and reread some of what was projected a few months ago. I focused on the advice — the stocks presented as outperformers next year because of the overabundance of babies. Like everything else in 2020, betting on the opposite of “conventional wisdom” has had the greatest payoff. Here is what’s actually happening to family size and what it means to investors.

Postponing Propagation

The Guttmacher Institute is a respected research organization committed to advancing sexual and reproductive health and rights in the United States. The researchers at Guttmacher surveyed 2,000 American women in late April and early May and discovered that 34% planned to delay pregnancy or reduce their expectations of the number of future children. The reduction was directly related to the coronavirus pandemic. This was twice the number of the 17% who said they now preferred more children or to increase household size sooner.

In June, the Brookings Institution, the think-tank research provider specializing in social science and economics,

released a study predicting the U.S. will have “a large, lasting baby bust.”

The Brookings researchers forecast that there will be 300,000 to 500,000 fewer children born in the U.S. in 2021 compared to if the pandemic had not occurred. This equates to a decrease of 10% from 2019. Based on their research, it is likely that the number of children never born is likely to be several times larger than Americans whose lives are ended by the novel coronavirus (current estimate is near 160,000). The impact of this population growth derailment will be long-lasting – Many of the curtailed births represent people who would have easily lived into the 22nd century.

This raises the question of whether postponing births will have an impact on total births for the decade. Evidence suggests that each time a child is postponed, the chances of that specific mother having a “catch-up” birth is reduced. According to Pew Research, “The expanding literature on the effects of unemployment on childbearing suggests that experiencing unemployment leads to different childbearing propensity for men and women.” They found that for men, being out of the labor force has a very negative impact on their propensity to father children. The results were a bit more contingent for women. Globally, their various studies have concluded: “Because a vast majority of women interrupt work after giving birth to a child and the maternity and parental leave allowances usually do not fully compensate for their lost wage, males’ ‘breadwinning capacity’ remains of paramount importance for couples’ childbearing decisions.” In July, the unemployment rate for men between 25-34 years-of-age was 11.7% up from 3.9% in January, for women of the same age group unemployment in July measured 11.1%, which was more than three times the January level of 3.5%. The higher unemployment rate among men suggests that the Guttmacher survey of women may actually understate the couples’ propensity to grow their family.

Repercussions

Recessions mean fewer children and fewer children lead to more recessions. One year can impact decades of business activity with this vicious circle. The spike in unemployment and a decline in GDP has already had an impact on reducing the number of expectant mothers (relative to 2019). Further, with guidelines prohibiting large groups from gathering, engaged couples (as many as 75%) are postponing their big wedding until next year. For most, this will push any plans for children farther down the road.

Surveys such as the National Survey of Family Growth show that the average American woman wants two children or possibly three. Depending on how long the economic pace remains challenging, the pandemic may leave that desire unfulfilled.

For the economy, the companies that are likely to take the first hit are those that had been touted earlier this year by newsletters telling us we could profit from the coming births. On May 22nd, I received one of these emails that listed baby clothes manufacturers, toymakers, formula, a manufacturer of birth center equipment, and a daycare company, as worthwhile investments. The second group most impacted are companies that make more durable goods (think washer/dryers, soccer mobiles, furniture, carpeting, etc.). Young adults will have a reduced need and reduced means to nest (fix up their homes). This will lower sales of all the related purchases they would have otherwise considered.

Down the road, a lower birthrate leads to fewer future workers. The Social Security system is at risk as it collects funds from today’s workers to make payments to today’s retirees. As of the last evaluation, the system becomes insolvent in 2034. A slower rate of births will compound their difficulties. Every two-tenths decline in the total fertility rate (that is, two fewer children per 10 women) requires an increase in the Social Security payroll tax of about 0.4 percentage points, according to the 2020 Annual Report of the Trustees of the Social Security Trust funds.

Outlook Past 2020

Business growth and wealth creation depend on consumption, productivity gains, and a low level of burdens on companies and income earners. Service industry employment now accounts for 71% of all nonfarm employment. Prior to what I’ll call the 2020 surprise(s), manufacturing in the U.S. began to increase. The percentage may still increase further, but any higher rate may be on a lower overall number of employed. This higher percentage may be the result of reduced reliance on Chinese manufacturing.

