Sierra Metals Reports Solid Consolidated Financial Results For The Second Quarter Of 2020, Despite Covid-19 Interruptions

Issuing Revised Production Guidance

Conference Call August 14, 2020 At 10:30 AM (EDT) Registration Link Below

(All $ figures reported in USD)

- Adjusted EBITDA of $12.6 million in Q2 2020 in-line with Q2 2019, as lower revenues due to COVID government mandated curtailments were partially offset by reduced operating costs

- Operating cash flows before movements in working capital of $13.2 million in Q2 2020 increased from $12.8 million in Q2 2019

- Revenue from metals payable of $41.9 million in Q2 2020 decreased from $50.7 million in Q2 2019 as the COVID-19 pandemic impacted quarterly production and metal prices

- Q2 2020 consolidated copper production of 9.7 million pounds was consistent with Q2 2019; consolidated silver production of 0.6 million ounces, consolidated zinc production of 13.7 million pounds and consolidated lead production of 6.4 million pounds declined by 32%, 17% and 21% respectively; consolidated gold production of 2,762 ounces increased 9% as compared to Q2 2019

- Quarterly silver production declined as Cusi remained under care and maintenance throughout the quarter. The Company announced restarting of Cusi operations on July 28, 2020

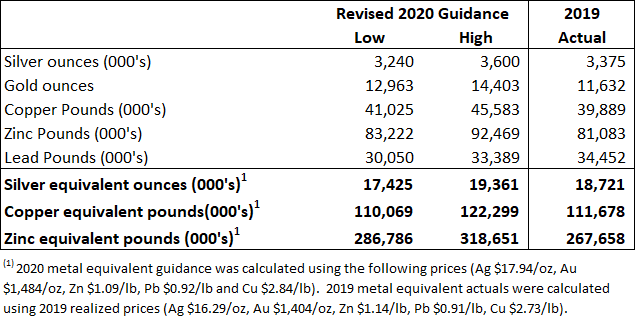

- Revised production guidance issued which anticipates that 2020 copper equivalent production will now range between 110.1 to 122.3 million pounds; or silver equivalent production will range between 17.4 to 19.4 million ounces; or zinc equivalent production will range between 286.8 to 318.7 million pounds.

- The Board of Directors has approved studies to be completed for potential expansions of all mines, as per ongoing Company strategy

- $40.7 million of cash and cash equivalents as at June 30, 2020

- $49.4 million of working capital as at June 30, 2020

- Net Debt of $58.7 million as at June 30, 2020

- Shareholder conference call to be held Friday, August 14, 2020, at 10:30 AM (EDT) – Preregistration required please see link below

