Ceapro Inc. Reports 2020 Second Quarter and Six-Month Financial Results and Operational Highlights

– Record second quarter sales of $4,666,000 compared to $3,054,000 for second quarter 2019, representing a 53% increase and highest quarterly sales in Company’s history –

– R&D activities focused on the development of innovative delivery systems –

– Net profit of $1,077,000 for Q2 2020 vs. net loss of $559,000 for Q2 2019 –

– Cash generated from operations of $2,727,000 in 2020 vs $853,000 in 2019 –

– Maintained production operations during COVID-19 pandemic, providing our customers with essential products while ensuring the health and safety of our employees –

EDMONTON, ALBERTA – August 20, 2020 – Ceapro Inc. (TSX-V: CZO; OTCQX: CRPOF) (“Ceapro” or the “Company”), a growth-stage biotechnology company focused on the development and commercialization of active ingredients for healthcare and cosmetic industries, today announced financial results and operational highlights for the second quarter and the first six months ended June 30, 2020.

“We are extremely proud of our employees who worked tirelessly since the beginning of the year to deliver these excellent results despite the COVID-19 pandemic. Progress was made on all fronts from production operations with the largest volumes produced in Ceapro’s history to Research Engineering where the PGX group has successfully developed and optimized new products like yeast beta glucan as a potential inhalable therapeutic for COVID-19. As we continue to move forward and navigate operations during these unprecedented times, our focus remains on the health and safety of our associates, followed by business continuity,” stated Gilles Gagnon, M.Sc., MBA, President and CEO.

Corporate and Operational Highlights

Pipeline Development:

• Announced expansion of collaborative research program with McMaster University to develop inhalable therapeutic for COVID-19; • Announced publication of positive results for a PGX-processed drug delivery system for accelerated burn wound healing;

• Pursued the development of new PGX-dried chemical complexes for potential applications under various forms like pills, capsules, fast dissolving strips and face masks; and

• Continued the monitoring of stability studies for liquid beta glucan and avenanthramides produced at the new manufacturing site as well as for the pharmaceutical grade dry powder formulation of avenanthramides.

Technology:

• Made significant technical upgrades of PGX demo plant;

• Completed technical assessment of available pieces of equipment world-wide for final decision on the type and location of future commercial scale PGX unit; and

• Executed on research collaboration projects with University of Alberta and McMaster University for the impregnation of various bio actives using PGX-processed dry beta glucan and alginate as potential delivery systems for multiple applications in healthcare.

Production Operations:

• Delivered the largest quantity of final product in Ceapro’s history; and

• Initiated decommissioning of Leduc manufacturing site.

Corporate:

• Advanced conversations with interested potential partners to utilize Ceapro’s innovative technologies; and

• Pursued out-licensing discussions for PGX-processed new chemical complexes.

Subsequent to Quarter:

• Announced publication of positive results from study evaluating avenanthramides in exercise-induced inflammation; and

• Announced successful development of yeast beta glucan as a potential inhalable therapeutic for COVID-19 and other fibrotic end-point diseases of the lung.

Financial Highlights for the Second Quarter and the Six-Month Period Ended June 30, 2020

