Why Robinhood Traders May Never Find the Next Apple

“I encourage people to educate themselves, but short-term

trading is more risky than long-term investing and I do worry about this risk

investors take…” Jay Clayton, SEC chairman, July 22, 2020

Are you growing weary of officials at different levels of government telling us how

they think we should protect ourselves? In the first half of 2020, it seems a record number of authorities, at times, openly ignoring their own advice, told us what’s “safe” and what’s “unsafe.” The advice is all worth considering before determining if you agree or not, but when it involves risk tolerance, that’s a very personal choice. So, if you disagree with the advice, it may be that you know what’s better for you when it comes to your own risk/reward tolerance. One recent warning that is worth considering occurred on July 22 on CNBC Squawk box. The Chairman of the U.S. Securities and Exchange Commission discussed what he thought was risky behavior, and the precautions retail investors can take to reduce their risk. What was said involves self-directed investors’ choice of stocks. The SEC does restrict the sale of unregistered securities to accredited investors, but commenting on investor’s valuation methods and holding periods seems barely within the purview of the SEC’s Congressional mandate.

The SEC’s stated mission is threefold:

- Protect investors

- Maintain fair, orderly and efficient markets

- Facilitate capital formation.

Based on the interview, it seems the activities of the latest crop of market participants are causing the SEC chair, Jay Clayton, to sprout some gray hairs. He’s concerned that individual investors are using assets for risky, short-term trades. These are primarily younger market participants, taking full advantage of free online trades. Recently, according to him, they’ve been causing the price of “certain stocks” to skyrocket. If his concerns are accurate, the SEC may further address it as part of one of the three stated roles they serve.

Protect Investors

The primary means the SEC “protects” investors is their disclosure rules and transparency requirements. These regs are designed so all investors, large institutions, or dabbling individuals will have access to basic facts about an investment prior to deciding whether or not they should transact. This is why the SEC requires public companies to regularly report specific financial and other pertinent information. The stipulation provides a base of knowledge for all investors so they may use it to judge for themselves whether to buy, sell, hold, or avoid an offering. It’s through the scheduled flow of timely, comprehensive, and accurate information that investors have a uniform basis for judgement.

Chairman Clayton seems to have concerns beyond company reporting requirements. His worry is with the investor side, not the issuer side. Clayton specifically expressed concerns for smaller investors with very short holding periods. His words during the July 22nd interview are:

“What we are seeing is significant inflows from retail investors, and they have the hallmarks of short-term inflows. And does that concern me? Sure. Because that’s more trading than investing…”

He continued by expressing:

“Short-term trading is much more risky than long-term

investing, and so I do worry.”

There will always be investors and traders looking to beat the market. This reality guarantees that there will always be people who find different methods than those that came before. Certain “styles” will seem to some to be unconventional, others risky, and to some just reckless. There seems to be a new “style” every few years. SOES trading, Japanese pairs, Tech funds, Bitcoin, Index funds, Leveraged CMOs, etc. Some of these blew up on participants while they were involved, others blew up later, and some methods, like many of today’s Robinhood traders, Bitcoin investors, and some Index fund buyers are still rewarding participants.

Should the Chairman of the SEC allow himself to be openly concerned for those involved so as to “protect investors?” Probably not under this part of their mandate. Should he be concerned because it impacts the commission’s second mission; to maintain “fair, orderly and efficient markets?” Let’s explore further.

Maintain Fair, Orderly and Efficient Markets

The SEC oversees securities broker/dealers, exchanges, investment advisors, and mutual funds. A primary concern is “fair” dealing, protecting against fraud, and disclosure of important market-related information to investors. With this, they make rules, after all, fairness amongst all involved dictates that regulators act with clear guidelines, not arbitrarily.