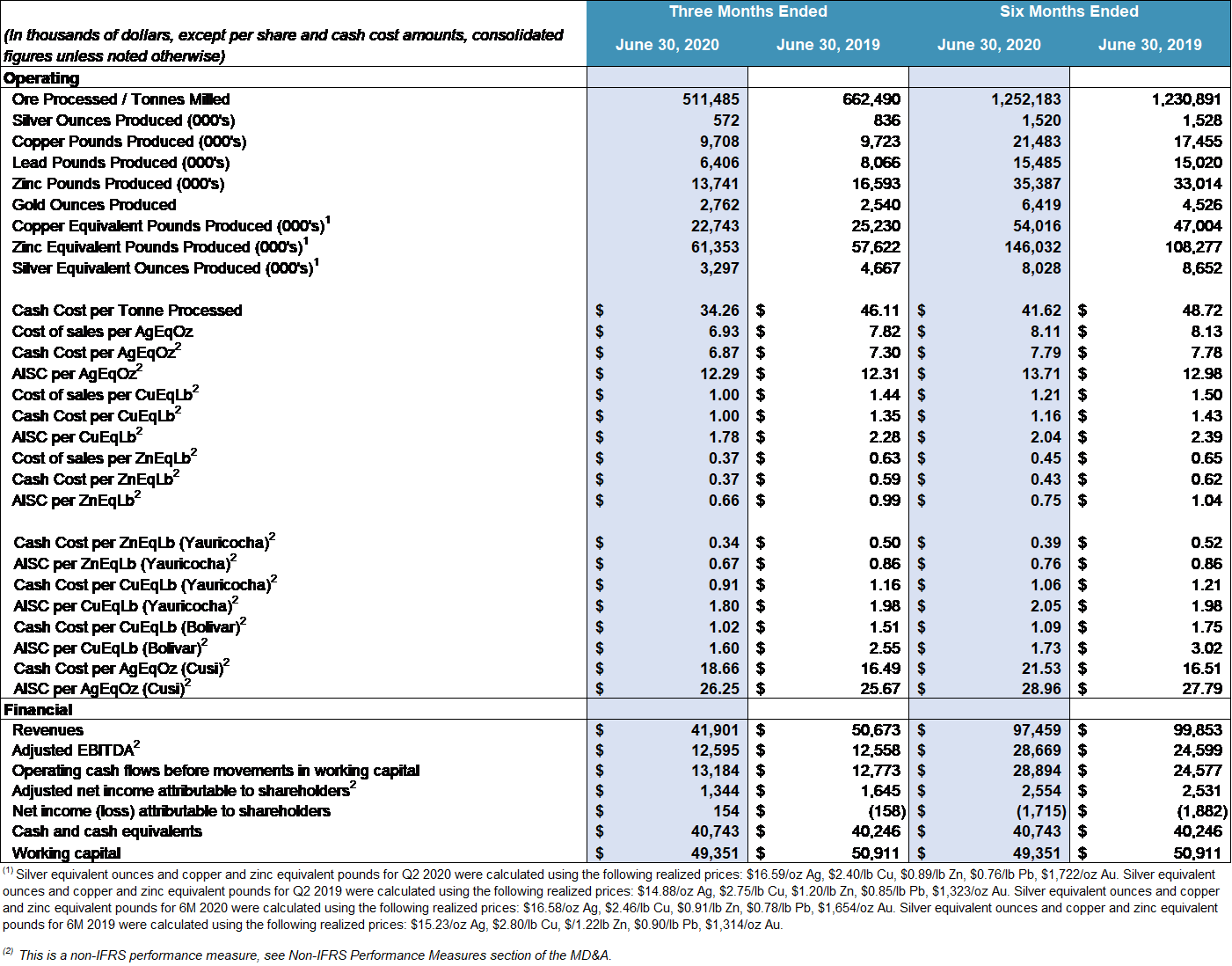

(1) Silver equivalent ounces

and copper and zinc equivalent pounds for Q2 2020 were calculated using the following realized prices: $16.59/oz Ag, $2.40/lb Cu, $0.89/lb Zn, $0.76/lb Pb, $1,722/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for Q2 2019 were calculated using the following realized prices: $14.88/oz Ag, $2.75/lb Cu, $1.20/lb Zn, $0.85/lb Pb, $1,323/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for 6M 2020 were calculated using the following realized prices: $16.58/oz Ag, $2.46/lb Cu, $0.91/lb Zn, $0.78/lb Pb, $1,654/oz Au. Silver equivalent ounces and copper and zinc equivalent pounds for 6M 2019 were calculated using the following realized prices: $15.23/oz Ag, $2.80/lb Cu, $/1.22lb Zn, $0.90/lb Pb, $1,314/oz Au.