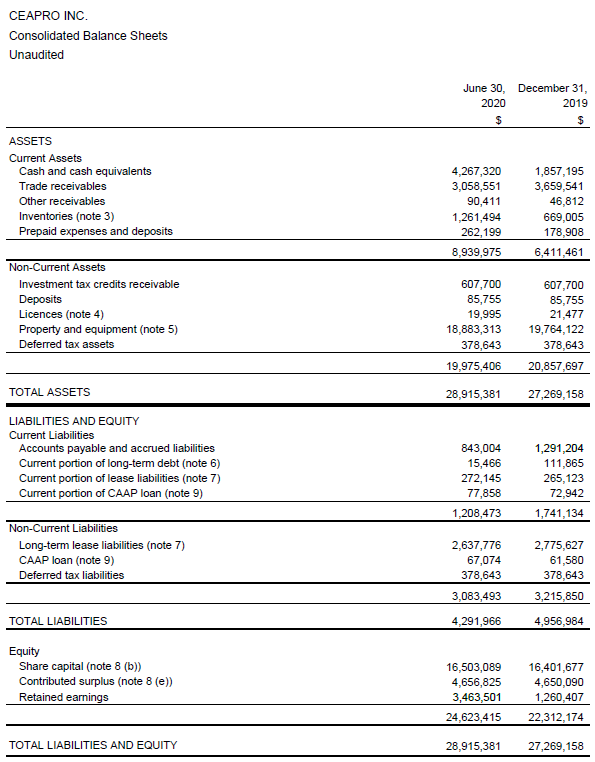

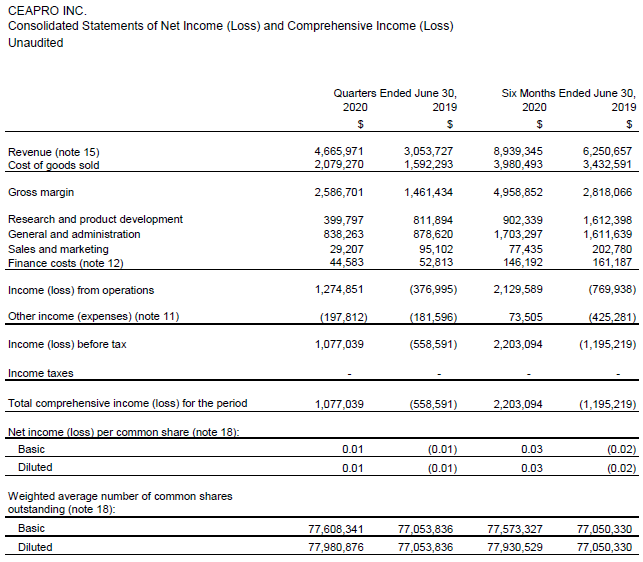

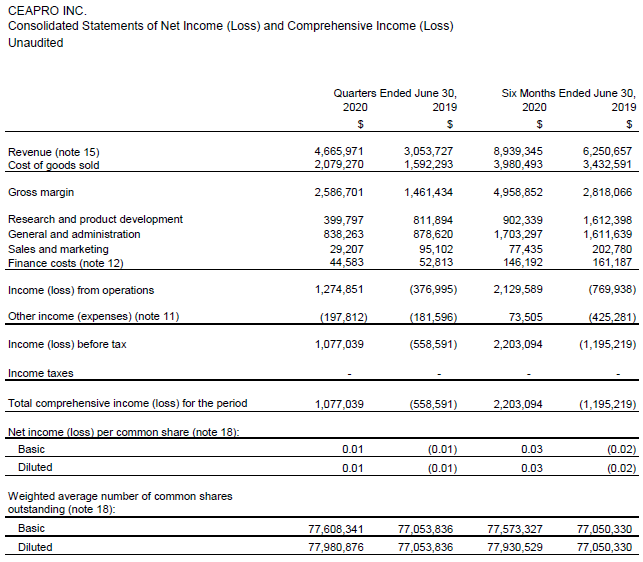

• Total sales of $4,666,000 for the second quarter of 2020 and $8,939,000 for the first six months of 2020 compared to $3,054,000 and $6,251,000 for the comparative periods in 2019. The 43% increase in sales for the first six months is mainly due to a significant increase in sales of avenanthramides as well as an increase in sales of beta glucan to China, compared to the same period in 2019.

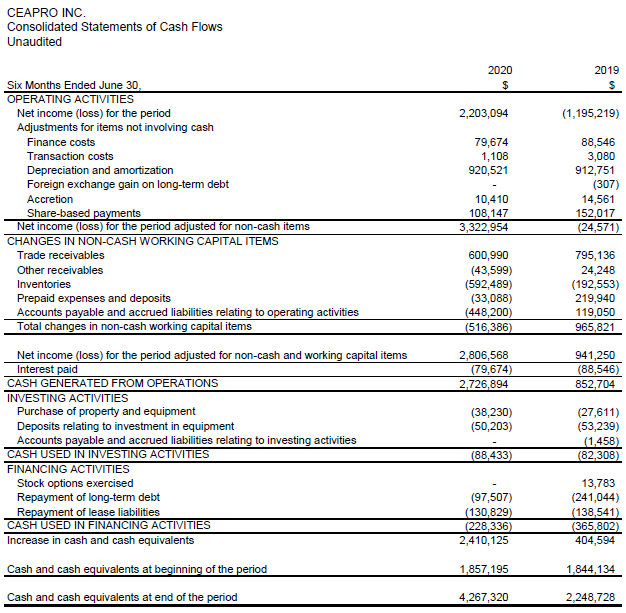

• Net profit of $1,077,000 for the second quarter of 2020 and $2,203,000 for the first six months of 2020 compared to a net loss of $559,000 and $1,195,000 for the comparative periods in 2019.