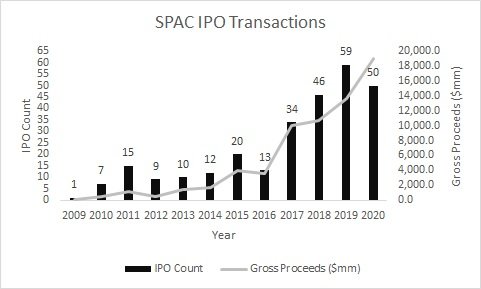

“Orderly” and “efficient” speaks to the manner and speed in which the commission handles all of the items on its plate. The markets are continually coming up with new products. Over time each of the new products usually has variants. The variants eventually have offshoots. The broad spectrum of investment options the SEC oversees doesn’t just grow, it compounds. Similar to how investors are creative in their methods, those that serve buy and sell-side players also are inventive. Newly engineered investments require review. The SEC expedites these reviews for the benefit of all. An easy to understand example is their review of the Spyder ETF, which was a unique security in the 1990s. This product was quickly mimicked and also expanded to include many other specific indexes. After the SEC became accustomed to the product and quickly approving other transparent ETFs, they had to review and make determinations on novel ETFs such as the actively managed, non-transparent ETF. The SEC knows the markets work best if there are no bottlenecks to the approval of newly securitized offerings or exchange tools, but they must all be reviewed.

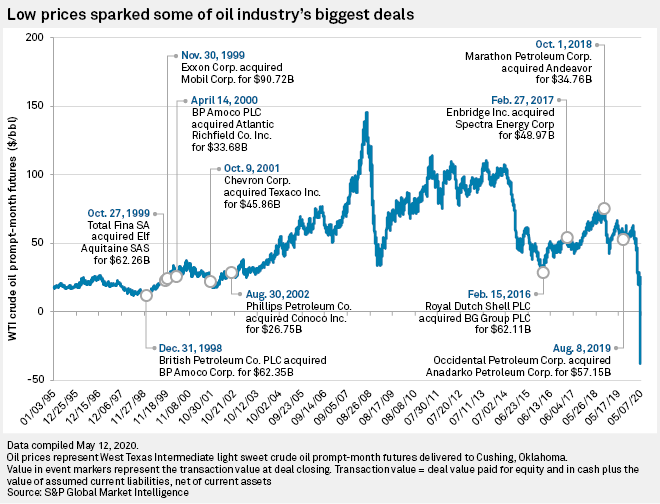

Are no-transaction-fee online trades a new invention. No. They seem to be an evolution of lower and lower fees that began since brokerage commissions became competitive in May of 1975. The same (or better) service has been offered at lower and lower prices since then. Do the no commission brokers impact the market? Not in as large a way as “program trading” did when it first began or the introduction of computers or the reduction of brokerage commissions from $100 to $10 by Charles Schwab and others. So this is not of much consequence to the SEC. It provides even more access to the markets.