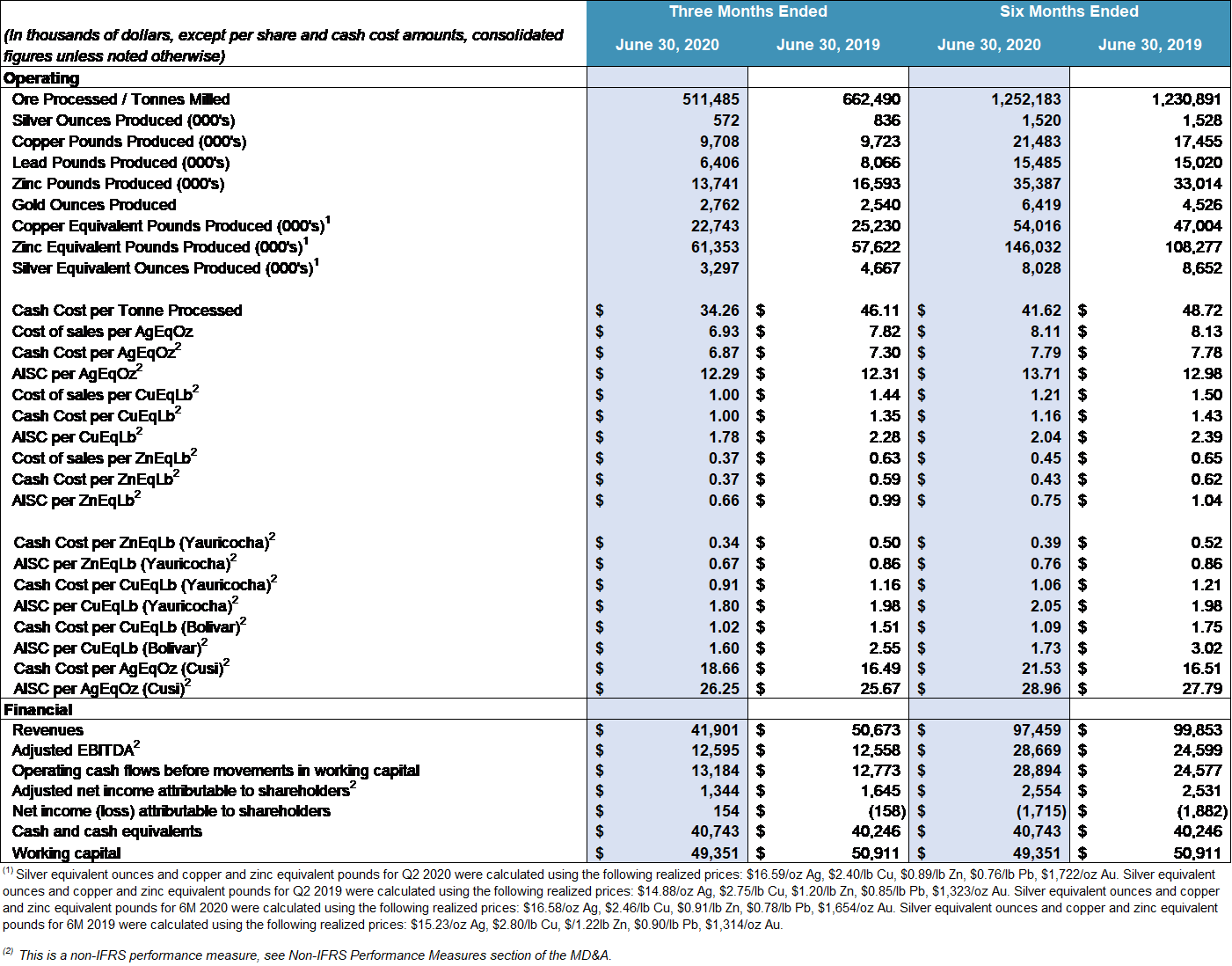

Toronto, ON – August 13, 2020 – Sierra Metals Inc. (TSX: SMT) (BVL: SMT) (NYSE AMERICAN: SMTS) (“Sierra Metals” or “the Company”) today reported solid consolidated financial results despite the effects of the COVID-19 pandemic, including a strong performance from the Bolivar Mine. Results included revenue of $41.9 million and adjusted EBITDA of $12.6 million on throughput of 511,485 tonnes and metal production of 22.7 million copper equivalent pounds, or 3.3 million silver equivalent ounces, or 61.4 million zinc equivalent pounds for the three month period ended June 30, 2020.

Revenues were negatively impacted by the COVID-19 pandemic on production and metal prices during the quarter. Average realized prices in Q2 2020 for copper, zinc and lead were 13%, 26% and 11% lower, respectively as compared to realized prices in Q2 2019. Silver and gold prices were 11% and 30% higher than their respective average realized prices in Q2 2019. Adjusted EBITDA generated during Q2 2020 was in-line with Q2 2019 however, as lower operating costs offset lower revenues.

Yauricocha’s cash costs declined 22% quarter over quarter due to lower operating costs per tonne. AISC per copper equivalent pound decreased 9% as lower cash costs were partially offset by higher treatment and refining charges and lower copper equivalent pounds sold as compared to Q2 2019. The Yauricocha Mine generated positive EBITDA during the quarter, despite the 20% lower throughput as compared to the same quarter of 2019. The mine resumed normal operations on June 5, 2020, as the Peruvian Government included mining and related activities in phase two of its economic recovery plan. The management team believes that the mine has operational flexibility to recover part of the production lost during the quarter.