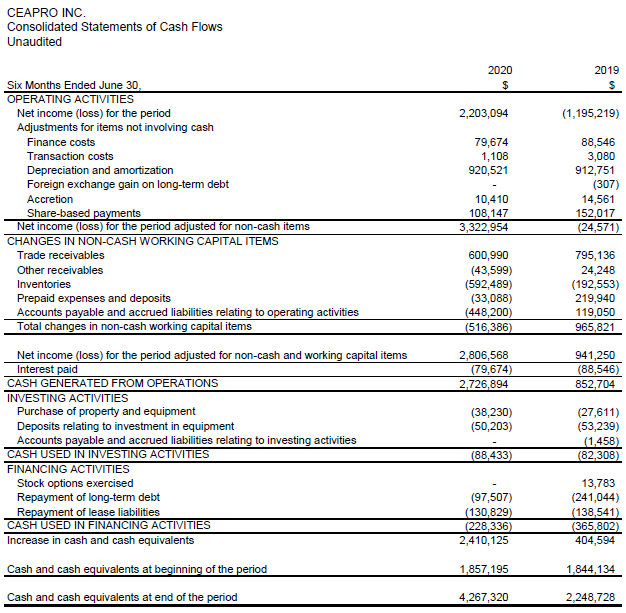

• Excluding non-cash items, mainly amortization, adjusted net profit for the first six months in 2020 is $ 3,323,000 versus adjusted net loss of $24,600 for the first six months of 2019.

• Cash flows generated from operations of $2,727,000 in 2020 vs $853,000 in 2019.

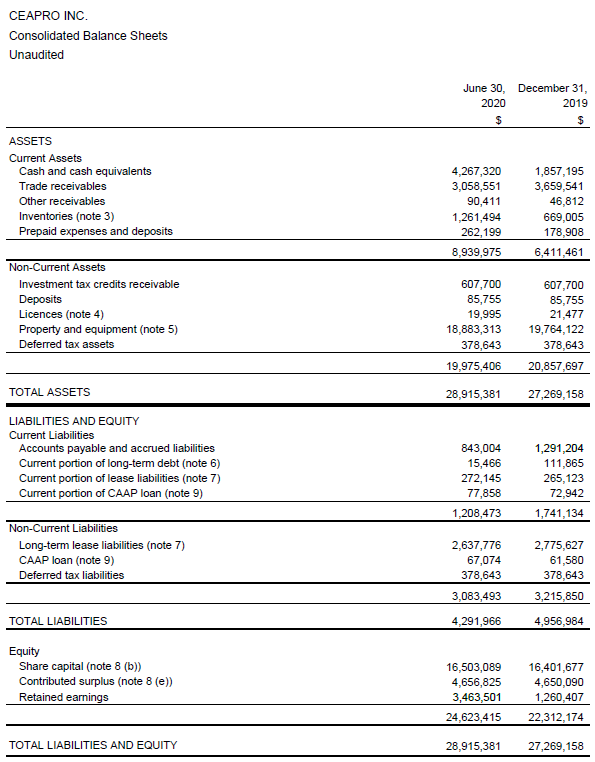

• Positive working capital balance of $7,732,000 as of June 30, 2020.

• Subsequent to quarter, made final payment clearing loan with Alberta Financial Service Corporation.

“Over the course of the second quarter, our operations executed and adapted well, delivering significantly improved results on both a sequential and year-over-year basis. This strong performance resulted in a record quarter for the Company, highlighting the resiliency of our business model focused on providing customers with essential, sustainable high-quality products. The ability of our business to successfully navigate through the challenging second quarter business environment is a testament to the commitment and hard work of our dedicated employees, and a measurable indication of the operational improvements and cost reduction initiatives being generated by our strategic investments of the past few years,” continued Mr. Gagnon.

“Looking ahead, while taking into account the ongoing potential economic impact related to COVID-19 and evolving consumption trends, we believe Ceapro is well-positioned to once again deliver a solid double-digit growth in sales over 2019. With a strong balance sheet, a group of dedicated people, and a solid base business coupled with the innovative technologies and products that we have developed to enable us to expand, Ceapro is poised to emerge as a successful Life Science company,” concluded Mr. Gagnon.

About Ceapro Inc.

Ceapro Inc. is a Canadian biotechnology company involved in the development of proprietary extraction technology and the application of this technology to the production of extracts and “active ingredients” from oats and other renewable plant resources. Ceapro adds further value to its extracts by supporting their use in cosmeceutical, nutraceutical, and therapeutics products for humans and animals. The Company has a broad range of expertise in natural product chemistry, microbiology, biochemistry, immunology and process engineering. These skills merge in the fields of active ingredients, biopharmaceuticals and drug-delivery solutions. For more information on Ceapro, please visit the Company’s website at

www.ceapro.com.

For more information contact:

Jenene Thomas

JTC Team, LLC

Investor Relations and Corporate Communications Advisor

T (US): +1 (833) 475-8247

E: czo@jtcir.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you