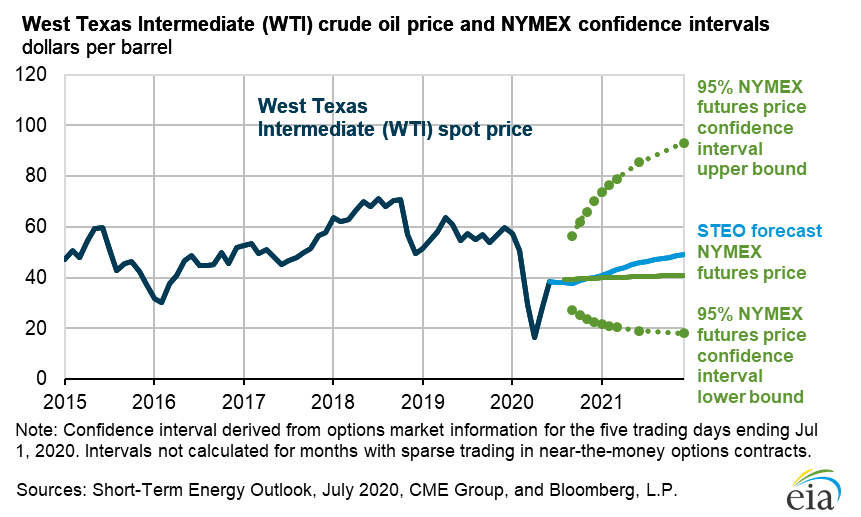

Although he did not name companies, Clayton spoke of stocks far exceeding normal valuations, which make them expensive by historical standards. He’s concerned the stocks may be rising more on emotion than prudent valuation processes. In his discussion, Clayton added that the SEC had issued guidance to brokers and investment advisors on how to give individuals proper warning about the risks they face when allocating capital in select equities. He did not suggest which equities, it is presumed he was thinking about companies like Tesla, which is up 240% YTD and 521% over the past 12 months. Tesla is the 10th most popular stock on Robinhood. Many renowned investors are short this stock (TSLA), in fact current short interest in TSLA is $28.5 billion. So this is a very real battle of well-known investors with huge short positions and tens-of-thousands of Robinhood accounts impacting price movement.

The guidance he suggested is a further explanation of risks to investors. This, of course, is within the mandate of the SEC, and is fair in that it may help the understanding of risk, while not setting guidelines that would directly impact companies or individuals.

Facilitate Capital Formation

When Congress included the consideration of “capital formation” in the SEC’s mandate, it did not define the term. However, it is not an unfamiliar concept. It is generally understood that capital formation is a macro benchmark that measures changes in productive capital available in the economy. This includes enhanced infrastructure as the economic base of capital formation. It is however, most often defined as the ability for entities to raise funds. If funds are more available for the same or an increase in purposes, this constitutes capital formation. To reiterate, it is not the act of raising capital as much as it is the availability of capital that is capital formation.

Surely individuals trading in their Interactive Brokers, Robinhood, or All of Us accounts are not creating more capital. At the same time, it is not hindering capital formation. So, as it relates to the SEC mandate, this is not adding to why SEC Chairman Jay Clayton is so concerned.

How to “Protect Ourselves”

Referring to the inflows of assets into accounts from investors and the holding period, Clayton said this during the CNBC interview:

“Here at the SEC, when we think about that investor, we think about someone who’s investing for the long term: investing over time, doing it on a monthly basis…”

As a result of the concern very short holding periods (trading not investing), the SEC has issued guidance to brokers and investment advisors on how to give individuals proper warning about the risks they face when allocating capital in select equities, and statistical risk to overtrading. The active trading language is not new; the language on specific equities is not defined but presumed to mean so-called “Robinhood” stocks.

“I hope people are heeding that,” he said.

The age group most associated with online trading apps are “the millennials.” This generation takes a lot of criticism from the generations that are older than them. Their sanity is again questioned as they trade shares of stocks under $5, or load up on bankrupt companies like Hertz, and JC Penney, and when the online traders drive the price up on Tesla while Wall St. giants are short the stock. What is the right way and wrong way to invest is measured by results. Today’s lack of transaction fees eliminates what had been a very large drag on results in the past. Perhaps it is the veterans relying on past performance to indicate future results that have it wrong. Time will tell.

These disagreements as to value are what makes markets. Investing goes through regular incarnations and reinventions. The use of technology has provided an environment where one need not be a Wall Street professional to have access to information and top execution. This latest generation that is comfortable with technology now finds themselves with discretionary investment accounts. They will make good trades and bad trades and we’ll all learn from each other.

Paul Hoffman

Managing Editor

Suggested Reading:

Investment Portfolios are Checked Twice as Often by Millennials

The Supply of Cash and Stock Prices

Has Robinhood, the Online Brokerage Disruptor, Been Disrupted?

Enjoy Premium

Channelchek Content at No Cost

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources:

The Role of the SEC

The New Age of Investor Relations

SEC Chief Worries About Retail Investors Trying to Get Rich Quick

SEC Chair Speech

The

Genesis of Discount Brokerage

Bets Against Telsa Stock Approach $30b

SEC Chair Clayton on Squawkbox Transcript

SEC Investor Objectives