Cash costs at Bolivar for Q2 2020 dropped 32% as compared to the same quarter of 2019, as the mine operated at lower operating costs and achieved mill throughput that was just 5% lower than Q2 2019, despite the impact of the COVID-19 related shutdowns in Mexico. The increase in revenues from the Bolivar Mine more than compensated for the loss of revenues from the Cusi Mine that remained closed throughout the quarter. Bolivar generated $6.6 million in EBITDA during the quarter. The mine resumed normal operations on June 1, 2020, as the Mexican Government deemed mining an essential activity effective that date.

Cusi remained in care and maintenance throughout Q2 2020 due to its proximity to urban communities and hence there was no production during the quarter. Cusi generated EBITDA of $0.2 million on revenue of $1.7 million during the quarter resulting from the sale of silver concentrate remaining at the end of Q1 2020. Cusi production recommenced on July 28, 2020 and a process has been implemented at the mine to mitigate the risk of COVID-19 to employees at the site through a testing and quarantine methodology. During the period of care and maintenance, the management team has had the time to complete an optimised view of the entire mine operation. Mine development is ongoing at Cusi to provide access to higher-grade economic ore and feed ore to the mill at the targeted rate of 1,200 tpd. Production will include ore from Santa Rosa de Lima zone, the Promontorio zone, as well as from a series of east-west vein systems including the new high-grade zone, Northeast-Southwest system of Epithermal Veins (“NSEV”) announced on June 18, 2020 that cross the Cusi fault near the Santa Rosa de Lima zone.

The Company expects to continue development and infrastructure improvements at Bolivar with the aim to push throughput close to 5,000 tonnes per day (“tpd”) before end of the year. At Cusi, mine development will continue to provide access to the higher-grade economic ore and feed ore to the mill at the targeted rate of 1,200 tpd. Additional drilling is also planned to better understand the extension of the NSEV zone at depth and to the Northeast. Further, the Company intends to commence studies on the potential expansion of Cusi and begin work on a new tailing dam near the Mal Paso mill, providing for deposition capacity for the foreseeable future.

“The Company was able to maintain essential activities while fully complying with the government protocols during the state of emergency,” stated Luis Marchese, CEO of Sierra Metals. “We achieved remarkable results and reported solid revenue, cashflow and positive EBITDA in the second quarter despite the negative implications of the COVID-19 related shutdowns. We also achieved lower costs at the Bolivar and Cusi mines which are attributable to higher operating efficiency and the prudent management of capital expenditures to protect the balance sheet, while also realizing improved head grades and more favorable foreign exchange rates. A good portion of the credit for these results is owed to the employees at Yauricocha and Bolivar who were able to maintain a high level of productivity with a reduced workforce. Also, to the management team, who led the Company through what we consider its biggest challenge in its history, while all operations were curtailed or placed into care and maintenance during the quarter as metal prices dropped sharply during the crisis. We are currently running our three operations at high operating rates. However, we remain cognizant that COVID-19 cases remain high in Peru and Mexico. As such, we continue proceeding cautiously, adhering to strict health protocols to protect our employees and the communities in which we operate, as well as to mitigate the potential for further work stoppages.”

He continued, “looking ahead to the second half of the year, due to our operating flexibility, we have the potential to recover some of the lost production experienced during the shutdowns at Yauricocha. We are also excited to see Bolivar continue in its strides towards the 5,000 tpd throughput level. Cusi having restarted earlier than anticipated is on track and performing well on its way to the 1,200 tpd throughput level. Metals prices have strengthened at the start of the third quarter especially for copper and precious metals. We are optimistic that with improved operating efficiencies and potential higher metal prices we will see a stronger second half for 2020. Furthermore, we will continue seeking the required permits to increase Yauricocha’s throughput to 3,600 tonnes per day for next year.”

He concluded, “Sierra Metals’ balance sheet, working capital and cash position remain strong. Considering that we remain in a vulnerable environment due to the COVID-19 pandemic, we are optimistic that further cash flow and liquidity improvements should be realized in the second half of 2020, due to higher production rates and improved metal prices. This would allow the Company to complete more of the deferred required capital expenditures and potential returns of capital which had been originally planned for this year. Management remains committed to the prudent and sustainable growth plan for the Company and more importantly to improving the per share value benefiting all shareholders now and, in the years to come.”

