SEC Updates Old Mining Disclosure Requirements – A Win for Investors and US Mining Companies.

In October 2018, the U.S. Securities and Exchange Commission released new disclosure rules for mining company issuers, including royalty companies. The new disclosure requirements replace the SEC’s existing Industry Guide 7 which had not been updated since 1982. The new rules are intended to provide investors with a more comprehensive understanding of a registrant’s mining properties to help make more informed investment decisions and more closely align the Commission’s disclosure requirements and policies with industry and global practices and standards. Major mining jurisdictions outside the United States, including Canada and Australia, have mining disclosure standards based on the Committee for Mineral Reserves International Reporting Standards (CRIRSCO) that differ in many respects from Industry Guide 7. SEC-registered mining companies must comply with the new rules for their first fiscal year beginning on or after January 1, 2021.

Out with the Old

Until the most recent changes go into effect, current SEC disclosure rules are governed by Regulation S-K and Industry Guide 7. The new rules rescind Industry Guide 7 as of January 1, 2021, and create a new Subpart 1300 of Regulation S-K, which contains the requirements for property disclosures by mining companies beginning January 1, 2021. Industry Guide 7 does not recognize mineral resources (i.e., inferred, indicated, and measured), only probable and proven reserves. Reserve requirements require ore to be economical to extract, requires an assessment of the likelihood of permitting, and economic analysis cannot use a commodity price greater than the three-year trailing average. Disclosure of mineral resources is limited to websites and press releases and are not allowed in SEC filings, including annual and quarterly reports, which places U.S. issuers at a disadvantage given that SEC reports do not contain information that is often reported in other jurisdictions such as Canada. There are other drawbacks as well, such as no requirement to publish technical reports or for a qualified person review of technical disclosures.

In with the New

SEC Chairman Jay Clayton stated that the new rules were intended to modernize the Commission’s mining property disclosure requirements by “improving the quality and reliability of information provided to investors and by harmonizing disclosures with international standards including removing the restriction on disclosure of mineral resource estimates that may have placed U.S. registrants and investors at a disadvantage.”

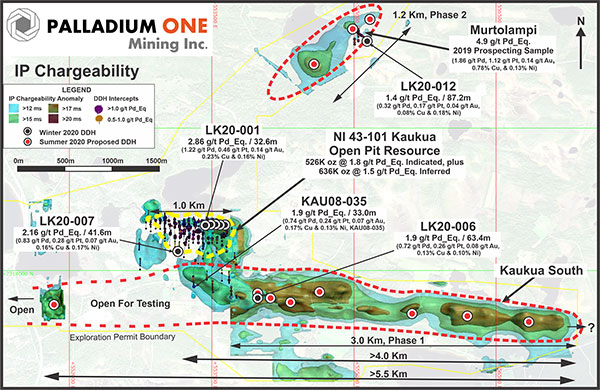

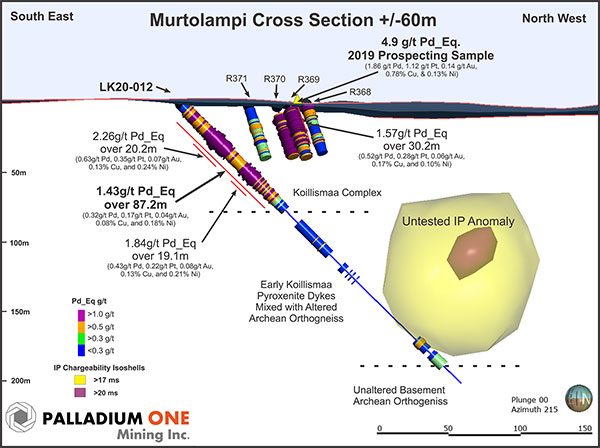

The new rules require companies to disclose mineral resources, mineral reserves, and material exploration results for their material mining operations in aggregate and for each material mining property, and to include supporting technical report summaries in the filings. The technical report summary must be filed as an exhibit when disclosing mineral resources or mineral reserves for the first time, or when there has been a material change in the mineral resources or mineral reserves from the last technical report summary filed for the property. Akin to Canadian NI 43-101 requirements and consistent with CRIRSCO standards, issuers’ disclosures of exploration results, mineral resources, or mineral reserves must be based on information prepared by an expert or qualified person. The SEC’s new mining disclosure rules provide flexibility in establishing the commodity price used in estimating resources, and inferred resources can be included in an initial assessment’s economic analysis. The technical report summary required to support the determination and disclosure of mineral resources is the “initial assessment.” A technical report required to support the determination and disclosure of mineral reserves in Commission filings may be either preliminary feasibility or a final feasibility study and include economic analysis, including a detailed discounted cash flow analysis.

Take-Away

One of the key differences is the ability to disclose mineral resources, instead of just proven and probable reserves, in SEC filings such as Form 10-K and quarterly reports, which aligns the new disclosure requirements more closely with reporting standards in other major mining jurisdictions. The ability to disclose mineral resources, in addition to proven and probable reserves, is important because it provides investors with a fuller picture and understanding of the company’s properties, enabling them to make more informed investment decisions. It is especially important for junior mining companies, whose assets may be comprised mostly of mineral resources, that need to raise capital to expand and upgrade their resources. It could also help investors to better evaluate the potential of each stage of a mining project. The new disclosure requirements could make the United States a more attractive choice for incorporation and make it easier for mining companies to raise capital in the United States.

Sources:

SEC Adopts Rules to Modernize Property Disclosures Required for Mining Registrants, Press Release, Securities and Exchange Commission, October 31, 2018

Final Rule: Modernization of Property Disclosures for Mining Registrants, Securities and Exchange Commission, October 31, 2018.

SEC

Overhauls Disclosure Requirements for Mining Companies, Shearman & Sterling Perspectives, Shearman & Sterling, November 5, 2018.

SEC

Overhauls Mining Property Disclosure Regime, SEC Update, Hogan Lovells, January 16, 2019.

Understanding

SEC’s New Mining Disclosure Rules, Dorsey & Whitney LLP, Christopher Doerksen and Kimberley Anderson, February 26, 2019.

Suggested Reading

Are Mining Companies Facing a Shrinking Opportunity Set?

Do Analyst Price Targets Matter?

Metals & Mining Second Quarter 2020 Review and Outlook

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you