Baby boomers are now in or within ten years of retirement age. The increasing cost of maintaining a substantial elderly population falls on those still in the labor force. The labor force is shrinking, and the pandemic lead decrease in births will in 20 years place further strains on government programs like Social Security.

Over the next ten years, there will be the largest wealth transfer in history. Baby boomers who have dominated the focus of marketers on everything from music to investment products will begin to leave their legacies to their children, mostly millennials. This younger age group has already become the largest demographic block; they will soon become the greater consumers. How they allocate mom and dad’s savings remains to be seen. But the new wealth handed to a generation with fewer kids will provide a great deal of discretionary buying power and possibly stimulus which can provide for economic growth.

Americans have always been quick to adapt when money is at stake. One thing that the “lockdown” provided was a push for companies to adopt technology that makes being physically together less important. This impetus to move faster to the inevitable office-optional future will help clear the path advancement and world needing fewer workers. Think about it; the largest problem with the lower birthrate is there are fewer people to provide goods and services (GDP). If many jobs require less as a result of changes in work environments, then productivity increases are established (more done in the same amount of time), and efficiencies are created (more done with less). This will either provide more profitable companies (economic stimulation), or the ability to get more for your dollar, which provides for a higher standard of living.

The problem with the scenario presented above is that it looks forward several years. In the interim, there will, no doubt, be hardship. People will have to reinvent themselves; some won’t do it successfully, those that do will have to first take a step backward.

Take-Away

Back in the 1970s, scientists talked about the population explosion the way some discuss global warming today. It was going to mean a horrible challenge for civilization. Slower population growth has to occur at some point. As a presidential hopeful in 2012,, Newt Gingrich promised a permanent human colony on the Moon and a shuttle to Mars. Discussions of outgrowing the planet have a long history. Increased longevity has been a good thing, but it has its drawbacks. Resources are limited.

The economic system we rely on has depended on constant growth in our population to provide for funding to the many liabilities and obligations of our government. Repaying the national debt would naturally be more difficult with a smaller tax-base, and an increase in longevity further stresses many government programs. We live on a finite planet with finite resources. Continual growth is mathematically unsustainable. The pivot that we have made as a result of the pandemic to do the same or more with increased efficiency than having someone else prepare our meals, having to commute to an office, consulting a retail sales clerk at a department store, etc., has been a forced awakening to unnecessary waste. The drawbacks of a reduced birthrate, on a planet that is currently housing 7 billion people, may continue to steer us toward solutions to problems that we have not been addressing.

Workers who have computer and technology skills should continue to excel in the next stage. Businesses that adapt and adopt early will thrive. Stock market investors looking for outperformers will need to assess who the winners and losers will be based on who is moving quicker to adapt. Change always creates losers. Losers always help create larger winners. As investors, this is what we need to sort out.

The most reliable thing change always creates is opportunity. Pay attention, watch what is going on, get analyst insight as to the inner workings of growth industries you are considering. Find the companies that can do more with less.

Paul Hoffman

Managing Editor

Suggested Reading:

Why Robinhood Traders May Never Find the Next Apple

Warren Buffett Vs. Elon Musk, Who’s Right?

COVID-19, Scary vs Dangerous

Enjoy Premium Channelchek Content at No Cost

Sources:

Yes, People Really Aren’t Naming Their Babies “Karen” Anymore

Blackout Baby

Myth

Projected SARS-CoV-2 US Deaths as of Aug. 6 2020

Life Expectancy

Unemployment and Birthrates (Pew Research)

Bureau of Labor Statistics (Labor Force, July 2020)

The Effects of Aggregate and Gender-Specific Labor Demand Shocks on Child Health

Natality Trends in U.S. (CDC)

Survey of Reproductive Health Experiences

Brookings Institute, Covid Baby Bust

Will Coronavirus Spike Births?

Pandemic Impact on Social Security

10 facts About American Workers (Pew)