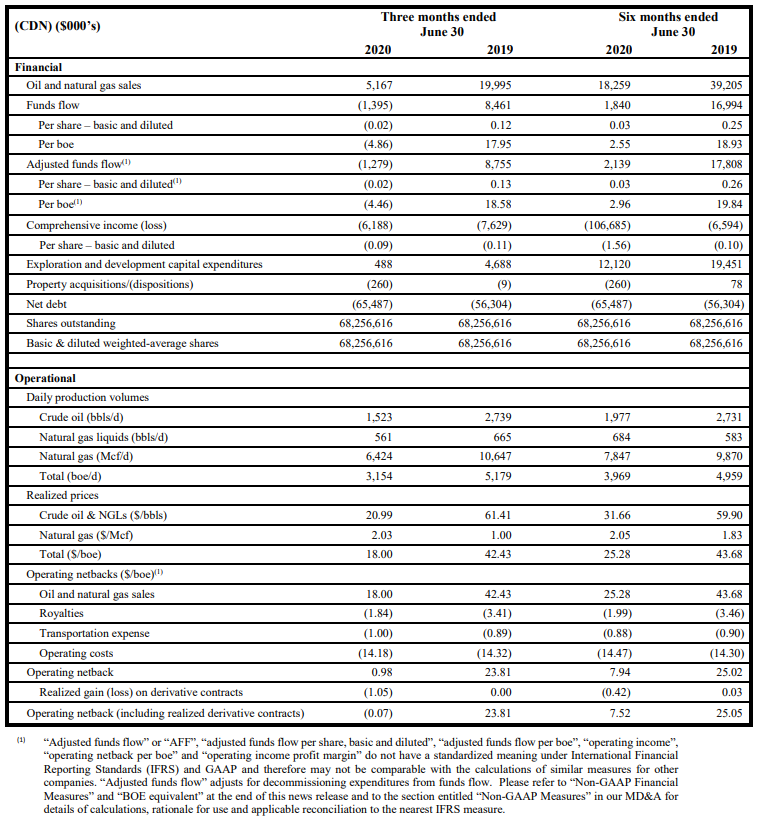

The following table displays selected financial and operational information for the three and six months ended June 30, 2020:

Q2 2020 Financial Highlights

- Revenue from metals payable of $41.9 million in Q2 2020 decreased by 17% from $50.7 million in Q2 2019. Revenues declined due to the COVID-19 pandemic, which impacted mine production and metal prices during the quarter. Average realized prices in Q2 2020 for copper, zinc and lead were 13%, 26% and 11% lower respectively as compared to realized prices in Q2 2019. Silver and gold prices were 11% and 30% higher than their respective average realized prices in Q2 2019;

- Yauricocha’s cost of sales per copper equivalent payable pound was $0.94 (Q2 2019 – $1.27), cash cost per copper equivalent payable pound was $0.91 (Q2 2019 – $1.16), and AISC per copper equivalent payable pound of $1.80 (Q2 2019 – $1.98). The decrease in the AISC per copper equivalent payable pound for Q2 2020 compared to Q2 2019 was due to lower cash costs and lower sustaining costs, which were partially offset by increase in treatment and refining charges and lower number of equivalent copper pounds sold;

- Bolivar’s cost of sales per copper equivalent payable pound was $1.01 (Q2 2019 – $1.77), cash cost per copper equivalent payable pound was $1.02 (Q2 2019 – $1.51), and AISC per copper equivalent payable pound was $1.60 (Q2 2019 – $2.55) for Q2 2020. The decrease in the AISC per copper equivalent payable pound was largely due to lower cash costs, lower sustaining costs and higher copper equivalent pounds sold as compared to Q2 2019;

- Cusi’s cost of sales per silver equivalent payable ounce was $16.33 (Q2 2019 – $10.99), cash cost per silver equivalent payable ounce was $18.66 (Q2 2019 – $16.49), and AISC per silver equivalent payable ounce was $26.25 (Q2 2019 – $25.67) for Q2 2020. AISC per silver equivalent payable ounce increased largely due to lower amount of equivalent silver sold as compared to Q2 2019, as concentrate inventory at the end of Q1 2020 was sold during Q2 2020. There was no production at Cusi throughout the quarter;

- Adjusted EBITDA(1) of $12.6 million for Q2 2020 was in-line with Q2 2019;

- Net income (loss) attributable to shareholders for Q2 2020 was $0.2 million (Q2 2019: $(0.2) million) or $0.00 per share (basic and diluted) (Q2 2019: $(0.00));

- Adjusted net income attributable to shareholders (1) of $1.3 million, or $0.01 per share, for Q2 2020 compared to the adjusted net income of $1.6 million, or $0.01 per share for Q2 2019;

- A large component of the net income for every period is the non-cash depletion charge in Peru, which was $1.6 million for Q2 2020 (Q2 2019: $2.4 million). The non-cash depletion charge is based on the aggregate fair value of the Yauricocha mineral property at the date of acquisition of Corona of $371.0 million amortized over the total proven and probable reserves of the mine;

- Cash flow generated from operations before movements in working capital of $13.2 million for Q2 2020 increased compared to $12.8 million in Q2 2019. The increase in operating cash flow is mainly the result of COVID-19 related reductions in general and administrative costs (“G&A”), as gross margins remained in-line with Q2 2019; and

- Cash and cash equivalents of $40.7 million and working capital of $49.4 million as at June 30, 2020 compared to $43.0 million and $49.9 million, respectively, at the end of 2019. Cash and cash equivalents decreased due to $14.5 million of capital expenditures and interest payment of $2.3 million were partially offset by $14.7 million of operating cash flows.

(1) This is a non-IFRS performance measure, see non-IFRS Performance Measures section of this MD&A.

Project Development

- Mine development at Bolívar during Q2 2020 totaled 1,296 meters. To offset impact of lower capacities, affected by COVID-19, major portion of this development (1,282 meters) was to prepare stopes for mine production. The balance of 14 meters were developed at the deepening of ramps and service ramps to be used for ventilation and pumping in El Gallo Inferior and Bolivar West orebody; and

- During Q2 2020, at the Cusi property, mine development totaled 146.0 meters to stope preparation in various zones within the mine;

Exploration Update

Peru:

In the Q2 2020, there was no surface exploration as a result of the Covid-19 emergency declaration. Underground exploration is planned to resume in September and surface exploration in October.

Mexico:

Bolivar

- Total 1,344 meters were drilled in Q2 2020. 558 meters of surface exploration included 9 meters at Bolivar West and 549 meters at Porphyry System. Additionally, 786 meters were drilled inside the mine as infill drilling.

Cusi

- During Q2 2020 the Company drilled 639.80 meters of surface diamond drilling to verify the settlement of the subsidence zone at the Promontorio area and to explore the extension of the NE veins system to the Northeast.

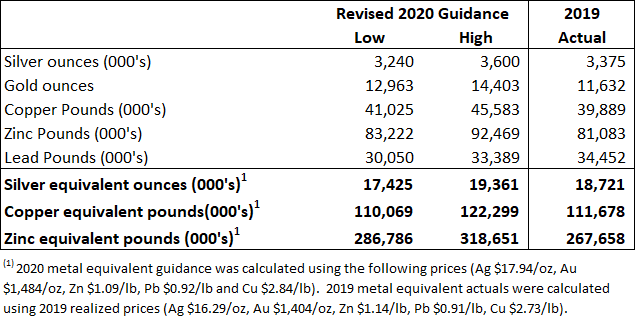

Guidance

The Company has issued revised 2020 production guidance and anticipates that 2020 copper equivalent production will range between 110.1 to 122.3 million pounds; or silver equivalent production will range between 17.4 to 19.4 million ounces; or zinc equivalent production will range between 286.8 to 318.7 million pounds. The decrease from the original 2020 guidance issued (see press release dated January 23, 2020) is related to work stoppages during the government mandated shutdowns due to the COVID-19 pandemic in Q2 2020. Please note that revised guidance assumes no further shutdowns or work stoppages as a result of the COVID-19 pandemic and is based solely on what management expects the Company’s operations can produce this year.

A table summarizing 2020 production guidance has been provided below:

Approval to proceed with Expansion Studies

As per the ongoing strategy of the Company, the Board of Directors has approved a proposal by management for expenditure to study further expansions at all three mines beyond the current capacity ramp-up levels. These studies will incorporate the latest NI 43-101 mineral resource updates, including the significant mineral resource increases at Bolivar reported in December 2019 and in March 2020. We believe the Company has excellent land packages with tremendous resource growth potential to support further organic growth at all mines.

Conference Call and Webcast

Sierra Metals’ senior management will host a conference call on Friday, August 14, 2020, at 10:30 AM (EDT) to discuss the Company’s financial and operating results for the three months ended June 30, 2020.

Via Webcast:

A live audio webcast of the meeting will be available on the Company’s website:

https://event.on24.com/wcc/r/2393587/AB458B2015EA9FEC98705CC780F49912

The webcast, along with presentation slides, will be archived for 180 days at www.sierrametals.com.

Via phone:

To pre-register for this conference call, please use the registration link provided below. After registering, a confirmation will be sent through email, including dial in details and unique conference call codes for entry. As well, reminders will be sent to registered participants in advance of the call.

If you have trouble registering, and need extra assistance please dial: +1 (888) 869-1189 or +1 (706) 643-5902.

Registration is open throughout the live call, however, to ensure you are connected for the full call we suggest registering a day in advance or at minimum 10 minutes before the start of the call.

Conference Call Registration Link:

http://www.directeventreg.com/registration/event/3580728

Qualified Persons

All technical production data contained in this news release has been reviewed and approved by:

Americo Zuzunaga, FAusIMM (CP Mining Engineer) and Vice President of Corporate Planning is a Qualified Person and chartered professional qualifying as a Competent Person under the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves.

Augusto Chung, FAusIMM (CP Metallurgist) and Vice President Special Projects and Metallurgy and a chartered professional qualifying as a Competent Person on metallurgical processes.

About Sierra Metals

Sierra Metals Inc. is a diversified Canadian mining company focused on the production and development of precious and base metals from its polymetallic Yauricocha Mine in Peru, and Bolivar and Cusi Mines in Mexico. The Company is focused on increasing production volume and growing mineral resources. Sierra Metals has recently had several new key discoveries and still has many more exciting brownfield exploration opportunities at all three Mines in Peru and Mexico that are within close proximity to the existing mines. Additionally, the Company also has large land packages at all three mines with several prospective regional targets providing longer-term exploration upside and mineral resource growth potential.

The Company’s Common Shares trade on the Toronto Stock Exchange and the Bolsa de Valores de Lima under the symbol “SMT” and on the NYSE American Exchange under the symbol “SMTS”.

For further information regarding Sierra Metals, please visit www.sierrametals.com or contact any of the following at +1 416 366 7777 or by email at info@sierrametals.com:

|

Mike McAllister, CPIR

V.P., Investor Relations

|

Ed Guimaraes

CFO

|

Luis Marchese

CEO

|

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com | Twitter: sierrametals | Facebook: SierraMetalsInc | LinkedIn: Sierra Metals Inc | Instagram:

sierrametals | LinkedIn: SierraMetals

Forward-Looking Statements

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of Canadian and U.S. securities laws related to the Company (collectively, “forward-looking information”). Forward-looking information includes, but is not limited to, statements with respect to the Company’s operations, including anticipated developments in the Company’s operations in future periods, the Company’s planned exploration activities, the adequacy of the Company’s financial resources, and other events or conditions that may occur in the future. Statements concerning mineral reserve and resource estimates may also be considered to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if and when the properties are developed or further developed. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential” or variations thereof, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking information.

Forward-looking information is subject to a variety of risks and uncertainties, which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the risks described under the heading “Risk Factors” in our Annual Information Form dated March 30, 2020 in respect of the year ended December 31, 2019 and other risks identified in the Company’s filings with Canadian securities regulators and the U.S. Securities and Exchange Commission, which filings are available at www.sedar.com and www.sec.gov, respectively.

The risk factors referred to above is not exhaustive of the factors that may affect any of the Company’s forward-looking information. Forward looking information includes statements about the future and are inherently uncertain, and the Company’s actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking information due to a variety of risks, uncertainties and other factors. The Company’s statements containing forward-looking information are based on the beliefs, expectations and opinions of management on the date the statements are made, and the Company does not assume any obligation to update forward-looking information if circumstances or management’s beliefs, expectations or opinions should change, other than as required by applicable law. For the reasons set forth above, one should not place undue reliance on forward-looking information.